Charging Ahead: How BYD Aims to Reclaim the Global Top Spot

![]() 07/09 2024

07/09 2024

![]() 588

588

“On that day, all new energy vehicle companies around the world remembered the fear of being dominated by BYD and the struggle of being trapped in a price war.”

On July 1st, several automakers announced their June sales figures, with BYD continuing to lead the pack, achieving over 300,000 sales for the fourth consecutive month. Seres’ sales exceeded 40,000 units for the first time, while Zeekr delivered over 20,000 units in a single month for the first time, and NIO’s deliveries doubled, setting a new record high.

However, during the past second quarter, BYD and Tesla, as the “representatives” of Chinese and American new energy vehicles, exhibited different trends:

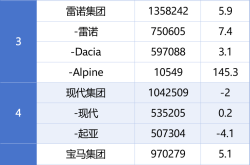

According to Bloomberg data, in the second quarter of 2024, BYD sold 426,000 pure electric vehicles and 983,000 pure electric and hybrid vehicles in total. In June alone, sales reached 341,000 units, up 35.2% year-on-year, setting a new record. In contrast, Tesla sold 441,000 electric vehicles in the second quarter, marking the second consecutive quarter of declining sales. Analysts predict that sales in key markets such as China and Europe are declining.

As BYD gains ground, we can observe a trend: it is poised to surpass Tesla once again to become the world’s largest electric vehicle seller. Amid this shift in market positions among giants, what has BYD done to maintain its “significant lead” in sales and growth? In the current market where price wars are accelerating the shuffling of players, what sets BYD apart? To escape the vicious cycle of “involution,” where are the next growth points for China’s new energy vehicle companies?

How is BYD, which reduces prices while increasing profits, poised to become the “king of electric vehicles”?

Compared to the nascent growth in 2021 and rapid development in 2022, the new energy vehicle market has slowed down in 2023 and 2024. With the maturing of the industrial chain and the gradual withdrawal of new energy subsidies, substantial price wars have become inevitable, forcing every automaker to “trade price for volume” to maintain market share.

Since 2023, BYD’s average vehicle price has continued to decline. At the beginning of 2024, BYD led the way in initiating the “first shot” of the Year of the Dragon’s new energy vehicle price war, pushing new energy vehicles into the era of RMB 70,000. Subsequently, brands such as Lixiang, NIO, Xpeng, and Tesla followed suit with price cuts, shifting the new energy vehicle market from “same price as gasoline vehicles” to “lower price than gasoline vehicles.”

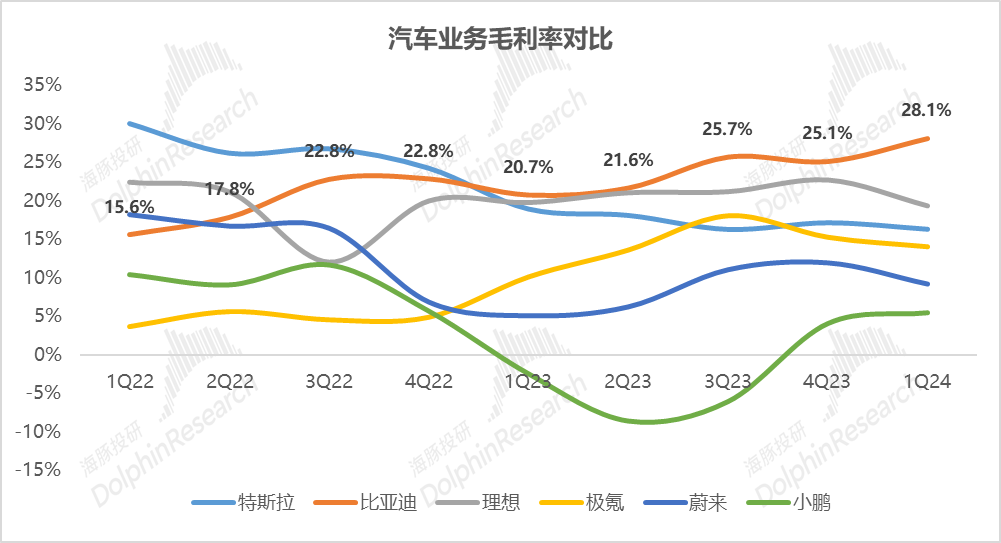

However, contrary to the conventional wisdom that price cuts erode profits, BYD’s automotive business (including battery business) gross margin has been rising, from 21% in the first quarter of last year to 28% in the first quarter of this year. Similarly, Tesla’s automotive business gross margin has shown a continuous decline, slipping from 19% in the first quarter of last year to 16.4% in the first quarter of this year, almost halving from its peak gross margin of around 30%.

As leaders in the fiercely competitive new energy vehicle market, why has BYD’s automotive business gross margin taken a different path?

The main reasons include three points:

From the perspective of upstream raw materials, a research report by China Securities Co., Ltd. shows that the average price of battery-grade lithium carbonate was RMB 101,500 per ton in the first quarter of 2024, a decrease of 74.8% from the same period in 2023. Lithium salt factories experienced a revenue decline of over 30% in the first quarter, with Tianqi Lithium’s revenue falling by 77.42%, translating to reduced battery costs for automakers. Meanwhile, BYD sold over 3 million vehicles in 2023, up 62% year-on-year, and higher sales volumes mean stronger bargaining power for BYD in raw material procurement. Dolphin Investment Research estimates that BYD’s cost reduction in the battery sector is approximately RMB 7,000.

From the perspective of midstream manufacturing, BYD’s 2023 Champion Edition adjusted battery capacity, motor power, and center console screen specifications while reducing prices by RMB 10,000, further lowering costs while maintaining profit margins and achieving price reductions.

From the perspective of downstream sales, BYD expanded its brand recognition in European and American markets through the Prestige series and sponsoring events such as the UEFA European Championship. In the second quarter, BYD launched its first hybrid pickup truck in Mexico, tapping into a new market segment. The proportion of high-end models and overseas sales has increased: BYD sold a total of 380,000 high-end and export models in 2023, up 476% year-on-year, and their share of BYD’s overall sales rose from 11% in the first quarter of 2023 to 22% in 2024.

As a result, BYD’s variable cost per vehicle decreased by RMB 18,000 in 2023, fully offsetting the decline in vehicle prices. The higher gross margins of high-end and export models further lifted BYD’s overall gross margin level. In the context of trading price for volume, BYD has ensured its profitability by leveraging its ultimate cost control and seeking new markets overseas, becoming the only Chinese new energy automaker with positive share price growth this year.

Why is BYD standing out in this red ocean?

However, purchasing raw materials at low prices, reducing costs through price cuts and configuration adjustments, and expanding overseas markets are strategies employed by all automakers. Brands such as Tesla, Leapmotor, NIO, and Geely have all introduced “price-cut and configuration-reduced” models to ensure profits. SAIC Motor, Chery, and FAW have made significant investments in foreign markets such as Europe and the Middle East. Among these automakers, why has BYD stood out?

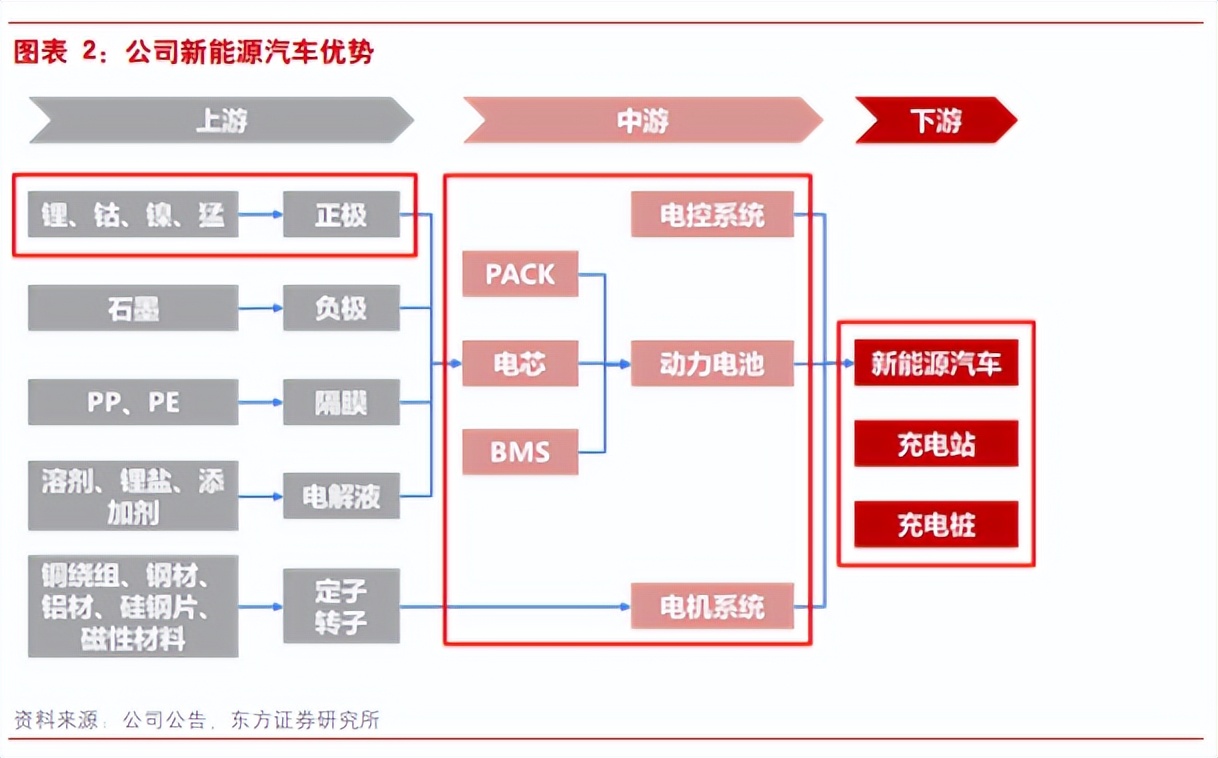

The deeper reason lies in BYD’s vertically integrated business model, achieving deep integration from raw materials to power battery systems, from electric drive systems to complete vehicle system integration, at scale.

A research report by Orient Securities shows that relying on the company’s years of technological reserves in IT and new energy industries, BYD has achieved self-sufficiency in batteries, motors, electronic controls, charging infrastructure, and complete vehicle technologies.

Upstream in the industrial chain, in 2017, BYD jointly established Qinghai Salt Lake BYD with Qinghai Salt Lake and Shenzhen Zhuoyu Cheng in Golmud, responsible for the development of salt lake lithium resources for the production of lithium carbonate and lithium hydroxide.

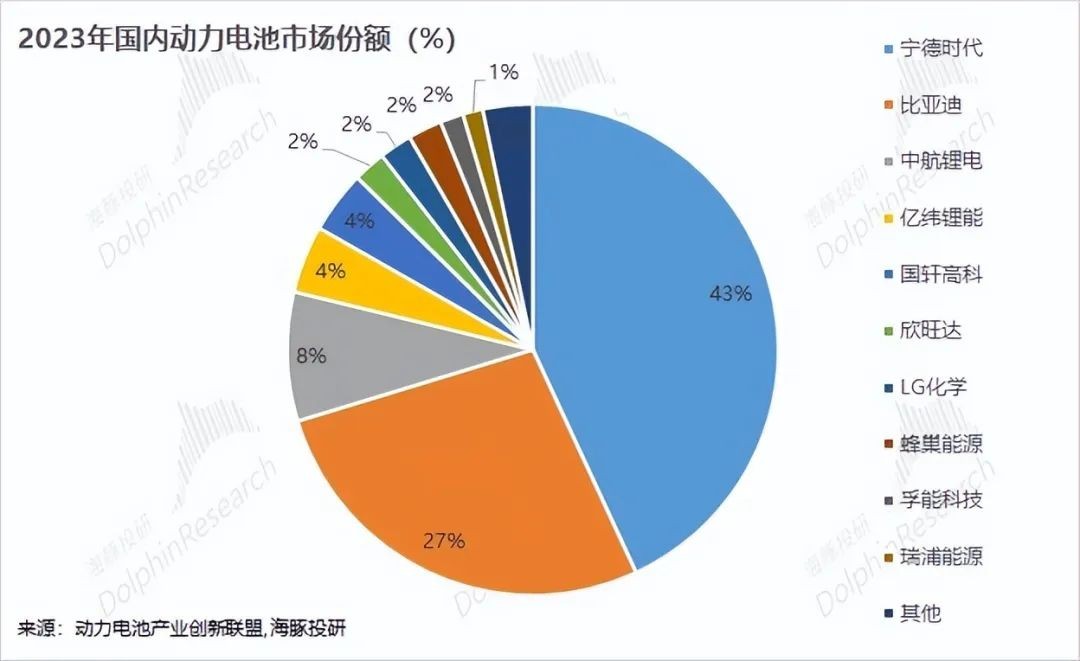

Midstream in the industrial chain, BYD’s Fudi is currently the second-largest lithium battery producer in the domestic power battery sector, with a market share of 27%. Fudi’s self-produced batteries are more cost-driven, focusing on lithium iron phosphate batteries, which saves R&D investment compared to CATL’s multi-faceted industrial technology layout.

Downstream in the new energy vehicle industrial chain, BYD’s products include pure electric and plug-in hybrid new energy vehicles, covering sedans, SUVs, MPVs, and buses, targeting both low-end and high-end markets.

It seems that BYD, which started as a battery manufacturer, has the most complete ecological barriers. In contrast, other manufacturers have deficiencies in different parts of the industrial chain. Take Tesla as an example; its battery technology started relatively late, and its self-developed 4680 batteries still rely on Panasonic and CATL for some production capacity, affecting its ability to maintain complete ecological barriers. This has led to slower-than-expected cost reduction speeds and profit erosion. In contrast, BYD saves the “CATL tax” that CATL would otherwise earn, protecting part of its automotive business profits. It is precisely with this vertically integrated business logic that BYD was able to grow against the trend and stand out from the vicious cycle of “loss-making vehicle manufacturing, selling more and losing more.”

Determined to Go Overseas: How Can Domestic New Energy Vehicles Survive the “Huawei Moment”?

However, the reason why BYD was able to complete industrial chain integration earlier than Tesla largely stems from China’s favorable treatment of the electric vehicle industry. The rapid development of China’s new energy vehicles and their expansion abroad are inseparable from policy support.

The purchase tax exemption implemented from January 2021 to December 2022 provided significant momentum to China’s nascent new energy vehicle market. In March 2024, the Ministry of Industry and Information Technology and the National Energy Administration allocated approximately RMB 9 billion to support the trade-in of electric vehicles and introduced support policies for improving county-level charging and swapping facilities.

In June 2024, the preferential tax exemption policy was extended and optimized. The Ministry of Finance, State Taxation Administration, and Ministry of Industry and Information Technology jointly announced that the purchase tax exemption for new energy vehicles would be extended from 2024 to 2025. According to preliminary estimates by the Ministry of Finance, the total scale of vehicle purchase tax exemptions from 2024 to 2027 will reach RMB 520 billion.

The effects of the policies are significant. According to foreign media reports, China has become the dominant force in the electric vehicle market, with pure electric vehicle sales expected to be four times that of North America in 2024 and to maintain over 50% of the global pure electric vehicle sales share until 2027, surpassing the combined sales of North America and Europe by 2030.

However, this has been accompanied by tariff restrictions from other countries. First, the United States increased tariffs on Chinese vehicles, and then the European Union imposed provisional countervailing duties. On July 4th local time, the EU announced the imposition of countervailing duties on Chinese new energy vehicle companies, with corresponding tax rates of 17.4% for BYD, 19.9% for Geely, and 37.6% for SAIC Motor. China’s new energy vehicle companies have encountered their own “Huawei Moment” in the European market.

In response, SAIC Motor and Geely Group both issued statements expressing their disappointment.

CEOs of automakers such as BMW and Volkswagen directly stated that such measures would not only fail to enhance the competitiveness of European automakers but might damage companies actively conducting business globally. The German Association of the Automotive Industry also stated that the tariff increase was not in line with the long-term interests of the EU.

From this perspective, the tariff increase will only turn the European electric vehicle market from a “win-win” situation to “mutually harmful”:

On the one hand, European local automakers have insufficient production capacity, high prices for green technologies and products. The tariff increase not only damages the business models of globally active companies but also limits the supply of electric vehicles to European customers and slows down the decarbonization process in the transportation sector.

On the other hand, the combination of European automakers’ brand influence and China’s complete electric vehicle supply chain system is not only conducive to European enterprises sharing market opportunities and development opportunities in China’s new energy market for green travel but also helps enhance the global competitiveness of European local automotive brands. At the same time, Chinese companies’ localization strategies and labor talent training in Europe benefit the creation of Europe’s own electric vehicle supply chain ecosystem.

In response, the answer given by Chinese automakers is: while stabilizing the European market, further opportunities should be sought in the development of Asian, African, and Latin American markets. Wang Xiaoqiu, President of SAIC Motor, stated that SAIC Motor would balance potential fluctuations in the EU market through its global production and sales layout, including the Middle East and Southeast Asia.

Previously, Macquarie released a research report stating that its long-term outlook for BYD remains unchanged, and it is confident that the company is poised to become the next Toyota Motor. More aggressive overseas expansion news from places like Thailand may also support a further revaluation of its shares.

From this perspective, linking Southeast Asia, Latin America, and African markets with China’s related upstream and downstream industries (such as power development, electric charging pile construction, automotive parts services, road infrastructure construction, etc.) to achieve diversified capacity extension and jointly cultivate and expand third-party markets will be a necessary and important path for Chinese automakers to go abroad.

Facts will ultimately prove that Europe’s automotive market, by being insular, cannot stop China’s new energy vehicles from going abroad. As Foreign Ministry spokesperson Wang Wenbin put it, after all, it is already 2024, and “protectionism protects backwardness and loses the future.”

Source: Hong Kong Stocks Research Society