Under pressure, "Bull" rushes into the new energy race

![]() 06/18 2024

06/18 2024

![]() 547

547

Editor-in-Chief | Su Huai

"What does not kill me, makes me stronger" (Anything that doesn't kill you makes you stronger). This famous quote by German philosopher Friedrich Nietzsche is perfectly interpreted by the leading socket brand, Bull Group (603195.SH).

In the history of the company's development, Bull has experienced two life-and-death struggles. The first was during its early start-up phase. In a price war, Bull, which insisted on making high-quality sockets, was forced into a desperate situation due to consumers' unwillingness to pay for its high-priced products and high inventory. However, when Bull was at the end of its rope, it suddenly received a large order from the United States, which brought it back from the brink of collapse. After this, Bull's leader, Ruan Liping, began to ponder "how to sell good products even better" and found a new approach by对标 Coca-Cola's strategy of "selling sockets as daily necessities," thus embarking on a journey of scaling new heights.

The second battle was against Xiaomi (01810.HK). In March 2015, Xiaomi launched an artistic-level socket product with a USB port and a price of only 49 yuan, selling 250,000 units on its launch day. In June of the same year, Xiaomi's power strip sales exceeded one million. This caused Bull, which had been comfortably sitting on the sidelines, to immediately become uneasy and urgently convene a senior management meeting to prepare for a full-scale battle. To ensure victory in this battle, Ruan Liping spared no cost, even offering 2.2% of the company's equity to attract Hillhouse Capital. Ultimately, this confrontation ended with a complete victory for Bull.

Defeating Xiaomi also completely reinvigorated Bull, unlocking more possibilities for sockets, and gradually moving towards intelligent, personalized, and high-value products. While its socket business flourished, Bull, leveraging its vast channel advantages, has also successively deployed into the lighting and new energy fields.

On June 12, Bull announced the completion of its industrial and commercial registration changes, adding new businesses such as "sales of new energy vehicle battery swapping facilities," "sales of charging piles," "battery manufacturing," and "centralized rapid charging stations."

So, will Bull, which has thrived in the socket industry, be able to swim freely after crossing over into the new energy sector?

01

Reasons behind the shift to new energy

The current hot new energy race has become a highly competitive field.

Bull's entry into new energy can be traced back to 2021, when it began its layout with charging piles and guns as the starting point.

In June 2021, Bull began trial sales of new energy charging guns online and officially launched them in July. In 2022, Bull started to build new energy offline channels and established strategic partnerships with State Grid EV Network and Geely (00175.HK). In 2023, Bull launched a liquid-cooled integrated cabinet, announcing its layout in industrial and commercial energy storage. The same year, its 800KW_1720KWh industrial and commercial energy storage pilot station in Ningbo Cixi Guanhaiwei Industrial Park was launched. As a result, Bull's new energy business took shape and achieved impressive results.

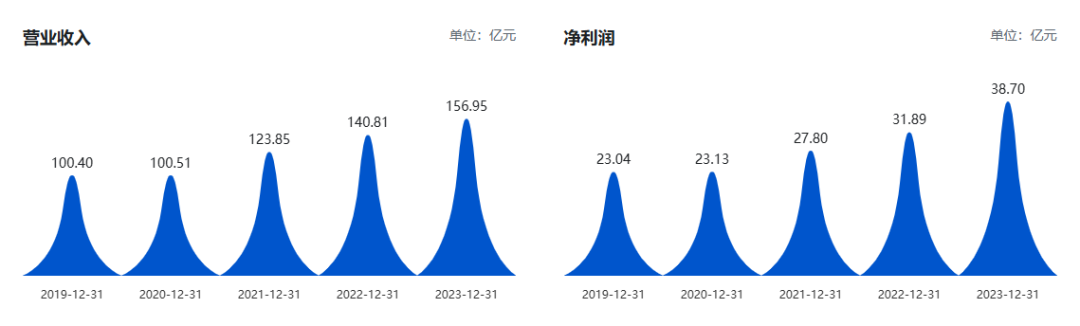

According to relevant data from Tianyancha and financial reports, from 2022 to 2023, Bull achieved revenues of 14.081 billion yuan and 15.695 billion yuan, with net profits attributable to shareholders of 3.189 billion yuan and 3.87 billion yuan, respectively. Among them, the new energy business achieved revenues of 153 million yuan and 380 million yuan, representing year-on-year growth of 638.62% and 148.64%, respectively.

Image source: Grandview Information · Bull Group Annual Financial Statements

It is not difficult to calculate that in 2021, the first year of Bull's new energy layout, it achieved approximately 22 million yuan in revenue from this business.

So, why did Bull choose 2021 as the time to enter the new energy race? According to our analysis, there are two main reasons:

First, Bull encountered monopoly penalties, leading to a slowdown in the growth of its main business.

On September 27, 2021, Bull announced that the company had been fined 290 million yuan for constituting and implementing a monopoly agreement with its trading counterparties. It was this penalty that began to expose the fatigue of Bull's main business.

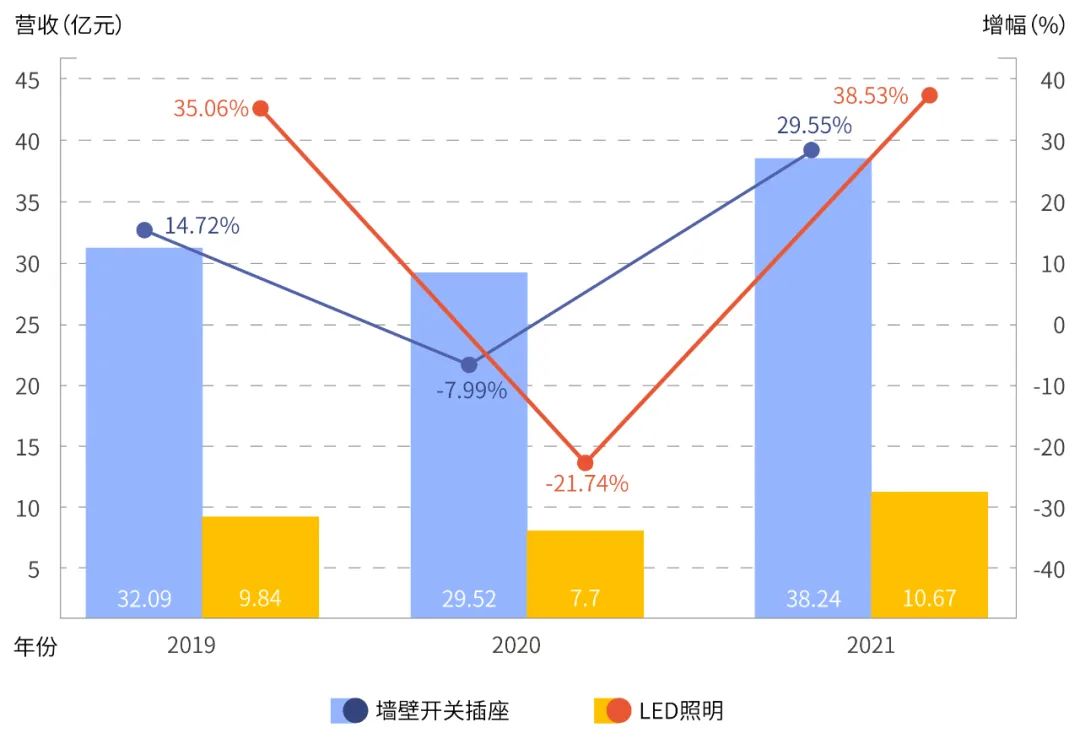

The financial report shows that in 2019, Bull's main products, wall switches and sockets, and LED lighting products, achieved revenues of 3.209 billion yuan and 984 million yuan, respectively, representing year-on-year growth of 14.72% and 35.06%, respectively.

Source Media Hub compiled and tabulated based on Bull Group's annual financial report data

Although Bull no longer separately disclosed the revenue of these two businesses in 2021, we can still get a glimpse from the growth rates. The financial report shows that in 2021, Bull's wall switches and sockets and LED lighting products achieved revenue growth of 29.55% and 38.53%, respectively, estimating that these two products achieved revenues of approximately 3.824 billion yuan and 1.067 billion yuan, respectively. Compared to 2019, the growth rates of these two main businesses of Bull were not significant at that time.

Coupled with the fact that many real estate companies successively went bankrupt in 2021, leading to a rapid decline in demand for refined decoration markets, and the growth of socket products was sluggish. According to data from AllViewCloud, there were 2,001 switch and socket supporting projects in the refined decoration market in 2022, down 42.6% year-on-year; the supporting scale was 1.4514 million sets, down 49.2% year-on-year.

Although Bull's main business growth has slowed, the new energy sector related to electrical products has ushered in a period of high dividends. This is the second reason why Bull ventured into the new energy field: the rapid growth in production and sales of new energy vehicles.

According to statistics and analysis by the China Association of Automobile Manufacturers, China's new energy vehicles became the biggest bright spot in the automotive industry in 2021, ranking first in global sales for seven consecutive years, and its market development has shifted from policy-driven to market-driven new development stages.

In terms of production and sales, in 2021, China's new energy vehicles achieved production and sales of 3.545 million and 3.521 million, respectively, both representing year-on-year growth of 1.6 times, with a market share of 13.4%, 8 percentage points higher than the previous year.

The rapid growth of new energy vehicles has also directly driven a surge in demand for charging infrastructure. According to data released by the China Electric Vehicle Charging Infrastructure Promotion Alliance, in 2021, China's charging infrastructure increment reached 936,000 units, of which the increment of public charging piles was 340,000 units, up 89.9% year-on-year; the increment of on-board charging piles surged to 597,000 units, up 323.9% year-on-year.

Image: Bull Safe DC Charging Pile | Source: BULL official website

By the end of 2021, the national charging infrastructure保有量 reached 2.617 million units, an increase of 70.1% year-on-year. The total charging volume for the year reached 11.15 billion kWh, an increase of 58.0% year-on-year. The demand for electric vehicle charging continues to grow rapidly.

On one hand, the main business is stuck in a growth bottleneck, and on the other hand, the new energy market is in a period of rapid growth. The combination of these two factors ultimately led to Bull's involvement in the new energy race. Together with electrical connections and intelligent electrical lighting, new energy forms one of Bull's three strategic business segments.

02

The "socket myth" may be difficult to replicate

Can betting on new energy create a new Bull?

Since entering the market in 2021, Bull has spared no effort to accelerate the development of its new energy business. In 2023, Bull's new energy product development SKU exceeded 90, an increase of 30% compared to 2022, and new product sales exceeded 100 million yuan, achieving 109% of its new product sales target.

In the charging gun and charging pile business, Bull has launched a series of products based on the different characteristics of the B-end and C-end markets: for the B-end, it has introduced fast DC charging piles represented by group charging; for the C-end, it has developed innovative aluminum extrusion integrated "mobile charging piles" that can be used in multiple scenarios such as fixed charging, multi-point fast charging, and portable charging.

In the energy storage business, Bull has launched both household energy storage and industrial and commercial energy storage products for the European and domestic markets. Taking industrial and commercial energy storage as an example, Bull has launched a 125KW, 230KWh liquid-cooled industrial and commercial energy storage cabinet that can greatly meet the needs of domestic small and medium-sized commercial users for the storage and use of new energy sources as well as the adjustment of industrial electricity demand between peak and off-peak hours.

From a channel perspective, for the C-end market, Bull has proactively expanded into professional distributors such as new energy automotive dealerships and beauty decoration stores. By the end of 2023, it had cumulatively developed more than 17,000 terminal outlets; for the B-end market, it focused on developing customers in scenarios such as government institutions, enterprises, and charging stations. By the end of 2023, Bull had cumulatively developed more than 1,500 operator customers, completed the construction of over 20,000 commercial charging piles and guns, and established strategic partnerships with companies such as China Tower Corporation, State Grid Corporation of China, Geely's EV brand Geometry, and Seres (601127.SH).

If we look at the above data performance alone, Bull's new energy business growth momentum is quite optimistic; however, if we return to the market level, such an optimistic situation is difficult to maintain. In the charging pile and gun business, whether it is the B-end or C-end market, Bull faces extremely stringent competitive challenges.

For example, on the B-end side, current players such as State Grid, Telaidian, and Xingxing Charging have already captured a large share of the market and possess strong offline charging networks. On the C-end side, well-known domestic and foreign new energy vehicle manufacturers such as Tesla (NASDAQ:TSLA), NIO (NYSE:NIO, 09866.HK), LI Auto (NASDAQ:LI, 02015.HK), and BYD (002594.SZ, 01211.HK) all have their own charging facilities. Except for some manufacturers that provide charging piles with the car, most car owners tend to prioritize purchasing the charging pile services provided by the car manufacturers themselves. Therefore, from any perspective, it will not be easy for Bull to catch up later in both the B-end and C-end markets.

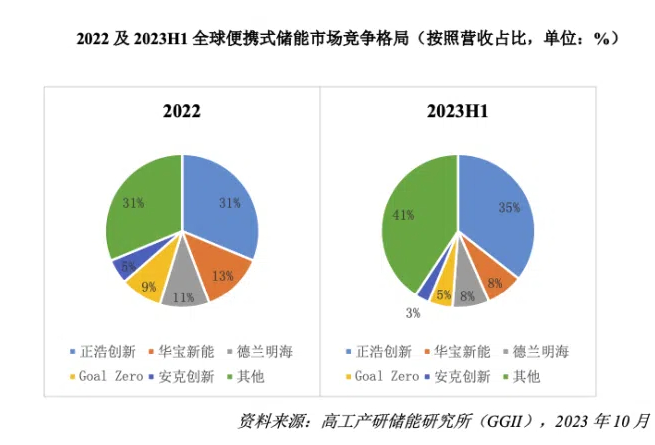

The energy storage business is also not optimistic. According to data from Gaogong Industry Research, in the first half of 2023, the top five global portable energy storage market share rankings were: EcoFlow with 35%, Jackery (301327.SZ) with 8%, Bluetti with 8%, Goal Zero with 5%, and Anker (300866.SZ) with 3%. The combined market share of the top five reached 59%, almost capturing more than half of the market, with a significant head effect.

Image source: Gaogong Industry Research

What is the industry's view on Bull's entry into new energy? Is lighting companies' layout in new energy a new trend?

"Bull's main business is sockets, belonging to the electrical industry, and making charging piles and energy storage products is more relevant than lighting. However, from the perspective of lighting companies, entering new energy (charging guns/charging piles) is not very relevant, while the energy storage industry would be more relevant. Because energy storage is similar to a large power bank, whether it's lighting or car charging, it's equivalent to electronic devices on a power bank, with a relationship between storing and using electricity," said an industry insider who wished to remain anonymous to Source Media Hub.

In addition, the person also said, "However, energy storage and photovoltaics have strong cyclicality due to the energy crisis and national subsidies. Also, new energy has begun to experience overcapacity in the past two years, which was caused by some low-end companies, such as those making power banks, entering the market in previous years."

Although from the perspective of relevance, Bull's layout in new energy is not considered "irrelevant to its main business," in the context of fierce market competition and the gradual formation of a top-tier landscape, with only three years of entry and a total revenue of approximately 555 million yuan, Bull does not have convincing power and discourse authority, whether it is on the channel side or the terminal side.

Therefore, it is by no means easy for Bull to replicate its "socket myth" in the new energy sector.

Some images are引用from the internet. If there is any infringement, please inform us for deletion.