With an Investment of 1 Million Yuan, You Can Become a Dealer Agent: GAC Motor Expands, Recruiting 600 Stores with a Focus on Lower-Tier Markets

![]() 12/15 2025

12/15 2025

![]() 432

432

At present, the mid-to-high-end automotive market is predominantly occupied by leading brands. Premium models from Huawei-affiliated entities and new energy vehicle (NEV) startups, alongside other prominent domestic brands, have firmly established themselves in the price range of 200,000 yuan and above. Consequently, it poses a significant challenge for traditional brands to penetrate this segment. Targeting the burgeoning county-level markets has, therefore, become an imperative strategy for numerous brands.

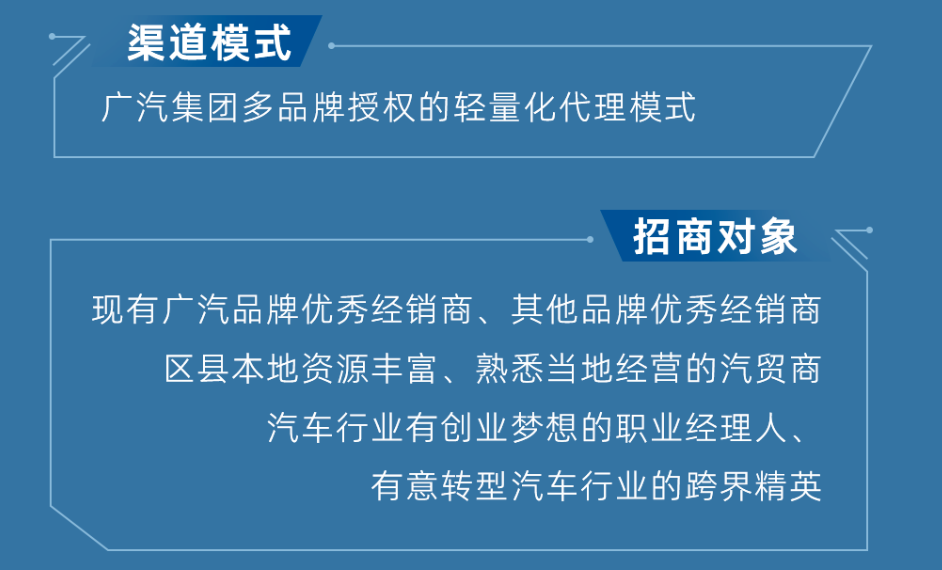

Recently, we obtained information from internal sources at GAC Group indicating that the company plans to establish 600 GAC brand collection stores across third, fourth, and fifth-tier cities by mid-2026. Following the announcement of this business initiative, over 1,000 investors have expressed interest and signed up. A spokesperson for GAC Group stated that this move is aimed at attracting talented individuals to sales and brand marketing roles.

No Threshold, Just Profitability

According to GAC's investment promotion personnel, traditional 4S stores typically necessitate a minimum of 10 million yuan in startup capital to commence operations. However, under the current scheme, one can acquire GAC brand agency rights for approximately 1 million yuan. Investors are required to provide their own venue, with 200-300 square meters being sufficient to initiate operations, along with a 3 million yuan deposit certificate. Upon meeting these basic prerequisites, the company will undertake the standardized renovation of the venue, while dealers will independently recruit 6-8 sales personnel.

This model also facilitates zero-inventory operations for dealers. Customers can place orders online via an app, adopting an order-based marketing approach to alleviate dealer pressure. Nevertheless, failure to meet long-term performance targets may result in the revocation of brand agency rights.

While agency operations may appear straightforward, profitability ultimately hinges on individual capabilities.

The pathway to profitability is relatively uncomplicated: firstly, earning commissions from vehicle sales; secondly, generating profits from maintenance and repair services.

It is understood that this model distinguishes itself from auto trade stores in that auto trade stores procure vehicles from 4S stores and do not benefit from new car incentives. Conversely, brand collection stores have direct access to manufacturers and receive equivalent fee and policy support. Their advantage lies in lower operational costs compared to traditional 4S stores, resulting in enhanced profit margins.

Regarding maintenance and repair services, agents are encouraged to form partnerships with repair companies. In the absence of such partnerships, GAC's nationwide 4S store network can provide warranty services, directing customers to nearby 4S stores for repairs. Investment promotion personnel noted that vehicle sales constitute only a portion of the profits, with substantial earnings potential in after-sales services. Maximizing profits necessitates the development of these functions.

While the profit model may seem straightforward, it is not without risks.

For instance, the costs associated with store setup are non-negligible, with expenses for renovation and sales personnel recruitment amounting to a significant investment. In county-level markets, where price competition is fierce, the promised high commissions may not translate into substantial profits for GAC models when pitted against competitors such as BYD, Geely, Leapmotor, and others. Additionally, the absence of in-house after-sales service may impact sales, offering little competitive edge over traditional dealers.

Therefore, investing in such an agency model requires a certain level of courage. While there are no entry barriers, investors prioritize future profitability and must meticulously assess potential earnings.

Zhang Hong, a member of the Expert Committee of the China Automobile Dealers Association, pointed out, "Under the lightweight agency model, agency stores are smaller and possess limited resources, making it challenging to equip them with professional after-sales teams and technical equipment. If the OEM fails to establish an effective after-sales support system, it may lead to inefficient repairs and inconsistent service quality, adversely affecting the customer experience."

Lang Xuehong, Deputy Secretary-General of the China Automobile Dealers Association, stated that while a dealer's profitability is closely tied to its operational capabilities, the OEM's product strength, channel policies, and pricing strategies are the core determinants of a dealer's profitability and even survival. Dealers must exercise due diligence in considering their risks, as this is a mutual selection process.

Qijing Ascends, GAC Descends

At the Huawei Qiankun Ecosystem Conference on November 20, Huawei and GAC jointly unveiled "Qijing" for the first time. All models in the lineup will fully integrate Huawei's most advanced Qiankun Intelligent Automotive Solutions. The arrival of this new brand paves the way for Huawei Qiankun to launch a new "Jing" series of brands.

For GAC Group, Qijing represents a new premium smart NEV brand co-created by Huawei Qiankun and the Qijing team. Funded by GAC Group, the main entity of the Qijing brand, Huawei Wang operates independently as the vehicle for the GH project, a technological collaboration between GAC and Huawei. Huawei Qiankun is deeply embedded as a core co-creation partner, participating in the entire product lifecycle, including definition, R&D, and cost control.

Qijing not only embodies Huawei Qiankun's strategic vision for the future of smart vehicles but also marks GAC's new foray into the premium market.

In terms of brand operations, besides enjoying top-tier team support from Huawei and GAC, Qijing differs from the "Five Boundaries" series brands in its sales channels.

The "Five Boundaries" adhere to Huawei's direct sales logic through user centers and space stores, relying on Huawei's offline stores and online traffic for sales. In contrast, the Qijing brand adopts a dealer agency model. According to Qijing's investment promotion materials, the brand plans to strategically cover 30 cities, adhering to the principle of fewer dealers but more stores.

Since Qijing initiated its investment promotion, the number of dealer applications has surged to three times the planned number of stores, with over 100 partners initially selected, covering numerous cities where HarmonyOS Intelligent Connectivity has yet to deeply penetrate.

As a new brand targeting the premium segment, Qijing indeed needs to focus on first and second-tier cities, where consumer purchasing power is high and market penetration is relatively easier. This strategy also benefits GAC's expansion into the premium market.

With Qijing established in the premium market, GAC's self-owned brands need to target new channels. Given that Qijing is a must-succeed brand for GAC, it is crucial to avoid internal brand competition. Therefore, these self-owned brands must identify suitable markets, with third and fourth-tier cities being ideal.

On December 5, GAC Group released its production and sales data for November 2025. Vehicle sales reached 179,700 units, marking a 5.2% month-on-month increase but a 9.72% year-on-year decline amid intensifying industry competition. Cumulatively, GAC sold approximately 1.53 million vehicles in the first 11 months, representing a 10.8% year-on-year decrease.

Judging by the development trajectory of GAC's self-owned brands—Trumpchi, Aion, and Hyper—over the past few years, their market presence has been waning. Trumpchi and Hyper lack blockbuster products, while Aion initially flourished in the B-end ride-hailing market but failed to capitalize on its growth due to internal resource allocation towards Hyper. Currently, Aion's sales are on a decline, making the exploration of lower-tier markets for incremental growth a viable strategy.

At present, county-level markets represent a critical growth area for domestic brands. BYD, XPeng, Li Auto, NIO, and others are all tapping into county markets. For instance, BYD extends its services to counties through its new energy vehicle rural outreach program, offering affordable pricing. XPeng launched the "Jupiter Plan" to accelerate channel expansion into lower-tier markets. FAW-Volkswagen introduced a "lightweight" network, encouraging 4S store investors to establish small "service stores" in communities.

Mastering the county-level markets ensures a stable sales base. Therefore, GAC Group's current lightweight channel agency strategy is on the right track. However, channels are merely the first step. Whether the model succeeds and whether vehicles can be sold depends on marketing, product strength, and, of course, GAC Group's pricing capabilities.