Nezha Auto rushes for IPO, aiming to repeat "Transsion" story in the automotive market?

![]() 06/27 2024

06/27 2024

![]() 582

582

On June 26th, Hezhong New Energy Automobile Co., Ltd. (hereinafter referred to as "Hezhong New Energy"), the parent company of Nezha Auto, submitted an application for listing on the Hong Kong Stock Exchange. If this application is successfully approved, Hezhong New Energy will become the fifth emerging automaker to IPO in Hong Kong stocks, with the previous four being Xpeng, Li Auto, NIO, and Leapmotor. Among them, Xpeng and Li Auto completed their Hong Kong IPO in 2021, while NIO and Leapmotor completed theirs in 2022.

These automakers belong to the first echelon of emerging automakers. With the rapid development of the domestic new energy vehicle market, these four automakers have basically grasped the growth momentum, and it is not surprising that they have successively completed their Hong Kong IPOs. In terms of sales, Nezha's volume is relatively small among these five automakers. Why does Nezha have the confidence to rush for the Hong Kong IPO at this time?

Betting on overseas markets, will Nezha become the "Transsion" of the automotive industry?

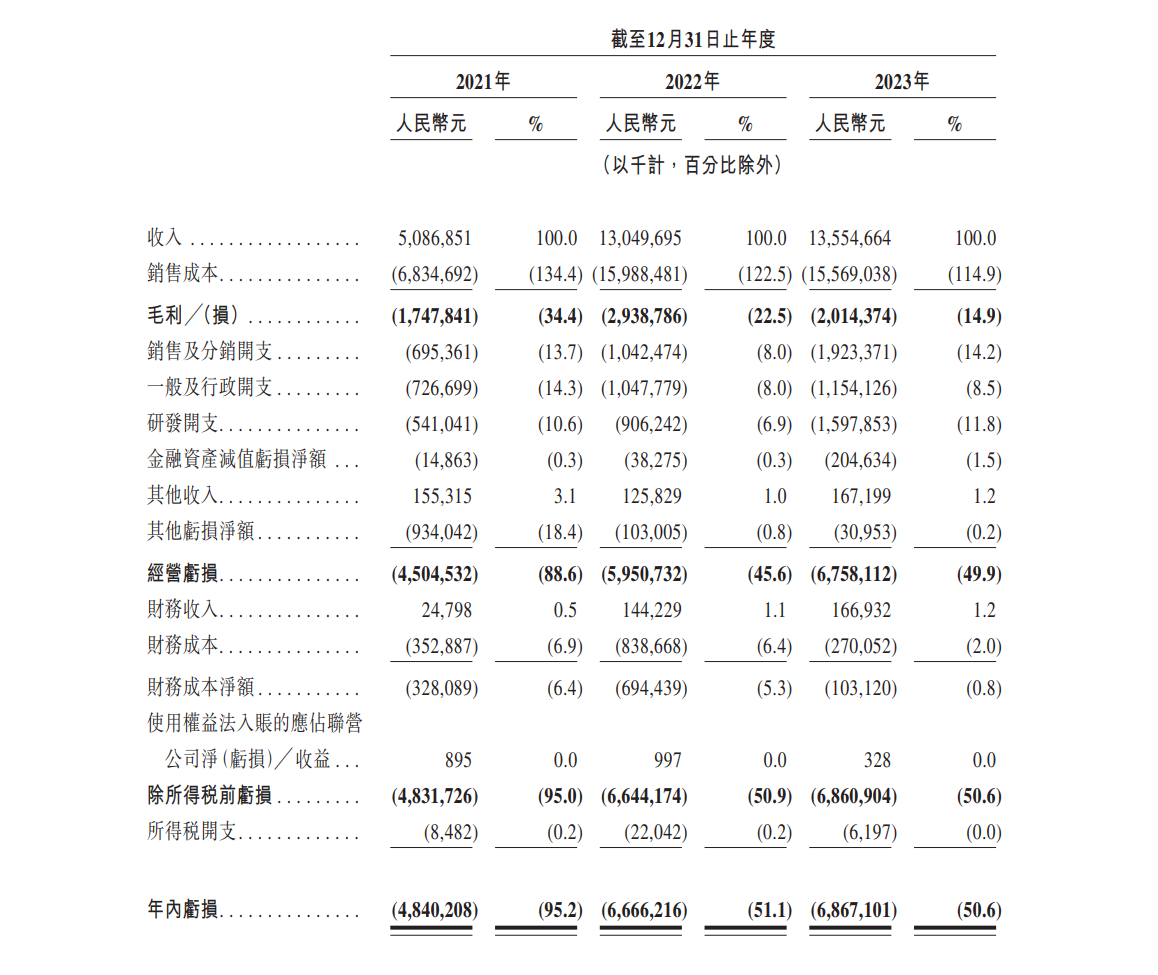

From the application materials, Hezhong New Energy Automobile recorded revenue of 13.555 billion yuan in 2023, with a gross profit loss of 2.014 billion yuan and a cumulative loss of 6.867 billion yuan. In terms of deliveries, Hezhong New Energy Automobile delivered 124,200 vehicles in 2023 and approximately 43,600 vehicles in the first five months of this year, showing a certain downward trend compared to the same period in 2023 and failing to reach 20% of this year's sales target.

Regarding the decline in deliveries, Hezhong New Energy Automobile believes that the main reason is that it has placed more focus on promoting overseas markets. Although its domestic market performance has declined somewhat, Hezhong New Energy Automobile's export volume has indeed increased. Data shows that Hezhong New Energy exported 17,000 vehicles in 2023, accounting for 13.7% of last year's total sales. In the first five months of this year, it has cumulatively exported 16,458 vehicles, already close to last year's total export volume, ranking first among emerging automakers.

It is understood that Hezhong New Energy's factory in Malaysia started construction at the beginning of this year, and factories in Thailand and Indonesia have also started production in March and May of this year, respectively.

On the other hand, looking at the emerging brands that have already completed their Hong Kong IPOs, Xpeng and NIO focus their overseas markets on Europe, with cumulative overseas sales of 2,835 vehicles and 672 vehicles, respectively, in the first five months. Li Auto has announced that it will not enter overseas markets before 2025 and currently relies solely on parallel exports to enter overseas markets. Leapmotor is the first reverse joint venture company in the Chinese auto industry, leveraging Stellantis Group's sales network to expand into overseas markets, but has not yet disclosed relevant overseas sales figures, only setting a KPI of "achieving profitability in the first year".

After comparison, it is not difficult to find that although Xpeng and NIO have had news of overseas expansion for a long time, their overseas performance is far from their domestic market sales. Hezhong New Energy and Leapmotor are more aggressive in overseas markets, and based on the current situation, overseas markets are Hezhong New Energy's biggest advantage among emerging automakers, which is the biggest confidence for Hezhong New Energy to go public.

Among Chinese mobile phone companies, "Transsion" is an alternative existence, as their biggest basic market has been overseas since their establishment, and they have become the "King of Africa" by deeply cultivating the African market, making them one of the top 5 global mobile phone manufacturers solely relying on overseas market shipments.

This brings us an insight that Hezhong New Energy also has the opportunity to achieve achievements surpassing local emerging automakers by deeply cultivating overseas markets, becoming the "Transsion" of the automotive industry. As for whether it will succeed in the end, of course, factors such as "favorable timing and location" need to be considered, but the most crucial thing is whether Hezhong New Energy can seize the opportunity and soar.

The "divine assist" from Zhou Hongyi

As early as 2022, news about Hezhong New Energy's plan to go public in Hong Kong had already been exposed, and in mid-2023, it was reported that Hezhong New Energy Automobile was considering submitting a US$1 billion Hong Kong IPO application. The company denied these reports, but its determination to go public in Hong Kong is genuine.

Enterprises need to complete a series of prerequisites for an IPO in Hong Kong, including financial requirements, business records, management stability, and public shareholding ratio. Among them, the highest requirements are naturally financial requirements, with the financial requirements for the Growth Enterprise Market being a market capitalization of at least HK$1.5 billion at the time of listing.

It is understood that to complete the IPO, Hezhong New Energy has signed a "Joint Agreement on High-Quality Development of Hezhong Automobile" with Tongxiang City State-owned Capital Investment and Operation Co., Ltd., Yichun Jinhe Equity Investment Co., Ltd., and Nanning Minsheng New Energy Industry Investment Partnership (Limited Partnership). The agreement mentions that the signing parties will jointly provide a total investment of no less than 5 billion yuan to Hezhong Automobile/Nezha Automobile to support Hezhong New Energy's IPO and promote its expansion of export scale.

In addition to capital injection, starting from the second quarter, the market heat of Nezha Automobile has gradually increased, but this heat is not brought by products or technology, but by CEO Zhang Yong and Zhou Hongyi, one of the major shareholders of Nezha Automobile. It cannot be denied that Zhou Hongyi's frequent "endorsement" of Nezha has indeed increased its popularity to a certain extent. Although the help in sales may not be very significant, it has helped Nezha reach the level of over 10,000 units in individual months, helping the public better understand this brand.

It is worth noting that sales volume cannot fully reflect the capital market's response. Taking NIO, which has already gone public, as a reference, NIO's founder Li Bin has participated in multiple live broadcasts, and after a live broadcast on endurance testing, NIO's Hong Kong stock price rose by more than 23% the next day.

Generally speaking, investors and lenders tend to invest in companies with strong brand images, as this means the company has higher market value and potential. The increase in the popularity of senior executives' personal IPs can promote the increase in stock prices to a certain extent. However, in my opinion, a company's profitability, innovation ability, and market share are the fundamental factors that determine its stock price. If these key points are not substantially improved, even if the stock price is continuously influenced by the popularity of senior executives in the short term, it will not last for a long time at a high level.

Of course, this is still too early for Hezhong New Energy. At this stage, an early IPO has the most direct benefits for Hezhong New Energy. Through listing, Hezhong New Energy can obtain a higher valuation, attract more investors' attention, and maximize its capital market value. More importantly, Hezhong New Energy needs more financing to accelerate its internationalization process.

So far, Nezha's overseas expansion has covered Southeast Asia, the Middle East, North Africa, Central and South America, and other regions. According to the plan, Nezha L will expand into the Middle East, the Americas, and Africa in the third quarter of this year and also plans to launch sales in the European market.

This year, Nezha needs to achieve an annual sales volume of 300,000 vehicles, with the overseas market contributing 100,000 vehicles. However, whether it is total sales or overseas market sales, to achieve this goal in the remaining six months, the monthly delivery volume needs to be at least 36,600 vehicles or more.

Judging from the fierce competition in the domestic new energy market, the difficulty for Nezha to achieve this goal is no less than "the chicken eats the rice clean, the dog eats the noodles clean, and the lamp burns the lock broken." However, if the "100,000 overseas market contribution" branch goal is achieved, it will greatly benefit Nezha Auto's subsequent development.

Smooth overseas expansion relies on excellent product strength

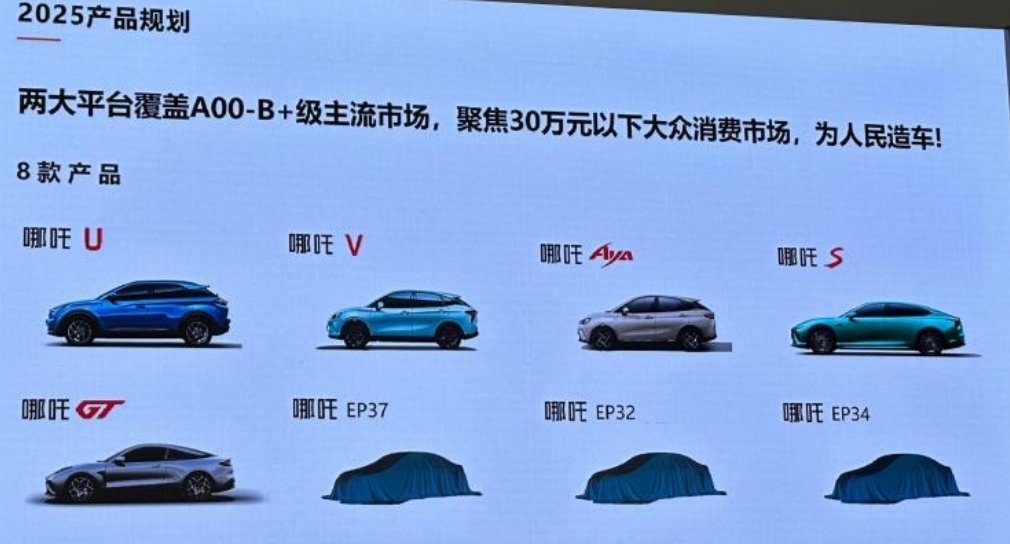

Nezha Auto has five models under its brand, including Nezha AYA, Nezha X, Nezha L, Nezha S, and Nezha GT. According to the IPO documents, Nezha will launch three more models in the next two years, with one model based on the Yunhe platform next year and one model each based on the Shanhai and Yunhe platforms the following year.

Perhaps Nezha Auto believes that having one heavyweight product like Nezha L this year is enough, but frankly speaking, the launch process of these three new Nezha models is not fast. Judging from the current product matrix, Nezha mainly targets the mainstream new energy market below 300,000 yuan, while other market segments are still blank for the time being.

Perhaps, not targeting the high-end market is one of Nezha Auto's goals, and with its current product line, Nezha Auto can complete the overseas market layout faster with these mainstream-priced products. After all, "good value for money" is almost a universal tactic in all markets, which is important for Nezha Auto, which takes overseas expansion as its strategic focus.

If we talk about the current shortcomings of Nezha Auto's products, since most of its models focus on cost-effectiveness, in terms of intelligence, which consumers attach great importance to, they cannot provide an experience that exceeds expectations due to cost constraints.

I previously test-drove Nezha X's high-level intelligent assisted driving system, but the vehicle only combines two functions: ACC adaptive cruise control and lane keeping. Although practical, the system at that time did not support intelligent control of vehicle speed, and only reminded the driver through images when it detected vehicle overspeed.

Since Nezha has decided to follow a cost-effective route, factors that mainstream consumers attach great importance to, in addition to intelligence, should also be at a high level in terms of energy consumption, materials, design, comfort configuration, etc. Overall, Nezha still has some room for improvement in its products. Although overseas market consumers may not be as picky as Chinese consumers, I believe that excellent product strength will be a "passport" for a brand to travel smoothly in any market.

Source: LeiTech