Ministry of Industry and Information Technology Tightens Penalties for Product Inconsistencies, Focusing on New Energy Vehicle Spontaneous Combustion and Battery Life Claims

![]() 06/27 2025

06/27 2025

![]() 475

475

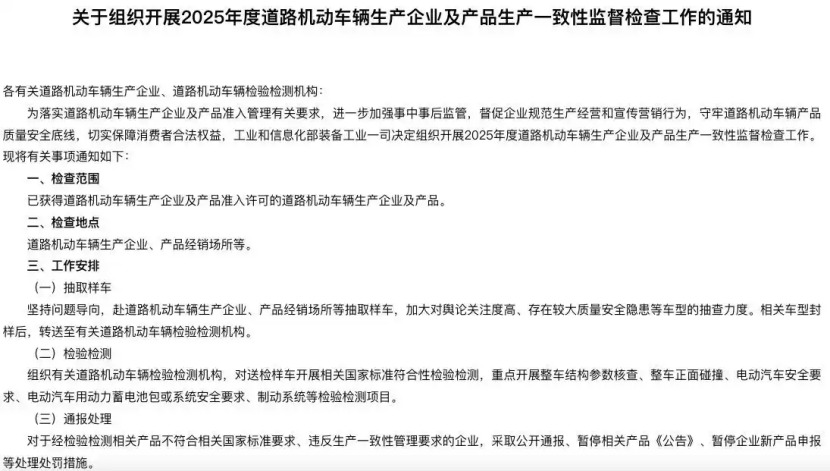

On June 9, 2025, the Ministry of Industry and Information Technology (MIIT) issued the "Notice on Organizing and Carrying Out the 2025 Annual Inspection of Production Consistency of Road Motor Vehicle Manufacturers and Products." Dubbed the "strictest ever" within the industry, this notice prioritizes spot checks on high-risk models and directly addresses key issues such as battery safety, misleading battery life claims, and the reliability of intelligent driving assistance systems in new energy vehicles.

With annual sales of new energy vehicles surpassing 12 million units and industry profit margins continuously declining, this inspection marks not only a response to market chaos but also a pivotal shift towards quality-driven growth from mere scale expansion.

▍Consumer Feedback: Quality Concerns Persist

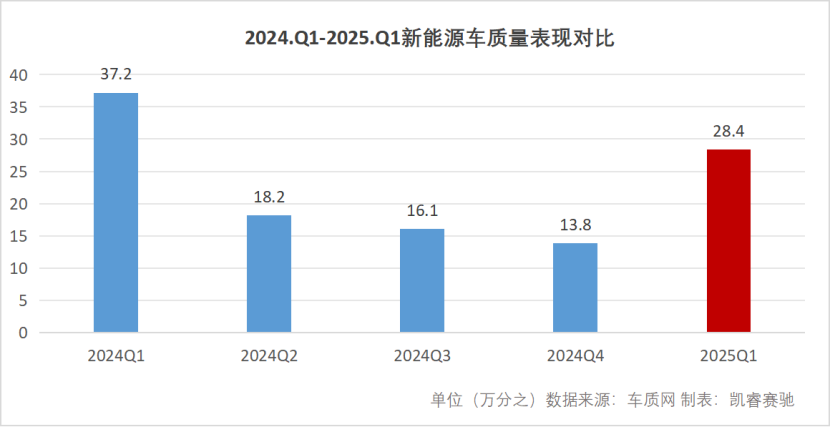

According to Chezhi.com, a leading domestic platform for automotive defect information and complaint handling, quality complaints for new energy vehicles surged by 18.7% quarter-on-quarter in the first quarter of 2025, totaling nearly 6,000 complaints—the highest in nearly a year. In contrast, new energy vehicle sales declined by over 30% quarter-on-quarter, ending three straight quarters of growth.

Chezhi.com's complaint-to-sales ratio, an indicator inversely proportional to quality performance, hit a one-year low in Q4 2024 but surged in Q1 2025, reflecting unsatisfactory product quality during this period. Complaints ranged from vehicles switching to neutral gear unexpectedly on highways to significant discrepancies between nominal and actual battery range.

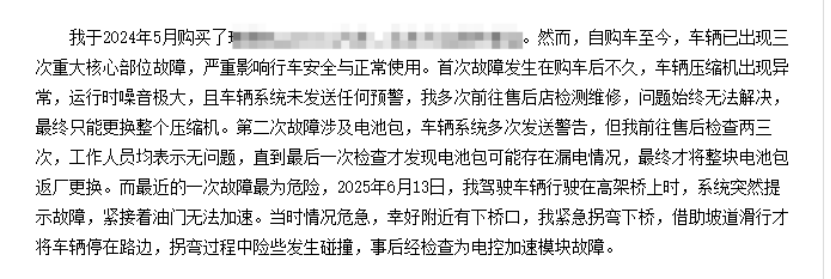

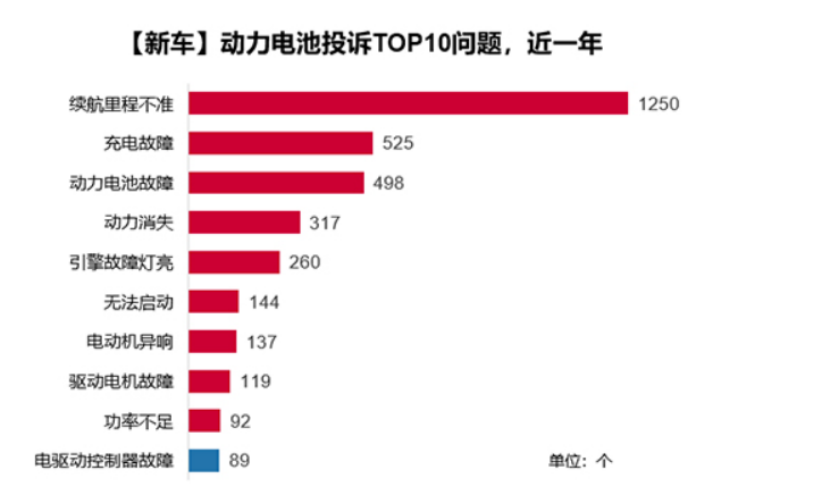

Chezhi.com's analysis of battery system complaints revealed that inaccurate range and inability to accelerate topped the list of issues in Q1 2025. Additionally, vehicles purchased nearly a year ago experienced issues such as charging failures and abnormal motor noise.

While MIIT has conducted annual inspections since 2017, focusing on verifying production consistency with announced parameters, the 2025 policy upgrade introduces several innovations: Firstly, it employs a "public opinion + hidden danger prediction" sampling mechanism, targeting models with frequent spontaneous combustion, high intelligent driving system failure rates, and concentrated complaints. Secondly, it deepens inspection content by adding 12 new energy-specific indicators, including battery safety and thermal runaway protection, and includes false battery life claims and misleading intelligent driving function advertising in the mandatory inspection scope.

The penalties for non-compliance are unprecedented, including public notification, suspension of sales qualifications, and freezing of new product launch applications. This "triple penalty" mechanism significantly increases the cost of violations, directly impacting automakers' expansion strategies, especially those relying on rapid iteration.

▍Quality Standards Cannot Be Compromised

Amid price wars and profit margins dropping to 3.9% in Q1 2025, regulatory oversight has intensified. The rapid market development, fierce competition, and unbalanced supply and demand have led to potential "consistency" issues, safety concerns with intelligent driving assistance, and exaggerated promotion by some automakers.

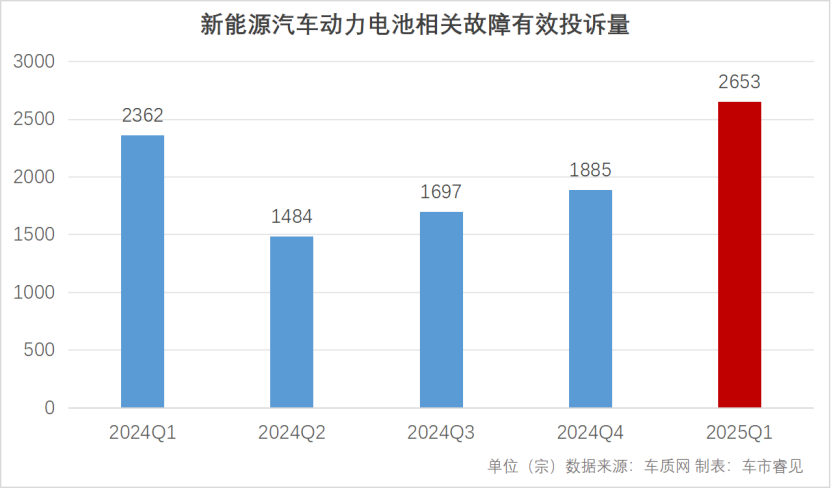

Chezhi.com received 2,653 valid complaints related to new energy vehicle battery faults in Q1 2025, a 40.7% quarter-on-quarter and 12.3% year-on-year increase, setting a new record.

Wei Jianjun, Chairman of Great Wall Motors, noted that the automotive industry faces significant competition, with some OEMs cutting corners at the expense of safety, lifespan, and reliability. He emphasized that significant price drops without quality assurance are unsustainable.

Strengthened quality supervision is accelerating the differentiation of automakers, with leading enterprises leveraging their full-cycle quality control systems to maintain an edge. At the same time, consumer protection has seen a qualitative leap, with test results becoming crucial evidence in class action lawsuits. This synergy between market mechanisms and regulatory policies is steering the industry towards prioritizing "safety and effectiveness" over mere "parameter gimmicks."

Supply chain reshuffling is inevitable, with battery and intelligent driving system suppliers now under regulatory scrutiny. This pressure forces supply chain enterprises to enhance compliance, further consolidating the industry. The top 5 battery suppliers' market share has risen from 65% in 2020 to 82% in 2025.

As competition returns to product and technology fundamentals, enterprises will invest more in rigorous R&D, production, and quality control. Consumers will benefit from faster technological advancements, more reliable quality assurance, and trustworthy service experiences, leading to overall improvements in quality and safety.

From a content perspective, the 2025 regulatory policy addresses market pain points through targeted spot checks, with new energy-specific inspections covering cutting-edge technologies. The "triple penalty" significantly raises the cost of violations, expected to clear out non-compliant vehicle models in 2025. From an industry impact perspective, the quality red line is reshaping the competitive landscape, with leading enterprises expanding their share based on system advantages, while small- and medium-sized enterprises face existential challenges. Long-term, regulation is steering resources towards safety technology R&D, returning the automotive industry to its "safety-oriented" roots.

Typesetting | Yang Shuo

Image Source: Ministry of Industry and Information Technology, Shutterstock