BYD leads the National Day holiday period but is trapped in a premium maze

![]() 10/09 2024

10/09 2024

![]() 632

632

Confidence boosted, the automotive market is also heating up.

This National Day holiday, various new energy vehicle brands enjoyed a fruitful period, with NIO, XPeng, and ZEEKR, among others, achieving their best sales results in September.

Leading the pack, BYD comfortably held onto the top sales position, surpassing the 400,000 monthly sales milestone and emerging as the biggest winner with its overwhelming performance. However, upon closer inspection, there are still underlying concerns beneath this apparent prosperity.

Brands are vying for market share by offering lower prices, targeting the lower-end market for sales. For instance, the price range of XPeng MONA M03 directly competes with BYD's popular models. Moreover, as the new energy vehicle market enters its second half, BYD's efforts to improve its intelligence capabilities will not be accomplished overnight, and the path to premium status remains long and arduous.

With just one quarter left in 2024, BYD is fully committed to breaking into the premium segment, while its competitors vigorously expand their markets. The market eagerly awaits to see if the future landscape will change.

Low prices, high competition for market share

The positive impact of policy-driven A-share gains has boosted confidence, invigorating the automotive market, with brands reporting strong sales during the National Day holiday.

According to various sales reports, during the National Day holiday, Lixiang received over 20,000 new bookings; Hongmeng Zhixing surpassed 28,600 bookings across its entire lineup; XPeng secured 16,000 new orders; ZEEKR received over 10,000 bookings; Xiaomi SU7 locked in over 6,000 orders; Zero Run received over 17,000 bookings during the holiday, with 3,576 new orders on October 7 alone, breaking a single-day record...

Signs of this robust momentum emerged even before the National Day holiday, in September.

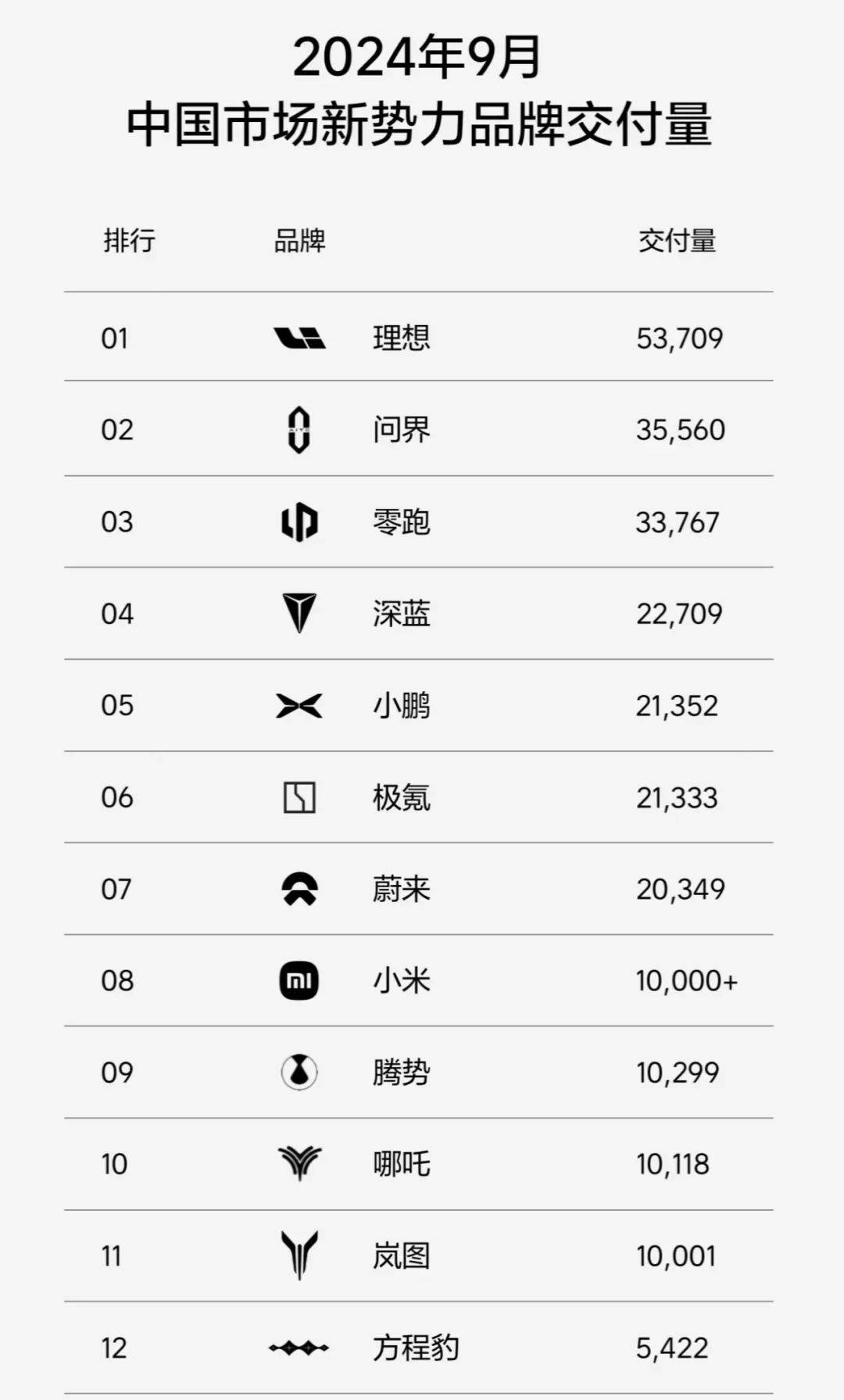

According to Tianyancha APP, Lixiang Auto delivered over 50,000 vehicles per month, leading the new energy vehicle market with 53,709 deliveries. Wenjie and Zero Run maintained deliveries around 30,000 units, while XPeng experienced rapid growth, joining ZEEKR and NIO in the 20,000-unit bracket. The star performer was undoubtedly BYD, which delivered 417,600 vehicles in September alone and received over 160,000 new bookings during the National Day holiday.

Leveraging its unbeatable cost-effectiveness, diverse product line, and technologies like DM-i Super Hybrid, BYD has long maintained a dominant position in the market.

Since surpassing Tesla in sales in the fourth quarter of 2023, BYD has firmly established itself as the world's leading new energy vehicle manufacturer. In the first half of this year, BYD's market share in the new energy vehicle segment increased to 32.6%, a year-on-year growth of 28%, continuing to outpace Tesla.

It would be hard to believe that competitors are not coveting BYD's position. In fact, numerous automakers, including NIO, XPeng, and Lixiang, are engaging in price wars to further increase sales.

After the setback of the MEGA launch, Lixiang introduced the Lixiang L6, priced in the 200,000+ yuan range. While not the absolute lowest price point, it offers exceptional product capabilities and a relatively high cost-effectiveness, becoming Lixiang's best-selling model and helping the company reverse its declining fortunes.

NIO and XPeng launched their own "king of price wars" models—the Letao L60 and XPeng MONA M03, respectively. The former has a starting price of 206,900 yuan, which drops to 149,900 yuan with the BAAS plan, and has reportedly received an overwhelming response. The latter, with a starting price of 119,800 yuan, contributed to XPeng's monthly deliveries exceeding 20,000 units.

Clearly, the straightforward strategy of offering low prices has had an immediate and significant impact on sales.

At the recent China Electric Vehicle 100 People Forum, BYD Chairman Wang Chuanfu stated, "The industry has entered a brutal elimination stage." The inevitable increase in industrial concentration, coupled with cyclical adjustments in the industry, necessitates that enterprises quickly establish scale effects and brand advantages.

Newcomers like NIO, XPeng, and Lixiang have made boosting sales a top priority, engaging in price wars to seize market share.

On September 28, Cui Dongshu, Secretary-General of the China Passenger Car Association, predicted at the World New Energy Vehicle Congress that domestic auto retail sales would reach 22.3 million units this year, a year-on-year increase of 3%. Among them, retail sales of domestic new energy passenger vehicles are expected to reach 10.4 million units, a year-on-year increase of 34%.

While BYD may initiate a price war, it cannot dictate its end. Whether BYD will ultimately benefit from this long-term process remains to be seen.

The challenge of ascending to the premium segment

Ascending from the bottom up is undoubtedly more difficult than descending from the top down.

Xiaomi's initial success with a cost-effective strategy has not shaken off the stereotype of being a "low-end" brand, and its attempts to move upmarket have been met with challenges. Similarly, when BYD first ventured into the automotive industry, the mainstream view was that its first car would not repeat the cost-effectiveness strategy. The subsequent launch of the Xiaomi SU7 coupe, positioning itself as mid-to-high-end, was indeed an instant hit.

In the automotive industry, BYD has been a victim of its cost-effective strategy. While it has achieved remarkable sales success through a combination of hybrids and cost-effectiveness, it has struggled to shed the "low-end" label, even with its premium brand Yangwang, which offers vehicles priced in the millions.

The transition from low-end to high-end seems to be hindered by an invisible barrier, as evidenced by BYD's sales structure.

Out of the record-high 410,000 vehicles delivered in September, the "Dynasty Network + Ocean Network" accounted for 96% of sales, while Fangchengbao sold 5,422 vehicles, Denza sold 10,299, and Yangwang sold just 310. Together, these three premium brands accounted for just 3.8% of total sales.

△Source: BYD Official Weibo

In the domestic premium vehicle market above 300,000 yuan, joint ventures and Tesla dominate, while in the new energy vehicle sector, the mid-to-high-end hybrid market is currently controlled by Lixiang and Wenjie. BYD is eager to break this deadlock.

Yangwang, with its unique features like in-place turns and water-wading capabilities, made its debut in the domestic million-yuan "no-man's land." While it does not carry the burden of high sales volumes, as a mass-produced vehicle, its sales have declined from 1,090 units in March to just 310 in September. Establishing a premium brand image will undoubtedly be a long and arduous journey.

Another ace up BYD's sleeve, Denza, is also struggling. Positioned in the premium segment between 300,000 and 500,000 yuan, it currently offers the D9, N7, N8, and Z9GT models. In September, Denza sold 10,299 vehicles, with the flagship D9 model accounting for 8,122 units, the N7 selling 1,005 units, and the Z9GT (with a sales cycle of less than a month) selling 1,172 units. The N8, however, has been largely forgotten by the market.

The recently launched Denza Z9GT, which had the potential to turn things around, got off to a rocky start with controversy over optional configurations. Fortunately, the manufacturer promptly addressed the issue, averting a crisis. During the National Day holiday, BYD teased the upcoming Denza N9, with Zhao Changjiang claiming it would be an SUV that competitors could not catch up with in five years. Facing competition from models like the Wenjie M9, it remains to be seen if Denza can regain some lost ground.

Before the National Day holiday, news broke that Mercedes-Benz, which previously held a 10% stake in Denza, had completely exited the joint venture. Denza is now a fully owned subsidiary of BYD. While Mercedes did not contribute significantly to Denza's sales, the end of their 14-year partnership suggests a lack of confidence in Denza's future prospects.

Fangchengbao, with its hardcore off-road focus, is also under pressure.

Earlier this year, the Leopard 5 sold over 5,000 units for two consecutive months but then saw a sharp decline to around 2,000-3,000 units per month, dropping below 2,000 in July. After a direct price cut of 50,000 yuan at the end of July, sales rebounded to around 5,000 units that month.

This indicates that the Leopard 5 has struggled to compete with the Great Wall Tank series. Even more detrimental, this price-for-volume strategy has left early adopters feeling betrayed, harming user sentiment and Overdrawn territory damaging the premium brand image. The upcoming launch of the Leopard 8 will likely require internal repositioning.

BYD's journey to premium status remains long and arduous.

Addressing intelligence shortcomings

Achieving premium status is not an overnight process. Along the way, it is crucial to consolidate strengths and address weaknesses.

BYD's numerous best-selling models have generated significant scale effects and cost advantages that competitors can only dream of.

This year, the Qin L and Seal 06, along with the second-generation Song Pro DM-i and Hai Shi 05 DM-i, offer highly consistent configurations, ensuring component commonality and powered by the all-new fifth-generation DM system, launching a fierce attack on fuel efficiency in the market. Furthermore, these sibling models in BYD's two sales networks cater to both home comfort and sporty styles, covering a broader range of market demands.

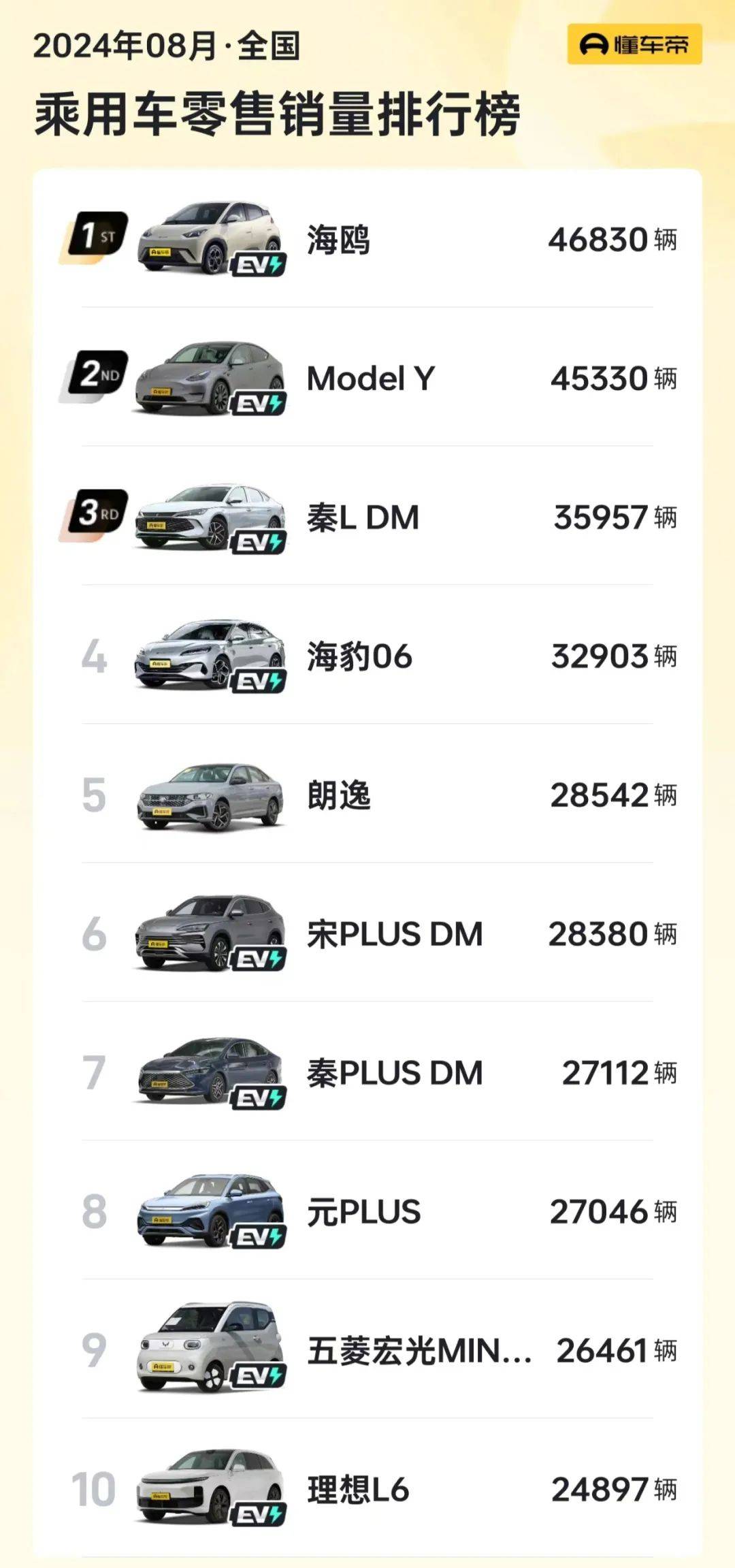

Li Yunfei, General Manager of BYD Public Relations, stated during a live broadcast, "Due to an overwhelming number of orders for the Qin L and Seal 06, we have temporarily chosen not to disclose sales figures to avoid causing industry turmoil.""According to Autohome data, in August 2024, BYD occupied six spots on the retail sales list. The top spot went to BYD's compact car Haiou (46,830 units), followed by Tesla's Model Y (45,330 units). The Qin L (35,957 units) and Seal 06 (32,903 units) ranked third and fourth, respectively, while the Song PLUS DM (28,380 units), Qin PLUS DM (27,112 units), and Yuan PLUS (27,046 units) took spots six through eight.

△Source: Autohome

Where to find the next wave of growth? For domestic brands, breaking into overseas markets is challenging due to various barriers. The best strategy is to capture market share from joint ventures and penetrate their stronghold in the luxury segment, thereby securing higher profits.

This year, once-prestigious BBA brands have resorted to price cuts to maintain sales in the domestic market, with BMW, once dismissive of price wars, reportedly returning to this strategy out of necessity. This presents an opportune moment for domestic brands to rise.

The industry consensus is that intelligence is the next frontier for new energy vehicles and a crucial weapon in the march towards the premium segment.

At the same time, this poses a formidable challenge for BYD, which has historically lacked standout autonomous driving technology. In the past, it would have seemed disrespectful to the market for a company with an average vehicle price below 150,000 yuan to invest heavily in autonomous driving technology. However, XPeng MONA M03 has now brought the price of autonomous driving within reach at 150,000 yuan, and facing competition from Tesla, BYD's lack of intelligence is a significant disadvantage.

Nonetheless, enhancing intelligence capabilities is imperative.

Yang Dongsheng, the head of BYD's autonomous driving division, stated in an interview that the company aims to equip mid-range and mass-market models with high-level autonomous driving capabilities within two years. "We will develop in-house capabilities and collaborate with suppliers. Whoever performs better, we will use their solutions," he said."Since 2021, BYD has invested in Horizon Robotics to enter the autonomous driving chip market and established a joint venture with Momenta, Dipai Zhixing, to develop in-house autonomous driving algorithms and delve deeper into underlying technologies. However, catching up with competitors in market outcomes will take time."Furthermore, BYD is striving to address its intelligence shortcomings in mid-to-high-end models. The upcoming Fangchengbao 8 will offer a version developed in collaboration with Huawei for autonomous driving. While this is largely a concession to market demands, ultimately, BYD will need to rely on in-house research and development to truly master the "soul" of intelligence and extend high-level autonomous driving capabilities to more models.

Even in times of prosperity, there are hidden concerns. As BYD continues to ride the wave of strong sales, it must also focus on addressing its shortcomings to secure its position at the top for the long haul.