Price cuts, layoffs, and factory sales: Can joint venture brands save themselves by taking drastic measures?

![]() 06/26 2024

06/26 2024

![]() 551

551

Recently, Chery announced its strategic cooperation intention with Jaguar Land Rover, and Jaguar Land Rover's new product line will adopt Chery's pure electric platform for production. On the other hand, Dongfeng Nissan Yunfeng Factory has chosen to produce a new pure electric SUV product for Lantu. Both of these foreign brands, one seeking OEM production from an independent brand and the other OEM producing for an independent brand, are aiming at cost savings.

If we go back in time, focusing on the issue of cost savings, FAW-Volkswagen and GAC Honda, two backbone joint venture brands, have submitted the same answer - layoffs, which also means that once high-profile joint venture brands have entered the most difficult moment. Especially when the sales data for May was released, the market share of joint venture brands dropped to 28.8%, making the public more intuitively aware of the severity of the situation faced by joint venture brands in China.

Although it is evident that joint venture brands are facing a rapid decline under the impact of electric and intelligent vehicles, the situation of recent years has still surprised many industry insiders. In this process that can almost be described as a "dive," what exactly did joint venture brands do wrong? Will they have an opportunity to stage a comeback in the future?

01 Even bone-breaking price cuts couldn't save sales

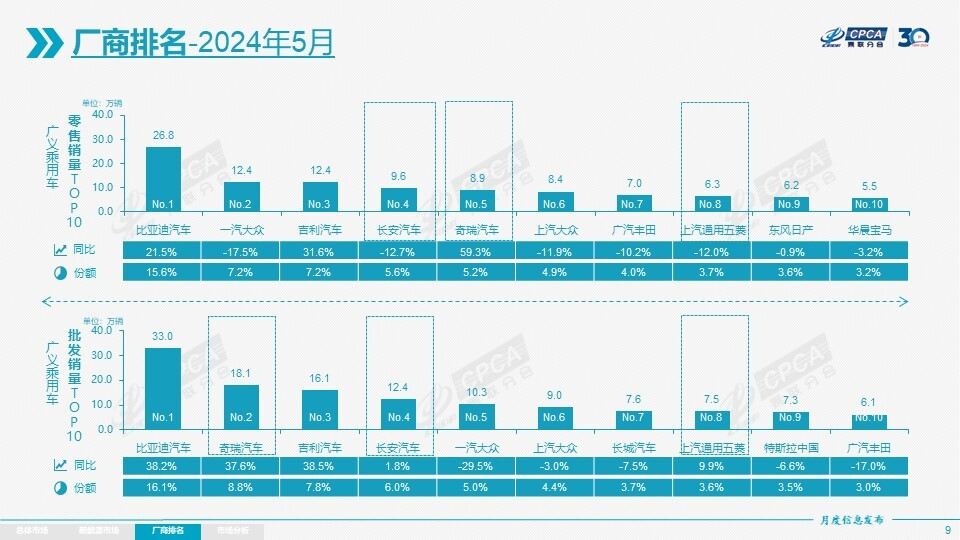

According to the latest data from the China Passenger Car Association, among the top 10 brands in retail sales in May, there were 4 independent brands and 6 joint venture brands. It is worth noting that, except for Tesla, all other joint venture manufacturers saw declines in sales, with FAW-Volkswagen, SAIC Volkswagen, and GAC Toyota suffering double-digit declines. In contrast, three of the four independent brands on the list saw sales growth of over 20%. Not only that, but the sales gap between the champion BYD and the runner-up FAW-Volkswagen has more than doubled compared to last year, from 70,000 vehicles to 144,000 vehicles.

Review of the national passenger car market in May. Source: China Passenger Car Association

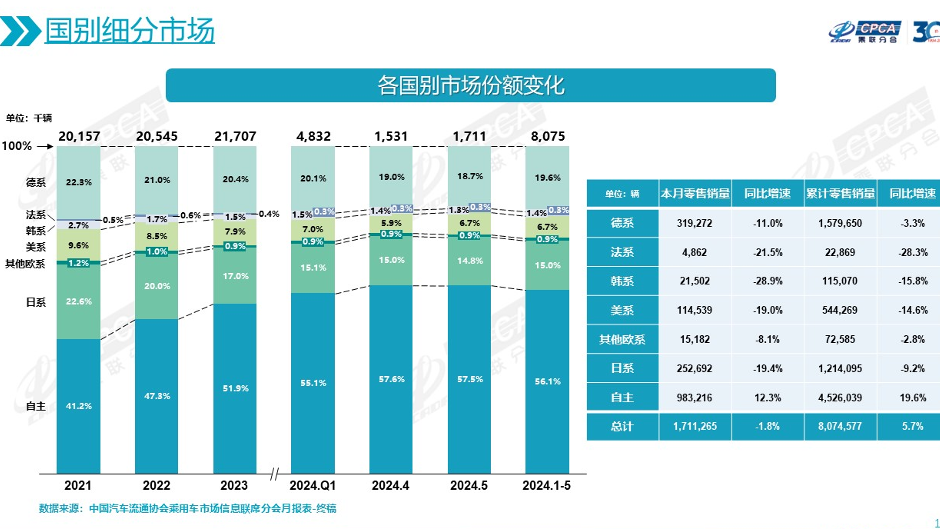

In recent years, although French, Korean, and American brands have gradually stepped down from their thrones, the German and Japanese brands, which are the backbone of joint venture brands, still performed relatively strongly. However, the latest sales data shows that even German and Japanese brands have both started a "diving" mode.

In May, the retail market shares of German and Japanese brands were 18.6% and 14.8%, respectively, down 2 and 3.2 percentage points year-on-year. Not only that, from a long-term perspective, the sales of German and Japanese brands have also shown a downward trend. From January to May this year, the cumulative retail sales of German and Japanese brands decreased by 3.3% and 9.2%, respectively, with market shares of 19.6% and 15.0%, respectively, a decrease of 2.7 and 7.6 percentage points compared to 2021.

Changes in market share by country. Source: China Passenger Car Association

It is worth noting that this achievement was still achieved through continuous price cuts and concessions made by joint venture brands and luxury brands.

In May this year, news spread that the prices of Audi's entire model line had collapsed. The entry-level version of the Audi A4L was available for as low as just over 190,000 yuan, and the Audi A6L price was reduced by 120,000 yuan, with the bare car priced at less than 310,000 yuan. In fact, Audi was not the first foreign brand to engage in crazy price cuts. After BYD Qin Plus Glory Edition went on sale at a price of 79,800 yuan at the beginning of the year, Volkswagen, Toyota, Honda, Mercedes-Benz, and BMW joined the price war, with fierce competition. For example, the entry-level price of the Volkswagen Teramont was directly reduced from 295,000 yuan to 249,000 yuan, the official price of the BMW i3 pure electric sedan was reduced to just over 170,000 yuan from 353,900 yuan, Mercedes-Benz C200L offered a starting price of 202,700 yuan (official guide price of 334,800 yuan), and a moderately equipped Highlander could be obtained for just over 200,000 yuan in the terminal market.

From the perspective of price reduction, product quantity, and brand scale, this round of price wars among foreign brands can be described as unprecedented. However, this wave of "bone-breaking" price cuts did not achieve the expected market recovery. Compared to the end of 2023, the market share of foreign brands has shrunk by 4.2 percentage points in just five months, and the speed of their sales decline has greatly exceeded the expectations of almost all industry insiders.

02 The "killer blow" that defeated foreign brands was plug-in hybrids

In the past memory of the public, foreign brands supported half of the domestic automobile market and performed very strongly. According to data provided by Xu Changming, a senior economist at the National Information Center, at the automotive industry forum, the market share of foreign brands has remained above 70% before 2014 and exceeded 60% before 2021. However, since the market share fell below 60% in 2022, its sales decline has become uncontrollable.

So, why did foreign brands, which previously dominated half of the domestic automotive market, suddenly become unsellable?

In the past decade, the domestic automotive market has undergone earth-shaking changes. The revolution of electrification and intelligence has opened up a new experience for automotive consumption and brought catch-up development opportunities for independent brands. The achievements of independent brands in the wave of electrification are evident, and many believe that this is also the main reason for the sharp decline in sales of foreign brands in China.

However, the real "culprit" behind the cliff-like decline of foreign brands is actually plug-in hybrids.

During the policy-oriented period, pure electric vehicles ushered in a major breakthrough, with sales soaring. However, it is worth noting that the sales growth rate of pure electric vehicles was surpassed by plug-in hybrids in 2020. In 2020 and 2021, plug-in hybrid models began to outperform pure electric models with a slight advantage; in 2022, the growth gap became larger, with plug-in hybrid models increasing by 138.4%, significantly exceeding the 66.8% increase of pure electric models.

From the perspective of consumer profiles, the choice of power forms is mainly divided into three categories: open-minded, moderate, and conservative. Among them, pure electric vehicles tap into the open-minded market, which gradually returned to rationality after reaching its peak in 2016. At this time, a more mature and reliable new energy technology is needed to tap into the moderate and conservative markets, and plug-in hybrids undoubtedly play the role of a transitional technology.

The joint efforts of local automakers have unleashed the potential of the plug-in hybrid market, and consumer acceptance and preference for plug-in hybrid models have reached an all-time high. In this field, foreign brands have been relatively slow in their transition to electrification, and there are rarely any layouts in the plug-in hybrid segment. When local brands swept the plug-in hybrid market, only a few joint venture cars such as the BMW X5 and the Chang'an Ford Escape launched plug-in hybrid models, and their gasoline-powered car market, which they relied on for survival, continued to decline as plug-in hybrids led the new energy vehicle market to surge forward. The end result is that the market share of foreign brands continues to be eroded by local brands.

It is worth mentioning that in recent years, local automotive giants such as BYD, Geely, Chery, and SAIC have successively launched plug-in hybrid technologies, especially BYD's DM plug-in hybrid system, which has played a very important role. According to BYD Chairman Wang Chuanfu, China's plug-in hybrid vehicles are already at the "top of the world." Last year, sales of plug-in hybrid models in the Chinese market increased by 85% year-on-year, making it the hottest segment in the new energy market. As of now, for every four plug-in hybrid models sold globally, three are Chinese brands. In addition, the launch of high-end extended-range plug-in hybrid products from brands like Lixiang and Wenjie has also disrupted the 250,000-500,000 yuan market traditionally dominated by BBA, which is also the main reason for the sharp decline in sales of Mercedes-Benz and BMW from January to May this year (declines of 9.4% and 6.9%, respectively).

03 Will the various self-rescue methods of joint venture brands work?

In the process of the rise of Chinese local brands with the help of the new energy race, Suzuki, Renault, Mitsubishi, Jeep, Fiat, and Acura have all become cannon fodder. However, the nightmare for foreign brands has not ended, and more brands such as Kia, Mazda, Skoda, Infiniti, Peugeot, and Citroen are heading towards the edge of the cliff. The mainstream German and Japanese brands, which have always performed the most resiliently, are also struggling to survive. In order not to lose China, the world's largest automotive market, these foreign brands have begun to do their utmost to carry out various self-rescue measures.

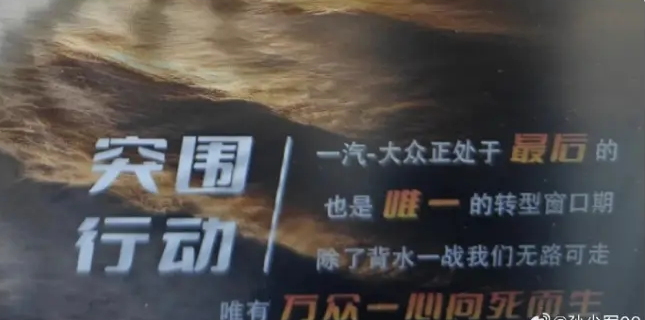

The first self-rescue method is the most common one of trading volume for price. This trading volume for price does not only refer to dealer behavior but also includes official price reductions by automakers: Honda North and South both launched limited-time offers, including a 0-down payment car purchase plan and a low-interest installment plan, with comprehensive trade-in subsidies of up to 51,000 yuan; FAW-Volkswagen launched an internal "breakthrough action" with significant price reductions on multiple models, with a maximum discount of 70,000 yuan; FAW Toyota offered a maximum trade-in subsidy of 23,000 yuan (combined with national subsidies), and the entire model line can also enjoy multiple financial policies such as 8-year 0-down payment and 36-month 0-interest; in addition, there are discounts of up to 36,800 yuan on five models under Beijing Hyundai, and a direct official price reduction of 100,000 yuan on the entire Cadillac XT5 line, covering most mainstream joint venture brands on the market.

The second self-rescue method is to adjust production capacity and reduce costs. Among these, the most surprising to the industry is Beijing Hyundai's sale of its Chongqing factory at a low price of 1.62 billion yuan (the first listing price last year was 3.684 billion yuan). In addition, many joint venture brands have taken measures to "shut down, merge, and transfer" to reduce their burden, such as FAW Toyota's Tianjin factory shutting down some production lines, and SAIC Volkswagen, after permanently shutting down its first Shanghai Anting factory, has recently been rumored to shut down its Nanjing factory in 2025. These actions to adjust production capacity are the helpless choices of foreign brands facing severe overcapacity under the impact of the automotive electrification wave.

The third is OEM production, as mentioned at the beginning of this article, with Jaguar Land Rover's new products being produced on Chery's pure electric platform and Dongfeng Nissan Yunfeng Factory OEM producing for Lantu.

The fourth is layoffs. Starting in May, GAC Honda launched a large-scale layoff plan, which is the first layoff in GAC Honda's 25-year history, with 2,300 employees leaving so far. Joining GAC Honda in wielding the layoff ax is FAW-Volkswagen Foshan, involving a total of 565 employees. Layoffs are a common cost-cutting measure used by automakers, but even the most dominant mainstream German and Japanese brands have embarked on the path of layoffs, sending out an even stronger signal.

Judging from the current industry situation, these various self-rescue methods of foreign brands have not yet exerted significant effects but have brought some significant negative impacts. Among them, trading volume for price can be described as "killing a thousand enemies but losing eight hundred of one's own troops." Although it can save sales in the short term, the damage to brand image, positioning, and reputation cannot be underestimated, and this negative impact will be long-term and even irreversible. Although layoffs, production line adjustments, and OEM production are relatively common management tools for automakers, they are also double-edged swords. As the number and frequency increase, even if they do not directly impact the company, they will subtly damage the corporate image.

In the long run, it is uncertain whether these self-rescue methods will work in the future, as the Chinese automotive market is constantly changing under the revolution of electrification and intelligence, and anything is possible. What can be said with certainty is that in the future, more foreign brands will follow suit and use the above methods to seek self-redemption. If they cannot maintain their existing market share and improve their declining performance despite trying their best, many foreign brands will only have the option of exiting the Chinese market.