Imported Cars: Losing Their Allure

![]() 06/27 2025

06/27 2025

![]() 669

669

Imported cars, once a symbol of luxury and exclusivity, are now experiencing an unprecedented market downturn.

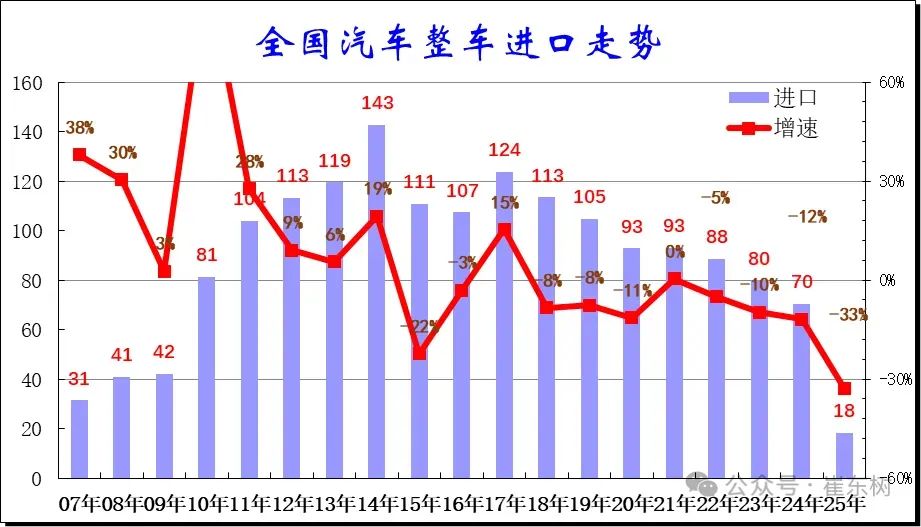

On June 24, Cui Dongshu, secretary-general of the Passenger Car Market Information Joint Meeting of the China Automobile Dealers Association, revealed that from January to May 2025, only 180,000 imported cars were sold, marking a year-on-year decrease of 33%. This decline is particularly striking when compared to the recent years' trends. A decade ago, China's imported car sales peaked at 1.43 million units in 2014.

Data Source: Cui Dongshu

The current imported car market exhibits a notable differentiation trend: traditional luxury brands like Lexus are revising the "premium pricing" myth through discounts and promotions; ultra-luxury brands such as Bentley and Rolls-Royce are barely maintaining their positions with their century-old brand stories; and the non-luxury imported car segment is rapidly shrinking amidst the wave of domestic substitution.

From Peak Sales to Structural Collapse

Cui Dongshu noted that after reaching a peak of 1.43 million imported cars in 2014, the market has been on a decline. Import growth stabilized and slightly improved from 2016 to 2017 but has continued to decline since 2018. In 2024, the import scale shrank dramatically, with only 700,000 imported cars for the entire year, a year-on-year decrease of 12%. Currently, the pressure on the continuous shrinkage of imported cars remains high.

In stark contrast to imports, China's vehicle exports soared in 2024, reaching 6.407 million units, a year-on-year increase of 22.7%, with an export value of $117.35 billion. This process underscores the transformation of China's auto industry from being "import-oriented" to "export-oriented".

Data Source: Cui Dongshu

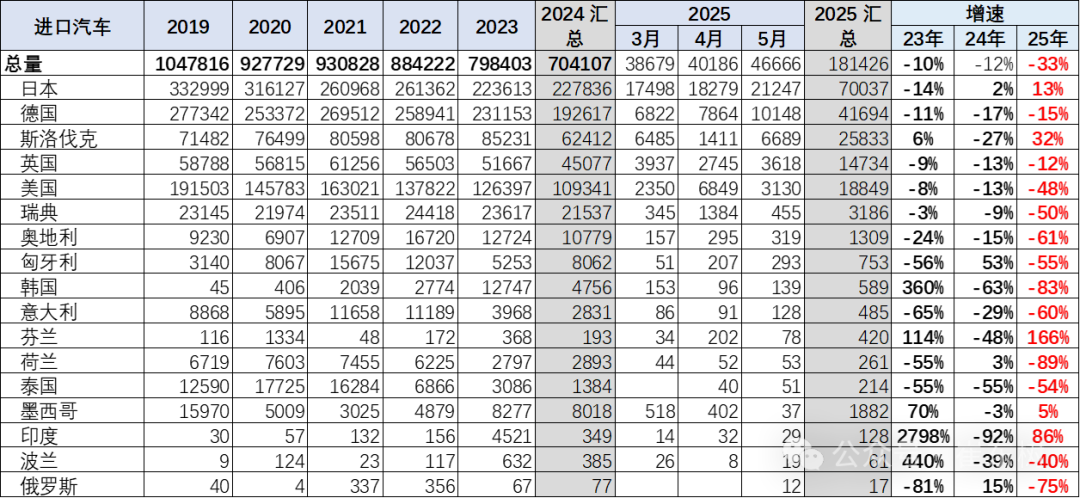

The top five source countries for imported cars from January to May this year are: Japan (70,037 units), Germany (41,694 units), Slovakia (25,833 units), the United States (18,849 units), and the United Kingdom (14,734 units). Notably, imports from the United States have fallen significantly, from 280,000 units in 2017 to 109,000 in 2024, and further to 18,800 in the first five months of 2025.

Japan tops the list of imported car data primarily because the Lexus brand has always been introduced into the country through imports. In 2024, Lexus led the imported car market with cumulative sales in China exceeding 180,000 units, a slight year-on-year increase of 0.3%. However, it is noteworthy that Lexus, which has maintained a stable pricing system, had to engage in the "price war" under competitive pressure in the past year. This stands in stark contrast to the previous scenes of "premium pricing" and "scarcity." More symbolic is its localization process: its wholly-owned Shanghai New Energy Automobile Plant is scheduled to commence production in 2027, with an annual production capacity planning of 100,000 units, poised to rewrite the past of "imported luxury".

In the past three years, Porsche's sales in China have also declined, from 95,700 units in 2021 to 56,900 units in 2024. In the first quarter of this year, Porsche's global deliveries amounted to 71,470 units, a year-on-year decrease of 8%, with significant declines in the German and Chinese markets. Sales in the Chinese market were only 9,471 units, with a decline expanding to 42%, almost the largest drop in nearly a decade. Oliver Blume, President and CEO of Porsche China, attributed the cold reception Porsche has encountered in the Chinese market primarily to the replacement of the Cayenne model and the unusually intense price competition in the market.

Meanwhile, ultra-luxury car brands, including Bentley, have also begun to experience sales declines. "Globally, the current market performance has indeed declined compared to the peaks in 2021 and 2022, and this trend is more pronounced in the Chinese and American markets," Dr. Frank-Steffen Walliser, Chairman and CEO of Bentley Motors, told ECNS. "Cyclical economies will surely recover, and we also look forward to the economies of important global markets returning to an upward cycle, but there are still many uncertainties."

Cui Dongshu emphasized, "Currently, the imported car market is primarily supported by demand for luxury cars, while the non-luxury imported car market has shrunk dramatically."

Subaru's fate is highly illustrative. Data indicates that in 2024, Subaru's sales in China were only 3,635 units, a year-on-year decrease of 54%. In 2011, Subaru reached its peak sales in China, exceeding 57,000 units, and has been struggling since then. In 2023, the withdrawal of Pang Da Group marked the complete loss of protection from local Chinese capital for this brand, which sells the "horizontally opposed engine" as its unique selling point.

Imported Cars: The Golden Age is Over

The contraction of the imported car market is an inevitable outcome of evolving consumer demand, domestic technological breakthroughs, and global industry restructuring.

Fuel vehicles once dominated the imported car market, but now the landscape has changed. Cui Dongshu commented, "With the continuous strengthening of China's auto industry, the electrification transformation has altered the market demand structure. The demand for fuel vehicles continues to shrink, and the demand for imported fuel vehicles has also decreased significantly."

Currently, the penetration rate of new energy vehicles in China is nearing 50%, and an increasing number of Chinese brands are making breakthroughs and beginning to gain a foothold in the high-end market. In the price range of 300,000 to 500,000 yuan, which was once monopolized by imported fuel vehicles, domestic brands such as Lixiang, NIO, Denza, Zeekr, and AITO have become the preferred choice for more consumers due to their more intelligent product experience and richer product configurations.

The replacement of imported cars by Chinese brands is not merely due to price advantages but also due to leapfrog development at the technical level. In the thriving new energy vehicle market, China not only leads in the three major technological fields of motors, electronic controls, and batteries but also possesses a comprehensive industrial chain for new energy vehicle manufacturing. Domestic new energy vehicle models have formed a dimensional reduction strike against imported fuel vehicles in the fields of electrification and intelligence.

Furthermore, international brands have continuously promoted the process of localized production in recent years. Nowadays, the main models of joint venture brands such as Toyota, Volkswagen, and BMW have essentially achieved localization, which not only reduces costs but also better aligns with market demand, further narrowing the living space for imported cars.

The rapid contraction of the imported car market is not an isolated phenomenon but an inevitable result of multiple intertwined factors. The comprehensive rise of domestic automobiles, supported by technology, price, and policy, coupled with consumers' demand for new energy and localization, has made imported cars a choice for only a select few. In the future, perhaps only Rolls-Royce's customized wood grain and Ferrari's racing genes will survive in niche markets, but the discourse power in the mainstream consumer market has been firmly grasped by Chinese auto companies that can define the "mobile lifestyle scene".