BMW has no choice, is Northvolt a hopeless case?

![]() 06/24 2024

06/24 2024

![]() 461

461

Lead

Recently, media reports have claimed that BMW has canceled a 2 billion euro order with Swedish battery manufacturer Northvolt. As the most prominent battery company in Europe, Northvolt has made limited progress in product mass production despite receiving a large number of orders and government subsidies.

According to foreign media reports, the order canceled by BMW originated from a long-term battery supply agreement signed between BMW and Northvolt in 2020. According to the agreement, BMW would purchase Northvolt's fifth-generation batteries, which were scheduled to be delivered to BMW in 2024. The biggest highlight was that these batteries would "utilize 100% wind and hydroelectric power" during production. However, based on the current situation, Northvolt seems to have failed to meet customer demand in terms of timely delivery or product quality.

BMW reportedly canceled a 2 billion euro order from Northvolt

Chinese and Korean battery companies are playing a leading role globally

The importance of batteries for electric vehicles is self-evident. Especially in the European Union, which is the first region in the world to make the decision to ban the sale of all vehicles with internal combustion engines, including hybrid technology, by 2035, having a competitive battery industry chain is crucial.

Compared to a number of Japanese and Korean battery companies, Northvolt can be considered the "Jia Baoyu" of the European automotive market, born with a golden spoon. Founded in 2016, this European battery company not only received significant subsidies from the European Union when establishing its factories, but has also received large orders from many European automakers over the years, including BMW, Volkswagen, Volvo, Scania, and other major customers, with orders to Northvolt totaling $55 billion.

Northvolt has received large orders from European automakers

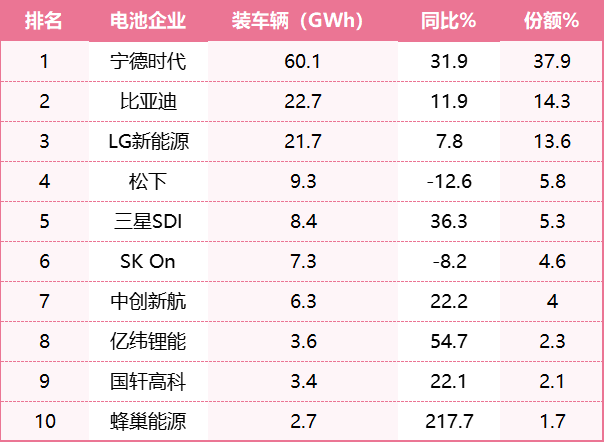

However, from the current lithium battery market perspective, Chinese battery manufacturers led by CATL and BYD have a significant advantage. According to the global battery installation rankings for the first quarter of 2024 released by China Automotive Industry Data Research, CATL and BYD jointly accounted for more than 50% of the global share, with Japanese and Korean battery companies trailing behind. Notably, no European battery companies made it into the top 10, which is a big irony for Europe's electric vehicle strategy.

Global battery installation rankings for the first quarter of 2024 released by China Automotive Industry Data Research

Does Northvolt still have a chance to turn things around?

Northvolt's inability to deliver batteries to BMW on time will not only have a significant impact on BMW's electric vehicle strategy, but also a slap in the face for the European Union authorities who have just announced punitive tariffs on Chinese electric vehicles. Using high tariffs to keep Chinese electric vehicles out of the European market is not a long-term solution. To truly establish a foothold in the electric vehicle sector, revolutionary breakthroughs in battery technology are needed.

At present, the main reason that troubles the promotion of electric vehicles, especially in Europe, is still the cost. The battery pack, which accounts for about one-third of the cost of electric vehicles, is the key to cost reduction. Based on current technology, Chinese battery companies excel in lithium iron phosphate batteries, which are the best choice to balance performance, cost, and safety. This is also one of the main reasons why Tesla chose BYD's blade batteries for its entry-level Model Y model produced at its super factory in Berlin, Germany.

In order to better compete with Chinese lithium iron phosphate batteries, Northvolt announced last year that it had made significant breakthroughs in energy density in sodium ion battery technology. The peak energy density of its developed sodium ion battery exceeds 160 watt hours per kilogram, and it does not contain lithium, nickel, cobalt, and graphite. Lower cost sodium ion batteries are expected to become the best technological solution to challenge China's lithium iron phosphate batteries, but the prerequisite is whether Northvolt can quickly promote the commercialization of sodium ion batteries.

However, compared to technological innovation at the product level, Northvolt still needs to address the "enterprise disease" in Europe. Compared to the crisis awareness of domestic battery companies, European companies generally do not have a significant sense of crisis. In the absence of intergenerational advantages in product strength, if Northvolt does not put in more effort, whether in new technology research and development or factory production capacity, it will definitely not be a competitor to domestic battery companies. But it may be even more difficult to keep Swedes and Germans working overtime to mass produce battery products as soon as possible.

BMW battery supplier is not just Northvolt

For BMW, if Northvolt performs better in the later stages, then BMW will definitely not abandon this "Jia Baoyu" in the European electric vehicle industry. But if Northvolt is still a struggling player, then BMW's existing supplier list also has enough options.

For BMW today, the curtain of electrification has already begun. The batteries previously purchased from Northvolt have been applied to i4, i7, and iX models. However, the highlight of BMW's electric vehicles has been placed on the Neue Klasse model. As a new generation of electric vehicles with a comprehensive leap in product strength, ensuring the success of the "Neue Klase" model will directly determine the success of BMW's electric vehicle strategic transformation, which is related to the future fate of the entire group. Therefore, there is no room for any negligence.

Due to the launch of the first electric vehicle of the new generation in 2025, BMW will choose relatively stable and mature technological solutions such as CATL, Yiwei Lithium Energy, and Yuanjing Power's circular batteries to solve the urgent need for battery supply for the new generation of electric vehicles; On the other hand, the first batch of solid-state battery A samples, which BMW collaborated with American solid-state battery company Solid Power, have been delivered to BMW in 2023. In the future, BMW will deploy better performing solid-state battery products on high-end models of the "new generation" electric vehicle project. At that time, the 1000 kilometer range achieved by domestic car companies using solid-state batteries can also be seen in BMW electric vehicles.

comment

For many European multinational car companies, collaborating with Chinese battery companies is a shortcut if they really want to make a difference in the electric vehicle field. Chinese companies not only excel in the field of complete vehicles, but also in the field of batteries. Chinese battery companies such as CATL and BYD invest heavily in research and development every year. Northvolt, without a first mover advantage, has little chance of winning against these Chinese battery manufacturers. If the European Union continues to exclude Chinese battery companies beyond the entire vehicle market, the European electric vehicle industry will completely lose its reliance. The 2035 ban on the sale of gasoline vehicles, as formulated by policies and regulations, will also become a laughing stock worldwide.