Xiaomi SU7 Ultra launches, making Lei Jun the most feared figure in Japan's automotive industry?

![]() 11/01 2024

11/01 2024

![]() 481

481

Author | Meng Xiao For more financial information | BT Finance Data Link The article contains 4717 words in total and is expected to take 12 minutes to read

"With the launch of Xiaomi SU7 Ultra, all of Lei Jun's dreams may have come true, and he has no worries for the time being."

On the evening of October 29, Lei Jun and his Xiaomi once again trended on social media, this time with the keywords of Xiaomi's 2024 new product launch event. The event featured several highlights: the official launch of Xiaomi 15 with a starting price of 4,499 yuan, a Diamond Limited Edition featuring lab-grown diamonds embedded in the frame priced at 5,999 yuan, marking Xiaomi's move towards a premium market segment.

Xiaomi HyperConnect now fully supports Apple devices, enabling easy file and image transfers by installing the "Xiaomi Interconnection Service." Additionally, Lei Jun announced that Xiaomi had delivered 20,000 SU7 units in October and was on track to meet its annual delivery target of 100,000 units by November.

The automotive industry is paying close attention to the timeline of Xiaomi SU7 reaching 100,000 sales. From its launch to achieving 100,000 sales, it took less than eight months. Even if we count from the establishment of Xiaomi Automobile, it has only been three years, which is a remarkable achievement. NIO took six years to reach 100,000 sales, as did XPeng and Li Auto, while Tesla took a full 12 years. In the field of new energy vehicles, reaching 100,000 sales is a crucial benchmark for a car company to establish its footing. Xiaomi SU7 achieved this milestone in the shortest time among many new energy vehicle companies.

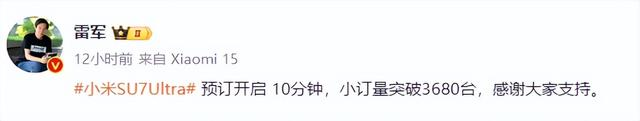

At the launch event, Lei Jun also introduced Xiaomi SU7 Ultra, a new model with a pre-sale price of 814,900 yuan, making it the most expensive Xiaomi product to date. Lei Jun announced that within 10 minutes of opening pre-sales, Xiaomi SU7 Ultra received over 3,680 small deposits.

BT Finance consulted a professional automotive sales expert regarding the difference between large and small deposits for pre-sale models. The expert explained that there is a significant difference between large and small deposits. A large deposit typically involves a significant amount, usually 10% to 30% of the car's price, and is legally binding. If the buyer changes their mind, the deposit is not refundable, meaning the order is considered final. In contrast, a small deposit is usually less than 10% of the car's price and represents a mere expression of intent to purchase. It is refundable if the buyer changes their mind. It remains to be seen how many small deposits for Xiaomi SU7 Ultra will convert into final sales.

However, following the launch event, Xiaomi's share price fell at the opening of trading on October 30, closing at HK$26.00, with a slight increase of 0.58%. Since August 5 (to October 29), Xiaomi's share price has actually been on a continuous uptrend, with an increase of 68.3% during this period.

1

Lei Jun becomes a social media sensation on Douyin

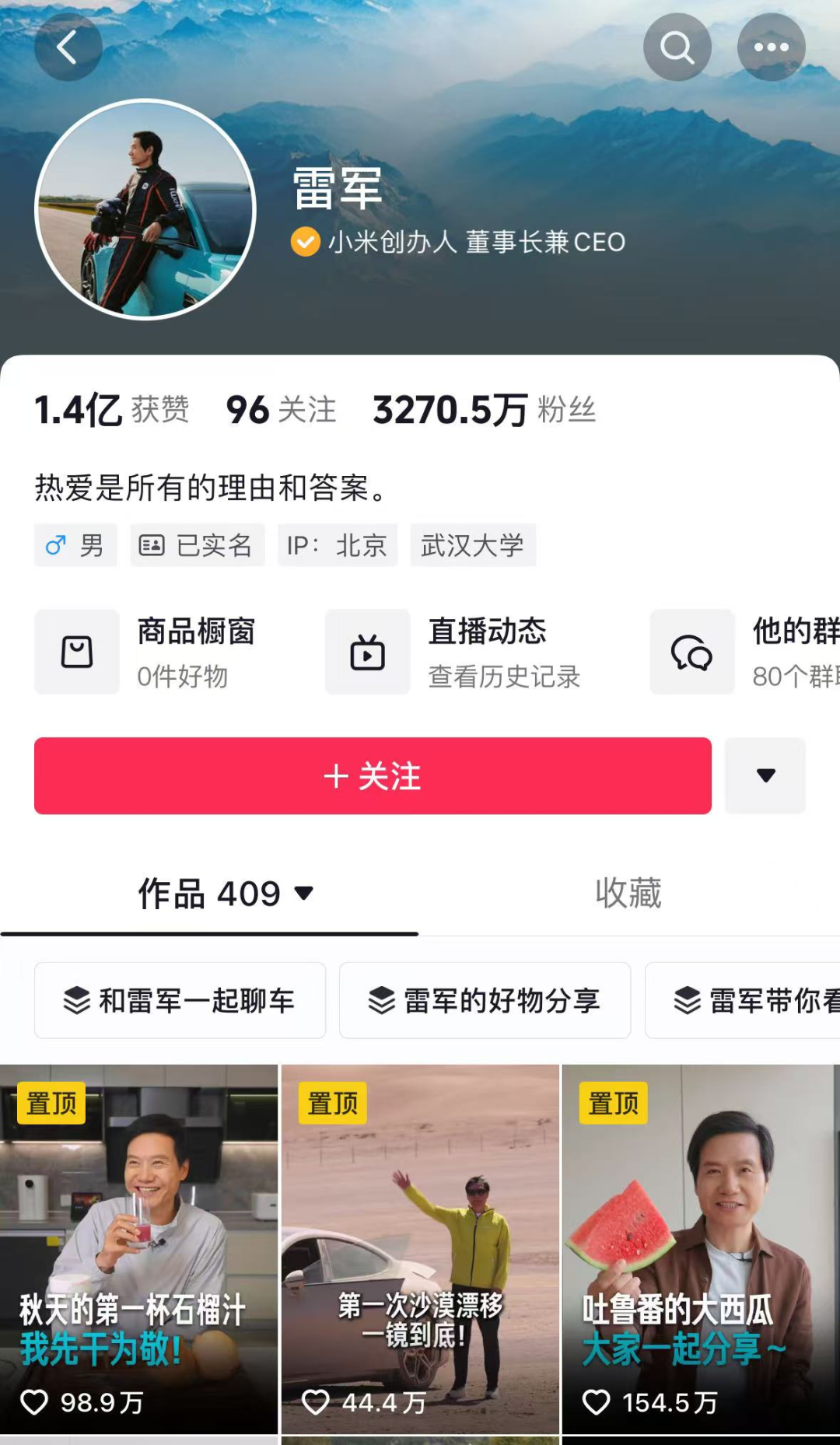

As of 9:30 AM on October 30, Lei Jun had over 32.7 million followers on Douyin, making him the entrepreneur with the most followers on the platform. Dong Yuhui, who had 26.93 million followers during the same period, was surpassed by Lei Jun, who had fewer followers than Dong just six months ago but now has nearly 6 million more.

On October 24, Lei Jun surpassed 30 million followers, indicating a gain of nearly 3 million followers in just five days. In the past year, Lei Jun's followers have surged by over 20 million, making him a true top-tier influencer among entrepreneurs.

According to previous articles by BT Finance, on August 12, Dong Yuhui had 26.92 million followers, while Lei Jun had 28.61 million. In just over two months, Dong Yuhui's follower count only increased by 10,000 due to leaving East Money and negative public opinion, whereas Lei Jun gained 4.1 million followers during the same period. Although Lei Jun is still far from the hundreds of millions of followers enjoyed by top influencers, he has undeniably become a top-tier influencer on Douyin.

Currently, Lei Jun has posted 409 videos, garnering over 140 million likes, with an average of 348,000 likes per video. Notably, Lei Jun rarely promotes Xiaomi products in his live streams but instead shares aspects of his daily life, such as enjoying the "first pomegranate juice of autumn" or asking viewers which watch band matches their outfit best. This content resonates well with Douyin's audience, making Lei Jun a favorite among Douyin users.

In stark contrast to Lei Jun's polished image is Zhou Hongyi, who aspires to be a top-tier influencer but lags behind with only 7.95 million followers. Since the beginning of the year, his follower count has increased from around 3 million, but at a much slower rate than Lei Jun. BT Finance also found that Zhou Hongyi's popularity is closely tied to external hot topics, such as the Luobo Kuaipao incident and the launch of Xiangjie S9, rather than his own business, 360. His videos related to his core business often receive fewer views than those about external hot topics, indicating a heavy reliance on trending content for engagement. This suggests that Zhou Hongyi lacks the ability to generate his own traffic and is not a true top-tier influencer.

Compared to Zhou Hongyi's casual appearance, Lei Jun always looks well-groomed in his videos, with meticulous attire and a straight posture, giving off an air of professionalism and approachability. It is evident that Lei Jun's media presence is carefully curated, with deliberate choices in music and cinematography.

(Comparison of Zhou Hongyi and Lei Jun's live streaming images)

Lei Jun's over 30 million followers have sparked interest among many media professionals. Media personality Lu Kai commented that even though Luo Yonghao, known for his tech expertise, has been active in the tech circle for years, his follower count has been overshadowed by Lei Jun. High-profile entrepreneurs who have entered the scene have also struggled to make a splash, with Dong Yuhui's emotional and stylish approach now surpassed by Lei Jun. Lu Kai believes that while Lei Jun's success seems simple, it is impossible to replicate.

2

Staying true to one's original aspirations is the most attractive trait

While Zhou Hongyi's pursuit of trending topics is evident, even placing his Douyin account at the entrance of the Internet Security Conference hosted by 360, negative public opinion incidents may be one of the factors contributing to his slow follower growth. However, the primary reason for his stagnant follower count is 360's poor business performance.

In 2022 and 2023, 360's revenue was 9.521 billion yuan and 9.055 billion yuan, respectively, declining by 12.54% and 4.89%. The net profit was -2.204 billion yuan and -492.5 million yuan, with year-on-year increases of -344.23% and 77.65%, respectively, resulting in net losses of nearly 2.7 billion yuan over two consecutive years. In the first half of 2024, 360's performance remained unsatisfactory, with revenue of 3.692 billion yuan, down 18.02% year-on-year, and a net profit of -341.3 million yuan, down 47.82% year-on-year. The non-deductible net profit was -516.3 million yuan, down 102.44% year-on-year. Zhou Hongyi's aspiration to become a top-tier influencer may be related to 360's continuous decline in performance.

In contrast, Lei Jun's follower count has surged, and his path to becoming a top-tier influencer has been remarkably smooth. At the same time, Xiaomi Group has also performed exceptionally well. In the first half of 2024, Xiaomi's revenue was 164.4 billion yuan, up 29.62% year-on-year, with a net profit attributable to shareholders of 9.28 billion yuan, up 17.86% year-on-year.

These contrasting business performances have led to different performances in the capital market. On the first trading day of 2024, 360's share price opened at 8.89 yuan and closed at 8.79 yuan on October 30, showing a year-to-date decline. Xiaomi's share price opened at HK$15.60 on the first trading day of the year and closed at HK$26.00 on October 30, with a year-to-date increase of 67%. The contrasting performances of these two companies are striking.

Investor Liu Bo believes that the essence of being an entrepreneur is staying true to one's original aspirations. If a company's performance is poor, riding on trending topics will have limited effect. "A top-tier entrepreneur is first and foremost an entrepreneur, and only then a top-tier influencer. Lei Jun has become a widely recognized top-tier entrepreneur because Xiaomi's business performance is solid. Conversely, poor business performance gives investors the impression that the entrepreneur is not focused on their core business, and excessive marketing may even have a negative impact, harming both the company and the entrepreneur themselves."

Another entrepreneur on the path to becoming a top-tier influencer is Dong Mingzhu of Gree Electric Appliances, whose company's performance is also mediocre. In the first half of the year, Gree's revenue was 100.3 billion yuan, up 0.54% year-on-year, making it the slowest-growing company in the home appliance industry. The once-leading home appliance company has been overshadowed by Midea, with revenue even lower than that of Haier Smart Home, which was 135.6 billion yuan during the same period.

3

Lei Jun has surpassed Steve Jobs

It is well-known that Lei Jun has pursued his dreams throughout his life, with different aspirations at different stages. When he first graduated, his dream was to be a "coder," which he has already achieved. During his entrepreneurial journey, his dream was the "mobile phone dream," which has come true with the establishment of Xiaomi. With this launch event, Xiaomi phones have entered the premium market. Lei Jun's most recent dream has been the "car dream." If Xiaomi SU7 was designed for volume sales, Xiaomi SU7 Ultra aims to generate profits. Lei Jun's "life dreams" have now been fulfilled.

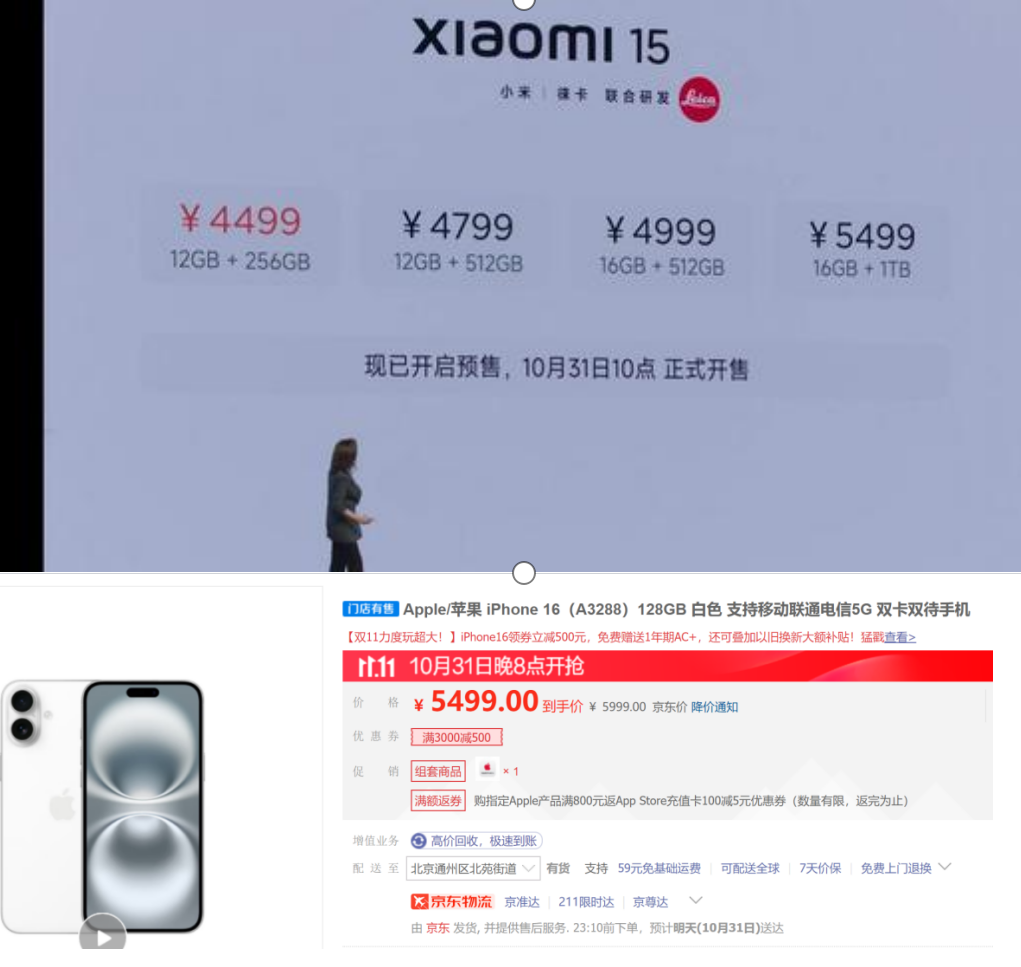

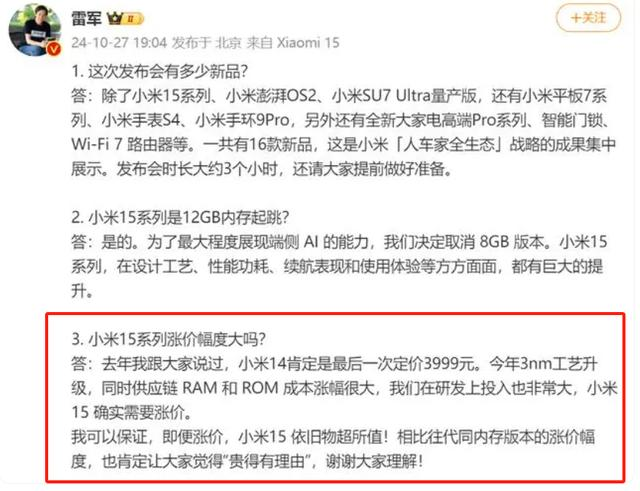

The highlight of this Xiaomi launch event was the premiumization of Xiaomi products, evident in both Xiaomi 15 and Xiaomi SU7 Ultra. This is Xiaomi's fifth year of premiumization, with Xiaomi 15 and Xiaomi SU7 Ultra embodying this strategy the most. The price of Xiaomi 15 is very close to that of Apple's iPhone 16. On October 30, the price of Apple's iPhone 16 (128GB) reached 5,499 yuan, while the top-of-the-line Xiaomi 15 (16GB+1TB) was also priced at 5,499 yuan. By increasing the price of Xiaomi 15, Xiaomi has shed its previous image as a "budget phone" manufacturer.

The price of Xiaomi 15 has significantly increased compared to Xiaomi 14. Xiaomi 15 features an upgraded ultrasonic fingerprint sensor and improvements in photography, battery life, telephoto capability, and processor. It also introduces an innovative aluminum metal highlight process, making the phone one-third the weight of stainless steel and achieving an "ultra-narrow four equal-sided" design with a bezel of only 1.38mm. The Xiaomi 15 Pro features a significant battery upgrade, with the charging power reduced from 120W to 90W but improvements in the processor and fingerprint recognition. The starting price of the Xiaomi 15 Pro series is 5,299 yuan, with the high-end version priced at 6,499 yuan. However, Xiaomi offered free screen protection and other incentives to customers during the initial launch period, partially offsetting the price increase.

Lei Jun previously responded to the price increase of Xiaomi 15 on social media, attributing it to higher costs and R&D investments. He expressed optimism about the price increase, stating, "Xiaomi 15 will be the smoothest, most visually appealing, and best-feeling small-screen flagship phone ever. I can assure you that even with the price increase, Xiaomi 15 is still excellent value for money! Compared to previous generations with the same memory configuration, the price increase will certainly make everyone feel that it's 'expensive for a reason.' Thank you for your understanding!"

According to Xiaomi, to achieve the ultra-narrow four equal-sided design and LIPO screen encapsulation, Xiaomi conducted full-process "from-scratch" research and development, with a total production line investment of over 100 million yuan and 30 patent applications. The entire process from pre-research to mass production took 20 months.

During the official launch of Xiaomi 15, a survey was conducted, revealing that 53% of the 13,030 participants believed Xiaomi 15 to be expensive. However, some netizens argued that "at the same price point, which Apple or Huawei phone can match Xiaomi's cost-effectiveness?" One user even considered Xiaomi 15 Pro's price of over 5,000 yuan to be quite affordable. While the Xiaomi 14 series has sold well, Xiaomi's financial reports reveal that the Redmi series remains the best-selling, with an average phone price of around 1,100 yuan. Xiaomi's premiumization efforts have yet to gain widespread market acceptance, and the company still faces challenges in this area.

Another example of Xiaomi's premiumization efforts is the Xiaomi SU7 Ultra, with a pre-sale price of 814,900 yuan. As an electric vehicle model, it is nearly the top-tier in its field, second only to BYD's U8, priced at 1.09 million yuan among domestically produced new energy vehicles.

According to Xiaomi, the SU7 Ultra boasts a powerful drivetrain with a 0-100 km/h acceleration time of 1.98 seconds and a top speed of 350 km/h, which Lei Jun calls "the fastest on the ground." The model is equipped with Xiaomi's Super Motor V8s, capable of reaching a maximum speed of 27,200 rpm, a three-motor torque vector control system, a high-power battery pack for racing versions, and can output 800 kW with only 20% battery remaining. In Lei Jun's view, these capabilities are on par with million-dollar supercars. The launch of this model topped social media trends. Some analysts have suggested that "when Xiaomi SU7 was first launched, it may have been priced at around 200,000 yuan due to competitive pressure from rivals. Now, the launch of luxury models marks the beginning of profitability for Xiaomi Automobile."

Lei Jun has defined Xiaomi SU7 Ultra as a "peak performance technology sedan", aiming to break the boundaries of the traditional automotive market. Its strategy is to become a top five global automaker within the next 15 to 20 years. However, it must first pass the market test, as it faces highly competent competitors in the same category, with Tesla being the biggest rival. Tesla's Model S Plaid is priced at 1,028,900 yuan and 1,059,990 yuan, with a 0-100km/h acceleration time of 1.99 seconds, making the difference minimal. However, amid the rise of domestic products, Xiaomi Automobile may have a greater advantage.

It is worth mentioning that Xiaomi Automobile's success has puzzled the Japanese automotive industry. They find it surprising that an internet-based smartphone manufacturer could achieve success with its first vehicle. Recently, the Japanese automotive industry has begun to dissect and study Xiaomi SU7, concluding that even an "outsider" like Xiaomi possesses technological advantages that are out of reach for Japanese automakers. Furthermore, the former CEO of Ford brought a Xiaomi SU7 back to the United States, where company personnel study and learn from it daily.

With recognition from peers, the current starting price of the Mercedes-Benz S-Class is 832,600 yuan, while Xiaomi SU7 Ultra is priced even higher. It is not surprising that Xiaomi Automobile has directly entered the high-end market in one step.

Xiaomi announced its move towards high-end products at the launch event. Xiaomi 15 and Xiaomi SU7 Ultra have garnered significant attention. Another certainty is that the event has significantly increased Lei Jun's fan base. Under Lei Jun's management, Xiaomi has not only achieved success in high-end smartphones but also in automobile manufacturing, surpassing the achievements of Steve Jobs. Perhaps soon, Xiaomi may also attain the status of a "god" like Apple under Jobs' management.