Huawei "Letting Go" of Wenjie

![]() 07/03 2024

07/03 2024

![]() 667

667

Introduction

Huawei is retreating as a means of advancing, and Seres is secure in its pocket.

Responsible Editor: Cui Liwen

Editor: He Zengrong

"Seres acquires the Wenjie brand from Huawei," as many Huawei and Wenjie fans were still reveling in the news that "HarmonyOS Intelligence achieved the top sales crown among new carmakers in the first half of 2024," this piece of news suddenly "boiled over".

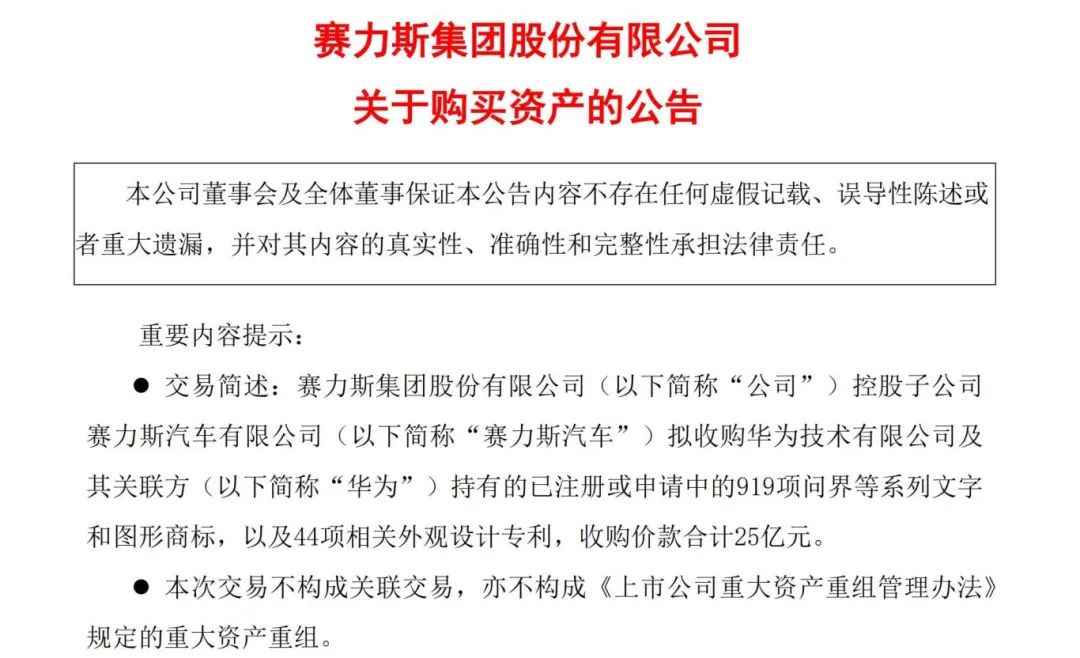

On the evening of July 2, Seres Group announced that its subsidiary, Seres Automobile, will invest 2.5 billion yuan to acquire 919 Wenjie series textual and graphical trademarks, as well as 44 related design patents from Huawei.

"No wonder Seres' stock price has been sliding for days, and those who are bearish are trying to escape this big thunder."

"Now Seres owns the Wenjie brand itself, which is a great fortune."

……

Two completely opposing voices began to collide in various dimensions on stock forums, discussion boards, and groups.

It's true that Huawei's advanced intelligent technology and brand empowerment are recognized by many as the source of "Wenjie's high value." However, the issue is not as simple as "Wenjie belongs to Huawei, so it's expensive; it doesn't belong to Huawei, so it's cheap." Even Huawei itself, its business model and path in the automotive industry, will change over time.

Has Huawei truly let go of the Wenjie brand by selling it to Seres?

How much are the assets related to Huawei, Wenjie, and Seres worth?

Is Seres still valuable after Huawei "lets go" of Wenjie?

How does Huawei make money in the automotive sector and help its automotive partners make money?

Not everyone can see clearly these questions, but they determine the future of Seres, Wenjie, and Huawei, and even affect the path of the future development of China's automotive industry.

Huawei is retreating as a means of advancing, and Seres is secure in its pocket.

"Helping them onto the horse and accompanying them for a while, and then each goes their own way," is the first reaction of many people after seeing the announcement.

Has Huawei really cut ties with Wenjie and Seres by selling the Wenjie brand to Seres? Is Huawei, known for its "wolf spirit," retreating from the automotive industry?

The answer is obviously not that simple.

From learning to speak as a child, to studying and learning as a teenager, to working and advancing as an adult, human individuals have corresponding missions at different stages, and the same is true for enterprises.

How should Huawei participate in the automotive industry? If it were just to pursue the hot sales of a related model or even a popular brand, that would be too short-sighted for Huawei, a company with revenue of 700 billion yuan and regarded as a leader in Chinese technology.

Domestic conventional automotive brands, with annual sales of 100,000 to 200,000 vehicles and revenue of 20 billion to 50 billion yuan, are already considered quite good results. Moreover, traditional manufacturing industries have low profit margins and long cost recovery cycles. According to data from the National Bureau of Statistics, the overall profit margin of the automotive industry is currently around 4.7%.

Even HarmonyOS Intelligence, which won the sales championship among new forces in the first half of the year, sold 194,207 vehicles, surpassing NIO, but it is unlikely to exceed 500,000 vehicles for the whole year, and its revenue is also unlikely to exceed 200 billion yuan. Since the revenue and profits of the entire vehicle need to be shared with partners, the amount that can be left for Huawei is even less.

Therefore, Huawei cannot be satisfied with selling "Wenjie M7, Wenjie M9 a few thousand units a month" or "a Wenjie brand sales comparable to NIO." Now Huawei selling the Wenjie brand to Seres is not for the 2.5 billion yuan price, but a strategy of retreating as a means of advancing.

"Do you think I, Huawei, cannot promote the making of good cars?" Huawei's answer to such质疑is the popularity of Wenjie M7 and Wenjie M9.

"Do you think I, Huawei, only want to usurp the role of an automaker?" Huawei's answer to such质疑is to completely give the Wenjie brand to Seres after "nurturing and strengthening" it.

What is the essence of this strategy of retreating as a means of advancing? In this new stage, Huawei needs to embrace more automakers, showing sincerity in cooperation by "giving up the Wenjie brand" and dispelling automakers' concerns about Huawei "taking over their souls." This is undoubtedly a good move for Huawei.

Then, on the side of Seres?

"This transfer of goods and brand assets does not affect the existing cooperative business between the two parties and further guarantees the long-term development of AITO Wenjie. It also reflects the initial intention of both parties to focus on joint business and AITO Wenjie products with users at the center."

Some people see confidence in this passage in the announcement, while others see心虚. But regardless, Seres' Wenjie is currently the segment with the highest sales, the deepest integration with Huawei's brand power, and the best embodiment of Huawei's Consumer BG system capabilities within HarmonyOS Intelligence.

Just looking at the sales figures for June 2024, HarmonyOS Intelligence sold 46,141 vehicles, second only to NIO among new forces. Among them, the 17,241 vehicles of Wenjie M9 are simply a miracle, surpassing the 15,000 vehicles sold in May—it should be noted that neither independent high-end brands like Hongqi and NIO nor foreign luxury brands like BBA and Porsche have achieved such sales figures in a month for expensive models starting at 550,000 yuan.

Seres has clearly been brought onto a positive track by Huawei Select/HarmonyOS Intelligence and has also benefited Huawei's Select business: according to Seres' announcement in April and Huawei's news, in the first quarter of this year, Seres' revenue surged 421.76% to 26.561 billion yuan, with a net profit attributable to shareholders of 220 million yuan. The gross profit margin for the quarter increased to 21.5%, and Yu Chengdong also said that Huawei Select has turned a profit.

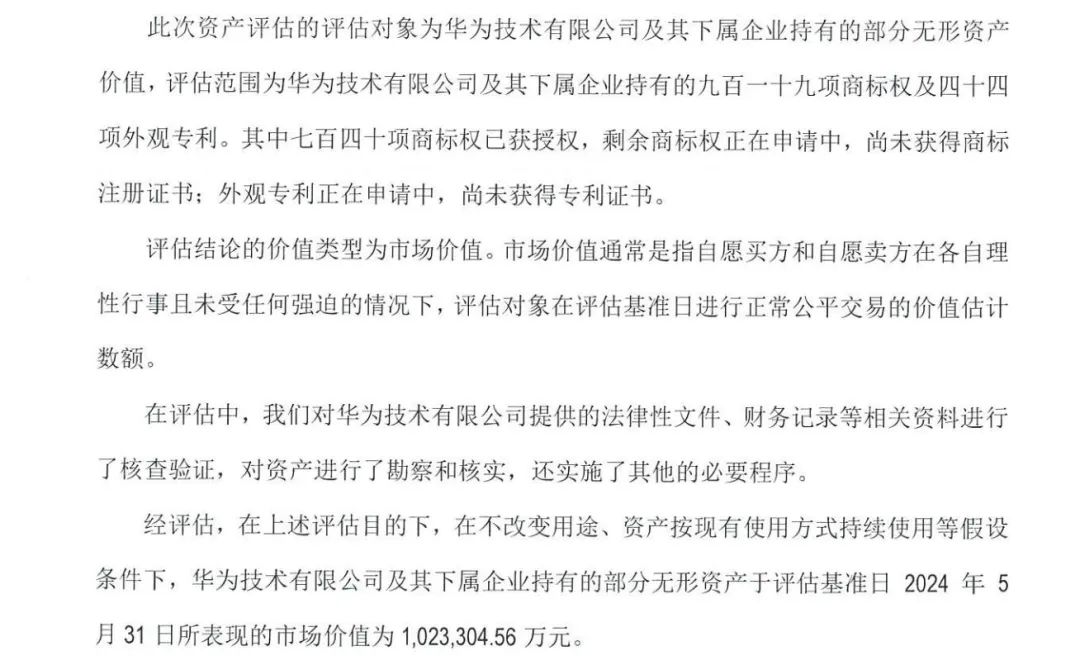

Entrusted by Seres, Zhongjing Minxin (Beijing) Asset Appraisal Co., Ltd. issued an assessment report on July 1: under the assumed conditions of not changing the purpose and continuing to use the assets in their current manner, the market value of certain intangible assets held by Huawei Technologies Co., Ltd. and its subsidiaries on the valuation baseline date of May 31, 2024 is 10,233,045,600 yuan.

In other words, these intangible assets are already worth 10.2 billion yuan. How could such a leap in value be achieved without the mutual pursuit of Huawei and Seres?

Undoubtedly, the cooperation between Huawei and Seres has become an undisputed success story. Even the inertia of the positive track is enough for Seres to enjoy long-term dividends. Using this "benchmark effect" to offset the "brand impression doubts" brought about by the attribution of the Wenjie brand, there may be gains and losses in face, but it will not shake the foundation.

More importantly, as the "Bosch of the new era," Huawei is unlikely to abandon its technical supply to Seres Wenjie, and Seres considering joining Huawei's Intelligent Vision business has even broader imagination space, although Intelligent Vision itself will encounter numerous challenges. In terms of substance, Seres Wenjie will not be disadvantaged.

In the end, Seres has already been described as "secure in its pocket" in the visible stage. Even in terms of stocks, Seres' share price has previously broken 100 yuan. Although there was a sharp drop for a while, the current level of 90 yuan+ is still higher than most automotive stocks, even if it slides further.

From Reckless Youth to Steady Adulthood

How should Huawei make money in the automotive sector and help its automotive partners make money? The answer is certainly not "making Huawei-branded cars."

Why?

First, traditional automotive manufacturing businesses have heavy investment models, long return cycles, and numerous related links, which do not align with Huawei's aspirations. For example, traditional vehicle manufacturing plants require hundreds of billions of yuan in investment and thousands of workers, involving significant capital and management costs, which are not what Huawei desires.

What are Huawei's aspirations? To open up new growth avenues beyond its enterprise business in base stations and consumer business in mobile phones. Smart electric vehicles are certainly a natural direction, but with the increasing prominence of software-defined cars, traditional vehicle manufacturing is no longer the "crown jewel." Instead, Huawei's expertise in intelligent technology is more likely to leverage a vast ecosystem. Why should we use outdated thinking to "box in" Huawei?

How to make more automakers accept Huawei's intelligent technology without worrying about "losing their soul" is Huawei's top priority.

When discussing Huawei's impact on China's automotive industry, it is necessary to trace back to Huawei's development history and several business models in the automotive field.

1. The most basic Tier 1 or Tier 2 component supplier business, providing standardized automotive components.

Xu Zhijun and others began promoting Huawei's automotive component business in 2012, and in fact, Huawei has been a supplier of automotive technology for more than 10 years.

Automakers can purchase varying quantities of components from Huawei, or they can purchase system-level assemblies (such as in-vehicle systems and electric drive systems), which can be further subdivided into different levels of sub-models.

As a Tier 1 supplier, Huawei has a very broad range of automotive customers, including BMW, Audi, Great Wall, and GAC, which have adopted technologies such as Hicar systems, motors, and AR-HUD. Even SAIC, which "does not surrender its soul to Huawei," has purchased Huawei AR-HUD for its Feifan brand, and competitors like NIO and Xpeng have also adopted Huawei motors.

As a Tier 2 supplier, Huawei cooperates with autonomous driving companies such as Momenta and MINIEYE, providing MDC computing platforms and underlying software.

2. The Huawei Inside (HI) model, providing a full-stack smart car solution.

Promoted by Xu Zhijun since 2012, Huawei's automotive component business was established as the Car BU in 2019, combining technologies provided by Huawei's optical, acoustic, cloud technology, and other businesses. Automakers adopt Huawei's full-stack smart car solution, covering five intelligent systems: intelligent cockpits, intelligent driving, intelligent connectivity, intelligent electric, and intelligent vehicle cloud services.

This model covers a broader range than Tier 1 suppliers and is known as Tier 0.5. It is also referred to as the "Bosch of the new era" in the industry. Among the current official customers, only Changan AVATR has made significant progress. The original BAIC ARCFOX Alpha S HI version did not perform well, and the GAC AH8 project was "downgraded" to a supplier model.

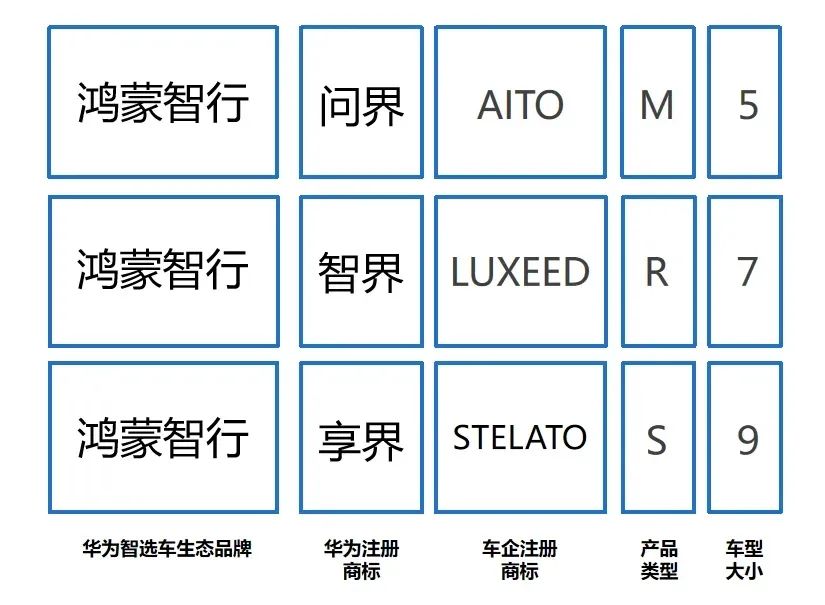

3. The HarmonyOS Intelligence model, previously known as the Intelligent Selection model, providing both technology and sales channels.

This model is led by Yu Chengdong's Huawei Consumer BG and is essentially a "certain Huawei technology + Huawei sales channel" model.

In the early stages of the Intelligent Selection model, Huawei's technological content was relatively low. For example, in the earliest Wenjie models, intelligent driving and parking came from Zongmu Technology, and the intelligent driving chassis came from Bosch, while Huawei only provided the intelligent cabin (in-vehicle system) and electric drive. However, later, Huawei's Car BU's full-stack intelligent technology was also provided to HarmonyOS Intelligence. Additionally, because Intelligent Selection involves sales channels and marketing dimensions, it has a greater say in defining cars.

Automakers and brands that adopt the HarmonyOS Intelligence model are familiar to the industry and consumers, including Seres-AITO Wenjie, Chery-Intelligent Vision LUXEED, BAIC-Enjoy Vision STELATO, and JAC-Pride Vision (English name not yet announced).

If we say