Midterm Exam of the Auto Market: The Everlasting "King of Di" and the Ever-changing New Forces

![]() 07/08 2024

07/08 2024

![]() 698

698

Thousands of miles away in Germany, the European Championship has determined the top four teams. In a few days, the new owner of the De Launay Cup will be determined at the Berlin Olympic Stadium.

In one month, 51 matches, multiple Chinese brands have showcased Chinese strength to the world through billboards beside the pitch. Among them is BYD.

In China, as June has just ended, Chinese automakers have successively disclosed their half-year sales results, with some rejoicing and others worrying.

Joint venture brands that once dominated the Chinese auto market are generally struggling under the new competitive situation; BYD remains firmly on the throne; and the new forces are constantly changing their leaders, with Hongmeng Zhixing replacing Ideal Auto and taking the half-year sales crown.

A common issue is that halfway through the year, most automakers are still far from their annual targets.

King Di remains King Di

In the early morning of July 7, Beijing time, the quarter-finals of the European Championship ended, with Spain, France, England, and the Netherlands advancing to the top four. In a few days, these four teams will meet in the semifinals to ultimately determine the winner of the De Launay Cup.

This summer, 51 matches between top European football teams have attracted the attention of billions of fans worldwide. Multiple Chinese brands, as official sponsors of the European Championship at the highest level, have rolled out on LED billboards beside the pitch.

Among them is BYD. It, along with its brands like Tenzhi, Fangshengbao, and Yangwang, achieved a collective showcase through this international event.

BYD's sponsorship of this European Championship has profound implications behind it.

Germany, the host country for the final stage of the European Championship, is also the birthplace of the modern automotive industry, giving birth to globally renowned automotive brands such as Mercedes-Benz, BMW, Audi, and Volkswagen.

In the past, automotive advertisements on the European Championship stage have been dominated by Korean and German brands. BYD's strong presence as the "World Champion of New Energy Vehicles" marks not just a transition between old and new brands, but also a significant shift in the automotive energy era.

This is the first time that the European Championship has teamed up with a new energy vehicle brand and also the first time it has "married" a Chinese automotive brand.

BYD's intention to fully enter the global market is self-evident. As the global new energy king for two consecutive years, BYD needs to find broader horizons beyond its Chinese home turf.

This year, BYD continues to adopt an aggressive market strategy. Shortly after the Spring Festival, it unleashed its price-cutting trump card, shouting the slogan "electricity is cheaper than oil."

As early as 2023, Wang Chuanfu had clearly stated that BYD would engage in a price war in the next 3-5 years, and the company had made sufficient preparations for this.

Stimulated by market demand, BYD's sales performance continues to be strong. In the first half of the year, it sold a cumulative 1.6071 million new energy passenger vehicles, representing a year-on-year increase of 28.76%. Among them, overseas sales totaled 203,400 vehicles, an increase of 173.76% from 74,300 vehicles in the same period last year.

Hongmeng Zhixing Tops as the New King

The competition among new forces is becoming more intense, and no one dares to say that they are definitely stable.

Ideal Auto, which focuses on extended range, selling refrigerators, stepping on points, and large sofas, has temporarily achieved phased success through pragmatism.

In 2023, Ideal Auto delivered a cumulative 376,000 vehicles, representing a year-on-year increase of 182.2%, and topped the new force rankings. For the full year, the company's revenue exceeded 100 billion yuan, with an overall profit of over 10 billion yuan, becoming the third profitable new energy automaker globally after Tesla and BYD, and the first profitable new force in China.

However, just a brief nap, and rivals have caught up. In early March, the failure of MEGA's launch dealt a significant blow to Ideal Auto and Li Xiang.

As Ideal Auto's most direct competitor, AITO Wenjie emerged as a dark horse. In Q1 this year, Wenjie sold a cumulative 85,842 vehicles, selling 5,442 more vehicles than Ideal Auto in the same period, and took the top spot on the new force quarterly ranking for the first time.

Gradually emerging from the shadow of the MEGA failure, Ideal Auto has regained its rhythm and begun to catch up vigorously. Finally, in May and June, it once again surpassed Hongmeng Zhixing (including Wenjie, Zhijie, Xiangjie, etc.). The first half-year sales results were released, with Ideal Auto selling a cumulative 189,000 vehicles, still about 5,200 vehicles less than Hongmeng Zhixing.

It may be hard for most people to imagine that the M9 model, which has the best market performance among the Wenjie brands, is actually a luxury car with an average price of over 500,000 yuan.

In May, the Wenjie M9 sold 15,900 units, taking the sales crown for models priced above 500,000 yuan in the domestic auto market. In June, M9 sales reached a new high of 17,200 units, with this model contributing over 40% of Wenjie's monthly sales.

In the past, the high-end automotive market was absolutely dominated by luxury brands such as BBA, and independent brands could only compete in the middle and low price ranges. Unexpectedly, the reversal came so quickly.

As the M9 surges forward, traditional first-tier luxury brands continue to lower their prices, with some models nearly halving in price. This is just to maximize sales in an increasingly competitive market environment.

Mostly Missing the Mark on Targets

Although the level of competition in the Chinese auto market has reached an unprecedented level, the strong growth momentum of new energy vehicles still makes most players optimistic about the future.

Almost all automakers have set relatively aggressive targets for 2024. However, as the half-year mark has passed, pressure is gradually emerging.

It is rumored that BYD's target for this year is 4.5 million vehicles, which means that the average monthly sales in the second half of the year must exceed 480,000 vehicles to achieve the target. This is probably difficult to achieve.

According to a report by LatePost Auto, Wenjie conveyed its 2024 target to suppliers of 600,000 vehicles. Hongmeng Zhixing delivered a cumulative 194,200 vehicles in the first half of the year, with a completion rate of less than one-third.

Ideal Auto has already lowered its full-year target from 800,000 vehicles to 560,000-640,000 vehicles in advance. Even so, the completion rate for the first half of the year is only about 30%.

Xiaopeng and Nezha have annual targets of 280,000 and 300,000 vehicles, respectively. In the first six months of this year, they delivered a cumulative 52,000 and 54,000 vehicles, respectively, with half-year completion rates of less than 20%.

Among the new forces in carmaking this year, Xiaomi, led by Lei Jun, is undoubtedly the hottest. Xiaomi SU7 has delivered a cumulative 26,000 vehicles in the three months since its launch and broke the 10,000-unit mark in June.

Previously, Lei Jun set a target for Xiaomi Automobile to deliver at least 100,000 vehicles by the end of the year, aiming for 120,000 vehicles. Xiaomi's biggest challenge is not order volume but delivery capability.

Geely Auto has always been relatively conservative in setting targets. At the beginning of the year, the company proposed to increase sales by 15% to 1.9 million vehicles based on last year's 1.648 million vehicles.

In the first half of the year, it has achieved cumulative sales of 956,000 vehicles, representing a year-on-year increase of 41% and completing 50% of its annual target, far exceeding expectations. While announcing its June sales data, the company took the opportunity to raise its target from 1.9 million vehicles to 2 million vehicles.

Among traditional large automakers, GAC Group seems somewhat disappointed.

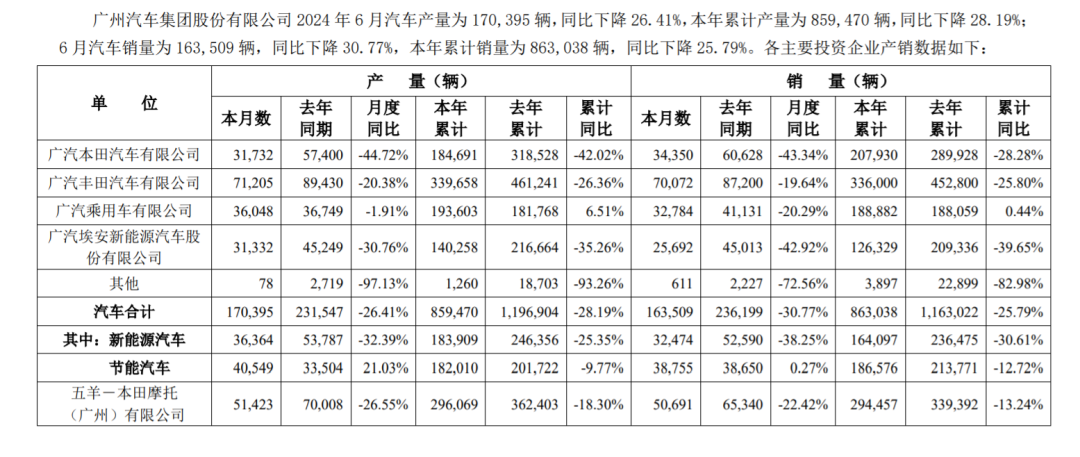

In the first half of the year, sales of Guangben and Guangfeng dropped significantly by 28.28% and 25.80%, respectively. Its new energy vehicle platform, GAC AION, saw a significant drop in half-year sales from 209,300 vehicles last year to 126,300 vehicles, a decrease of 39.65%. During this period, the group's cumulative sales of new energy vehicles reached 164,100 vehicles, down 30.61% year-on-year.

Under such circumstances, it is not surprising that Zeng Qinghong, the chairman of GAC Group, publicly called on the industry to oppose "internal competition."