Evolution of New Energy Vehicles: Plug-in Hybrids Soaring, Battery Electric Vehicles Lagging

![]() 06/25 2024

06/25 2024

![]() 549

549

The fuel tank is actually the core competitiveness of new energy vehicles.

Is the fuel tank actually the core competitiveness of new energy vehicles?

Recently, the China Passenger Car Association released sales data for new energy vehicles in China from January to May. Among them, the cumulative retail sales of pure electric vehicles reached 1,931,676 units, an increase of 17.5% year-on-year, while the cumulative retail sales of plug-in hybrid electric vehicles (including range extenders) reached 1,324,095 units, an increase of 70.1% year-on-year.

Although pure electric vehicle sales still lead plug-in hybrid electric vehicles by about 600,000 units, the growth rate is only a quarter of the latter. If this trend continues, it is expected that domestic plug-in hybrid electric vehicle sales will catch up with pure electric vehicles by 2026.

The purpose of promoting the development of new energy vehicles is to get rid of dependence on fossil fuels and reduce carbon emissions through the application of electric energy. While plug-in hybrid electric vehicles can reduce energy consumption and carbon emissions to a certain extent, they ultimately go against the original intention of the new energy vehicle industry.

How to enhance the competitiveness of pure electric vehicles and make their growth rate exceed plug-in hybrid electric vehicles has become an issue that some car companies need to face.

Plug-in sales soar due to insufficient pure electric experience

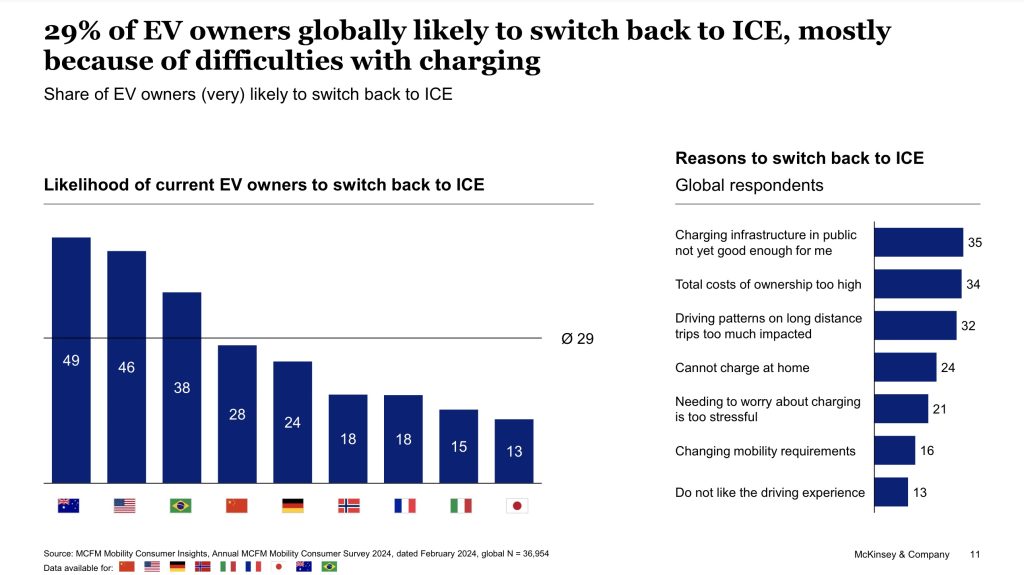

A while ago, McKinsey & Company launched a survey among 30,000 electric vehicle owners globally, including China, the United States, Japan, Australia, Germany, France, Italy, Norway, and Brazil.

In the survey, 29% of electric vehicle owners said they might return to internal combustion engine (ICE) vehicles. The proportion of electric vehicle owners in Australia and the United States considering returning to ICE vehicles reached 49% and 46%, respectively, while in China, 28% of electric vehicle owners plan to return to ICE vehicles.

Respondents indicated that electric vehicles have issues such as imperfect charging infrastructure, high overall ownership costs, and limited long-distance travel. It seems that global consumers have similar feelings about new energy vehicles.

The domestic situation is slightly better, with charging standards already unified, car companies actively building charging stations, and a number of third-party charging stations available. However, during peak periods like holidays, there may still be insufficient charging piles in expressway service areas.

Especially during the Spring Festival, when a large number of migrant workers drive long distances to return home, some service areas have long queues at gas stations, with waits of at least half an hour for gas. Long waits for charging are not uncommon.

In addition, although domestic battery companies and car companies have released many 800V, 5C products, the charging piles in expressway service areas still mainly use 2C, with a charging power usually not exceeding 180kW. It takes about 40 minutes to fully charge a battery from 20% capacity.

Slow charging speeds and insufficient charging piles during holidays can affect consumers' travel experience. While short-distance travel may not be too affected, long-distance travel with long queues at charging piles can easily evoke owners' range anxiety.

Regarding costs, pure electric vehicles have the advantage of low travel costs, but due to the high price of batteries, the same model's pure electric version is mostly priced higher than the plug-in hybrid version, such as BYD Qin/Song PLUS, Deep Blue S7/SL03, and WENJIE M5/9.

However, due to the upgrading and iteration of hybrid technology, the travel cost of plug-in hybrid models is also constantly decreasing. For example, BYD's latest masterpiece, the Qin L Dm-i, has a 65L fuel tank that achieves a range of over 2000 kilometers, with an average cost per kilometer of less than 0.3 yuan, which is not much different from the travel cost of pure electric vehicles.

In the competition with plug-in hybrid vehicles, pure electric vehicles are already at a disadvantage. If they cannot be changed in a timely manner, more pure electric vehicle owners or potential consumers may return to the fuel powered and plug-in hybrid vehicle camp in the future.

Breaking through the core experience becomes the key to breaking the game

At the beginning of this year, Zou Liangjun, Senior Vice President of Ideal Automobile, revealed in an interview that the company plans to launch four electric vehicles this year, forming a "4+4" lineup with extended range vehicles. However, the pure electric MPV model MEGA did not achieve the expected results after its debut, resulting in Ideal having to postpone the release and launch of the remaining three pure electric SUVs.

The sales growth of pure electric vehicles has gradually reached a bottleneck, while plug-in hybrid vehicles have maintained a high growth rate, with sales reaching new highs. The key to the breakthrough of pure electric vehicles lies in the joint efforts of pure electric vehicle suppliers, car companies, and third-party charging companies to increase investment in battery, vehicle research and production, and ecology.

To reduce the cost of electric vehicles and improve the energy replenishment experience, the first thing to consider is whether the supply chain, especially power battery companies, can compress battery costs and improve charging power through technological upgrades.

On April 25th of this year, CATL released the world's first lithium iron phosphate battery, the Shenxing PLUS, which combines an ultra long range of 1000 kilometers and 4C fast charging. Lithium iron phosphate batteries have low cost, but low energy density and slow charging speed. Shenxing PLUS has achieved a technological breakthrough, allowing lithium iron phosphate batteries to have ultra long range and 4C fast charging, which is expected to solve the range anxiety of mid to low-end pure electric vehicle consumers.

More and more car companies are establishing power battery factories to reduce the procurement cost of power batteries through self research and production.

In addition, the lithium battery recycling system is becoming increasingly perfect, and the price of lithium carbonate is also steadily decreasing. These factors will all lead to a decrease in the cost of power batteries, and pure electric vehicles will also have more room for price reduction.

The compression of vehicle costs mainly depends on the actions of car companies. In recent years, domestic car companies have launched integrated die-casting solutions. Although there are differences in the industry's treatment of this technology, integrated die-casting has actually reduced automobile production costs and improved vehicle body strength. In addition, with the hot sales of new energy vehicles, car companies can share costs through large-scale mass production and also reduce the total production cost of new energy vehicles.

However, after entering June, the price war among domestic car companies slowed down, and some executives of car companies even proposed the concept of abandoning price tags and shifting to value tags. Xiaotong believes that the two are not in conflict. The value of the roll is to enable consumers to purchase products with a better experience, while the price of the roll is to enable consumers to afford the products they desire. The foundation for the healthy development of the industry lies in both the price and value of the car company's paper.

Finally, in terms of ecology, at the recent press conference of the National Development and Reform Commission, spokesperson Li Chao stated that as of the end of May, the country's basic charging facilities had reached 9.92 million, including 3.05 million public charging facilities and 6.87 million private charging facilities, making it the world's largest automotive charging system.

Considering the high energy consumption at high speeds, reduced battery life at low temperatures, and limited number of 4C and 5C charging stations in pure electric vehicles, there is still room for improvement in the domestic charging ecosystem. Fortunately, both car companies and third-party charging companies are accelerating the construction of a charging ecosystem to ensure the charging experience for pure electric vehicle owners.

For the problems existing in new energy vehicles, relevant departments, car companies, suppliers, and ecological chain enterprises have all been prepared and committed to changing the current situation through technological upgrades. But it still takes time for technology to go from research and development to implementation, and then to acceptance by consumers.

Pure electric is the future, but it is still far away

At the beginning of 2024, global automotive giant Stellantis Group announced a $6 billion investment in the development of internal combustion engine vehicles, while car companies such as Mercedes Benz, Ford, BMW, Audi, and Porsche postponed their electrification transformation goals. UBS Group also predicts that the sales growth of electric vehicles in the United States will decline to 11% this year, and the sales growth of new energy vehicles in Europe, America, and Australia will slow down.

For a while, the entire industry was filled with the topic of European and American players "withdrawing" from the new energy industry, but the reality is not so. These car companies are still investing heavily in the research and development of new energy technologies. However, at this stage, the competitiveness of new energy vehicles is not obvious, and it is necessary for fuel vehicles to stabilize the basic market.

IDC predicts that the size of China's new energy vehicle market will reach 15.98 million units in 2026, with a compound annual growth rate of 35.1%. Although the growth rate of new energy vehicles in China has relatively slowed down, it still exceeds the global average level. The most likely reason for this is that overseas companies are unwilling to invest too much resources in building new energy vehicle related ecosystems, while domestic related companies are actively building ecosystems.

Returning to plug-in hybrid vehicles and pure electric vehicles, Xiaotong believes that the changes in the domestic industry are different from those overseas. Foreign consumers are planning to return to the internal combustion engine (ICE) camp because there are not many options for plug-in hybrid vehicles (PHEVs) in the local market. Overseas car companies mainly focus on pure electric vehicles in their new energy vehicle business, and in 2023, China's plug-in hybrid vehicle market share is about 68.9% of the global market.

It is likely that pure electric vehicles and plug-in hybrid vehicles will seize the market share of gasoline vehicles in China. Considering that plug-in hybrid vehicles have no range anxiety, lower ownership costs, and lower travel costs, the sales growth of domestic plug-in hybrid vehicles will be higher than that of pure electric vehicles in the coming years, and even annual sales will exceed that of pure electric vehicles.

Perhaps only when the share of gasoline vehicles is less than 20%, new energy vehicle technologies and ecosystems are mature and perfect, plug-in hybrid vehicles and pure electric vehicles are in direct competition, and the cost of owning pure electric vehicles is on par with plug-in hybrid vehicles, can the sales growth of pure electric vehicles surpass that of plug-in hybrid vehicles.