Just as life was getting better, has the MPV market crashed?

![]() 07/11 2024

07/11 2024

![]() 529

529

Lead

Introduction

When so many players flood into a relatively small market, the competition will inevitably become fierce and ruthless.

Editor-in-Charge: Li Sijia

Editor: He Zengrong

As a highly competitive and saturated segment, the MPV market has seen its fair share of ups and downs. From the setbacks faced by Ideal MEGA to the new breakthroughs brought by the 789,000-yuan Zeekr 009 in the high-end MPV space, to the counterattack launched by the MPV kingpin Buick GL8 against Tengshi D9 in the form of a PHEV, and with new players like Xpeng X9, Lantu Dreamer, and LEVC L380 eyeing this segment, the MPV market, despite its annual total of just over 1 million units, has been incredibly lively.

However, after 182 days of fierce competition within the industry and among competitors, the MPV market, which was once highly anticipated, seems to have hit a growth bottleneck.

Data from the China Passenger Car Association shows that in the first half of this year, the total volume of the entire MPV market, whether wholesale or retail, was only around 460,000 to 470,000 units, marking a negative growth of 8% to 9%. Entry-level and household A-class MPVs saw the biggest declines, while B-class MPVs remained largely consistent with the same period last year. C-class high-end MPVs, on the other hand, totaled only 100,000 units in the first half, with both retail and wholesale trends pointing downwards. This is a stark contrast to last year's double-digit growth in the high-end MPV segment.

"The decline is very obvious. It's not as easy to sell as last year, even with new PHEV products," said Zhao, a salesperson at a Buick 4S store in Shanghai. He told the author that competition is fierce now, with customers who used to buy GL8 now often bringing other competitors like Tengshi D9 or Toyota MPVs into the store for negotiations.

As a representative product in the MPV market, GL8 is under immense pressure. In June, the retail sales of all GL8 variants totaled only 6,000 units, marking the first time it fell out of the top three positions in the MPV market. Ahead of GL8 were the Trumpchi M8, Sienna, and the runaway leader Tengshi D9. This also contributed to SAIC-GM's sales decline exceeding 70% in June, with its ranking falling out of the top 20 automakers.

Facts have proven that when so many players flood into a relatively small market segment, the competition to win over consumers and market share will inevitably become fierce and ruthless. However, everyone involved in the MPV market is wondering if this highly anticipated high-end segment, coupled with competition from high-end SUVs and economic downturns, will still usher in a spring of consumption and experience upgrades.

Who will fall? Who will rise?

On a weekday afternoon in July, when the author approached a Buick 4S store in Shanghai, a Buick GL8 PHEV model was prominently displayed. Apart from the author, there were no other customers in the store. Despite the heat outside, the showroom was deserted.

After a brief stroll, the receptionist approached and asked if the author needed a sales consultant. Typically, this Buick 4S store only has two salespeople on duty from Tuesday to Thursday afternoons. Five minutes later, a salesperson appeared, and upon learning that the author was interested in the GL8 PHEV, they immediately became more energetic.

"Currently, the GL8 PHEV comes with a 30,000-yuan subsidy for vehicle purchase tax. If you trade in your old Buick, you can also get a 30,000-yuan trade-in subsidy. The mid-range model comes with a 30,000-yuan upgrade package. If you decide to buy, you can also apply for a 5,000-yuan insurance package. The car, with a guidance price of 390,000 yuan, can basically be yours for 390,000 yuan," Zhao said, outlining the pricing and policy information. He added that the policies for this car are indeed very attractive.

"Our store has already booked over 70 units, most of which are from existing GL8 owners trading in their cars. Other stores might take one or two months to deliver, but we can get them in a week," Zhao said confidently, exuding an air of confidence that the car would sell easily.

Since the launch of the Buick GL8 PHEV on April 24 this year, there has been much speculation about whether it could regain some advantage in the competition against Tengshi D9 and other new energy MPVs. However, facts have shown that slow production ramp-up, a laid-back sales attitude, and the usual joint venture-style service have made it extremely difficult for GL8 to stage a comeback.

Retail sales data for June showed that the GL8 PHEV sold only 400 units, virtually disappearing in the MPV market with a limited number of products.

If the GL8 PHEV version has yet to find its rhythm, the downturn of the traditional gasoline-powered GL8 can be seen as the true portrayal of the Waterloo faced by Buick GL8 and SAIC-GM. This chill has spread from Shanghai to the entire country.

Data from the first four months of this year shows that Buick GL8 sold only 23,400 units, a year-on-year decline of nearly 50%. Its average monthly sales have dropped from over 10,000 units to less than 6,000 units. This performance has also caused Buick GL8's market share in the MPV segment to plummet from a peak of 12% to 8%, a worrying situation.

From a national perspective, coastal provinces like Shandong, Jiangsu, Beijing, and Shanghai are the key sales regions for Buick GL8, with the top five provinces accounting for roughly half of its sales. However, according to insurance data from 2023 and the first four months of this year, Buick GL8, squeezed by competition from other MPVs, has almost been pushed towards Shandong, Beijing, and Shanghai, with sales in other provinces declining across the board.

We have reason to believe that the downturn in the entire MPV market is driven by Buick GL8. After all, when a once-leading model experiences a 50% decline, it is only natural that the entire segment will also see a single-digit decline. The question is, who will take over the market share lost by Buick GL8? This is a question that all automakers targeting the MPV market need to ponder.

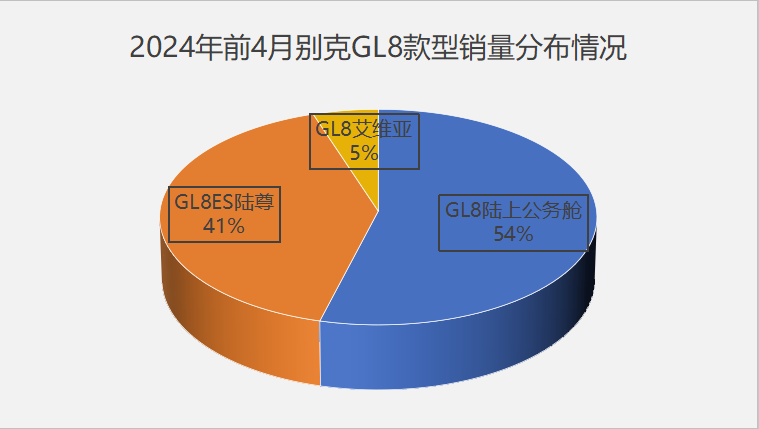

Of course, this question is not difficult to answer. It depends on where Buick GL8's current core sales segment lies. Based on insurance data from the first four months of this year, out of the total sales of 23,400 units, the Land Business Class, priced in the 200,000-yuan range, accounted for more than half of the sales, while the Land Respect, priced at over 300,000 yuan, accounted for 40%. The Avenir version, priced at around 400,000 yuan, only accounted for 10%.

So, the situation facing Buick GL8 is that in the 200,000-yuan price range, there is the Trumpchi M8 as an alternative, especially since the M8 also has a hybrid version that is more advantageous in terms of fuel consumption and running costs compared to the GL8. In the 300,000-yuan range, both the Tengshi D9 and Toyota's Sienna and Granvia pose direct competition to the GL8. The Avenir version and Century, on the other hand, face competition from high-end new forces like Xpeng X9, Lantu Dreamer, Ideal MEGA, and Zeekr 009. As an isolated king, Buick GL8 is quickly being pulled down by various forces.

Where is the real problem?

"Business is indeed not good. Daily reception tasks have declined significantly, and the company fleet even wants to downsize," said Chen, a driver who serves a transportation company with Buick GL8s, when asked by the author.

Many believe that this may be a direct cause of the decline in Buick GL8 sales. Perhaps, as Chen and many others perceive the unfavorable environment for MPVs, MPVs, as an essential part of both household and commercial use, have always been a barometer of the economy. Low-end MPVs transport goods, while high-end MPVs transport people, both of which are symbols of economic prosperity.

In the past few years, low-end MPVs have generally been on the decline. On the one hand, entry-level MPVs used for cargo transportation have been replaced by new energy microvans with lower operating costs. On the other hand, the boom in the mid-to-large SUV market has directly replaced some of the market demand for entry-level MPVs, causing the MPV market to shrink continuously.

Fortunately, in the mid-to-high-end MPV segment, the trend of consumption upgrades has created market opportunities for these vehicles, becoming the most solid support for the MPV market.

In addition, more and more automakers have realized that while commercial MPVs are the biggest driver of MPV consumption, the limited market space and the commercial MPV travel sector dominated by Buick GL8 necessitate finding a new path to create new breakthroughs, such as targeting household use or establishing different experience standards from GL8.

The ultimate experience brought about by new energy electrification and intelligence is a good solution. From the hybrid version of Tengshi D9 to the hybrids of Sienna and Trumpchi M8, a very obvious phenomenon and perception is that the addition of hybrids has reduced daily fuel consumption and travel costs, which are highly valued by consumers, whether for household or commercial use. This is also why as long as a hybrid MPV is price-competitive, its sales are generally good.

On the other hand, mid-to-high-end MPVs with electrification and intelligence have seen a fundamental improvement in the experience. For example, when parking and resting, one can enjoy a more comfortable in-car experience without starting the engine. Another example is the quietness during low-speed driving, which traditional fuel-powered MPVs cannot provide.

Regarding the upgrade in experience, Chen once told the author that the reception fleet in their company mostly used low-end Buick GL8s, and then spent 10,000 to 20,000 yuan to modify the interior and seats to improve quality and texture. This is the most cost-effective approach for commercial operations. "The commercial vehicle modification industry is a very complete industrial chain, and Buick GL8 has the largest market share in it."

However, for later OEMs, why can't they provide factory-configured MPVs with an experience that surpasses customized ones? Therefore, today's mid-to-high-end MPVs offer a full range of in-car comfort and atmosphere, eliminating the need for consumers to customize and upgrade their vehicles. Coupled with the convenience brought by factory configurations, more consumers or transportation companies prefer the latest products.

Of course, the concern about the prospects of mid-to-high-end MPVs is not unique to Buick GL8. On the one hand, as a relatively niche market, the MPV segment is already highly competitive, facing not only erosion from other MPV products but also competition from medium-to-large SUVs like WJ and Ideal.

Although belonging to different market segments, more medium-to-large SUVs, with their better space performance and ride comfort, are gradually eroding the user base of high-end MPVs. Vehicles like Ideal L9 and WJ M9, with prices in the 400,000 to 500,000 yuan range and monthly sales exceeding 10,000 units, continue to set sales records in this price segment, providing direct evidence. After all, Chinese consumers prefer SUVs to MPVs.

On the other hand, there are limitations to pure electric MPVs, especially those represented by Geely Holding, which has deployed three high-end MPV products in the 300,000 to 800,000 yuan range, from Volvo EM90 to Zeekr 009 to LEVC L380. However, the pure electric positioning limits many business travel scenarios. Pure electric MPVs struggle with tasks like urgent 800-kilometer deliveries, deterring many families who want to travel long distances.

So, even though pure electric is the future direction, pure electric MPVs cannot achieve the same breakthroughs as hybrid MPVs in the short term. This is a costly lesson learned by pure electric MPVs like Tengshi D9, Ideal MEGA, Zeekr 009, and Volvo EM90.

To answer the topic discussed in this article, have MPVs really crashed? In the current economic environment, against the backdrop of cyclical and competitive changes, at least Buick GL8 has temporarily crashed, and pure electric MPVs have also crashed. The real opportunities in the MPV market are left to players with a clear understanding of the MPV market.