Porsche's luxury cars have fallen below 400,000 yuan

![]() 10/28 2024

10/28 2024

![]() 555

555

The myth of luxury cars is failing, and it's not just Porsche.

Produced by New Product Insight??????

Written by Wu Wenwu

Behind the fall of Porsche's prices below 400,000 yuan is not only that Porsche is increasingly difficult to sell, but also that the mythical effects of traditional luxury car brands have collectively failed.

01

Porsche prices fall below 400,000 yuan

Another luxury car brand can't hold on anymore!

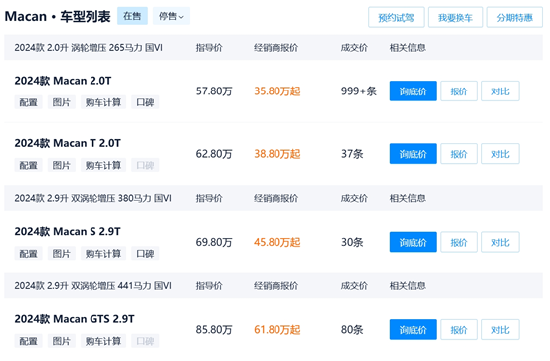

New Product Insight noticed that on October 25, according to Sina Tech, the 2024 Porsche Macan 2.0T has a manufacturer's suggested retail price of 578,000 yuan, but some Shenzhen dealers are offering it for as low as 358,000 yuan, equivalent to a 60% discount.

Soon, the topic "Porsche Prices Have Fallen Below 400,000 Yuan" trended on social media, sparking widespread attention and heated debate. Additionally, Porsche's Taycan, Panamera, and other models are also on sale at discounted prices.

After the above news was reported by the media, a Securities Times reporter contacted the relevant Porsche dealership on the same day, and the staff replied that it was true, and that the store was conducting a promotion with a relatively large discount.

The staff member said that the 358,000 yuan quote was for a barebones Macan Standard Edition. Currently, this model has over 20% off, with cash discounts and gift packs available. The price after customization can be discussed in-store. The promotion for the Macan is a limited-time offer.

However, Porsche's discounts do not apply nationwide. Reports indicate that staff at Porsche's Shanghai direct sales store stated that they had not heard of the Macan being offered for less than 400,000 yuan barebones. After customization, insurance, and purchase tax, the cheapest Porsche would still cost over 600,000 yuan.

Those familiar with Porsche's sales strategy know that it is generally difficult to directly purchase a base Porsche model without customization, which is typically done by individual buyers. Customization can significantly alter the final price.

This time, a Porsche dealership in Shenzhen offered the Macan for as low as 358,000 yuan, a clear attention-grabbing move with more marketing and buzz value than actual sales impact.

Such aggressive promotions directly reflect the intense sales pressure faced by Porsche dealers, who are resorting to all means to sell cars.

In the era of short videos and live streaming, Porsche dealers across the country have been leveraging these platforms for marketing and promotions. Porsche dealership anchors are actively selling and engaging with viewers in live streams.

The last time Porsche trended on social media, sparking heated debate, was on July 20 this year, when Porsche announced a change in leadership for its China business. As of September 1, Alexander Pollich replaced Michael Kirsch as President and CEO of Porsche China.

This time, Porsche dealers offered unprecedented discounts to sell cars, once again plunging the luxury car brand into controversy.

02

Porsche is increasingly difficult to sell

Since the beginning of this year, Porsche has frequently trended on social media, but none of the news has been good. The term "under immense pressure" falls short of describing Porsche's current situation.

First, in May of this year, some Porsche dealers in China "pressured" Porsche's German headquarters, criticizing them for "forcing" inventory onto dealers to boost sales figures. This incident ended with a joint statement from Porsche China and all authorized dealers.

Next came news of the leadership change in Porsche's China business. However, the market has repeatedly debated not only Porsche's declining global sales but also its continued decline in China, one of its key markets.

Since entering the Chinese market in 2001, Porsche has experienced rapid growth, positioning itself between BBA (BMW, Benz, Audi) and super-luxury brands like Ferrari and Maserati. By 2015, China had become Porsche's largest single market globally.

In those years, Porsche effortlessly thrived in the Chinese market, earning substantial profits. Both Porsche and its parent company, Volkswagen Group, were optimistic about future sales growth in China.

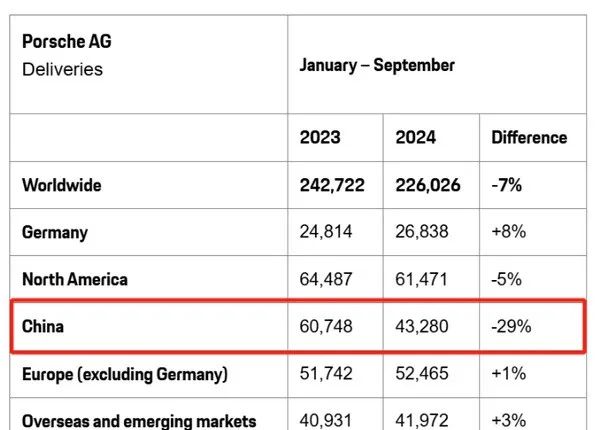

However, starting in 2023, Porsche's sales in China began to decline. In 2024, sales continued to slide, with a year-on-year decrease of 24% in the first quarter and 33% in the first half of the year. This significant decline was a direct factor in the leadership change at Porsche China.

According to the latest data released by Porsche, in the first three quarters of 2024, Porsche delivered a total of 226,026 vehicles globally, with global sales down 7% year-on-year. Sales in China fell by 29% year-on-year, with only 43,280 vehicles delivered, making it Porsche's largest single market with the most significant decline globally.

In the first three quarters of this year, several Porsche models faced sales difficulties. For example, sales of the electric sedan Taycan plummeted 50% year-on-year to just 14,042 units, the lowest among its models. Sales of the Panamera were also unsatisfactory, down 20% year-on-year. The Macan, Porsche's flagship model and sales pillar, saw a 20% year-on-year decline in sales.

According to the latest data released by Porsche, China, which was once Porsche's largest single market for several consecutive years, has now dropped to third place globally.

03

The myth of luxury cars is failing, and it's not just Porsche

While a Porsche executive has acknowledged the decline in sales in the Chinese market, the continuous drop in sales has undoubtedly put both Porsche China and its headquarters on edge.

Whenever Porsche's declining sales in China are discussed, the topic of the failure of the Porsche myth inevitably arises.

As mentioned earlier, Porsche's sales in China began to decline in 2023 and have continued to do so in 2024. The fact that Porsche is increasingly difficult to sell reflects the failure of the Porsche myth.

Several factors contribute to Porsche's declining sales in China. Firstly, the current macroeconomic environment and consumer sentiment undoubtedly play a significant role.

For example, a large portion of Porsche buyers in China are female consumers, particularly young women, many of whom are now financially constrained.

However, in the view of New Product Insight, behind Porsche's continuous decline in sales in China lies the failure of the Porsche myth. Looking at the entire luxury car market, the myth of luxury cars is failing, and it's not just Porsche.

In the era of traditional gasoline-powered vehicles, Porsche was a typical representative of luxury cars, with a strong sense of prestige. However, since China's automotive industry entered the era of new energy vehicles, the consumption logic of the Chinese market has changed dramatically.

New-energy vehicle makers like NIO and Lixiang have directly entered the mid-to-high-end automotive market. NIO, focusing on the pure electric luxury car market, has already established a foothold, while Lixiang, with its extended-range models, has also gained popularity at a relatively high price point.

China's local new-energy vehicle brands are continuously rising, directly attacking the main territory and strategic hinterland of traditional luxury car brands, catching traditional luxury car brands off guard. Whether it's Porsche's electric cars or BBA's, they simply can't sell without discounts.

After dominating China's luxury car market for decades, BBA has also begun to decline. In the first half of 2024, sales of BBA vehicles in the domestic market declined. Specifically, Mercedes-Benz sold 350,705 vehicles, a year-on-year decrease of 10%; BMW sold 363,998 vehicles, down 5% year-on-year; and Audi sold 329,556 vehicles, a year-on-year decrease of 3%, despite significant price cuts. ?

In particular, the strong rise of Huawei's new energy vehicle brands has further captured the market share of traditional luxury cars. According to the latest data as of October 26, Wenjie M9 has surpassed 160,000 orders in just 10 months since its launch, taking away market share from traditional luxury gasoline-powered cars priced above 500,000 yuan.

As China's new energy vehicle brands continue to rise and adopt a luxury strategy, China's mid-to-high-end luxury new energy vehicle brands have become viable alternatives to traditional luxury car brands.

Traditional luxury car brands are traditional in terms of intelligence and lack intelligence, which can no longer meet the needs of many young consumers. Intelligence and autonomous driving are precisely the strengths of China's local automotive brands.

04

Conclusion

Porsche's declining sales in the Chinese market and aggressive promotions by its dealers, such as the recent offer of a barebones Macan for as low as 358,000 yuan, have once again surprised the market.

In the past year or two, BBA has attempted to maintain market share through price cuts, but this has failed to halt the decline in sales. In July this year, BMW announced it would withdraw from the price war but was unable to contain the decline in sales and recently returned to price cuts.

Whether it's Porsche, BBA, or Japanese luxury car brand Lexus, the halo effect of traditional luxury car brands has diminished significantly, and their mythical status has waned. In short: the era of easy wins for traditional luxury car brands in the Chinese market has ended.

As China's local car brands continue to rise and capture market share from traditional luxury car brands, these established luxury car brands must adapt to the new consumption patterns of China's new energy vehicle era rather than evade them.

While China's automotive brands have achieved remarkable results, we cannot deny that Porsche, BBA, and other traditional luxury car brands still have strong competitiveness and their own consumer groups, whose competitiveness should not be overlooked.

In the future, only luxury and joint venture car brands that keep pace with the changing Chinese automotive market will thrive.