The next battleground for auto companies: computing power?

![]() 10/21 2024

10/21 2024

![]() 618

618

Tesla's computing power surpasses the combined total of domestic auto companies. How can domestic auto companies win in the second half of the smart car race?

On October 11, Beijing time, Tesla will hold its "WE, ROBOT" event in California, USA, where it will unveil new products and technologies, including Robotaxi. Tesla CEO Elon Musk calls it "a day that will go down in history."

Image source: Tesla

Tesla is increasingly resembling an AI company. And this event will push the transformation of smart cars into deeper waters.

"In the AI era, what the auto industry lacks most is the infrastructure for intelligent computing, not production capacity," said Zhang Yongwei, Vice Chairman and Secretary-General of the China Electric Vehicle Hundred People Forum, at the Global Intelligent Vehicle Industry Conference (GIV2024) held in Hefei recently. Tesla's computing power stands at 100 EFLOPS (EFLOPS refers to exaFLOPS, or quintillions of floating-point operations per second), equivalent to the combined computing power of all domestic auto companies.

The wave of intelligent transformation in the auto industry has arisen before electrification is complete. "In the era of intelligence, the competitive landscape in the auto industry has undergone new changes. China has taken the lead in initiating market-end reforms, while the US holds absolute development advantages in chips and software on the technology side," said Zhang Yongwei.

However, the intelligent transformation will bring tangible benefits to consumers – allowing them to purchase better-performing vehicles at cheaper prices. Cao Xudong, CEO of MOMENTA, told China Newsweek, "The development of high-level autonomous driving follows Moore's Law and will rapidly gain popularity. Specifically, under the influence of Moore's Law for hardware, the bill of materials (BOM) for high-level autonomous driving hardware will halve every two years, driving down costs. Meanwhile, the industry average for Moore's Law in software can enhance product experience tenfold every two years."

Competition in 'computing power' is unavoidable

As Tesla's proprietary D1 chip, the Dojo project continues to evolve – this AI supercomputer will serve as the cornerstone of Tesla's AI ambitions and a training ground for Full Self-Driving (FSD). Tesla has previously announced that AI software trained by Dojo will eventually be pushed to Tesla customers via over-the-air updates.

According to related information, Dojo's total computing power is expected to reach 100 EFLOPS by October this year, roughly equivalent to that of 320,500 NVIDIA A100 GPUs. By the end of this year, Dojo1 is projected to achieve online training equivalent to approximately 8,000 H100 chips. At the recent All-In Summit 2024, Musk announced that Tesla's next-generation AI chip, Dojo 2, is scheduled for large-scale deployment by the end of 2025.

Image source: China Electric Vehicle Hundred People Forum

Data shows that domestic auto companies' current computing power is below 10 EFLOPS. By the end of 2024, China Mobile, China Telecom, and China Unicom plan to have computing powers of 17 EFLOPS, 21 EFLOPS, and 15 EFLOPS, respectively, totaling 53 EFLOPS. However, for an "end-to-end" large model, an ideal computing power requirement for a single enterprise can reach up to 100 EFLOPS.

Lang Xianpeng, Vice President of Ideal Auto's Intelligent Driving R&D, previously stated that Ideal Auto's training computing power reached 5.39 EFLOPS and is expected to exceed 8 EFLOPS by the end of 2024, with annual investments in training computing power exceeding RMB 1 billion. Ideal Auto also noted that the computing power required to achieve full autonomous driving should reach 100 EFLOPS, translating to an annual investment exceeding USD 1 billion.

"Substantial investments are required in computing power, and these investments must be sustained. It's essential to build a large-scale team focused on data, computing power, and algorithms," said Zhang Yongwei. Currently, software development around chips is still in its infancy, and domestic computing power is immature, with chips but lacking software. "By enriching software and ecosystems, we can transform immature computing power into mature capabilities and reduce the risk of hardware supply constraints in the future," he added.

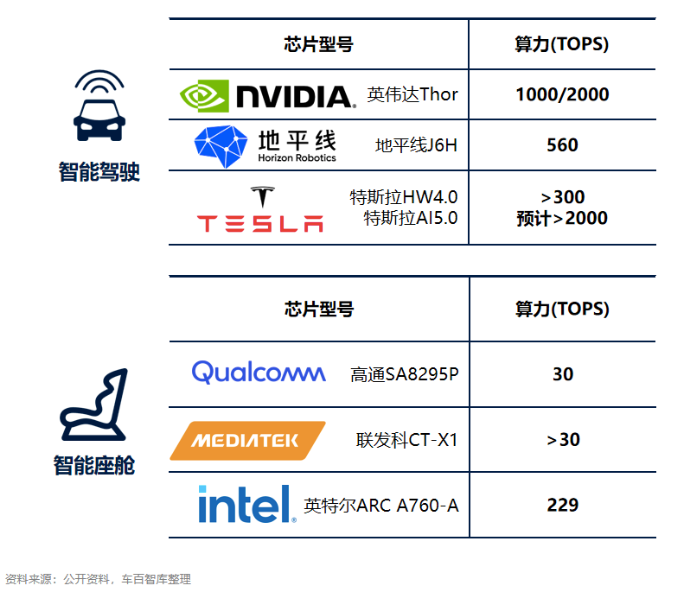

Li Tao, General Manager of Baidu's Smart Cockpit Business Unit, believes that waste of computing power should be avoided in product design. "Many current cockpit designs simply install tablets in cars and migrate mobile apps directly to in-vehicle systems," said Li. According to industry statistics, some vehicles can carry up to 189 apps. "Imagine how difficult it would be to navigate through 189 apps while driving to find the one you need, which also consumes valuable in-vehicle computing power and memory resources," he added.

Costs decline under Moore's Law

How much extra does a high-level autonomous driving-equipped vehicle cost?

A year ago, top-tier autonomous driving models like the AITO M7 and XPeng G6 demonstrated that an advanced autonomous driving system with both hardware and software in place would add an extra RMB 20,000 to 40,000 to the price tag.

However, in the second half of the smart new energy vehicle race, high-level autonomous driving features that were once exclusive to models priced above RMB 300,000 are now appearing on some new energy vehicles priced around RMB 100,000. This trend is likely to become even more pronounced in the future.

Today, the upgrade and intelligence of new energy vehicles are increasingly aligning with Moore's Law in the semiconductor industry. Based on the experience of Gordon Moore, one of Intel's founders: The number of transistors that can fit on a chip doubles every 18 to 24 months, roughly doubling performance every two years while halving the price.

Cao Xudong predicts that by the end of 2025 to early 2026, high-level urban autonomous driving will become standard in vehicles priced above RMB 200,000 or even RMB 150,000.

"Moore's Law for hardware means that the BOM for high-level autonomous driving hardware will halve every two years," said Cao. "A year or two ago, implementing city-level Navigate on Autopilot (NOA) with dual Orin-X lidars could cost over RMB 20,000 for the entire BOM. Now, a single Orin-X lidar system can be implemented for around RMB 10,000." Cao predicts that by the end of 2025 to early 2026, this cost will drop below RMB 5,000.

"The industry average for Moore's Law in software is a tenfold improvement in product experience every two years," said Cao. Leading companies in the industry may progress even faster, achieving a tenfold improvement annually. "MOMENTA has improved more than tenfold since the second half of last year, and we aim for more than tenfold improvement by this time next year. We can expect at least a hundredfold improvement over two years," he added.

In other words, smart cars of the future will undoubtedly become more affordable and offer better experiences.

How to embrace the AI era?

The integration of artificial intelligence, particularly with its hallmarks of high computing power, big data, and large models, superimposes new AI-driven intelligence onto emerging smart cars.

"The auto industry's change cycle is getting shorter and even exhibiting characteristics of superimposed change: the previous transformation has yet to be completed, but a new one is already underway. This superimposed development has become the new normal for the auto industry's evolution. The latest driving force behind this century-old industry is artificial intelligence," said Zhang Yongwei. Facing the arrival of the AI era, how should the industry adapt to these new changes and make adjustments? Zhang Yongwei mentioned that the first step is to focus on the value of AI technology and data to create new competitiveness. "We must change the current situation where auto companies lack sufficient data mining capabilities and underutilize data value. We need to turn data into assets that generate value," he said. Meanwhile, Zhang noted, "Currently, it's difficult for us to achieve the vast amount of data that Tesla has in terms of training software and systems. Relying solely on data from a single auto company is insufficient for us."

"Just as Android faced challenges from Apple in the past, we are now facing challenges from Tesla," said Liu Li, CTO of Digital China's Automotive Business Group, to China Newsweek.

"Everyone is now studying domain controllers, while Tesla has already moved towards central computing. Although Tesla will open-source its previous-generation technology, it will be very difficult for us to merely replicate their previous-generation products or catch up with them," said Liu. In his view, cooperation with auto companies is crucial. "This is not only for technology implementation but also to jointly drive industry progress. Through cooperation, we can complement each other's strengths and jointly develop innovative products that can compete with Tesla."","Our entire company is already using AI code tools to generate code, improving production efficiency by 30%. The best application scenario for artificial intelligence is, in fact, the smart electric vehicle industry," said Li Bin, Chairman of NIO. A successful smart electric vehicle company must possess AI R&D and operational capabilities; a successful smart electric vehicle company is also a successful AI company.