Entering 2024, newcomers and veterans in the automotive industry are gradually taking on each other's forms.

In May 2024, news came in succession that AVATR was transitioning entirely from a direct sales model to a distribution model, and that NIO's newly launched sub-brand "LeDao" may consider cooperation or franchising in the future and build stores separately.

On May 1st, the first batch of 33 direct-sales stores of Great Wall Motors opened simultaneously in 17 cities, covering Chengdu, Guangzhou, Hangzhou, Hefei, Nanjing, Ningbo, Qingdao, Sanya, Shanghai, Shijiazhuang, Tianjin, Wuhan, Xi'an, Changsha, Zhengzhou, Shenzhen, Chongqing, and others.

Since Tesla opened its first direct-sales store at Fangcaodi Shopping Center in Beijing in November 2013, new forces seem to have fallen for "direct sales," with "NIO, XPeng, and Li Auto" becoming pioneers among them, determined to revolutionize the automotive distribution system, overturn the traditional 4S store model, and create a direct-sales model unifiedly managed by automakers.

In recent years, everything seems to have changed. New forces have actively embraced dealers, not to mention Huawei and Xiaomi, which have followed the distribution and franchising model in the mobile phone market. New forces such as XPeng, NIO, and AVATR are also trying to shift to a distribution model. This trend has become increasingly clear as Xiaomi Automobile quickly opens stores with its distribution network this year.

On the other hand, traditional automakers, who once valued 4S stores dearly, are cautiously exploring direct sales. In interviews with the media about the direct sales model, executives of Great Wall Motors repeatedly emphasized that direct sales and distribution models are not opposing but complementary, fearing that a single misstep could lead to total defeat.

Amid the bold strides of one side and the cautiousness of the other, automakers, both new and old, have launched an exploration and transformation of channels, gradually moving closer to each other, ultimately evolving into another form.

02

Direct Sales or Distribution?

In May 2024, car dealers in the automotive industry welcomed two good news.

First, AVATR is transitioning entirely from a direct sales model to a distribution model. It is reported that AVATR has basically completed the transition from direct sales stores to dealer stores, with the exception of a small number of direct sales stores remaining in Beijing, Shanghai, and Guangzhou.

Second, NIO Automobile launched the sub-brand "LeDao," which differs from the main brand NIO's direct sales model. "LeDao" plans to introduce dealers and establish stores separately.

For car dealers who are eagerly awaiting new business opportunities, this is undoubtedly a timely assistance.

Data from the China Association of Automobile Manufacturers shows that in 2023, China's automobile production and sales reached 30.161 million and 30.094 million units, respectively, representing year-on-year growth of 11.6% and 12%, both setting new historical highs. However, the joy belongs to new energy vehicles, not gasoline vehicles, and to new energy manufacturers, not dealers.

On the contrary, the pressure of growth and stagnation in the overall automotive market has fallen on dealers. According to data from the Joint Meeting of Passenger Car Market Information, by the end of December 2023, the national passenger car inventory had declined to 3.81 million units, of which 0.78 million were manufacturer inventories and 3.03 million were channel inventories, accounting for nearly 80%.

Of course, they are not sitting idly by, and many are also trying to embrace new energy vehicles. For example, Yongda Automobile has obtained the network authorization of seven new energy brands such as XPeng, ZM Auto, and Xiaomi, while Hexie Automobile obtained the dealership authorization of BYD in Hong Kong and Cambodia in 2023.

The problem is that the offensive and defensive dynamics in the automotive market have changed. Dealers, who once held the dominant power in the era of supply less than demand, are now passive and become the chosen ones in the current era. The secretary of the board of Guanghui Automobile once said that in 2023, the new energy business department actively integrated various resources and chose to enter new force brands with good development momentum, obtaining the authorization of brands such as AITO, Ora,岚图, and XPeng.

Fortunately, more and more new forces are exploring the distribution model.

As early as September 2018, Leapmotor publicly announced the specific details of its "direct sales + city partnership" sales business model, planning to adopt a city-exclusive partnership model outside Hangzhou. However, for a long time, direct sales remained the mainstream for new forces, until 2023.

In 2023, the new energy vehicle market was booming. Data from the China Association of Automobile Manufacturers showed that the market share of new energy vehicles reached 31.6% in 2023. At the same time, drastic changes within the industry have also begun. The situation of new forces like "NIO, XPeng, and Li Auto" is not optimistic, while traditional automakers such as Geely, GAC AION, and Changan, or brands with a traditional automaker background, are in good shape.

A revolution in automobile sales has begun in full swing.

In September 2023, at a channel conference, XPeng Automobile announced the "Jupiter Plan," aiming to gradually replace the direct sales model with the dealership model. At the same time, XPeng Automobile reduced its 24 sales regions nationwide to 12, planning to gradually eliminate inefficient direct sales stores and expand the scale of agency dealerships.

NIO has also been considering a distribution model, but it has not been implemented yet. The trend has become increasingly clear since 2023. Last year, it was reported that NIO actively contacted leading domestic dealer groups, planning to open up the dealership model for its sub-brand Alps, with the after-sales service and delivery centers of Alps being taken over by nationwide dealer groups.

At the same time, traditional automaker-backed brands such as ZM Auto (SAIC) and Zeekr (Geely) are also increasing their dealership proportion. For example, Zeekr has increased the proportion of authorized dealership stores (comprehensive 4S stores) and reached cooperation with some dealers of Geely's Lynk & Co brand.

Another force voting for the dealership model comes from the mobile phone industry. In the mobile phone market, Huawei and Xiaomi have cultivated mature and extensive dealer networks. As they delve deeper into the automotive market, they have also transplanted this sales network to the automotive market.

Among them, in July 2023, it was reported that Huawei is promoting the construction of sales channels for the Wenjie ecological brand and plans to recruit "Wenjie" dealers from existing Huawei terminal dealers and external investors, adopting a franchise model.

By the end of 2024, Xiaomi Automobile is expected to cover sales and service outlets in all provincial-level administrative regions across the country, planning to open 219 sales outlets in 46 cities and 143 service centers in 82 cities. One of the pillars of this ambition is the dealer network established by the original Xiaomi Home.

Currently, with the rapid development of Wenjie and Xiaomi Automobile, the trend of the dealership model becoming the mainstream in new energy vehicle sales is becoming increasingly clear.

02

Efficiency or Scale?

Behind the shift to the dealership model by new forces, there is actually a game between two automotive development paths: fighting for efficiency or fighting for scale.

"Cooperating with dealers will not have a good ending." In June 2013, at Tesla's annual shareholder meeting in Mountain View, California, Musk categorically stated this influential remark in the automotive industry. Since then, under Tesla's leadership, direct sales has begun to sweep the automotive industry.

According to Musk's vision, the direct sales model is essential to ensure user experience and achieve efficient operation. In his response to investors, Musk once said, "Adopting a direct sales model is to most effectively ensure that customers can enjoy excellent products and services." In a blog post on the official website, Tesla emphasized that this model "benefits consumers first."

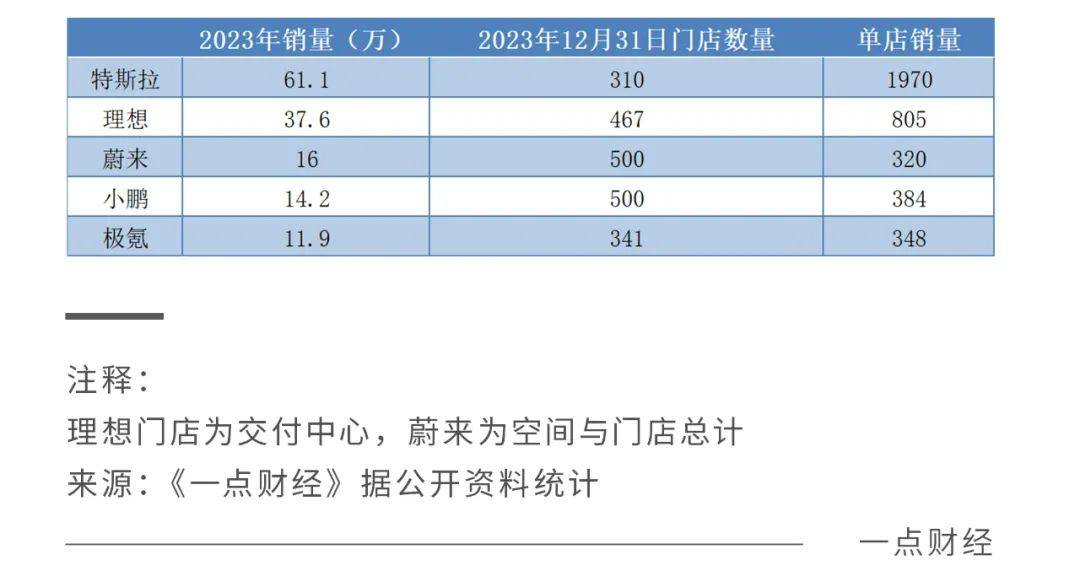

This consideration for user experience, ultimately, is a kind of efficiency thinking - to provide a good consumer experience and maximize the value of a single store and a single user. As Musk's followers increase in the automotive industry, a new metric related to efficiency has been introduced, namely the average sales per store, similar to the "store efficiency" in the retail industry.

For many new forces starting from scratch, when scale is out of the question and funds are limited, fighting for efficiency is almost inevitably the first choice, which is also the fundamental reason why new forces like "NIO, XPeng, and Li Auto" chose the direct sales model in their early development.

However, several years have passed, and the Chinese automotive market has undergone drastic changes, with both market conditions and competitive situations evolving.

Firstly, as new energy vehicles continue to see rising sales of new cars, the first round of penetration from top to bottom, from the premium market to the lower-end market, has been largely completed. The third- and fourth-tier markets and even lower-tier townships have become the focus of competition going forward. These markets are more regional and emphasize adaptability to local conditions, making the distribution model more suitable for local situations.

Secondly, unlike some manufacturers who were still in the observation stage a few years ago, the momentum of new energy vehicles has been unstoppable in recent years, becoming a "must-win" territory. Not only new forces but also traditional automakers and newer forces such as Huawei and Xiaomi have participated in this competition. Compared to the direct expansion of one city at a time, the dealership model, which covers faster and larger scales, has naturally become the choice.

In short, the importance of scale has increased in the current era.

On June 18th, Li Chao, Deputy Director of the Policy Research Office and Spokesperson of the National Development and Reform Commission, introduced the production and sales of new energy vehicles at a press conference in June: In 2023, China's new energy vehicle sales reached 9.495 million units, accounting for 31.6% of total automobile sales; in the first five months of this year, new energy vehicle sales reached 3.895 million units, accounting for 33.9% of total automobile sales.

The third- and fourth-tier markets and even lower-tier markets have become the focus of competition for all automakers going forward. While announcing the "LeDao" brand and revealing that it is likely to open a franchise model, Ai Tiecheng, President of LeDao, also said that LeDao's focus is on laying out in second-tier, third-tier, and fourth-tier cities, expecting its market share to exceed that of NIO - NIO, which targets the high-end market, has placed its hopes on market penetration and scale expansion on its sub-brand.

Moreover, the scale battle in the new energy era is inevitable. In the era of gasoline vehicles, the main purpose of the scale battle between manufacturers was to maximize scale, intensify costs, and seek maximum profits. In the new energy era, automobiles also have the attributes of nodes and entry points, possessing network characteristics. The scale battle is not only to maximize cost and scale advantages but also to strengthen network and ecological value.

Of course, while scale is important, efficiency is equally important.

"In the end, it will be found that the essence of any business is not starving to death but dying of overeating. Because all cash flow and profits are invested, turning into a pile of stagnant materials, sitting in inventory." Zou Liangjun, Senior Vice President of Sales and Service at Li Auto, emphasized in an interview with the media that any brand cannot treat channel partners as a "reservoir," which is a very dangerous idea.

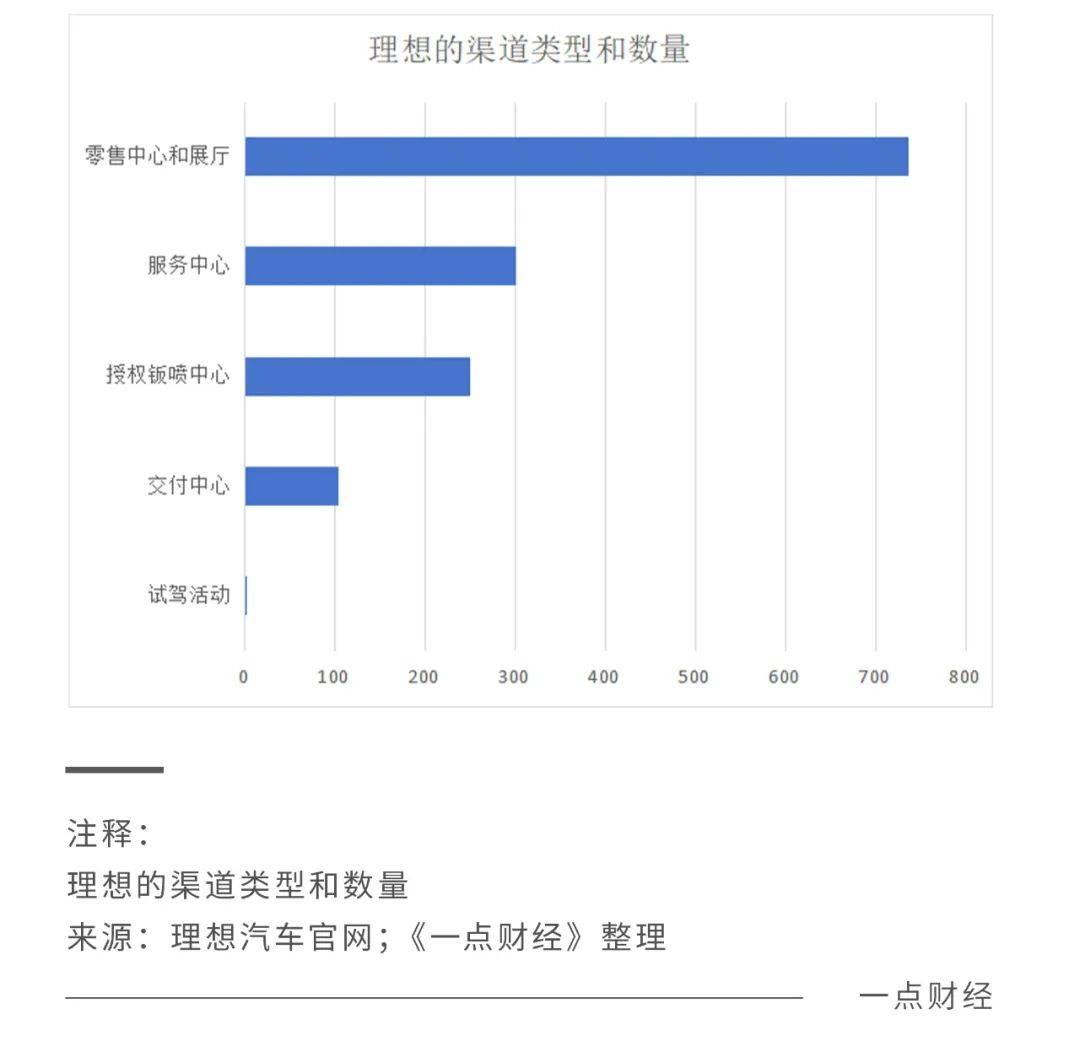

Li Auto can be said to be a firm supporter of the direct sales model. In April 2023, Zou Liangjun, a "veteran" of Huawei, joined Li Auto as Senior Vice President of Sales and Service, reporting directly to CEO Li Xiang. His emphasis on supply chain management and inventory issues during his tenure at Huawei was brought to Li Auto - or, to put it another way, their ideas coincided.

According to Zou Liangjun, the peak inventory of Li Auto's full-channel was 10,000 units, with a channel inventory coefficient of approximately 0.2 to 0.3, "the efficiency of channel inventory is several times that of BMW and Mercedes-Benz."

Li Auto's emphasis on efficiency is not unique. Compared to the previous flooding-style expansion and scaling, every automaker now views efficiency as the foundation.

03

A New Path or the Old Path?

For efficiency, different manufacturers have made different choices, with some like Li Auto adhering to direct sales and others like AVATR and XPeng shifting to the dealership model.

A research report shows that the average cost of operating a direct sales superstore in China is approximately 4 million yuan per year, which is an unbearable burden for many automakers. In contrast, dealers who have been deeply rooted in various regions for many years, with connections and resources, are more likely to obtain relatively inexpensive and well-located stores.

However, after shifting the cost pressure to dealers, manufacturers moving towards the dealership model inevitably face another kind of pressure, coming from dealers. In March of this year, media reported that XPeng Automobile required dealers to stockpile inventory, purchasing half of the target sales volume each month. In response, XPeng Automobile explained that it was to speed up delivery, improve efficiency, and ensure that dealers have cars to sell.

"Reservoir," "water tank"... These are the terms many people use to describe 4S stores under the traditional dealership model. Many times, when automakers show off impressive sales figures, many cars are actually sitting in 4S stores rather than in the hands of consumers. With the advent of the new energy era, cars have changed, but dealers' destiny seems to have not changed, still being the "reservoir" and "water tank".

Last April, a self-proclaimed store manager of a Leapmotor dealership in Jinan, Shandong, revealed online that Leapmotor often "coerced dealers to register cars under employees' names to boost sales," with issues such as inflated sales figures. Although Leapmotor later issued a statement on its official Weibo account denying the above information, the contradiction between automakers and dealers is evident.

New energy vehicles have opened a new path for the industry, but hopefully, both manufacturers and dealers will not return to the old path.

After fully embarking on the new energy track, the Chinese automotive market has undergone drastic changes: first, the consumption level of Chinese people has improved, and car consumption enthusiasm is high while being more rational; second, there are numerous participants in the automotive market from various backgrounds, resulting in an overall supply exceeding demand; third, the internet has further penetrated the automotive industry, bringing changes to production, operation, sales, and other aspects.

Ultimately, this leads to a shift in the Chinese automotive market from channel-oriented and product-oriented to customer-oriented. Previously, it was a matter of who had more and stronger dealers, who had higher product cost-effectiveness and stronger brand power, and whose cars sold well. Now, having good dealers and good products is not enough; there also needs to be good marketing and service that directly faces consumers. In short, it's not enough to be To B, but also To C.

Great Wall Motors woke up earlier. In 2023, 15 executives registered on Weibo using their real names; in April of this year, Chairman Wei Jianjun launched his first live broadcast and concluded, "We have a tradition at Great Wall that we have always done the work without saying much, failing to make good use of the internet and media"; in May, the first batch of direct sales stores opened.

In addition, Geely's Lynk & Co and GAC AION's Hyper are exploring direct sales, with Hyper planning to develop 100 direct sales stores in 2024. At the same time, regarding the age-old topic of the relationship between autom