Does the joint venture electric vehicle have a future?

![]() 10/22 2024

10/22 2024

![]() 578

578

Introduction

In fact, it has always been in their own hands.

The article begins by first sharing two sets of data.

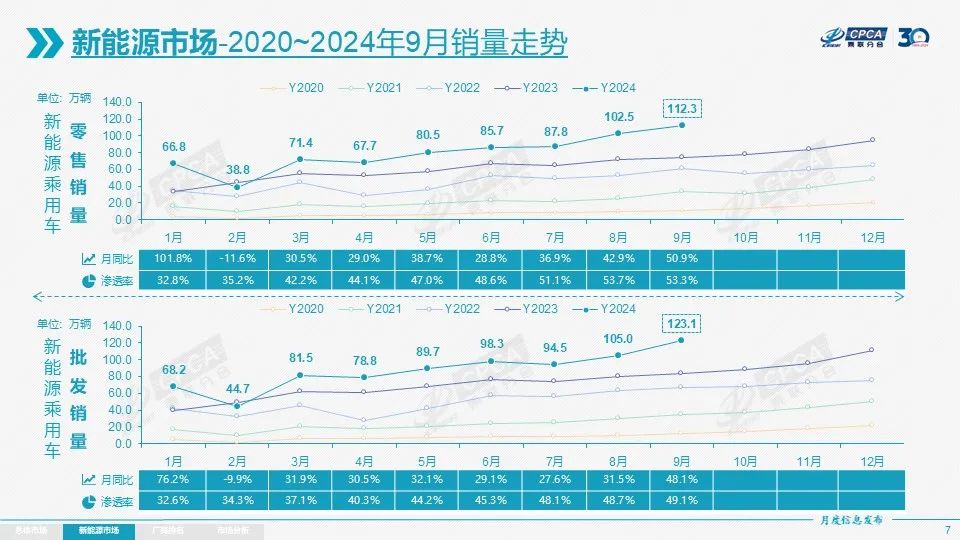

Taking September as an example, referring to the terminal performance released by the China Passenger Car Association (CPCA), the retail penetration rate of new energy vehicles continued to reach a gratifying 53.3%. And since July, it has exceeded the 50% mark for three consecutive months.

At the same time, the retail sales of domestic brands in September reached 1.34 million units, a year-on-year increase of 25% and a month-on-month increase of 11%. Their market share reached 63.5%, an increase of 10.1 percentage points from the same period last year. Further focusing, the retail penetration rate of domestic brand new energy vehicles in September reached an even more astonishing 74.9%.

So, what does this illustrate?

The answer points directly to the frequently mentioned viewpoint, "Whether acknowledged or not, the overall landscape is undergoing tremendous changes. Today, domestic brands are gradually taking over the dominance of the Chinese automotive market from joint ventures. Their proactive electric vehicle products are their most effective weapons."

Precisely based on this background, some voices believe that "by the end of this year, the retail penetration rate of new energy vehicles may approach 60%. Correspondingly, the retail sales share of domestic brands may approach 70%."

Then, I can't help but ask again, what should joint venture brands do if the above-mentioned process really hits the mark? Objectively speaking, the continuous decline in the overall share of joint venture brands has become a foregone conclusion.

Among them, the stronger German and Japanese brands can delay the decline to some extent with their profound foundation. In contrast, traditional American brands (excluding Tesla) and struggling Korean and French brands, due to various reasons, have to face an irreversible cruel outcome.

But I also believe that as time passes, the joint venture brands that remain in the game will form a stable coexistence with domestic brands.

In other words, in the gasoline vehicle segment where they excel, they still have considerable profits; in the new energy vehicle segment firmly controlled by us, they are not without opportunities to share the pie.

The latter part is the focus of this article today.

Price is always the primary factor for hot sales

Does the joint venture electric vehicle have a future?

In fact, the reason for the above thoughts stems partly from genuine feelings after seeing the September terminal performance, and partly from the shocking news that suddenly emerged last week.

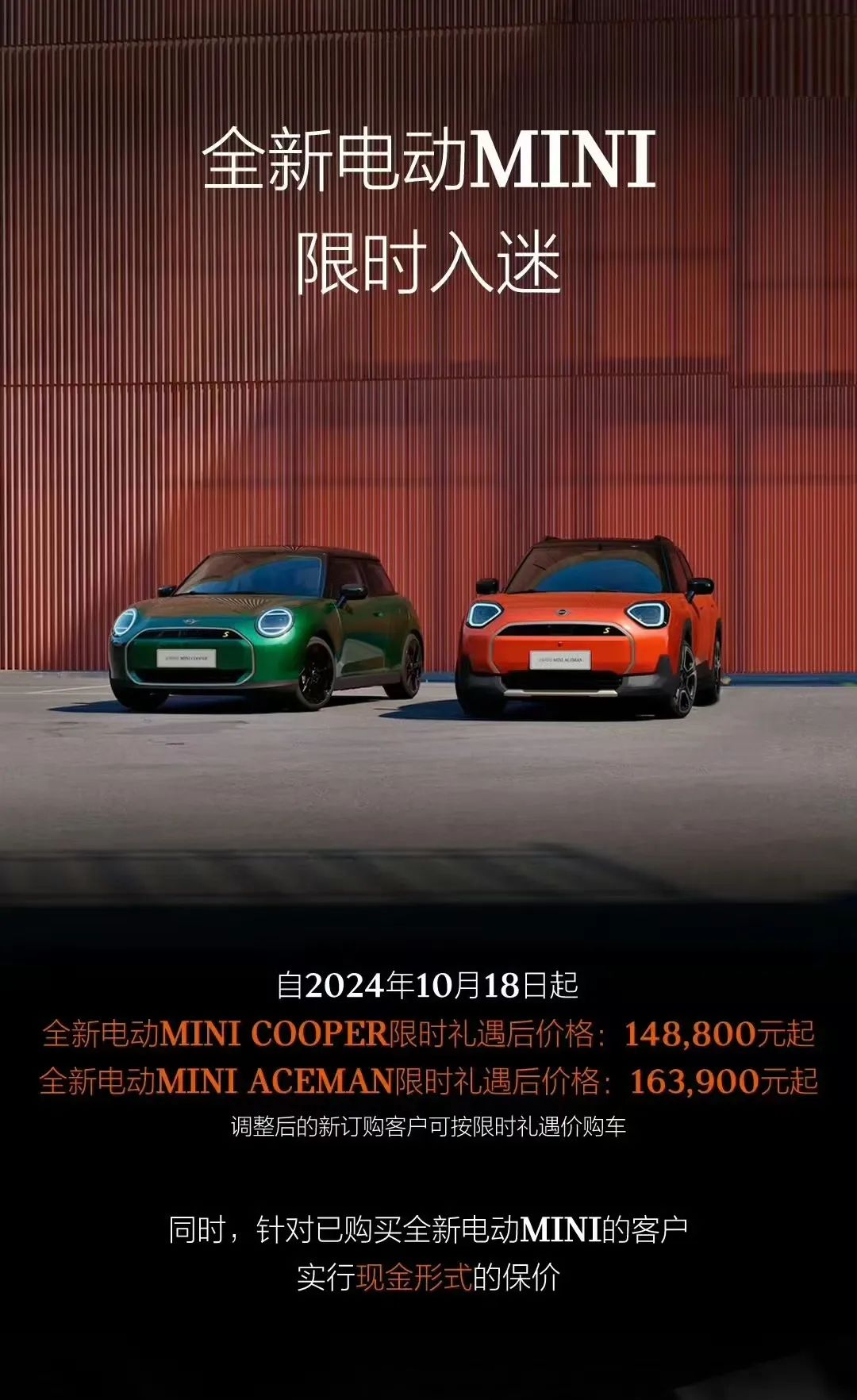

Without any warning, MINI China officially announced on its official website that the price of the new electric MINI COOPER has been adjusted to start at RMB 148,800, a reduction of RMB 41,000 from the launch price of RMB 189,800 in July this year. At the same time, the price of the new electric MINI ACEMAN has been adjusted to start at RMB 163,900, a reduction of RMB 46,000 from the launch price of RMB 209,900 in August this year.

More importantly, MINI China will offer a cash price guarantee to all customers who have previously purchased these two models.

After further investigation, it was learned that MINI China's significant adjustment not only involved the starting prices of the two models but also eliminated their so-called "entry-level" versions. If converted based on the same configuration, the actual price reductions for the new electric MINI COOPER and ACEMAN could be as high as RMB 57,000 to RMB 70,000.

As it turns out, I visited one of the brand's stores in Shanghai over the weekend. After communicating with the salesperson, I learned that "I've never seen such a large customer flow. I closed four deals today alone. Coupled with the current trade-in subsidy policy, the cost-effectiveness is suddenly very prominent."

Soon, I heard from a customer who came to look at the cars, "In the past, it sold for over RMB 200,000, and there were too many options in the same price range. Now, with everything taken into account, it only costs RMB 150,000. I heard they also offer a three-year interest-free financing plan, which makes it super attractive. I mainly want to buy a car for my wife to commute, and with MINI's strong brand power, I should place an order soon."

These two simple sentences hide many profound meanings behind them.

First of all, it can be said that the new electric MINI alone has proven that there are no unsalable joint venture electric vehicles, only unattractive prices. In today's turbulent Chinese automotive market, this subheading is the most apt description.

Secondly, if I'm not mistaken, unlike most joint venture electric vehicles that stubbornly stick to their official guide prices and then secretly hope that dealers will offer significant discounts, the new electric MINI has demonstrated its sincerity from the root cause by directly addressing the issue.

Judging from the phased feedback, compared to the previous concealment that severely damaged and overdrew the brand image, this approach is undoubtedly more effective and dignified, conveying a signal of willingness to actively change to potential customers.

Furthermore, the approach of the new electric MINI has effectively announced to all joint venture brands a painful yet undeniable survival rule: "To sell electric vehicles well, one must abandon premium pricing, proactively lower one's stance, and even become more humble than domestic brands to have a chance to stand out from the murderous quagmire."

In summary, only in this way can there be a future.

Do whatever it takes, whether it's a plug-in hybrid or an extended-range electric vehicle

"Joint venture brands are not selling electric vehicles poorly; they simply don't want to sell them at this stage. In fact, they are waiting for domestic brands to engage in self-destructive competition, significantly deplete their resources, and for the market to mature before slowly entering to reap the benefits."

"Even if a joint venture brand never sells electric vehicles well in the Chinese market, it can still make a fortune in the broader global market with greater demand, so even if it exits, it is a choice made after weighing the pros and cons."

One can guess that similar criticisms of today's article will undoubtedly emerge in the comment section.

In the eyes of these doubters, the decline in market share of joint venture brands and their lack of presence in the new energy sector are merely minor setbacks or strategic adjustments. As the elephants turn around, the current seating arrangement is bound to be completely reshaped, and the question of who will win or lose is far from settled.

As a rebuttal, I want to say, "Are you sure? Are you sure you're not burying your head in the sand?"

While I have always agreed that joint venture brands should not be unduly disparaged, their incompatibility with the increasing trend of electrification is an undeniable fact.

Regarding the two viewpoints at the beginning of this paragraph, there are indeed many loopholes to be exploited.

For example, domestic brands have rapidly captured the hearts and minds of consumers when it comes to selling electric vehicles, making it natural for everyone to perceive them as the leaders.

For joint venture brands to catch up as latecomers is no easy feat. Whether in marketing, technology, or product aspects, the gap is clearly visible. Once domestic brands take the lead, their advantage will continue to snowball.

Furthermore, in terms of the competitive intensity within a single sector, the Chinese market is the largest and most brutal globally. If any joint venture brand can prove its worth in this land, it will undoubtedly be unstoppable in other sectors as well.

On the contrary, if they cannot even thrive in this land, they will inevitably become riddled with problems in other sectors. After all, automobile manufacturing, especially electric vehicle production, is a game for the strong, and everyone wants to pass the hardest level.

Fortunately, it is reassuring to see that most joint venture brands have recognized their true situation and what they truly want, rather than blindly being arrogant and intransigent. "To sell electric vehicles well, one must embrace China."

Against this backdrop, the following sections aim to provide some suggestions.

First, do whatever it takes, whether it's a plug-in hybrid or an extended-range electric vehicle.

Referencing the CPCA's terminal performance again, the wholesale sales ratio of pure electric vehicles, true plug-in hybrids, and extended-range electric vehicles in September reached 59%, 32%, and 9%, respectively. For reference, the corresponding figures for the same period last year were 68%, 23%, and 8%, respectively.

While it may sound ironic, the fuel tank still plays a crucial role in the Chinese automotive market. In other words, as time goes on, the product lineup comprising true plug-in hybrids and extended-range electric vehicles may well share the market with pure electric vehicles, jointly attacking gasoline vehicles.

For joint venture brands, expecting them to transition directly and completely to pure electric vehicles is somewhat unrealistic. In contrast, both true plug-in hybrids and extended-range electric vehicles hold significant consumer demand, and they should embrace them wholeheartedly given their expertise in "playing" with fuel tanks.

More bluntly, "If curving the path to salvation works, why not do it?" Moreover, if they can incubate a hit product that feeds back globally, they may even reap unexpected rewards.

Second, there's no shame in finding helpers.

Regarding this, Volkswagen, a standout among joint venture brands, has already set an exemplary precedent. For this wealthy German veteran, it's more productive to find like-minded partners for a win-win situation than to struggle alone.

Over the past few decades, domestic brands have traded their market for technology from joint venture brands; today, the roles have reversed but the goal remains the same: a win-win situation. However, it's crucial to note that there aren't many affordable and high-quality "chips" left on the table, so one must act swiftly. Delaying action is tantamount to forgoing the shortcut.

Third, intelligence must not lag behind.

Borrowing from Wang Chuanfu, Chairman of BYD, "Electrification is merely the first half; intelligence will decide the winner in the second half."

I have always believed this. Starting this year, it has become increasingly apparent that a mature smart cockpit and a promising high-level autonomous driving system are rapidly becoming must-haves, rather than bonuses, in the car-buying process for consumers.

However, joint venture brands have long been perceived as lagging behind in intelligence when it comes to electric vehicles. Frankly, this is detrimental to their expansion over time. Therefore, finding ways to keep up, or at least reach industry averages, is a crucial pain point they must address.

Otherwise, they will suffer greatly in direct competition with domestic brands. As for the future of joint venture electric vehicles, it has always been in their own hands...