Not many new forces that haven't gone public yet

![]() 06/27 2024

06/27 2024

![]() 610

610

Author: Zhang Wen | Editor: Jiang Jiao | Cover: Unsplash

After four years of striving for a listing, Nezha Auto finally submitted its prospectus to the Hong Kong Stock Exchange yesterday (June 26) and plans to go public in Hong Kong.

Counting up, Nezha Auto should be one of the last batch of new force automakers to go public. Apart from Nezha Auto, the only remaining unlisted new force brand is Aion under GAC Group.

However, Aion was officially established in 2017, while Nezha has been in operation for ten years. It is one of the earliest Chinese start-ups to enter the new energy vehicle industry. NIO, which was founded in the same year as Nezha, went public in the United States as early as 2018, and Lixiang Auto, which was founded a year later and even took a detour in microcars for a while, also went public three years ago.

Nezha Auto has had a long and arduous journey towards going public. It initially aimed for the STAR Market and planned to complete its listing in 2021, but failed. Later, it shifted to Hong Kong stocks, which coincided with the period when Chinese concept stocks concentrated on returning to Hong Kong. Ideal, NIO, and Xpeng successively achieved secondary listings in Hong Kong. Zero Run Auto, which has a similar positioning and price range to Nezha's early models, also achieved a listing in Hong Kong last year.

Nezha is the fifth new force automaker to go public in Hong Kong and also the slowest one. Media coverage of its listing has focused mostly on its urgency to "infuse capital." Its cash on hand is already limited. According to the prospectus, as of the end of 2023, Nezha Auto's cash balance was only 2.836 billion yuan. Based on its average annual loss of 6.1 billion yuan over the past three years, this money is probably only enough to last Nezha for half a year.

The day before submitting its prospectus to the Hong Kong Stock Exchange, Zhang Yong, the CEO of Nezha Auto, who has recently been keen on positioning himself as an internet celebrity, promoted the company's new car, Nezha L, on social media platforms. He said, "Every challenge is a tribute and song of praise to nature."

This may be the sentiment of this veteran automotive professional with more than a decade of career experience.

01

Like most new force automaker brands, Nezha Auto has been operating at a loss. Its losses can be glimpsed in the annual report of its shareholder 360. 360, which has been operating for many years, has been profitable since 2014, but has been losing money continuously since 2022. Its 2022 and 2023 annual reports both showed losses.

Although Zhou Hongyi is constantly promoting Nezha on social media platforms, 360's annual reports are quite straightforward. For example, when losses first appeared in 2022, 360 stated that the losses brought by Nezha Auto were the main reason for the group's overall losses. In 2023, while losses shrank, Nezha incurred an investment loss of 687 million yuan.

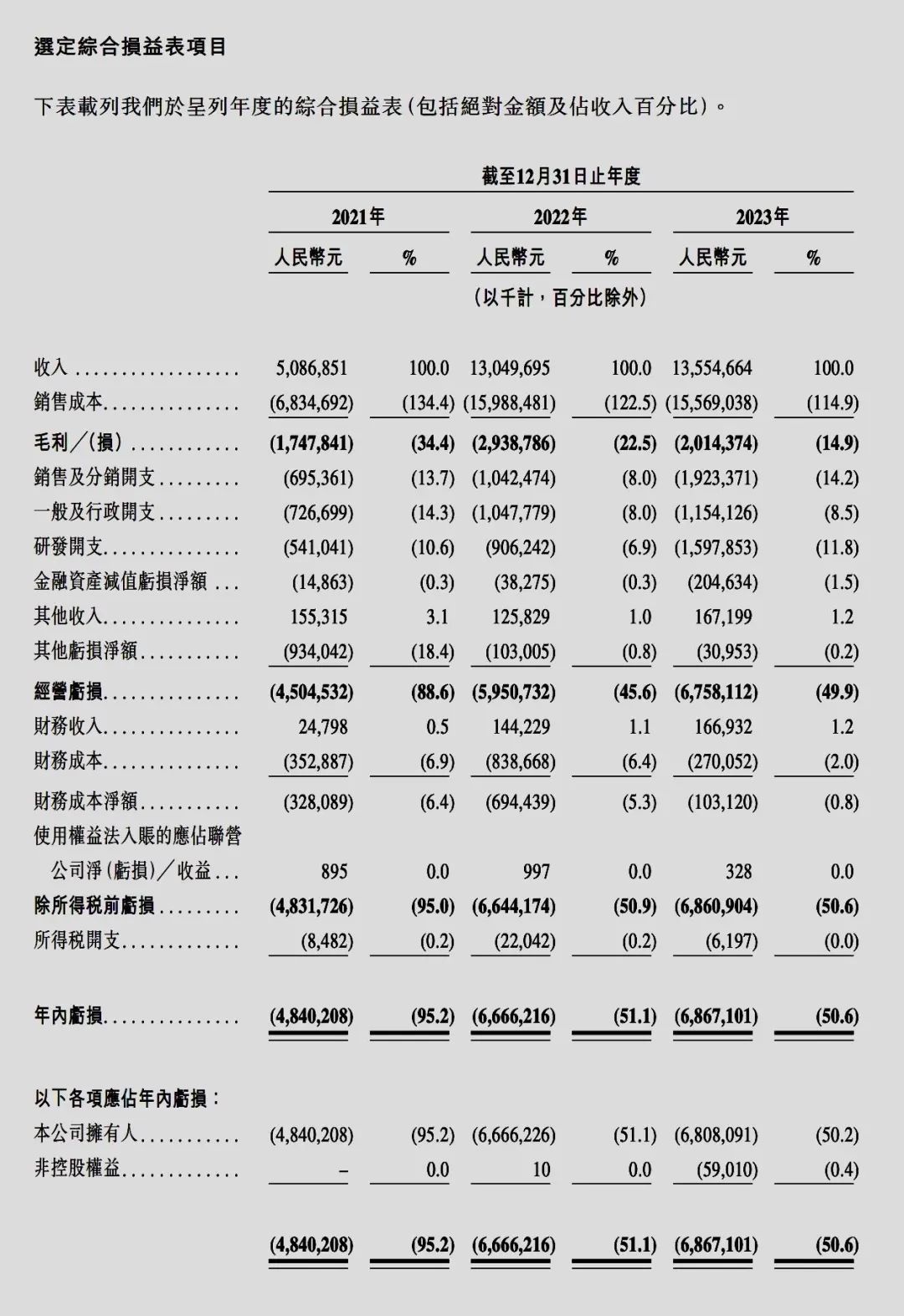

Now, Nezha Auto's prospectus provides more detailed financial data. Over the past three years, Nezha Auto has accumulated losses of about 18.4 billion yuan. Compared to other new force automakers, this loss amount is not significant. NIO lost 20.7 billion yuan last year alone, and Xpeng also had losses of over 10 billion yuan. However, compared to Zero Run, which has a similar positioning to Nezha, Zero Run only lost 4.216 billion yuan last year, and its losses over the past two years were less than Nezha's.

2023 was a year when Nezha fell from the top of new force automakers, selling 124,200 vehicles, with sales declining by about 18% year-on-year. It was the only new force automaker with a decline in annual sales, and its capacity utilization rate dropped from 97.3% last year to 72.7%. It also recorded its highest loss in the past three years, reaching 6.867 billion yuan.

Compared to other automakers that are also operating at a loss, Nezha Auto's financial data is worse. Its gross margin has been negative so far, standing at -34.4%, -22.5%, and -14.9% over the past three years, respectively. Zero Run Auto has already achieved positive gross profit for the full year last year and aims to achieve a gross margin of 5% to 10% this year.

Nezha Auto's operating cash flow has also been negative, standing at -2.991 billion yuan, -5.408 billion yuan, and -4.354 billion yuan over the past three years, respectively. Meanwhile, Nezha Auto's marketing expenses have increased year by year, rising from 695 million yuan in 2021 to 1.923 billion yuan in 2023.

Although NIO has been operating at a loss, most of its losses come from huge infrastructure investment and R&D spending. Li Bin is also more adept at fundraising and can continuously obtain financing from the market. Zhu Jiangming, the founder of Zero Run Auto, already has a successful listed security company, Dahua Technology, as a backup, so they have more confidence in insisting on independent research and development in automotive core technologies.

Nezha Auto is at a disadvantage in these areas. Almost all of its founding team members come from traditional automakers such as Chery and BAIC and are less adept at fundraising. Before going public, Nezha Auto's financing almost entirely came from local governments, state-owned enterprises, and even real estate developers, and it was only in recent years that it started to obtain funding from the industry.

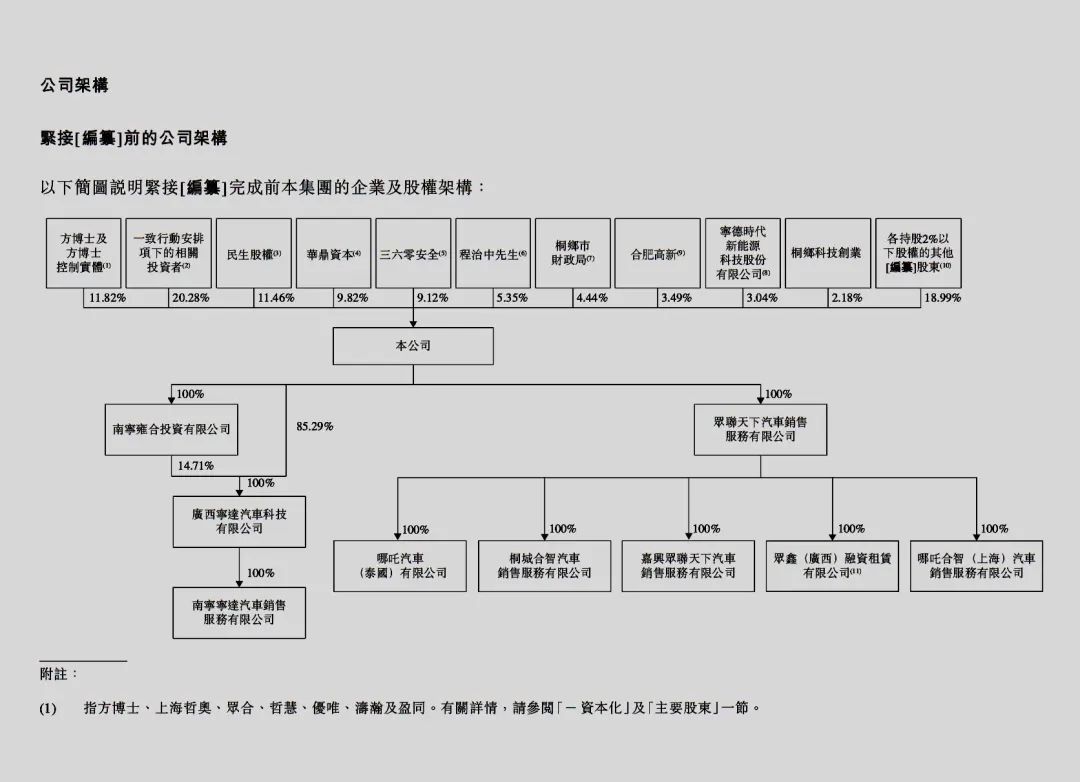

Before going public, Nezha Auto raised a total of 22.844 billion yuan in financing, with a dispersed shareholding structure. The company's founder, Fang Yunzhou, and his controlled entities own approximately 11.82% of the shares, but they have signed a relevant consistent action agreement with shareholders who collectively own 20.28% of the shares to ensure control of the company. Zhou Hongyi's 360 owns 9.12% of Nezha Auto's shares.

02

This year is a year when Nezha Auto is trying to get back on track. After learning from the lessons of last year's Nezha GT and Nezha S, the new car Nezha L they released this year began to regain cost-effectiveness,模仿起理想汽车的经验, using an extended-range, large five-seater SUV with a refrigerator, TV, and large sofa, priced at around 150,000 yuan, to open up the market.

Moving away from BYD's siege of the 100,000 yuan market segment, the 100,000-200,000 yuan price range is also a fiercely competitive segment. Nezha Auto needs to face similar competitors like Zero Run Auto, NIO and Xpeng, which are starting to launch their second brands this year, as well as an increasing number of traditional automakers that are imitating Lixiang Auto.

Nezha Auto is also expected to launch a shooting brake version of the Nezha S this year. In the prospectus, Nezha Auto disclosed that it will launch three new models in the second half of next year and 2026, respectively. Two of these models will be based on the lower-positioned Yunhe platform and launched first, while the higher-positioned Shanhai platform model will be launched last.

This may be Nezha Auto's lesson learned from last year's blind rush. Over the past three years, the average selling price of Nezha Auto's vehicles was 71,000 yuan, 84,000 yuan, and 109,000 yuan, respectively. In the first four months of this year, the average selling price further increased to 113,000 yuan.

The two lower-positioned models are likely to target overseas markets simultaneously. In the prospectus, Nezha Auto's overseas performance is quite impressive. Among the 124,200 vehicles sold by Nezha last year, the overseas market accounted for 13.7%, contributing 12% of the company's annual sales revenue.

Nezha Auto's current overseas focus is on the Southeast Asian market. According to a report by CIC Consulting, they are ranked among the top three brands in terms of new energy passenger vehicles in Southeast Asia based on insurance premium volume. The main selling model is Nezha's current lowest-positioned Nezha AYA series, priced below 100,000 yuan.

Nezha Auto at the Thailand Auto Show / Source: Nezha Auto

Nezha currently has plans to build three factories in Southeast Asia, with the Thai factory and the Indonesian factory commencing production in March and May of this year, respectively, and the Malaysian factory starting construction in January of this year.

In the prospectus, Nezha Auto has placed the most emphasis on using the funds raised from the listing for overseas markets, including further investment in Southeast Asia and rapid expansion into Latin America, the Middle East, and Africa.

With intense competition in the domestic market, going overseas has become one of the focuses of most new force brands. After receiving investment from Stellantis, Zero Run has already established a joint venture company last month and plans to sell its products in European markets starting from the second half of this year. Zeekr, which recently went public in the United States, has also announced that they plan to enter more than 50 countries and regions globally, including Europe, Southeast Asia, and Latin America, by the end of this year.

Nezha Auto is still a well-performing new force brand under the background of traditional automakers. Its counterparts like WM Motor and HiPhi Auto have fallen into bankruptcy or shutdown situations, while only Nezha has reached the threshold of going public.

However, the market's attitude towards new force automakers is now different from before. When Zero Run Auto went public in Hong Kong last year, it opened below its issue price and closed down 30% on its first day. Its share price has yet to recover to its issue price level. Zeekr Auto opened high on its first day of trading but has since fully retraced, failing to recover its opening price.

Currently, the only remaining unlisted new force brand in China is Aion under GAC Group. Market rumors suggest that Aion also plans to go public in Hong Kong. In response, Gu Huinan, general manager of Aion, said, "Now is not a good time for an IPO. The entire capital market, including both mainland and Hong Kong markets, is not performing well. The IPO process of GAC Aion depends on whether the market can recover in the future."

However, Nezha can no longer wait. With only 2.836 billion yuan in cash on hand, and as of the end of last year, Nezha Auto's short-term borrowings reached 15.4 billion yuan, of which approximately 4.3 billion yuan needs to be repaid within the year.

To supplement its cash flow, Nezha Auto raised 4.3 billion yuan this year through investment proceeds, bank loans, and the issuance of convertible bonds. This includes a 2.1 billion yuan long-term bank loan and two 1.06 billion yuan convertible bonds issued to Tongxiang and Nanning local state-owned assets. The issuance cost of these two convertible bonds is 16.15 yuan per share, which is the same as Nezha Auto's per-share cost in 2023.

© All rights reserved by Shangshan. Unauthorized reproduction is prohibited.