The collapse of BBA prices, how did traditional luxury brands suddenly falter?

![]() 06/27 2024

06/27 2024

![]() 433

433

Over a month ago, when Mr. Wang stumbled upon the news that "Zhou Hongyi proudly sold his 9-year-old Maybach for 9.9 million yuan and was preparing to purchase a domestic new energy vehicle," BBA's used cars were still hard currency in his hands. Unlike the new car market, in the used car market, new energy models are a hot potato, and the most profitable ones are still BBA, after all, the quality is guaranteed, the brand effect is there, and the price is relatively stable. But he never imagined that a month later, BBA cars would also crash into his hands.

On June 23, unable to sleep, Mr. Wang sought out Feige, who is also in the automotive industry, for a chat. Feige advised him to sell all the cars in his hands as soon as possible, otherwise it would only get worse. Mr. Wang was anxious and annoyed: "I can't even sell at a loss of 20,000 yuan now, otherwise, I'll show you my receipt."

Mr. Wang was truly anxious, regretting not being more vigilant. In hindsight, that casual news he stumbled upon represented a new trend among luxury car consumers. And in Feige's opinion, the price plunge of BBA was an inevitable certainty.

Currently, BBA is slashing prices by as much as 100,000 yuan or more, and even the bare prices of some models have almost halved. BBA's darkest moment has also become the darkest moment for people like Mr. Wang.

What caused the collapse of BBA prices? When will the price war between traditional luxury cars end?

Can BBA still represent luxury?

From the financial reports released in the first quarter of this year, it can be seen that in 2024, whether it is the global market or the Chinese market, most of BBA's performance indicators showed a downward trend. BMW, which is relatively stable, saw a 3.8% decline in sales in China and a 0.6% year-on-year decline in global revenue, with profits down 24.6%. Mercedes-Benz saw a 10.4% decline in sales in China and a 4% year-on-year decline in global revenue, with profits down 30%. Although Audi's sales in the Chinese market increased by 14% year-on-year, its global revenue declined by 18.7%, and profits plummeted by 58.4%.

Protecting the market through pricing is imminent, so a series of shocking news emerged in the market: the Mercedes-Benz C200L, with a guide price of 334,800 yuan, has a dealer price of 202,700 yuan, with a discount of over 130,000 yuan. The 2024 EQB 260 model, with an official guide price of 352,000 yuan, offers a price discount of 160,000 to 176,000 yuan, equivalent to a 50% discount. The BMW i3 eDrive 35L, with an official guide price of 353,900 yuan, can be purchased for 180,000 to 200,000 yuan, equivalent to a halving of the price. The Audi Q4 e-tron 2024 model 40 e-tron Edition One has an official guide price of 317,100 yuan, and the discounted price can reach 210,000 yuan. For entry-level models, the price after the discount is even only 190,000 yuan.

The strategy of trading prices for market share has not started this year. Relevant data shows that last year, BBA's discount rates were already 12.6%, 17.66%, and 20.84%, respectively, with discounting efforts higher than the industry average. And this year, they have only increased and not decreased.

Another set of data from the China Passenger Car Association shows that in May, luxury brand production decreased by 13% year-on-year and 3% month-on-month. Luxury car retail sales reached 240,000 units, down 3% year-on-year and up 19% month-on-month. The luxury brand retail share in May was 14%, down 0.2 percentage points year-on-year.

In other words, while reducing production and cutting prices, it still failed to stop the downward trend in the retail market.

After discounts, the prices of BBA's new energy models have entered the market below 200,000 yuan. Compared with the industry practice of defining luxury cars as models priced at 300,000 yuan and above, in the era of electric vehicles, can BBA still represent luxury?

The Displaced BBA

It should be said that BBA's entry into the electric vehicle market was not late, but they have suffered repeated setbacks. Why?

The traditional luxury car brands represented by BBA are facing unprecedented challenges. They have discovered that the biggest threat may not come from traditional competitors, but from new players who have quickly entered the market using innovative technologies and business models, such as new forces like NIO, XPENG, and LI Auto.

XPENG Motors has successfully covered a wider range of user needs through its unique "pure electric + extended range" dual-power strategy. NIO has established strong brand loyalty through its innovative service model and user community culture. LI Auto, backed by the strong technical support of Huawei and SAIC Motor, has quickly won the favor of consumers with its high performance and intelligent features.

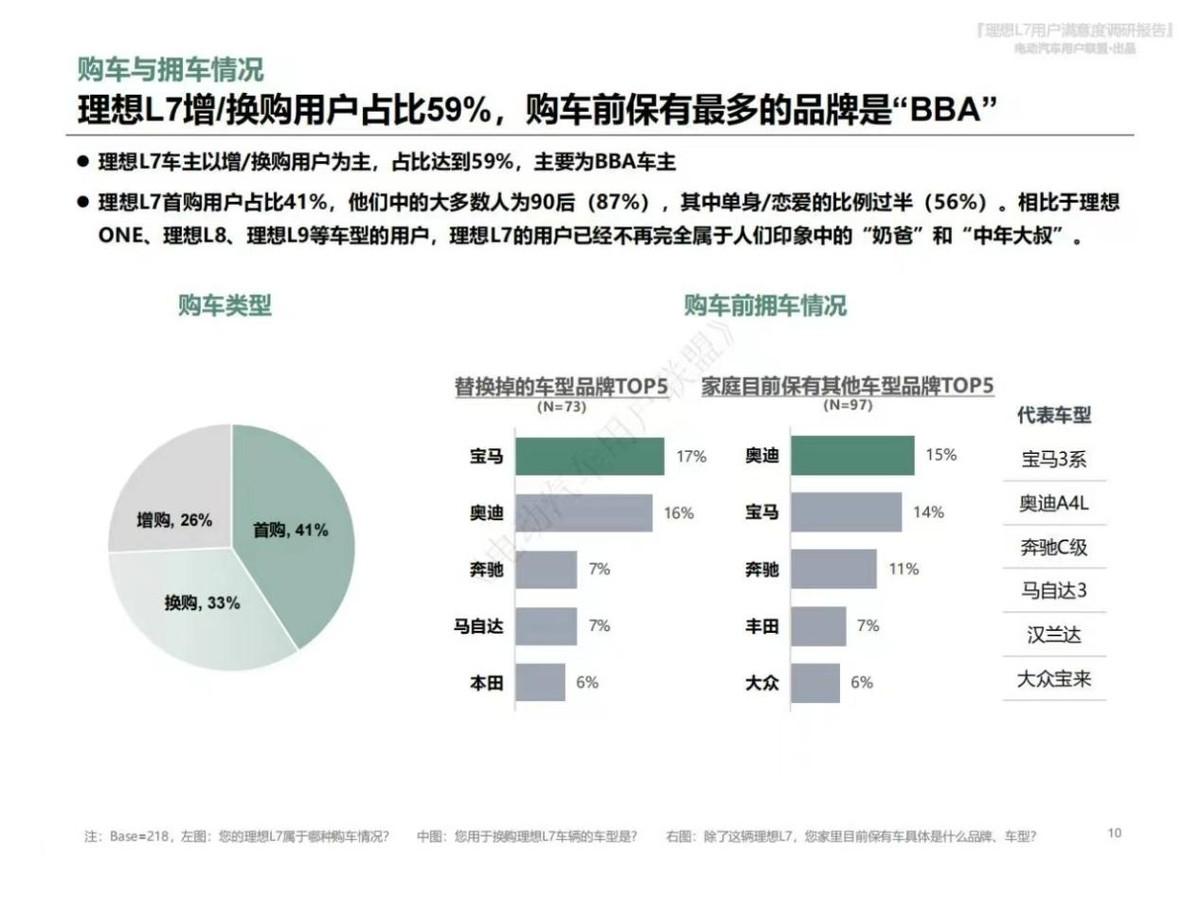

To some extent, the collapse of BBA began with the continuous growth in sales of XPENG Motors. Among the user profiles of LIDEAL L7, the proportion of incremental purchases is as high as 59%, and the brand with the most ownership before purchasing is BBA. In other words, a large proportion of LIDEAL's customers are those who have switched from BBA. Since 2023, LI Auto has been rising, and its market performance has been surging in 2024. The launch of the LI Auto M7 and M9 has further accelerated the loss of BBA customers. There seems to be a subtle substitution effect between the two.

(Image by Electric Vehicle Users' Alliance)

Delving into how BBA watched so many customers embrace the new forces, the reasons are actually not complicated at all.

On the surface, the electrification process seems to be the main reason for BBA's loss, but in reality, it is the extended-range and plug-in hybrid technologies that have truly hit the nail on the head. Consumers are generally divided into three categories: conservatives, pioneers, and the majority of hesitant middle-of-the-roaders. Generally speaking, pioneers will directly opt for pure electric vehicles to try them out, while conservatives and middle-of-the-roaders struggle to make a choice. They are torn between the high fuel consumption of traditional fuel cars and the range anxiety/recharging anxiety of pure electric vehicles. Extended-range and plug-in hybrid vehicles solve this problem perfectly. On the one hand, they don't need to be charged, and their fuel consumption is lower than that of traditional fuel vehicles. Additionally, they offer a high level of intelligence and good safety. Another crucial point is that eligible models are exempt from purchase tax, saving around 10% to 15% instantly. Coupled with the advantage of unlimited licenses in major cities, it's hard not to be tempted.

It can be said that the challenges faced by BBA not only come from product and technological competition but also from the new automotive consumption concepts and ecological construction represented by the new forces. Or perhaps from their insight into the market and understanding of consumers' needs.

To maintain loyal customers, new forces are redefining the concept of luxury cars by building intelligent connected ecosystems, providing personalized customization services, and creating innovative user interaction experiences. Clearly, BBA, which has always led the way with pride, is still too "slow" in the face of these new players.

The market has also proven that a new landscape is being reshaped. Since its launch on December 17, 2023, the LI Auto M9 has surpassed 90,000 orders. With an average selling price of 500,000 yuan, the total order value of the LI Auto M9 has exceeded 45 billion yuan. In May, the LI Auto M9 topped the retail sales chart for passenger cars priced above 500,000 yuan, leaving BBA far behind.

According to data released by the China Passenger Car Association, in May, the domestic retail penetration rate of new energy vehicles was 47.0%, an increase of 14 percentage points year-on-year. Among them, the new energy vehicle penetration rate among independent brands was 71.2%; among luxury cars, it was 28.4%; and among mainstream joint venture brands, it was only 7.5%.

Can BBA regain its luxury glory?

"Seven-fold Leopard, eight-fold Tiger, Cadillac at a 50% discount" was once a satire on second-tier luxury brands desperately cutting prices to maintain sales. Who could have imagined that today's BBA has followed in the footsteps of second-tier luxury brands.

Price wars are already familiar territory for second-tier luxury brands. There are brands like Lexus, which has stabilized the market by continuously reducing prices on its once-premium models, and Volvo, which has already launched its "third round of price wars." Cadillac has gone so far as to offer a "three-year, 80% discount, and guaranteed repurchase" policy. While brands like Infiniti and Acura have clearly run out of options, with dismal sales, shrinking dealerships, dealers switching networks, and brand voices gradually falling silent.

From the perspective of capital, research and development, or strategic strength, BBA is by no means like second-tier luxury brands that can only defend themselves. However, whether BBA can regain its luxury glory is still uncertain.

To avoid repeating the old path of second-tier luxury brands, given the current sales situation and price cuts, BBA must adjust its sales targets and work closely with dealers. Recently, BMW has introduced subsidy reduction policies to ease the operational pressure on dealers. Stabilizing dealers is not only about stabilizing the market but also about stabilizing the "conservatives" among consumers, who are the true brand advocates and the core wealth that brands should not and cannot lose.

Secondly, reducing supply and destocking are necessary to control the continuous price decline and stop losses. However, this can only achieve a halt in the decline; it is unlikely that prices will return to pre-discount levels.

This price cut wave has served as a wake-up call for BBA. If they do not want to repeat the mistakes of second-tier luxury brands, they need to re-examine market changes and make up for their shortcomings. They may want to learn from independent brands.

Recently, the Volkswagen Group has collaborated with XPENG Motors to jointly develop electronic and electrical architectures. Jaguar Land Rover has partnered with Chery Automobile, utilizing Chery's electric platform and using the "Freelander" brand licensed by Jaguar Land Rover.

The benefits of such collaborations lie in, on the one hand, making up for deficiencies in electrification and intelligence to enhance product competitiveness, and on the other hand, reducing manufacturing and time costs, enabling a faster response to market changes. Recently, Audi has signed a cooperation agreement with SAIC Motor and SAIC Volkswagen to jointly develop an "intelligent digital platform" and build a new generation of high-end intelligent connected models based on this platform.

Of course, BBA, as a luxury brand with a century-old history, is unlikely to lie down and give up like second-tier brands. They are also actively preparing for the next step. If this step falters, whether they can reclaim lost territory and regain glory in the next step will be even more crucial.

Currently, BMW has launched its new-generation models, and the sixth-generation battery project that matches them is also progressing steadily. It is reported that the "new generation" models are the largest investment in BMW Group's history and will be launched in the global market next year.

2024 is a decisive year. When the dust settles, a new landscape will emerge. Whether BBA can regain its luxury brand glory, let's wait and see.