Insights from a Closed-Door Meeting on Model Y L: Perspectives from Former Tesla Engineers, Wall Street Analysts, and AI Experts

![]() 07/24 2025

07/24 2025

![]() 627

627

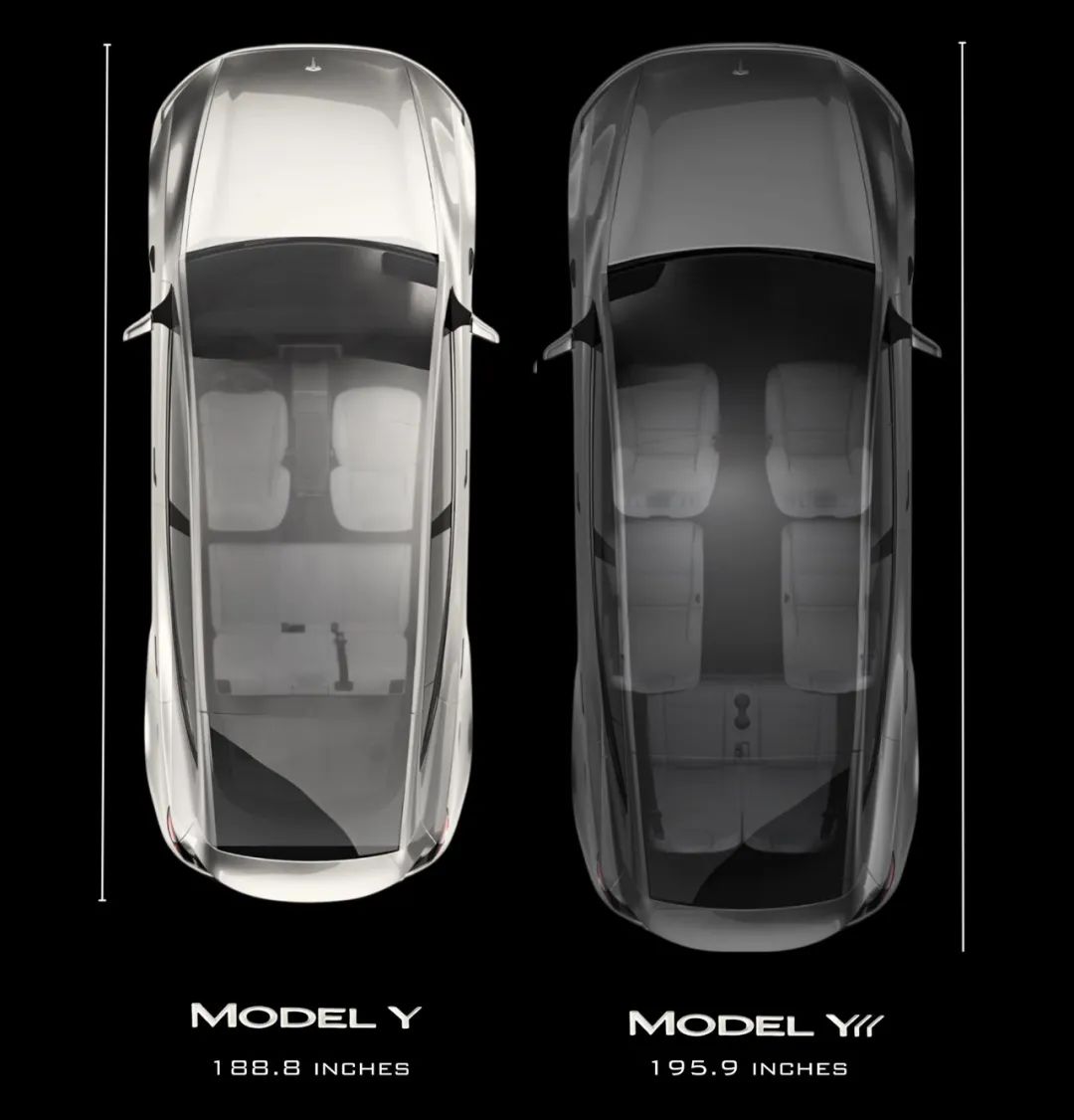

In the summer of 2025, Tesla reignited the fiercely competitive Chinese new energy vehicle market with the launch of its new model, "Model Y L."

The announcement of this six-seat version, tailored for the Chinese market, with a pre-sale price targeting the 400,000 yuan range, resonated deeply with the market.

Reactions from NIO's founder Li Bin, who "actively welcomed" the news, to Li Auto's CEO Li Xiang, who felt "pressured," and social media opinions like "Tesla finally bowing to the market" and "special edition harvester" created a buzzworthy public opinion.

Yes, this is a Tesla that is visibly more "understanding" of China and more "down-to-earth." It precisely targets the "family six/seven-seat SUV" segment, which has been repeatedly validated by local brands like Li Auto, AITO, and NIO and has become a red ocean in recent years.

However, beneath the surface clamor, a more thought-provoking strategic paradox emerges: In 2025, when the demand for FSD (Full Self-Driving) to enter China is at its peak and technological faith is at its zenith, why did Tesla, which has always used "intelligence" and "technology" as its spearhead, choose to play the seemingly plain and even somewhat "traditional" card of "space"?

To interpret this as a mere passive defense against declining sales or simple pandering to Chinese market preferences would be to underestimate Elon Musk and Tesla's strategic intentions.

Therefore, I organized a closed-door roundtable meeting at the first opportunity, inviting three heavyweight experts from Silicon Valley:

A former core engineer of Tesla's vehicle platform, deeply involved in the development and optimization of the Model Y platform.

A senior market analyst with years of experience on Wall Street, focusing on the automotive supply chain.

The co-founder and strategic leader of a top AI company in Silicon Valley, who has long tracked the commercialization path of AI technology in various industries.

In this in-depth, three-hour discussion, we jointly uncovered the three-tier "open strategies" hidden behind Tesla's Model Y L move.

Open Strategy of Efficiency

"The common perception is that Tesla was forced to make defenses and compromises in the 'refrigerators, TVs, and large sofas' competition. But for a true 'cost control master,' this is a 'low-risk, high-leverage' offensive," our market analyst stated, with a hint of excitement.

Model Y L is not a brand-new platform; it's a "modified optimized version" of the existing Model Y platform, which has already amortized huge R&D costs. What does this mean?

Tesla can maximize the reuse of its existing supply chain system with over 95% localization rate in the Shanghai Gigafactory. From the powertrain system, thermal management, to the central control screen in the cabin, most core components do not need to be redeveloped and verified, significantly shortening the time to market and avoiding the risks and costs of introducing new suppliers.

The core manufacturing processes, especially Tesla's prized "Gigapress" technology, will once again play a crucial role.

The former Tesla engineer explained, "Extending the rear half of the vehicle body would mean scrapping and resetting molds and fixtures for traditional automakers' stamping and welding lines. But for Gigapress, the complexity of adjusting the molds is relatively lower. This is Tesla's engineering confidence in launching 'new models' at astonishing speeds."

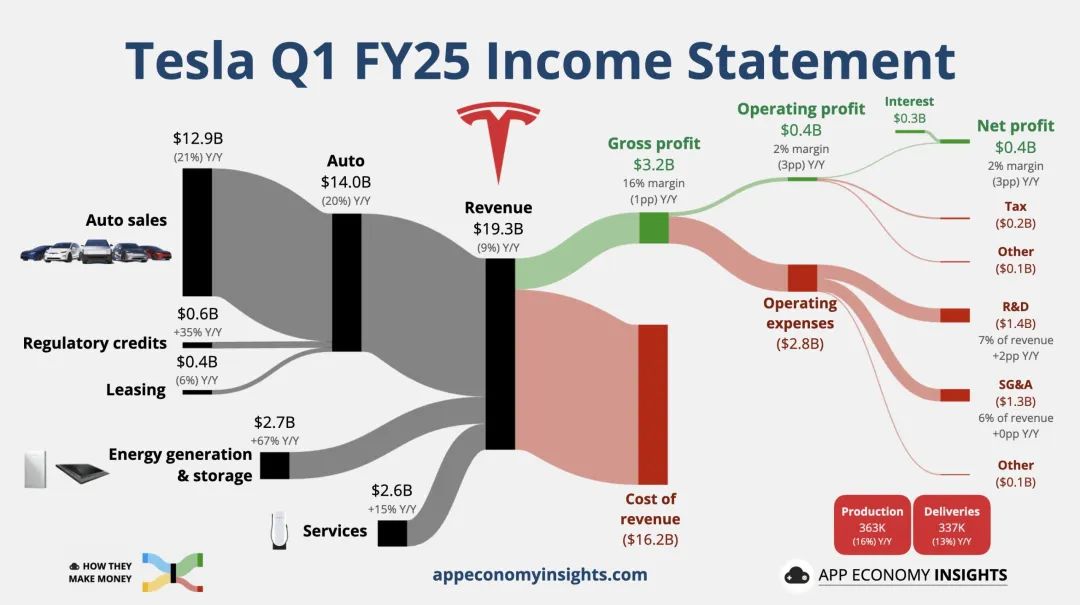

"Forget the flashy configurations and let's do a simple calculation," our market analyst said, mentioning ASP (Average Selling Price) and Gross Margin.

From five seats to six seats, from the standard version to the "L" version, the selling price of Model Y L is expected to be 50,000 to 80,000 yuan higher than the regular version. This increment will directly and significantly increase Tesla China's overall ASP.

What are the additional costs? Mainly the material costs of two additional seats, some extended body coverings, and corresponding interior trim panels. Compared to the increase in selling price, the growth of this BOM (Bill of Materials) cost is almost negligible.

When ASP increases significantly while the cost per vehicle only increases slightly, the extra part almost entirely converts into gross profit. For Tesla, facing a global price war and sustained pressure on gross margins, this is undoubtedly a shot in the arm. Model Y L's primary mission is to deliver a beautiful "profit defense counterattack" on the financial statements.

This reveals the full picture of the first "open strategy": Tesla abandoned heavy gambling in the uncertain field of "intelligence," which is difficult to monetize on a large scale in the short term, and instead chose to use a seemingly simple product variant in the field of "manufacturing costs," where it has an absolute moat, to precisely target a proven high-value market segment. With extreme manufacturing efficiency and brand appeal, it conducts a "cost line" strike against existing players, quickly grabs market share, and repairs and boosts financial performance.

Open Strategy of Mindset

"A non-consensus view that may make many 'Tesla fans' uncomfortable: The emergence of Model Y L marks that Tesla is actively completing a key brand mindset dimensioning in the Chinese market—from a 'technological icon' that needs to be looked up to, to a 'reliable shelf product' that is within reach," said the strategic leader of the AI company. He believes the essence of this move lies in the precise grasp of "user mindset."

Undoubtedly, FSD is Tesla's crown jewel and the core pillar of its valuation. But in China in 2025, it's still a "distant water." Despite the imminent entry of FSD into China, it will still take a long process of market education and trust-building for millions of Chinese car owners to willingly pay for its high buyout or subscription fees.

The full commercialization of high-level intelligent driving in China and even globally still faces complex regulatory approvals, liability definitions, and ethical challenges. For ordinary consumers, whether the FSD experience is good or truly "useful" remains a controversial topic.

In stark contrast, the demand for "more space" and "more seats" is "rigid" and "consensual." It requires no education or explanation; it's a core value that every multi-child family and every user who wishes to travel with their parents can understand and perceive within three seconds.

"This is almost identical to Apple's product strategy," the AI expert further elaborated. "Looking back at the history of the iPhone, when technological innovation entered a plateau period, what ignited a new round of growth? It was the iPhone 6 Plus. It didn't have revolutionary technology; it just made the screen bigger. But this seemingly simple 'Plus' accurately responded to the market's desire for large screens and opened up a new super replacement cycle."

Model Y L is Tesla's "iPhone Plus moment" in the Chinese SUV market. When the power of the FSD trump card cannot be fully unleashed in the short term, using a simple, brute, but extremely effective "L" to stabilize the base, attract new users, and consolidate market position is an extremely astute strategic pragmatism.

There are voices in the market that believe this is Tesla "giving up" under the "refrigerator, TV" offensive of NIO, XPeng, and Li Auto.

"On the contrary, this is not a sign of giving up but a reflection of strategic maturity. A great company must not only have the idealism to change the world but also the realism to face reality. A company willing to temporarily set aside its 'technological ego' for the ultimate victory and use the weapons its opponents are most proficient in to win battles is far more terrifying than a 'bigot' who only sticks to their comfort zone."

The core of this second "open strategy" lies in: Tesla actively switches its strategic focus, temporarily shifting the core of competition from "future technology" back to the dimension of "current product strength" before the decisive moment of intelligent driving arrives. It declares to the market and competitors through actions: I can play in your strongest field of "family users"; and when my FSD matures, you may not be qualified to enter my game. This is a typical asymmetric warfare mindset of "you fight yours, I fight mine."

Open Strategy of Data

"You all only see the cars, but for Tesla's core team, every car on the road is first a mobile, wheeled data collection terminal. And Model Y L will be the highest-value one they can deploy so far," said the former Tesla engineer, revealing the deepest and most easily overlooked third-tier "open strategy."

In the past, Tesla has accumulated massive mileage data through its huge fleet. But the evolution of AI models, to a certain stage, requires no longer repeated, low-quality data (e.g., daily urban commuting) but high-value, high-complexity "edge case" data.

The target users of Model Y L—middle-class families in China—are precisely the perfect producers of such high-quality data.

Their usage scenarios naturally cover the training materials most needed by AI models. From urban pick-ups during morning and evening rush hours (complex pedestrian and non-motor vehicle interactions) to weekend outings in the suburbs (mixed road conditions in rural-urban fringe areas), to long-distance highway travel during holidays (long-duration, cross-regional driving), these are all top-tier "nutrients" for training FSD to handle complex road conditions.

Every time a Model Y L owner drives manually, the FSD "shadow mode" running in the background is greedily learning. When the owner makes a precise lane-change decision on a complex overpass or avoids a suddenly appearing obstacle on a rural road, these valuable human driving decision data are all recorded and used to feedback and iterate Tesla's neural network.

If data is "fuel," then the commercial subscription of FSD is Tesla's future "money printer." Model Y L is also locking in the best customers in advance for this business loop.

A family user who often needs to drive for more than three hours on long trips has a much higher willingness to pay for an intelligent driving system that can truly "free hands and relieve fatigue" compared to a user who only commutes 20 minutes a day in the urban area.

Once family users purchase a car, they usually hold onto it for a longer time. This means that once they become FSD subscription users, they may continue to contribute high-profit software service revenue to Tesla for several years. This is an extremely attractive "Software-as-a-Service" (SaaS) business model.

The logical chain of this third-tier "open strategy" is now completely clear: Use "space" as bait to attract family users who can generate the most diverse, complex, and high-quality driving data, transforming them into massive "AI coaches"; while "feeding" and accelerating the evolution of the FSD model, lock in this batch of "golden seed" users who are most likely to pay for high-level intelligent driving in the future. Model Y L is not just selling cars; it is also selling "first-class tickets" for future FSD services and the "ultimate training camp" for AI models.

Returning to our original question, the Tesla Model Y L is far from a simple product stretch or a passive compromise.

When your team is debating over technical routes, when your investment decisions hang in the balance, when your product strategy is shrouded in uncertainty... remember, the confusion you face may very well be a journey that some experts have already traversed. We believe: genuine firsthand experience always comes from those who are driving industry change themselves.