Chery, Overlooked in China, Is Replacing BBA Overseas

![]() 07/08 2024

07/08 2024

![]() 580

580

Author | Meng Xiao

For more financial information | BT Finance Data Hub

Total word count: 5114 words, Estimated reading time: 13 minutes

Chery, overlooked in China, is making waves overseas.

As of May 31, 2024, Chery's export volume reached 435,000 vehicles, once again defending its title as China's top automaker in exports. Ranking second is SAIC Motor Group with 366,000 vehicles, followed by Changan with 239,000 vehicles in third place, and Geely with 196,000 vehicles in fourth place.

BYD, the sales king of 2023, exported 179,000 vehicles in the first five months of 2024, ranking fifth, with a gap of 256,000 vehicles compared to Chery's export volume. Although Great Wall, which has been vigorously deploying overseas operations, has seen significant growth compared to the same period in 2023, its export volume of 163,000 vehicles is nearly 280,000 vehicles behind Chery. In terms of exports, Chery has stood out among independent brand automakers.

In fact, there are early signs that Chery's export performance could stand out. In the first quarter of 2024, Chery's export volume reached 253,000 vehicles. In 2023, although BYD sold 3.02 million vehicles globally, its overseas market sales were only 243,000 vehicles. Chery's quarterly export volume exceeded BYD's annual export volume in 2023. Data shows that in 2023, Chery's total sales were 1.88 million vehicles, of which overseas market sales were 937,000 vehicles, accounting for 49.8% of total sales. Overseas profits accounted for more than half, and export business has become Chery's "cash cow".

Why can Chery outperform others in overseas markets? The answer still lies in its performance.

1

Chery Is Making Waves Overseas

Chery completed automobile exports in 2001, becoming the earliest domestic independent brand automaker to export. In 2002, a Syrian car dealer took a fancy to Chery's first-generation Fengyun sedan and traveled to Chery's headquarters in Wuhu, Anhui. At that time, Yin Tongyue, the then Executive Deputy General Manager of Chery Automobile and now Chairman of Chery Automobile, was on a business trip in Shanghai. The Syrian car dealer then rushed from Wuhu to Shanghai and demanded a large order for 200 vehicles from Yin Tongyue, but Yin Tongyue, out of caution, only agreed to provide 10 vehicles. From the meeting to the finalization of the contract, it only took 10 minutes.

Since then, Chery has opened a new chapter in overseas exports, gradually radiating to more than 80 countries and regions around the world, from Iran and the Middle East.

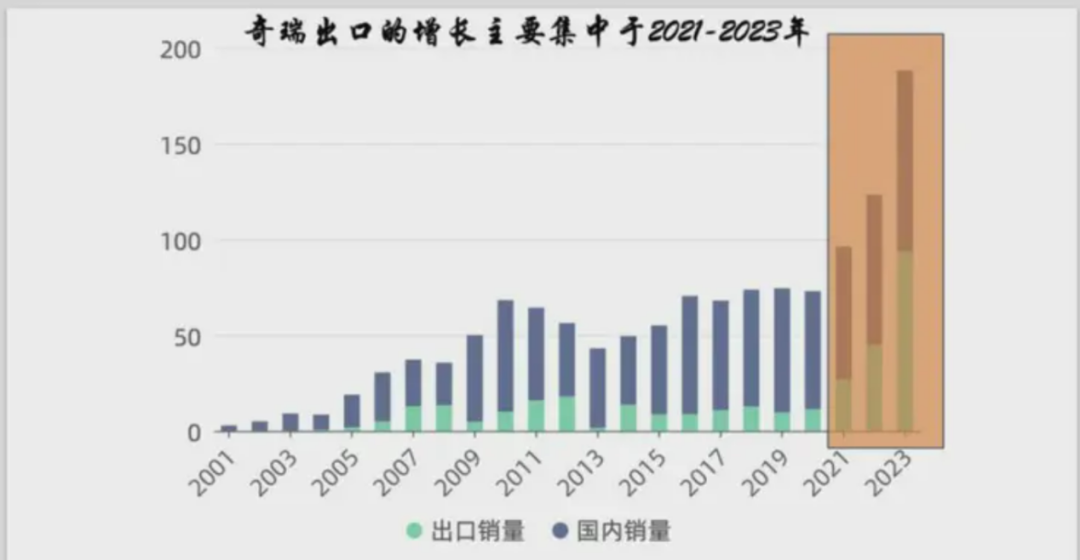

Before 2005, Chery's export proportion was not high, but Chery had a high reputation in the third world, maintaining an export rhythm of more than ten thousand vehicles per year. Until 2020, the proportion of overseas exports hardly exceeded one-third. However, since 2021, Chery's export sales have surged, and the proportion of overseas markets has gradually increased to about half, making it the automaker with the highest proportion of domestic and overseas market operations.

The reason for the surge in Chery's export sales from 2021 to 2023 lies in the strong demand in the Russian market. Before 2021, the Russian automotive market was dominated by European veteran automakers from Germany, France, and other countries, as well as Japanese and Korean brands. However, after the conflict between Russia and Ukraine in 2022, European and Japanese and Korean automakers withdrew from the Russian market, and half of Russia's automotive industry capacity collapsed due to the conflict. Chery happened to appear in the Russian market at the right time.

Data shows that in 2020, Chery's global export volume was only 114,000 vehicles, while in the first quarter of 2024, Chinese automakers exported 176,000 vehicles to Russia, most of which were contributed by Chery. From 2021 to 2023, Chery's overseas sales were 269,200 vehicles, 451,300 vehicles, and 937,100 vehicles, respectively. Year-on-year growth was 68% and 108%, respectively. In 2023, export sales increased by 248% compared to 2021, more than tripling. In 2021, Chery's automobile export sales accounted for only 28% of total sales, but this proportion has surged to 49.81% by 2023. With the intensification of geopolitics, Chery's acquisition of shipyards and improvement of the supply chain, Chery's strong performance in the Russian automotive market and overseas markets is expected to continue.

2

Chery's Rise Is Not Accidental

Chinese people are no stranger to the Chery brand. Many post-80s' first cars were Chery QQ, priced at less than 50,000 yuan. Relying on its popularity in those days, Chery QQ dominated the market for nearly a decade among similar competitors, giving consumers the habit of thinking of Chery cars as low-end models. At that time, as the "sole seedling" of domestic independent automakers, Chery's camp did not include BYD or Geely, making Chery the representative of domestic independent brand models.

In 2001, to be included in the national vehicle production and management directory, Chery agreed to transfer 20% of its registered capital to SAIC Motor Group free of charge under the coordination of the State Economic and Trade Commission, officially joining SAIC Motor Group, and the company was renamed SAIC Chery. In 2001, Chery sold 28,000 sedans, with sales revenue of over 2 billion yuan. In 2002, Chery sold 50,000 sedans, with sales revenue of over 4 billion yuan. In 2003, Chery continued to make progress, selling over 90,000 vehicles and generating nearly 8 billion yuan in sales revenue.

On December 18, 1999, Chery's first sedan rolled off the assembly line. In October 2001, Chery launched its first-generation Fengyun sedan, kicking off the "military competition" for independent brand cars. At that time, Yin Tongyue was the Executive Deputy General Manager of Chery Automobile. In 2002, Geely's Beauty Leopard was launched, but there were significant controversies regarding its appearance and quality, and its market popularity was far inferior to Chery QQ, which was launched a year later. In 2001, before Chery launched Chery QQ, Chery sold 28,000 sedans with sales revenue of over 2 billion yuan. In 2002, sales reached 50,000 vehicles with sales revenue of over 4 billion yuan. After the launch of Chery QQ in 2003, Chery's sales exceeded 90,000 vehicles, with sales revenue of around 8 billion yuan, almost doubling both sales and revenue.

It was the market success of Chery QQ that prompted BYD to officially enter the automotive manufacturing field, launching its first independently developed car model, the Flyer. This marked BYD's official entry into the automotive market, opening the door to automotive manufacturing. BYD's total revenue that year was 4.076 billion yuan, only about half of Chery's. Geely's revenue that year was only 42.49 million yuan, about one-two-hundredth of Chery's.

With the decline of Chery QQ, Chery has rarely had the opportunity to "show its face" besides leaving the inherent impression of being a low-end car. The last time Chery garnered a hot search was its 62-year-old Chairman Yin Tongyue's live streaming debut. However, Chery, as the representative of domestic independent brand models, has always enjoyed a good reputation. "Earning dollars for research and development" and "excellent engine technology" have become Chery's labels. However, few people know that Chery has quietly risen behind the scenes and has always been the leader in China's automotive exports. Even strong automakers like BYD lag far behind Chery in overseas market sales. Chery is gradually changing the old impression of itself among Chinese consumers through overseas markets.

3

Investing Earned Dollars in Research and Development

Chery's low net profit margin has been criticized by the market. Although Chery has not disclosed its net profit margin as it is not listed, based on Chery's total sales of 449,000 vehicles and revenue of 34.762 billion yuan in 2020, with a net profit of 7.3718 million yuan, Chery's net profit margin in 2020 was only 0.02%, and the net profit per vehicle was only 16.4 yuan. Compared with automakers with net profit margins of tens of thousands of yuan per vehicle, Chery's net profit margin is significantly lower.

Despite its low net profit margin per vehicle, Chery still maintains a profitable rhythm. Looking at the entire automotive industry, independent brands with low net profit margins per vehicle are not limited to Chery. Chang'an Automobile's net profit margin per vehicle was once as low as 33.2 yuan, and FAW Group's net profit margin per vehicle was only 27 yuan for a period of time. One of the major reasons for Chery's low net profit margin per vehicle is that they invest the dollars earned from overseas markets in research and development.

In 2021, Chery proposed the strategic slogan of "exporting 500,000 vehicles and earning $5 billion annually." This "double 50" target was originally set for 2025, but Chery exceeded it in 2023, selling 937,100 vehicles that year. In 2021, Chery began to conduct "localized" development and tuning overseas, such as in Brazil, Saudi Arabia, Russia, etc., testing extreme conditions like extreme cold and heat to meet consumer demand. Chery has established six overseas R&D bases, 10 overseas factories, and over 1,500 overseas dealers and service outlets. These R&D and strategic layouts have required significant financial investments from Chery.

Chery's willingness to invest heavily in R&D has historical reasons. In 1997, when Chery was first established, it purchased a used Ford engine production line from the British for a high price of $29.8 million. However, when the British assembled it, they strictly prohibited Chinese personnel from participating to protect their technology. As a result, the British workers were unmotivated, and after several months, the machinery was still not fully assembled. As a newly established company, Chery had to cut corners and could not afford to support these workers, so they were dismissed. Finally, after many difficulties, the assembly was successfully completed. Having learned from this lack of technology, Chery began to attach importance to independent R&D of technology.

As we all know, the engine is the heart of a car, and domestic engine technology has been criticized by consumers. However, Chery's engine technology has won the respect of consumers. After years of heavy investment in R&D, Chery's engines have reached world-class levels. In particular, the Kunpeng 2.0T engine equipped on the Xingtu Lanyue and Tiggo 8 Kunpeng Edition has top-notch power performance among domestic models. It has a maximum horsepower of 254Ps and a maximum torque of 390Nm. At the same time, this engine maintains strong power while having good fuel economy, with a relatively broad high thermal efficiency range.

Chery was the first brand to propose a lifetime warranty and 10-year or 1 million km warranty for its engines, demonstrating their confidence in independently developed engine products. Its 2.0T engine remains a king in the era of fuel vehicles, and its 1.5L naturally aspirated engine performs well on the Tiggo 3X. Even Kawasaki Heavy Industries in Japan has purchased over 1 million engines from Chery, considering that Japanese automakers' engine technology has always been leading globally.

By investing earned dollars in R&D, Chery has gradually accumulated its technological advantages. In addition to engines, core components such as transmissions and chassis have also formed their technological advantages, making Chery a worthy domestic brand worthy of market respect. Chery's quality has also completely bid farewell to its "black history" of "Chery Chery, waiting in line for repairs." Chery insists on using world-class standards for product planning, development, validation, and sales. It is with high-quality products, services, and a trustworthy brand image that Chery has won full recognition in overseas markets. Quality is the "knocking brick" for Chinese automotive exports, and technology is the "passport" to enter international markets. Chery's excellent performance in overseas markets is closely related to its excellent quality and technology.

4

Chery Is Replacing BBA in Overseas Markets

In 2014, Chery established its first overseas automobile production plant in Brazil, becoming the first Chinese automaker to build a factory overseas for exports. As of 2023, Chery has established 10 production bases globally, including factories in Tula, KamAZ in Russia, Argentina, Turkey, Ukraine, Iran, Egypt, South Africa, and Indonesia, with the Brazilian factory as a representative. The establishment of these overseas factories has increased Chery's overseas production capacity, not only enhancing Chery's competitiveness and brand influence in the global market but also creating opportunities for local economic development and employment.

Chery's Brazilian factory is located in Jacareí, São Paulo state, Brazil. The overall plan is to eventually build the Chery Brazil Industrial Park, covering an area of 1 million square meters with a total investment of $400 million, followed by an additional $400 million. Depending on the market and factory operating conditions, outstanding suppliers from China will be introduced into the Chery Brazil Industrial Park to support Chery and other automakers. The first phase of the project will introduce models such as the Chery S12 (A1) and A13 (Fengyun 2), which are flexible fuel vehicles that meet the requirements of the Brazilian market. Other models will be gradually introduced based on market developments.

One of the key factors for Chery's rapid development in overseas markets is its "localized" approach. Taking the Brazilian market as an example, South American roads are not in good condition, with many mountainous roads. Many people live on hillsides, so there are high demands on car power and acceleration. Chery has tailored its vehicles exported to South America to enhance power, improving acceleration and hill-climbing performance.

In the Middle East, due to the many desert areas, sand particles floating in the air can easily accelerate vehicle component wear. Chery has also targeted its vehicles exported to the Middle East with internal reinforcement and sealing treatment.

This series of tailored approaches to overseas consumers has allowed Chery to have 3.8 million car owners overseas, including all federal police cars in Brazil, which are Chery vehicles. In the Brazilian market, Chery has become a representative of mid-to-high-end models. Although the prices are not cheap, due to its focus on technology and quality, overall sales are quite good.

Currently, in the Brazilian automotive market, Chery holds a significantly high position. The brand has positioned itself in Brazil as catering to mid-to-high-end models, focusing on technology and quality, with prices that are not cheap. Despite the high prices, sales have been impressive. Brazilian President Jair Bolsonaro has even used the Chery Tiggo 8 as his campaign vehicle and to host Elon Musk. Although the Tiggo 8 he used was a modified bulletproof version, it still demonstrates the recognition that the Chery Tiggo 8 has gained in the local market. This is a point of pride for Chinese independent brands.

What does it mean for a car to serve as both the president's vehicle and the government's reception car? According to BT Finance, the German Chancellor's car is the Mercedes-Benz S 680 Guard, the South Korean President's car is the Hyundai Equus, the Japanese Prime Minister's car is the Lexus LS600h, the British Prime Minister's car is the Jaguar XJ Sentinel, the Russian President's car is the Aurus Senat (Golden Russia), the Italian President's car is the Maserati Quattroporte, and the U.S. President's car is the Cadillac Beast. Likewise, our leaders' cars are Hongqi, which are all national brands representing the highest level of car manufacturing in their respective countries and enjoy high consumer recognition. That Chery can become the official car and reception vehicle for the Brazilian president indicates that Chery has become a "luxury car" in the minds of local consumers in Brazil.

Even Middle Eastern tycoons take pride in driving Chery vehicles. Chery's status in the Middle East is approaching, and even surpassing, the traditionally dominant positions of brands like BMW, Mercedes-Benz, and Audi (BBA).

Unlike some companies that cut prices and make concessions to seize overseas markets, Chery's prices in overseas markets are much higher than in the domestic market. For example, the Chery Arrizo 5 sells for 60,000 RMB in China but 112,500 RMB abroad. The Tiggo 5X sells for 70,000-90,000 RMB domestically but over 150,000 RMB abroad. The Exeed TXL, which sells for less than 200,000 RMB in China, sells for 500,000 RMB in Russia. The Tiggo 7, which sells for just 70,000-140,000 RMB in China, reaches over 260,000 RMB in Russia. The fact that Chery's models are sold at nearly double the domestic prices in overseas markets, yet still see a surge in sales, speaks volumes about Chery's reputation abroad.

It turns out that Chery, which has always been relatively quiet in the domestic market, has been galloping ahead silently in overseas markets. Due to Chery's outstanding performance in overseas markets and its solid technical foundation, there are also reports of Chery planning an IPO in 2024, with an estimated market value of 150 billion RMB. This market valuation would surpass Geely, Changan, and GAC Group, almost equaling SAIC Motor.