Interpretation of Mid-Year Report: Behind a 97% Surge in Profits, Thalys Successfully Completes High-End Breakthrough

![]() 07/14 2025

07/14 2025

![]() 480

480

As the mid-term results of the new energy vehicle market are gradually announced, an answer sheet of "inverted profits and sales" has caused shockwaves in the industry.

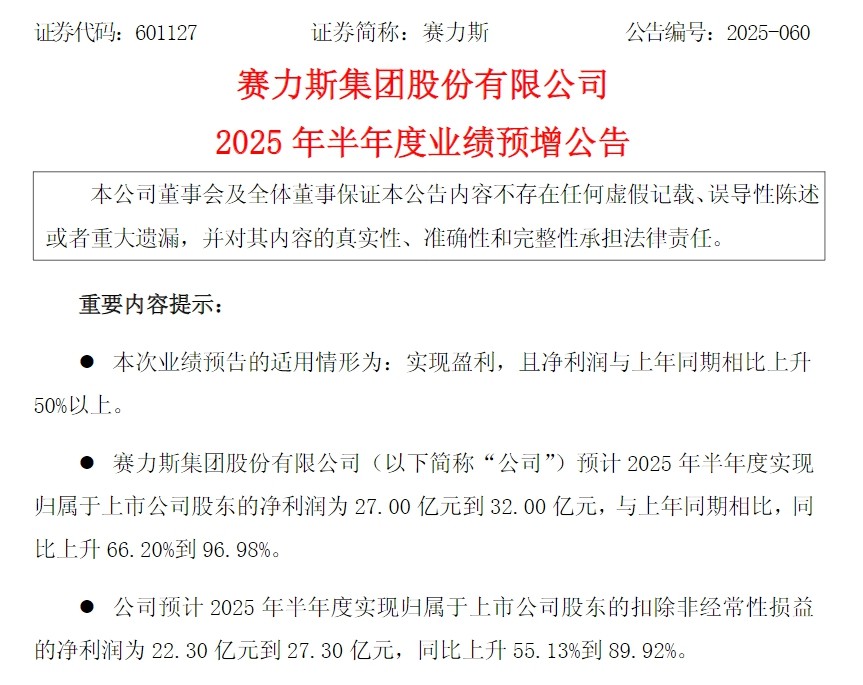

Thalys Group's latest performance forecast shows that it is expected to achieve a net profit of 2.7 billion to 3.2 billion yuan in the first half of 2025, representing a year-on-year increase of 66.20% to 96.98%, nearly doubling. Intriguingly, its vehicle sales during the same period declined by 15.77% year-on-year, with new energy vehicle sales down 14.35%.

Source: AITO Official

The scissors gap between profit and sales trends reveals a qualitative change in the competitive logic of China's new energy vehicle industry. As price wars reach their limits, the extensive strategy of "trading volume for price" is giving way to higher-order competition of "trading quality for profit".

The winning formula behind the surge in net profit

The performance forecast shows that the net profit after deducting non-recurring gains and losses is also expected to be between 2.23 billion and 2.73 billion yuan, representing a year-on-year increase of 55.13% to 89.92%.

Source: Official Announcement

In terms of sales, production and sales data show that Thalys sold a total of 198,600 vehicles from January to June this year, of which 172,100 were new energy vehicles.

Breaking it down, in the first half of this year, the sales of the AITO brand series were 152,239 vehicles, the sales of the BlueElectric brand series were 19,869 vehicles, and the sales of the FengGuang brand series were 26,495 vehicles.

However, high-premium models are often an important source of automakers' profits, and Thalys' counter-cyclical growth precisely coincides with the explosion of the luxury electric vehicle market.

Production and sales data show that AITO M9 sold 62,492 vehicles in the first half of the year, a year-on-year increase of 6.28%. In the past 15 months, the total delivery volume of AITO M9 has even exceeded 200,000 vehicles, making it the monthly sales champion in the 500,000 yuan price range in the Chinese market for 11 consecutive months.

On July 8, Hongmeng Smart Travel officially announced again that the cumulative delivery of AITO M8, which has been on the market for less than three months, has exceeded 40,000 vehicles, continuing to lead the sales of SUVs in the 400,000 yuan price range. The latest data shows that M8 delivered 5,044 vehicles last week, surpassing SUVs of the same size such as the Lynk & Co 900, Li Auto L9, ARCFOX S09, and Denza N9.

It can be seen that high-end models are becoming an invisible engine for Thalys' profit growth. In this regard, Thalys officials also stated that the company will adhere to the technical route of software-defined vehicles, firmly define the market route of user-defined vehicles, and enrich the product layout.

With the launch of new products in the second quarter of 2025, the company's sales volume in the second quarter increased significantly compared to the first quarter, its profitability enhanced, and its operating quality continued to improve.

Moreover, in the areas of battery life and refueling that users are anxious about, Thalys' Super Extended Range System provides a solution and builds a differentiated barrier. In comparison, its combined fuel consumption is reduced by 15%, and the frequency of noise perception of the range extender is reduced by 90%. A thermal efficiency of 44.8% and an oil-to-electricity conversion rate of 3.65kWh/L have successfully set an industry benchmark.

Technical dividends are directly converted into market discourse power. In 2024, Thalys sold over 470,000 range extenders and supplied them to 12 partners, and technology output is becoming a new growth driver.

Overall, the core logic behind Thalys' counter-cyclical growth in performance in the first half of 2025 lies in the strategic success of its high-end product mix. Although overall sales declined year-on-year, high-end models represented by AITO M9 and M8 continued to lead traditional luxury brands, and significantly increased the average price per vehicle and gross profit margin through high premiums, becoming an engine of profit growth.

This achievement directly confirms the effectiveness of the company's technical route of "defining the market with users", achieving a competitive upgrade from "trading volume for price" to "trading quality for profit" by accurately targeting the demand for luxury smart electric vehicles.

What is Thalys' trump card as high-end models take over cities and territories?

Behind the sharpness of high-end models taking over cities and territories lies the solid barrier that Thalys has quietly constructed on the underlying technical architecture.

The continuous leadership of AITO M9 in the 500,000 yuan market, the miracle of M8's "instant hit upon launch", and the establishment of an industry benchmark by the Super Extended Range System are not isolated achievements. Their common foundation is Thalys' commitment to technical foundation.

As Thalys advocates, "software-defined vehicles" are not just a conceptual gimmick. In terms of electrification, its Magic Cube technology platform, as a globally leading full-stack multi-power compatible platform, has taken the lead in the industry in realizing the compatibility of three new energy power forms: super-extended range, pure electric, and super-hybrid.

In terms of intelligence, the Magic Cube technology platform has currently achieved 100% SOA, equipped with full-scenario connectivity technology and multi-dimensional display technology, and supports seamless upgrades, enabling vehicles to have the ability to "evolve as they are driven".

Source: AITO Official

Moreover, its intelligent capabilities have been extended to the field of safety - the pioneering "scenario-defined safety" system realizes active risk prediction through multi-dimensional sensor fusion and algorithm decision-making. This has enabled AITO M9 to repeatedly obtain a super five-star rating in the C-NACP crash test, embodying the concept that "safety is the greatest luxury".

Behind Thalys' technological leadership lies its all-in investment. Financial report data shows that Thalys invested 7.053 billion yuan in research and development in 2024, a year-on-year increase of 58.92%; over the past decade, Thalys has invested a cumulative 23.817 billion yuan in research and development.

According to China Automotive Information and Technology Center's 2024 automotive patent statistics, the number of invention patents authorized for Chinese automobiles in 2024 reached 111,700, a year-on-year increase of 3.62%. Among them, Thalys made the Top 10 with 474 invention patents and ranked first in the growth rate of independent vehicle enterprises with 301.69%.

In addition, a key move was made in Thalys' deep collaboration with Huawei in the first half of this year. In March, Thalys further strengthened intelligent driving collaboration by strategically investing in Huawei's Yiwang Intelligence (holding 10% of shares).

Under the dual-track layout, Thalys leverages both Huawei's ADS3.0 intelligent driving system, HarmonyOS cabin, and other front-end technologies, and masters underlying capabilities such as the three-electric system and vehicle integration through independent research and development.

Nowadays, technical accumulation is also being converted into global chips. In April this year, Thalys officially submitted an application to the Hong Kong Stock Exchange. The prospectus shows that 20% of the funds raised will be used for investment in diversified new marketing channels, overseas sales, and charging network services to enhance global brand awareness.

At this time, the versatility of its Magic Cube platform demonstrates its strategic value. It can adapt pure electric versions for the European market and launch super-hybrid models for Southeast Asia, avoiding the incompatibility of "one technology for the global market". This flexible technical architecture distinguishes Thalys from automakers with a single technical route and gives it broader market penetration.

Survival rules under the differentiation of new forces

However, when the technological moat encounters drastic reshuffling of the market landscape, whether Thalys can convert its technological potential into a sustainable survival advantage needs to face the brutal reality of accelerated differentiation within the new force camp.

In the sand-washing new energy vehicle sector, many brands have already fallen in the first half of this industry marathon.

In the first half of this year, the sales rankings of new forces once again saw major changes. Zero Running Automobiles, which was previously lukewarm, topped the half-year sales list with 221,700 vehicles (a year-on-year increase of 156%).

Source: Zero Running Official

Hongmeng Smart Travel (including AITO) also slightly surpassed Li Auto with 204,700 vehicles. Li Auto delivered a cumulative total of 203,900 vehicles in the first half of this year, with a year-on-year increase of only 7.9%.

Even more brutal is the elimination of the tail end, with brands such as Jiyue and Nezha falling out of the top ten, confirming that the industry has entered a period of consolidation where "the strong get stronger".

Although Thalys was dragged down by the decline of older models such as M7 and M5, the proportion of high-end models continued to increase, with high-end models priced above 350,000 yuan accounting for 76%, and structural optimization offsetting the overall contraction.

In addition, the tense year of 2025 is also regarded as the year of the profit inflection point, with new forces collectively rushing to the profit or death line. Following Li Auto's two consecutive years of profitability, Thalys achieved a net profit of 4.74 billion yuan in 2024, turning losses into profits. In the first half of this year, net profit rose again, with net profit attributable to shareholders of the listed company expected to reach 2.7 billion to 3.2 billion yuan.

In comparison, in the first quarter of this year, Zero Running and XPeng increased their gross profit margins to around 15% through cost control, while NIO was still deeply mired in losses, with a gross profit margin of 7.6% in the first quarter. Thalys' gross profit margin has soared from 7.2% in 2023 to 23.8% in 2024, and in the first quarter of this year, it approached 30%.

It has to be said that when the capital market runs out of patience for "burning money for growth", the profit model is bound to become a new valuation anchor.

Thalys' triple layout (capital support, technical accumulation, product upgrades) is driving it to break through the siege and transform from a "Huawei OEM factory" to a technology-driven automaker.

When AITO M9 dominates the 500,000 yuan market over BBA, and when the Magic Cube platform begins to export technology externally, Thalys has quietly crossed the value gap of the OEM model.

Competition in China's new energy vehicle industry is escalating from a "war of sales" to a "war of profits" and a "war of technology". Thalys' mid-term answer sheet points out a path for the industry to traverse the cycle: enhancing value through high-endization, solidifying the foundation through technologicalization, and opening up space through globalization.

This path is bound to require continuous huge investments and strategic resolve, but for Thalys, which aims to join the million-vehicle club, this may be the inevitable battle to transform into a true industry giant.

Source: Pinecone Finance