European Auto Market | Spain June 2025: New Energy Vehicle Boom, Chinese Brands Shine

![]() 07/03 2025

07/03 2025

![]() 784

784

In June 2025, the Spanish passenger car market extended its growth trajectory, recording a year-on-year increase of 15.2% with total sales of 119,125 units—marking the best performance for the same period post-pandemic.

The electrification trend in the market has gained significant momentum, with new energy vehicles (pure electric and plug-in hybrid) accounting for over 20% of sales for the first time. Renault reclaimed the top spot, while Dacia Sandero set a fresh monthly sales record.

Chinese brands achieved remarkable breakthroughs in the local market, with BYD, MG, Omoda, Jetour, Lynk & Co, Leapmotor, and XPeng delivering impressive results, emerging as key players in the Spanish automotive landscape.

01 Spanish Auto Market: Overall Performance and Competitive Landscape

The Spanish auto market grew by 15.2% year-on-year in June 2025, tallying 119,125 units sold. Cumulative sales for the first six months of 2025 reached 609,801 units, up 13.9% year-on-year, marking the 10th straight month of positive growth.

The main drivers of this growth included the surge in vehicle replacement demand spurred by extreme weather events, with the Valencia region witnessing the highest increase of 42.2% year-on-year.

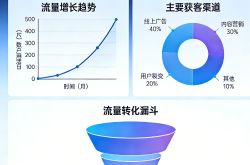

In terms of purchase channels:

◎ Private consumption surged the most, with a year-on-year increase of 28.8%

◎ The leasing channel experienced a slight decline of 1.5%

◎ Corporate purchases and leases maintained stable growth, underscoring the balanced structure of the overall market.

The leap in the new energy power structure is particularly noteworthy—electric vehicles and plug-in hybrids sold a combined 24,776 units in June, a year-on-year surge of 130.7%, accounting for 20.8% of the total market share, a record high.

This trend is also evident in cumulative sales, with new energy vehicles selling a total of 102,348 units in the first half of the year, with market share increasing from 10.4% in 2024 to 16.8% this year.

From a brand perspective:

◎ French brand Renault sold 9,590 units in June, up 44.4% year-on-year, overtaking Toyota and Volkswagen to top the list, with a market share of 8.1%.

◎ Toyota ranked second with sales of 8,993 units, up 3.2% year-on-year.

◎ Volkswagen followed closely with sales of 8,822 units, up 22.6% year-on-year.

◎ Dacia grew by 29.4% to rank fourth.

◎ SEAT, once a local powerhouse, declined by 19.2% year-on-year to drop to fifth place.

◎ In the mid-to-high-end segment, Mercedes-Benz, BMW, and Audi all performed solidly. Mercedes-Benz grew by 21.9% to 6,274 units, BMW grew by 9.8%, while Audi declined by 9.7%.

◎ Emerging forces represented by Tesla, BYD, and MG grew particularly rapidly: Tesla grew by 60.7%, BYD surged by 791.9%, and MG grew by 40.5%. BYD sold 2,408 units this month, ranking 20th.

On the model ranking:

◎ Dacia Sandero topped the chart for the 11th consecutive month, selling 4,329 units in June, setting a new record.

◎ Renault Clio followed closely with sales of 3,317 units, up 113% year-on-year, marking its best monthly performance since 2017.

◎ Other standout models include the Peugeot 208 (+88.8%), Opel Corsa (+69.1%), and Volkswagen T-Roc (+39.6%).

◎ In the new energy vehicle segment, Tesla Model Y sold 1,179 units in a month, up 127.2% year-on-year, ranking among the mainstream best-sellers.

02 Chinese Brands: Performance and Market Breakthroughs in Spain

In the Spanish market, Chinese brands are no longer marginal players but have demonstrated a strong momentum to penetrate the mainstream market in June 2025.

◎ BYD sold 2,408 units this month, surging nearly eightfold, becoming one of the fastest-growing brands in Spain.

Cumulative sales in the first half of this year have exceeded 10,000 units, reaching 10,196 units. This success is attributed to its pure electric platform, technological prowess, and targeted launch of models like the Seal, Dolphin, and Song PLUS EV in the Western European market.

◎ MG led the pack of Chinese brands with sales of 3,606 units, maintaining its 15th position in the overall ranking. Cumulative sales in 2025 reached 25,494 units, nearing the volumes of traditional European brands like Opel and Ford.

Among them, the MG ZS remains the flagship model, selling 1,889 units in a single month, ranking 15th among all models and becoming one of the most recognized Chinese models by European consumers.

◎ Omoda sold 1,306 units in June, up 57.9% year-on-year. Cumulative sales for the year reached 6,043 units, showcasing steady performance. Its product line, focused on avant-garde, moderately priced crossover models, has achieved initial success among young users.

◎ Jaecoo also made the list, with monthly sales of 824 units and cumulative sales of 4,342 units. Its product strategy emphasizing off-road and rugged styling is starting to pay off in Spain.

◎ Although Lynk & Co is still a niche brand, its sales have experienced explosive growth, selling 506 units in June, up 96.9% year-on-year, indicating that its high design appeal and intelligence have a certain allure for European urban consumers.

◎ Leapmotor and XPeng have also started to expand their footprint in the Spanish market this year. Leapmotor sold 227 units in June, while XPeng sold 63 units.

From a product standpoint, Leapmotor T03 and XPeng G9, as representative models, focus on entry-level electric and high-end intelligent directions, respectively, reflecting Chinese enterprises' keen understanding of European market demand in both electrification and intelligence.

◎ Dongfeng, Ruilan, NIO, Thalys, among others, have also appeared on the list of the Spanish market, indicating that a broader spectrum of Chinese brands has entered the "warming-up" phase.

The market structure of Chinese brands in Spain is gradually evolving into a "dumbbell-shaped" structure:

◎ On one end are established players like BYD and MG that have entered the mainstream brand tier.

◎ On the other end are emerging brands like Leapmotor, XPeng, and Jetour that are completing entry-level exploration and gradually expanding their influence.

Against the backdrop of the rapid increase in the share of new energy vehicles, the product competitiveness, price structure, and technological configuration advantages of Chinese brands have become increasingly prominent, earning them more space in the Spanish and even European markets.

Summary

In the Spanish auto market in June 2025, French brands Renault and Dacia continued to lead the pack, with German and Japanese brands showing stable growth. However, the most noteworthy development is the comprehensive breakthrough made by Chinese brands in the Spanish market, leveraging systematic product strength, price advantages, and fresh offerings. BYD and MG have entered the mainstream, while emerging forces such as Omoda, Jetour, Leapmotor, and XPeng are accelerating their market presence.