BYD and Geely go to war, will joint ventures pay the price?

![]() 11/07 2024

11/07 2024

![]() 585

585

As the leading brands fight, the smaller players disappear, a scenario that continues to unfold in the auto market in 2024.

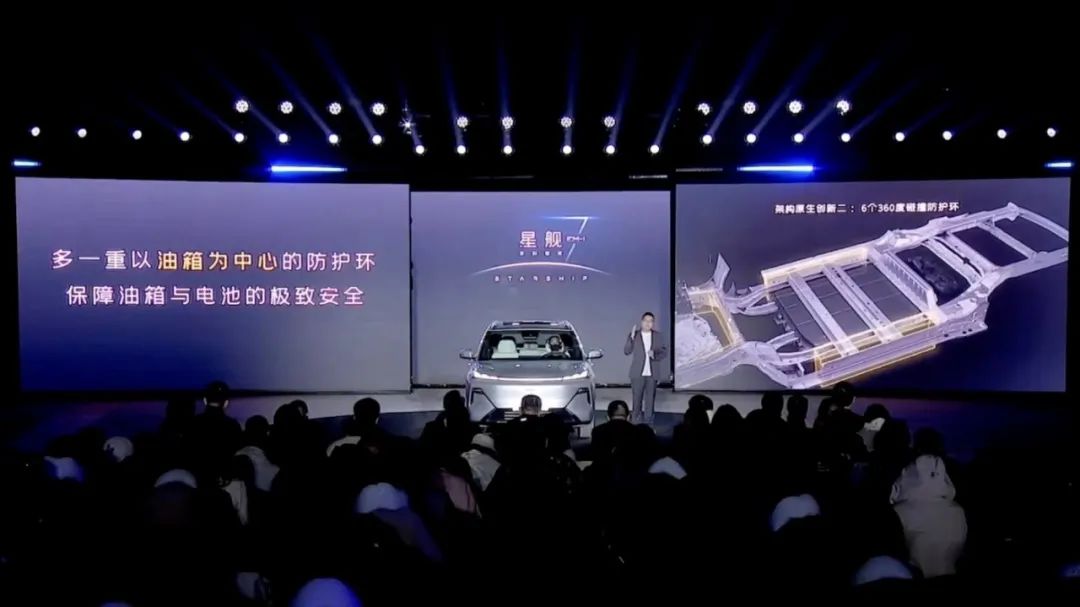

In September, the spotlight was stolen by Huawei, Zeekr, and Ledao's siege on Tesla's Model Y. Overlooked was Geely Yinhe E5's challenge to BYD Yuan PLUS, followed by Geely Xingyuan offering Dolphin-sized cars at Sparrow prices, the upgrade of Leishen Power with the introduction of single-gear plug-in hybrid EM-i, and the global debut of Xingjian 7.

Geely claims a fuel consumption of 3.75L/100km under low battery conditions, with an extreme low battery consumption of 2.67L/100km and a full range of 1430km with a full tank and battery. Currently, the most popular product in the market, BYD's fifth-generation DM, boasts a full range of over 2000km with a full tank and battery. In the latest round of plug-in hybrid competition, SAIC also aims to participate with DMH, and the Roewe D7 DMH offers a range of 2208km with a full tank and battery.

Although Geely hasn't made as bold a statement as Chery, it's clear that the former leader in the fuel era wants to reclaim its throne in the new energy era.

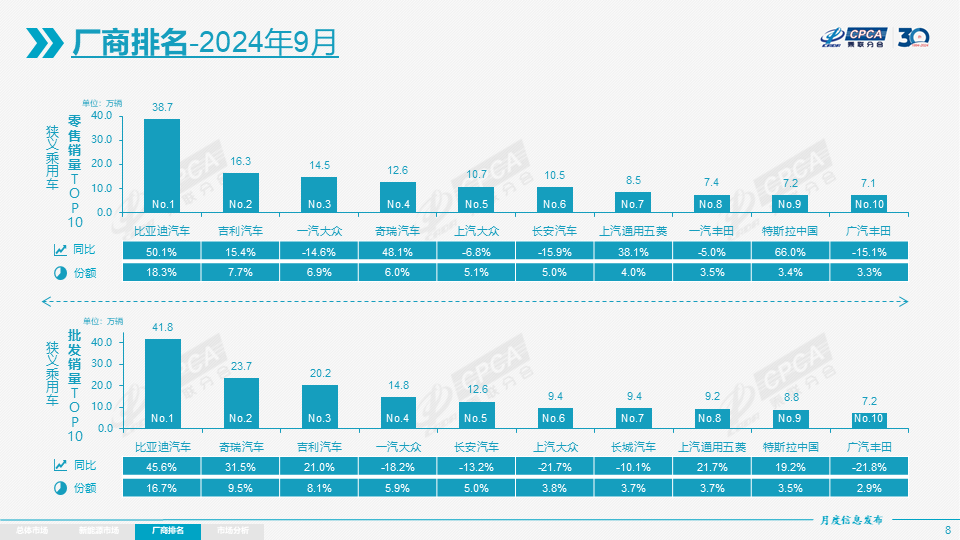

High-intensity competition among giants will undoubtedly alter the development trajectory of the automotive market. Currently, from September this year, Geely Holding's new energy vehicle sales have doubled from around 50,000 units per month to over 100,000 units per month. While still far from BYD's recent record of 500,000 units per month, Geely has surpassed Chery, Changan, and Great Wall and stabilized in second place.

Moreover, unlike Wuling or FAW Besturn's strategy of boosting sales with microcars priced under 50,000 yuan, the competition between the top two players has not affected each other's sales but has impacted other companies instead, contrary to common perception.

Geely wages war on BYD, joint ventures decline by 390,000 units

Taking August 2024, when Geely launched the Yinhe E5 to challenge BYD Yuan PLUS, as a timeline, the competition between Geely and BYD has not resulted in a "two tigers fighting, one must be injured" scenario.

Overall sales show that both Geely and BYD are growing significantly amidst competition.

In July, Geely sold 59,000 new energy vehicles, while BYD sold 342,300. In August, Geely sold 75,400, and BYD sold 379,600. In September, Geely's sales doubled to 152,500 units, while BYD grew to over 410,000 units, primarily due to the delivery of Geely Yinhe E5. In October, Geely brand new energy sales (excluding Zeekr) reached 108,700 units, while BYD set a record with 505,200 units.

From a single-vehicle sales perspective, whether it's Yinhe E5 challenging Yuan PLUS or Geely Xingyuan challenging Dolphin + Sparrow, sales figures indicate that competition fuels growth.

In the A-segment pure electric SUV market, Yinhe E5 sold 12,200 units in August compared to 30,000 for Yuan PLUS; in September, Yinhe E5 sold 14,200 units, and Yuan PLUS sold 31,500 units; in October, Yinhe E5 sold 15,700 units, and Yuan PLUS sold 32,400 units.

In the A00-A0 pure electric car segment, the combined sales of BYD Dolphin and Sparrow were 61,000 units in August and 63,700 units in September. Starting in October, Geely Xingyuan, which offers Dolphin-sized cars at Sparrow prices, delivered 16,100 units, while BYD's sales increased to 75,700 units.

This is partially due to the end-of-year trade-in policy, where new energy vehicles receive a subsidy of 20,000 yuan, more advantageous than the 15,000 yuan for fuel vehicles. However, the market's sales base is relatively fixed, and without substantial changes in income expectations or the economic environment, the shift in sales between large bases has not disappeared. Therefore, in the new energy vehicle competition among giants, it is ultimately fuel vehicles that pay the price.

Examining the sales performance of mainstream joint venture brands after August reveals the answer.

SAIC-GM saw a decline of 72,100 units in August and 77,900 units in September compared to 2023.

SAIC Volkswagen declined by 25,000 units in August and 26,000 units in September.

FAW-Volkswagen declined by 18,500 units in August and 10,700 units in September.

FAW Toyota saw an increase of 200 units in August but a decline of 1,500 units in September.

GAC Toyota declined by 16,700 units in August and 12,500 units in September.

Dongfeng Nissan declined by 15,400 units in August and 3,500 units in September.

Dongfeng Honda declined by 32,500 units in August and 39,800 units in September.

GAC Honda declined by 9,600 units in August and nearly 30,000 units in September.

Over two months, sales of these eight mainstream joint venture brands declined by over 390,000 units compared to August and September 2023. Further breaking it down into relevant price segments of Yuan PLUS, Yinhe E5, BYD Dolphin, Sparrow, and Geely Xingyuan, it's evident that sales of many fuel vehicles have declined, such as the entry-level compact SUVs Honda XR-V and Honda Vezel, both selling around 1,000 units per month, and Toyota Corolla and Levin, both selling around 10,000 units per month. Honda Fit and Toyota Yaris sell around 1,000 units per month on average.

The current trajectory mirrors China's domestic brands gradually taking market share from joint ventures a decade ago, but with significantly higher intensity. Additionally, a more significant variable is that the competition between Geely and BYD is expanding into broader markets. Geely offers the EM-P and EM-i plug-in hybrid combinations and will soon introduce Xingjian 7 to compete with BYD Song PLUS DM-i. The latest news indicates that the starting price of Geely Xingjian 7 is expected to be within 130,000 yuan, significantly lower than the 135,800 yuan starting price of Song PLUS DM-i.

Judging from the trajectory set by Yinhe E5 and Geely Xingyuan, when Geely Xingjian 7 begins to compete with BYD Song Pro, Song PLUS, and Hailion 05, the list of models under pressure will likely include:

The Envision PLUS with a limited-time price of 169,900 yuan, the CR-V and Honda Vezel with a starting price of less than 150,000 yuan, and the RAV4 and Wildlander with a starting price of less than 130,000 yuan.

That is, apart from Volkswagen, which has a deep presence in China, most models in the same segment will face significant pressure, especially with Volkswagen offering the Tharu with a limited-time starting price of 79,900 yuan.

Price wars must change course, and so must BYD

The reason every move by giants garners industry attention is that when they initiate changes, other participating companies must decide whether to follow suit.

Not doing so would be tantamount to giving up, which is why even brands like Rolls-Royce, Lamborghini, and Ferrari have embraced the transition to new energy. Lagging behind means losing market competitiveness, as evidenced by the current new energy and fuel vehicle landscape.

Market competition rules rarely change drastically; the more competitive the market, the more transparent prices become. This is evident in the smartphone industry, where iPhone prices have steadily declined. The automotive industry is no exception. The price war since 2023 is due to excess inventory and capacity in fuel vehicles and breakthroughs in new energy vehicle technology, leading automakers to compete for market share.

However, prolonged price wars lead to diminishing returns from price cuts and a point where further reductions are impossible. The ongoing Double 11 sales show that the latest round of promotions is less intense than before.

For example, HarmonyOS Intelligent Driving currently offers 49,999 yuan in benefits, including a 20,000 yuan ADS advanced driving assistance option, which effectively raises the price of the previously 36,000 yuan Qiankun Intelligent Driving system to 30,000 yuan before reducing it to 16,000 yuan, back to the first half of 2024 levels.

The Buick GL8 PHEV offers a 10x multiplier on a 500 yuan deposit, up to 45,000 yuan in trade-in subsidies, and a 7,000 yuan upgrade package, similar to the 5,000 yuan insurance, up to 30,000 yuan in trade-ins, up to 30,000 yuan in configuration upgrades, and 30,000 yuan in guaranteed repurchase offers when it launched in April.

Dongfeng Honda offers up to 57,000 yuan in comprehensive benefits, Chevrolet Cruze offers 59,900 yuan, and Chery Fengyun A8 offers 20,000 yuan, all similar to offers seen since 2024.

The next round of competition will not be solely about price but about offering attractive prices alongside technological breakthroughs. Facing Geely's competition with its 11-in-1 electric drive, EM-i, EM-P, and Flymeauto smart infotainment system, BYD's strategy is becoming increasingly clear.

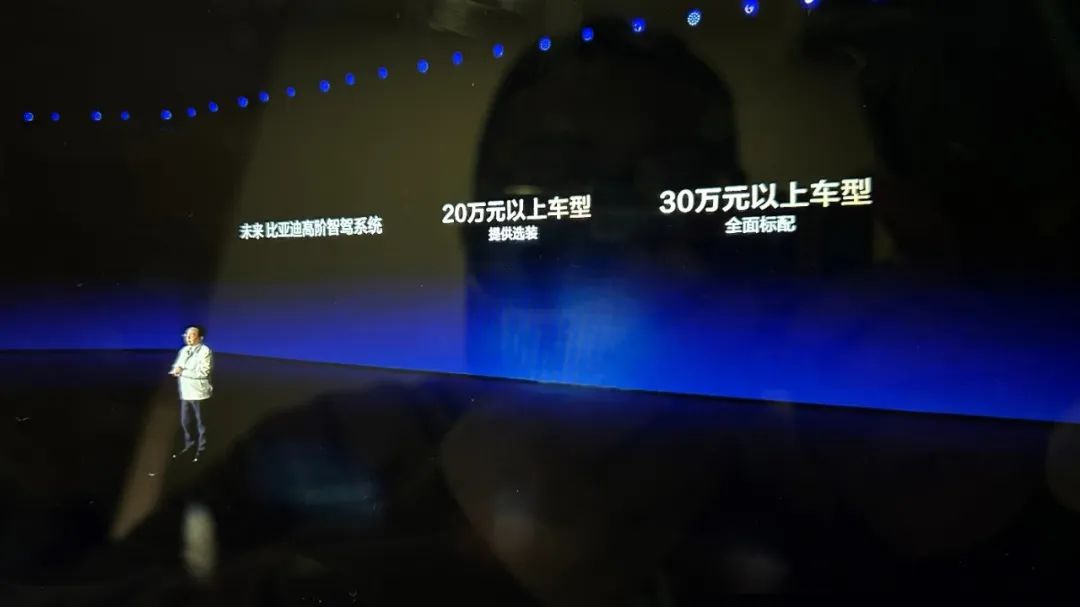

The answer lies in intelligence, and BYD's recent moves demonstrate both its aggressiveness and Wang Chuanfu's urgency. In the first half of 2024, BYD announced its intelligent driving development roadmap at its Dream Day, introducing AI big data models, proposing vehicle intelligence, and offering advanced driving assistance as an option for models priced above 200,000 yuan and standard on models priced above 300,000 yuan.

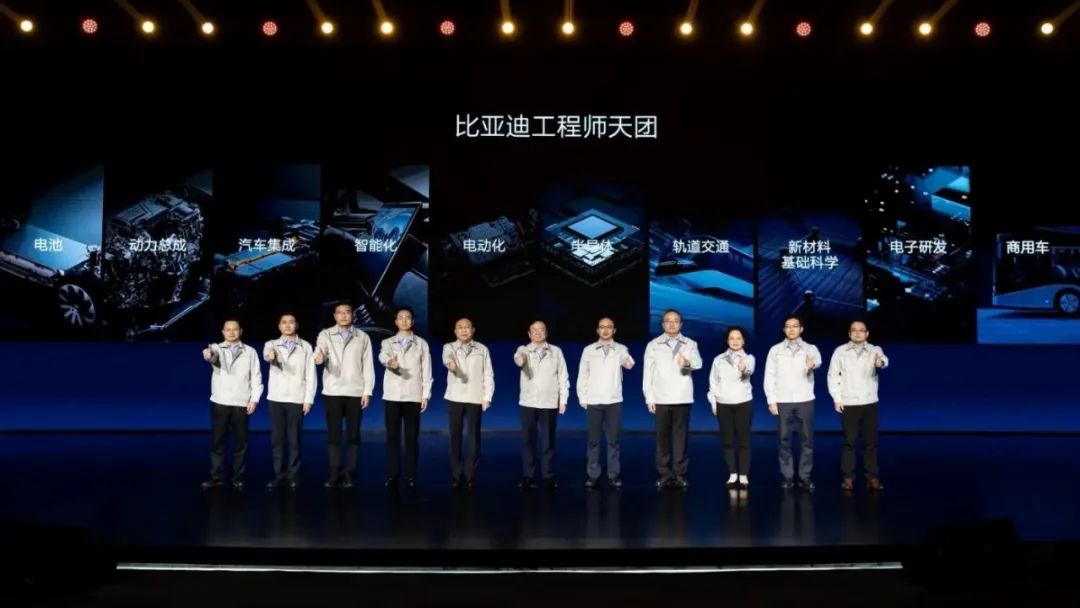

Six months later, BYD has undergone a significant transformation. In an August 2024 interview, Yang Dongsheng, Dean of BYD's New Technology Institute, said he often receives late-night calls from Chairman Wang Chuanfu, discussing intelligence as their main topic. At that time, BYD's intelligent driving team comprised over 4,000 people, exceeding the industry average, with over 1,000 in the core algorithm team. The large team size is due to BYD's deep integration of the industrial chain.

At the end of October, it was reported that BYD's two internal departments responsible for self-developed intelligent driving, the Tianxuan Development Department and the Tianlang Research and Development Department, had completed their integration. The former department focuses on self-developed technology, while the latter develops relatively basic solutions.

In November, BYD further strengthened its efforts in intelligent driving by recruiting employees across the group. Those who pass the interview can transfer directly without the consent of their original business departments. BYD is also preparing to equip all models across the group with standard intelligent driving features, with plans to extend basic intelligent driving functions to entry-level models in the future.

Moreover, BYD's self-developed algorithm based on the NVIDIA Orin X chip is expected to enter mass production and be installed in vehicles as early as November. In short, facing the fierce market competition, BYD has changed its approach, and subsequent price wars and other competitions will also change accordingly.

In fact, the situation of structural competition is already clear. Chang'an has invested in NIO through AITA as a third party, while Geely, which holds a stake in Yijiaotong, ZEEKR, which seeks self-development and rapid advancement, and Chery, which has been forthright about its intelligence efforts, have all made similar choices. Additionally, within joint ventures, trends are similar, such as between GAC Toyota and Momenta, and Volkswagen and DJI.

Postscript

When the top two competitors fight, someone has to pay the price. In 2024, the leader in China's automotive industry can only be BYD. If other companies choose not to keep up or cannot keep up with BYD's changes, losing market share is only a matter of time. It is foreseeable what situation fuel vehicles will face once BYD equips its entry-level models with intelligent driving and other functions.

The current polarization is increasingly significant. To such an extent that even if BYD stops selling new vehicles starting in November and only delivers existing orders, it can still achieve 100% of its sales target set at the beginning of the year.

As of the end of October, BYD's cumulative sales in 2024 have reached 3.25 million vehicles, a year-on-year increase of 36.5%. According to previous statements by BYD, the sales target for 2024 is to maintain growth of over 20% based on the 3.02 million vehicles sold in 2023, which translates to 3.624 million vehicles. Comparing with data from several authoritative third-party automotive sales channels, in the just-concluded October, BYD received over 500,000 orders. If BYD completes the delivery of all these new vehicles, it will achieve 3.75 million sales in 2024. Therefore, the sales figure that BYD can achieve in 2024 will exceed the revised annual target of over 4 million vehicles that Li Yunfei debunked in September this year.