Who leads the list of the most profitable car brands per unit?

![]() 09/23 2024

09/23 2024

![]() 470

470

Introduction | Lead

In the first half of this year, which automaker made the most money per car sold? Although domestic auto brands are thriving in the domestic market, their profits per unit generally lag behind international brands that operate globally.

Produced by | Heyan Yueche Studio

Written by | Zhang Dachuan

Edited by | Heyan

Total words: 2966

Reading time: 4 minutes

This year, the domestic automotive market has been engulfed in a price war. While we pay attention to automakers' sales figures, we seem to overlook their net profits, especially profits per unit. Compared to sales volume and net profit, profit per unit is an even more crucial indicator worth monitoring.

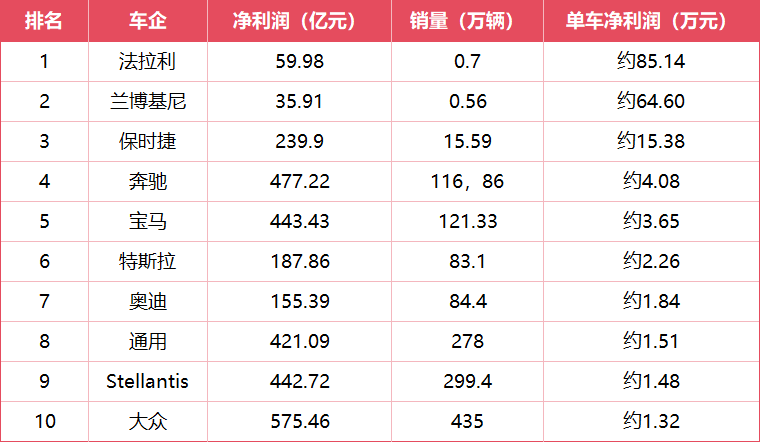

Among 28 automotive brands, Ferrari stands out as the clear leader, boasting a staggering profit per unit of 851,400 yuan, leaving a significant gap behind other automakers. Additionally, ultra-luxury brands like Lamborghini and Porsche continue to demonstrate strong profitability. These brands achieve such high profits per unit not only due to their technological prowess but also because consumers are willing to pay a premium for their brand.

△Ferrari leads the pack in profit per unit

Tesla's profit per unit surpasses Audi's

Another noteworthy point from the table is that Tesla's profit per unit has surpassed Audi's. While Tesla still lags behind Mercedes-Benz and BMW, it has managed to outpace Audi, one of the Big Three luxury brands.

In the first half of this year, global demand for electric vehicles significantly weakened, prompting automakers to shift focus to plug-in hybrid technology. To stabilize sales, Tesla had to resort to price cuts and announced its entry into the Robotaxi market. Given Tesla's profitability concerns, its long-awaited $25,000 electric car has yet to materialize. For Tesla to overtake BMW and Mercedes-Benz, a rapid increase in Cybertruck sales would be crucial. Otherwise, not only will it struggle to surpass BMW, but Audi could easily catch up from behind.

△It's not easy for Tesla to surpass BMW and Mercedes-Benz in profit per unit

For Audi, the gap in profit per unit with General Motors (GM) behind it is narrow. Considering GM's significantly higher sales volume and its losses in the domestic market in the first half of the year, GM's performance is still commendable. With a strong presence in the North American market, GM has a good chance of competing with Audi in terms of profit per unit if it can address its challenges in the Chinese market. For Audi, the question of how to continue growing, or even if it can continue to grow, will be a crucial consideration for Volkswagen Group's management.

△GM, trailing Audi, remains a formidable competitor

Which domestic auto brand has the highest profit per unit?

Compared to multinational automakers, Chinese auto brands lag behind in terms of profit per unit. Among domestic automakers, Great Wall Motors and Geely Auto stand out. Despite significant sales growth, BYD has not demonstrated a similar level of profitability per unit.

Great Wall Motors, which trails BYD, Geely, and Changan in sales, has regained confidence in its unit profitability. Strong demand for its off-road vehicles and pickup trucks, combined with limited competition, has contributed to its profitability. While Great Wall Motors has been less active in the electric vehicle sector, this has actually benefited its overall profitability. Going forward, the Hi4-based plug-in hybrid system will be a new driver of sales and profit growth for the company.

△The Tank brand has contributed significantly to Great Wall Motors' profits

Geely Auto also performs impressively. Surpassing Renault Group in profit per unit is a milestone achievement for Geely, fueled by brand premiums generated by Lynk & Co. and Geely's Geely New Energy brand, which have distinguished themselves from other domestic auto brands through collaborations with overseas partners like Volvo. For Geely, catching up with BYD in sales and leveraging Volvo's support to achieve a global footprint, creating a Chinese automotive "Volkswagen Group," is a crucial goal for Li Shufu.

△Lynk & Co. has emerged as a successful case study for domestic brands aspiring to ascend and expand overseas

BYD, which leads in sales, surprisingly lags behind Geely in profit per unit. Despite the unshakeable position of its Dynasty and Ocean series in the domestic market, BYD has yet to achieve top profitability per unit. While BYD has regained Denza and launched premium sub-brands Fangchengbao and Yangwang, only Denza D9 has made a significant sales impact. While BYD has built a formidable moat in terms of new energy vehicle costs, it still needs to "charge up" its three premium brands to boost profit per unit.

△Compared to the Tank brand, Fangchengbao lags behind in sales and appeal

Losses among new energy vehicle startups are not sustainable in the long run

For most domestic new energy vehicle startups, losses per unit remain prevalent. Among them, NIO and Lixiang are among the few that have achieved profitability.

However, Lixiang's profits in the first half of the year mainly came from financial investments. With nearly 100 billion yuan in cash reserves, Lixiang can generate substantial returns through financial products and investments. Despite stabilizing sales with the L6, this has led to a decline in profit per unit and gross margin. The success of multiple electric vehicle launches in the first half of next year will be crucial for Lixiang to achieve further sales growth. As for Seres, its breakthrough is attributed to Huawei's full support. Facing fierce domestic competition, Seres has little choice but to fully embrace Huawei's decisions.

△The Lixiang L6 has become the "anchor" stabilizing Lixiang's sales in the first half of the year

Apart from Lixiang and Seres, most other new energy vehicle startups are still mired in losses. Among them, Zeekr's situation may be better. According to the company, it achieved profitability in the second quarter and is expected to reach overall profitability for the full year as sales increase. Xpeng Motors, previously the sales champion among startups, has regained some of its former glory with the MONA series' first model, the M03. However, the popularity of the M03 is likely to put pressure on NIO and Leapmotor, which also target the entry-level electric vehicle market. Competition in this segment will continue to intensify.

△Xpeng Motors finds a way forward with the MONA series' first model, the M03

Among the 28 automotive brands, NIO incurs the highest losses per unit. With losses of approximately 118,800 yuan per unit, this poses a significant challenge for any automaker. Nonetheless, NIO's monthly sales have stabilized at over 20,000 units, and its gross margin per unit has turned positive. The significant losses are primarily due to heavy investments in battery swap stations and R&D, with quarterly R&D expenditures reaching around 3 billion yuan. While NIO needs to continue investing heavily in its battery swap network in the short term, a successful battery swap business model could yield substantial returns if recognized by users and eventually lead to an IPO. However, NIO's continued losses will test its CEO Li Bin's fundraising abilities, especially amid domestic demand constraints.

△How much can the launch of Letao L60 contribute to NIO's gross margin per unit improvement?

Commentary

In the long run, any business is established with the goal of profitability. If a company consistently incurs losses, investors lose the incentive to fund it, preferring instead to deposit money in the bank for interest. Even if investors tolerate short-term losses, they do so with the expectation of long-term profitability. Domestic automakers that focus solely on the domestic market at the expense of sustainability risk not only hindering their own growth but also facing high tax barriers when expanding overseas. High-quality sustainable development is crucial for every automaker in the current domestic automotive market landscape.

(This article is originally created by Heyan Yueche and may not be reproduced without authorization)