Xiaomi sells 6,000 vehicles! Automakers rush to share National Day sales reports, who really won big?

![]() 10/09 2024

10/09 2024

![]() 494

494

Weekly sales exceed monthly sales.

In the days leading up to the National Day holiday, many automakers quickly announced their September sales figures, which were generally positive. Among them, BYD surpassed the 400,000 sales mark for the first time, and new players like Li Auto, Xpeng, Zeekr, and NIO showed significant growth in deliveries, with many breaking monthly sales records.

After all, it's the 'golden September and silver October', and rising sales are naturally the main theme of the automotive market's peak season. It is noteworthy that due to the excellent sales figures, many automakers gradually disclosed their sales data or order volumes during the National Day holiday, seemingly impatient to wait until early November to announce them.

From a macro perspective, the implementation of the 'trade-in' subsidy policy, the holding of promotional auto shows in various regions, and the trend of self-driving tours are the main reasons for the increase in auto sales during the National Day holiday. According to data released by the State Administration of Taxation, new car sales during the National Day holiday increased by 11.7% year-on-year, with new energy vehicle sales growing by 45.8% and the motor vehicle charging industry continuing to show strong growth, with sales revenue increasing by 29% year-on-year.

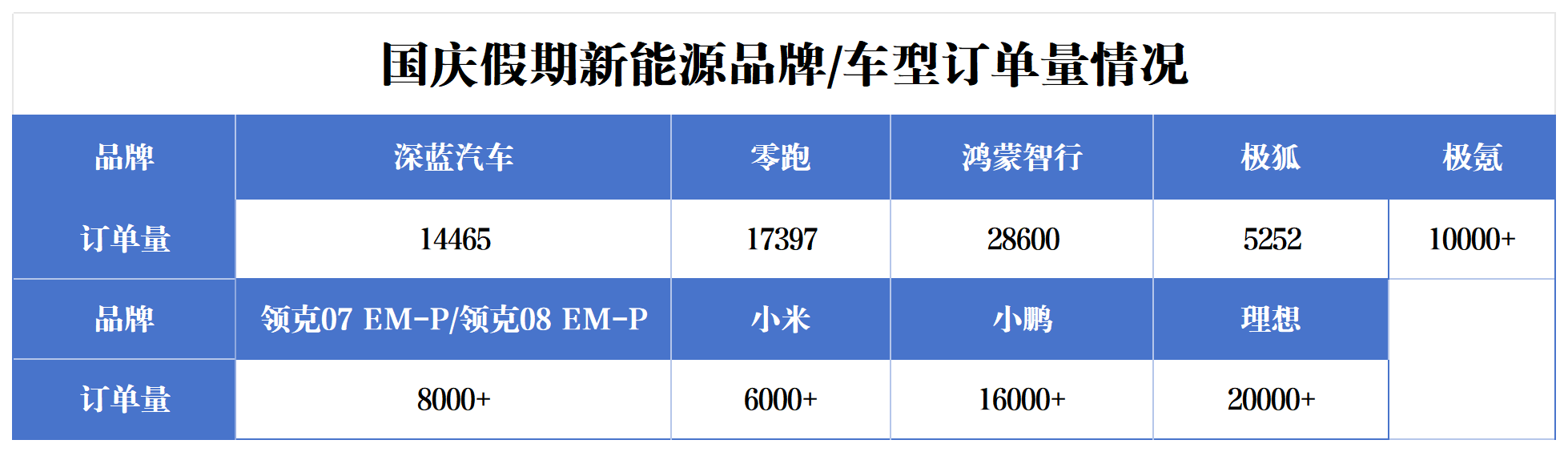

So, how many orders did each automaker receive during the National Day holiday? Let's take a look at the following table.

It is not difficult to see that new players like Hongmeng Zhixing, Li Auto, NIO, and others that are popular in the new energy sector, as well as traditional automakers' new energy brands like Shenlan, Lynk & Co EM-P family, ARCFOX, and Zeekr, all achieved impressive order volumes during the National Day holiday. Notably, Xiaomi Automobile, which currently only has one product, the Xiaomi SU7, and has been on the market for most of the year, still maintains a high level of market heat.

It's only been a week into October, and these automakers have already achieved sales figures close to that of an entire month. It is foreseeable that October's sales data will continue the growth momentum of September. However, aside from the aforementioned macro factors, what are the secret weapons that automakers use to attract customers to place orders?

Killer Deals: Limited-time Benefits + Aggressive New Car Launches

Taking advantage of the 'trade-in' policy and local discounts offered by promotional auto shows, automakers also offer certain discounts or limited-time benefits to attract consumers.

Let's start with Hongmeng Zhixing, which has the highest number of orders. Its approach to stimulating sales is simple: offering limited-time benefits. Data shows that the large order volumes for Hongmeng Zhixing's Zhide R7, Wenjie M9, and Wenjie M7 exceeded 6,300, 5,100, and 5,700 vehicles, respectively. During the holiday, customers who ordered any Hongmeng Zhixing model received a portable charging and discharging kit worth 1,800 yuan, as well as additional gifts like electric sunshades, electric footrests, storage boxes, etc., depending on the model. In total, customers could save tens of thousands of yuan.

Xpeng Motors offered limited-time deals like '0 down payment + 0% interest for 2 years' and a '5,000 yuan option fund', which effectively stimulated sales growth. Converting 16,000 orders into sales is already on par with Xpeng's sales level from the previous one and a half months. As a new player focused on cost-effectiveness, NIO continued its September car purchase incentives in October, offering customers comprehensive benefits of up to 40,000 yuan.

Xiaomi Automobile, which currently only sells one model, the Xiaomi SU7, directly offered incentives to stimulate sales in October: customers who placed orders received lifetime free access to its advanced driver assistance system and a complimentary Nappa leather seat. While you may sneer at high-level autonomous driving, automakers' attitudes towards it suggest that significant advancements may soon arrive. For Xiaomi Automobile, which has a strong technological foundation, offering lifetime free access to its advanced driver assistance system is undoubtedly attractive to tech-savvy consumers.

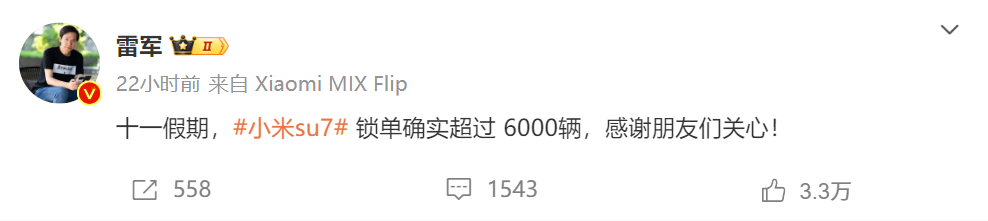

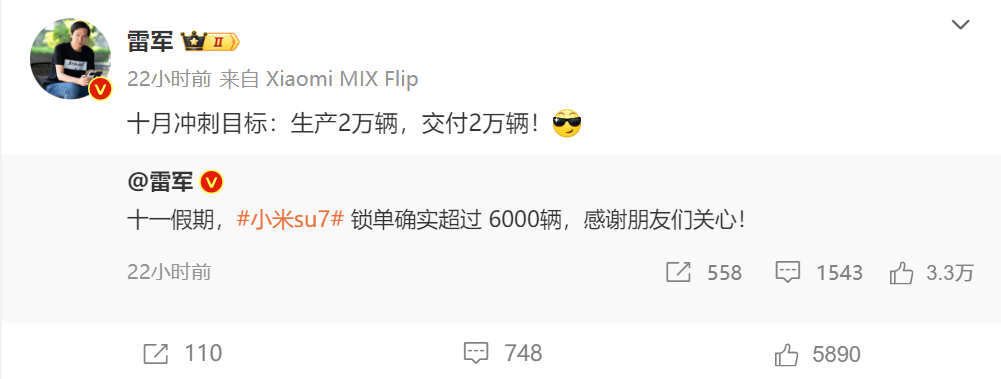

With over 6,000 orders, which is already half of Xiaomi Automobile's monthly sales target, it is clear that such incentives are well-received by consumers.

Turning our attention to new energy brands under traditional automakers, their limited-time subsidies are even more generous. Shenlan Automobile models are eligible for cash subsidies of up to 45,000 yuan, as well as trade-in subsidies and other benefits. IM Motors offers a 'luxury gift pack' worth over 30,000 yuan for its IM L6 model. Geely Geometry and Ora have also announced limited-time subsidies for October.

Cash discounts and benefit incentives naturally lead to impressive sales figures, but to maximize sales during the National Day holiday, the most important step is to drive traffic before the holiday to increase brand exposure as much as possible.

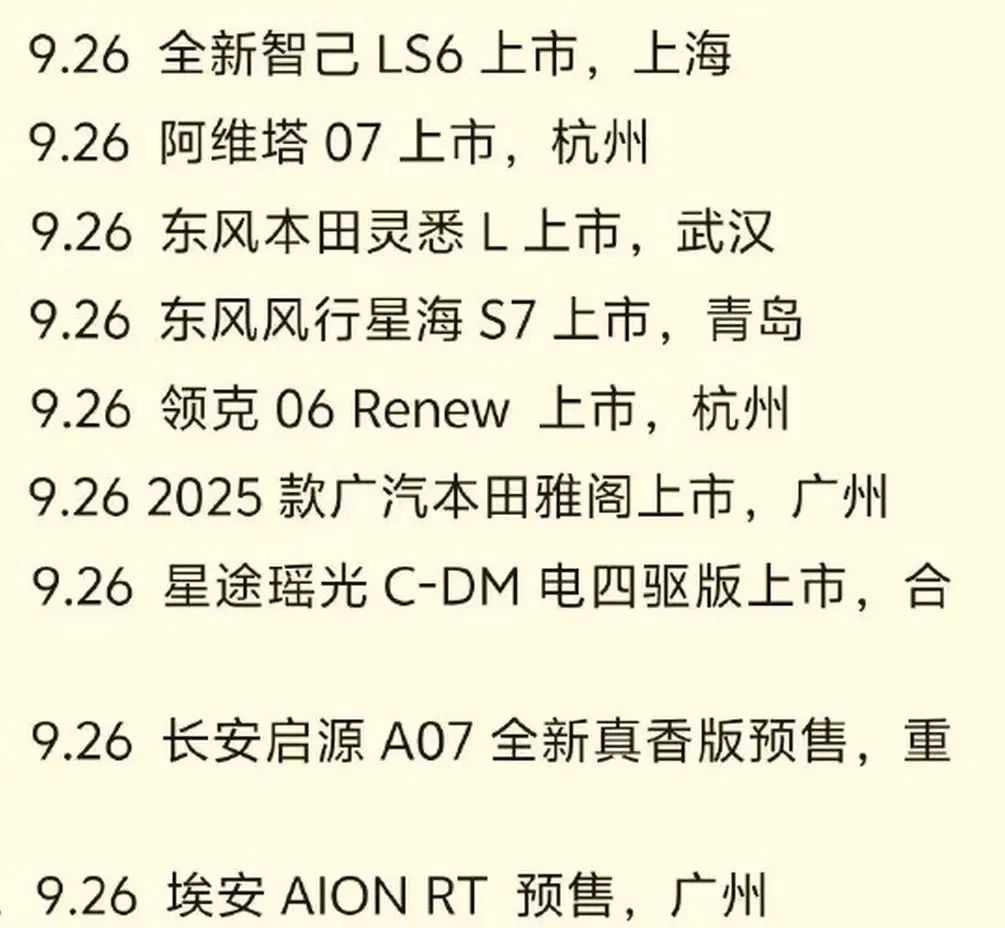

Xiaotong understands that many important new cars were launched, went on sale, or began pre-sales in September, with many of them concentrated in the two weeks leading up to the National Day holiday. Alone on September 26, nine new cars were launched, and automakers generally extended their incentives beyond the holiday.

Taking the newly launched IM LS6 as an example, the automaker offered related limited-time benefits at its launch. Within 48 hours of its launch, it received over 11,000 large orders. On the penultimate day of the incentives (October 7), IM LS6 received over 1,600 large orders in a single day, which is already half of its monthly sales target.

The automotive market is fiercely competitive today, and both new players and mainstream brands face significant revenue pressures. The three months leading up to the Chinese New Year are crucial for automakers to grab more sales. Aggressively launching new cars and offering generous limited-time discounts before holidays has become a standard practice for automakers over the years. Although this scenario repeats itself annually in the automotive market, the tangible incentives are genuinely appealing to potential customers.

Xiaomi Aims for 20,000 Units, While Multiple Automakers Hold Back

So far, most new energy automakers have already unveiled their key products for the year, such as Hongmeng Zhixing, Li Auto, Xiaomi Automobile, ARCFOX, etc. Although NIO plans to unveil its new model, the NIO B10, at the Paris Motor Show, it is unlikely to significantly boost sales of its existing lineup. These brands will rely entirely on their current product portfolios and promotional tactics to boost year-end sales.

It is worth noting that Lei Jun stated that Xiaomi Automobile aims to produce and deliver 20,000 Xiaomi SU7 units in October. For Xiaomi Automobile, sales are not a concern; rather, its monthly production capacity of over 10,000 units is a stumbling block. Many users have privately messaged Xiaotong, stating that they typically start looking for cars shortly before making a purchase. While the Xiaomi SU7 is a worthy choice, delivery times have been pushed back to after next Chinese New Year due to high demand. As a result, some customers who urgently need a car have opted for competitors' models instead.

Undoubtedly, a monthly production of 20,000 units will significantly reduce customer wait times. As a result, Xiaomi SU7's monthly deliveries could surpass those of the Tesla Model 3, potentially enabling Xiaomi Automobile to achieve its annual delivery target of 100,000 vehicles by November. Furthermore, Xiaomi Automobile's upcoming SUV, if priced and positioned competitively, could replicate the success of the Xiaomi SU7's launch, posing a challenge to automotive brands focusing on the SUV market.

There are also rumors that the Xiaomi SU7 Ultra version will be released in the first quarter of next year, with an average selling price of 800,000 yuan. However, this information has not been officially confirmed, and such a high price point is likely to appeal only to car enthusiasts with substantial budgets. To boost sales figures, automakers must focus on mainstream models.

Of course, several brands are holding their aces close to their chests for the year-end push, including Shenlan, Xpeng, and Zeekr. Shenlan Automobile's all-new compact SUV, the Shenlan S05, is set to debut soon. Xpeng will release its new pure electric sedan, the Xpeng P7+, while Zeekr will unveil its new mid-size pure electric model, the Zeekr MIX.

These products primarily target the current mainstream new energy market. Based on available information, each of these products boasts unique features. For instance, the Shenlan S05 is equipped with Huawei-powered megapixel headlights. The Xpeng P7+ adopts a new generation of AI Hawk Eye vision technology, promising impressive autonomous driving capabilities. The Zeekr MIX breaks traditional MPV design conventions, offering users innovative features and functionalities.

Whether it's comprehensive strength or product highlights, these new cars have the potential to become 'dark horses.' However, ultimately, their ability to attract more customers may hinge on pricing. Given the intense competition in the automotive market, these new cars are likely to offer attractive purchase thresholds.

Closing Thoughts

The final quarter of the year is a crucial time for automakers to boost year-end sales. They are likely to offer even more substantial limited-time incentives to attract consumers. Xiaotong's friend purchased a car during the holiday, and the salesperson frequently called to remind them of the current promotional offers, subtly urging them to place an order promptly.

Xiaotong's advice is to keep an eye on the expiration dates of limited-time incentives, shop around, and complete your order before the deadline. Don't let salespeople's pressure tactics sway you easily.

In this environment, automotive sales in the final quarter of the year are undoubtedly poised for further growth, especially in the new energy market. With technological advancements, a flurry of new product launches, and policy support, consumers' acceptance of new energy products is on the rise.

It is worth noting that multiple automakers have announced plans to widely roll out high-level autonomous driving systems in urban areas this year, signaling intensified competition in the mid-to-high-end new energy vehicle market. In the final quarter of this year, the new energy vehicle market may witness new technological iterations, with high-level autonomous driving potentially becoming a standard feature in future new energy vehicles.

Source: Leitech