Xiaomi's SU7 priced at over 800,000 yuan has become a hit, but ultra-luxury cars are still hard to sell

![]() 11/07 2024

11/07 2024

![]() 616

616

Recently, Xiaomi launched several new software and hardware products at its 2024 new product launch event, including the new Xiaomi 15 series smartphones and the mass-produced version of the Xiaomi SU7 Ultra, a new car priced at over 800,000 yuan, which has been nicknamed by the outside world as 'really daring to set the price'.

Looking back to before the launch of the Xiaomi SU7, there were many guesses about its price. Lei Jun personally responded, stating that cars equipped with the same battery pack as the SU7 have an average price of over 400,000 yuan and that it was impossible to sell at a starting price of 99,000 or 149,000 yuan.

However, the starting price of the Xiaomi SU7 ended up being just over 200,000 yuan, still offering excellent value for money. Nevertheless, just over half a year later, Lei Jun dared to set the price of the new car at over 800,000 yuan. What is the confidence behind domestic luxury cars?

More importantly, the current ultra-luxury car market is collectively "enduring a crisis," with some ultra-luxury car brands experiencing a significant drop in sales. For domestic car brands, is this an opportunity to overtake on the bend or a good time to seek win-win cooperation?

1. Ultra-luxury cars collectively lose steam

According to information released by Xiaomi, within 10 minutes of pre-sale, pre-orders for the Xiaomi SU7 Ultra exceeded 3,680 vehicles. It is worth mentioning that the outside world has always considered the Xiaomi SU7 to resemble a "Ferrari," and the positioning of the Xiaomi SU7 Ultra as a "high-performance racing car" is also considered a direct competitor to Ferrari.

Lei Jun also recently revealed the pricing details behind the Xiaomi SU7 Ultra. He said that the company had discussed the pricing of the Xiaomi SU7 Ultra for months internally, but Lei Jun believed that the price should be set the same as benchmark products (such as Tesla). This way, some of the profits can be used to increase R&D investment and provide better products for users.

There are indeed many benefits to the high-end positioning of cars, one of which is the high profit margin mentioned by Lei Jun. However, maintaining a high-end brand seems to be becoming increasingly difficult.

According to data from the China Passenger Car Association, since January to September this year, sales of traditional luxury cars such as Maserati, Bentley, Rolls-Royce, and Ferrari have all declined to varying degrees.

Among them, McLaren and Maserati have seen the most significant declines. Taking Maserati as an example, its cumulative sales from January to September this year declined by up to 79% compared to the same period last year, with monthly sales from July to September averaging only about 30 vehicles, or an average of only one vehicle sold per day.

Once upon a time, ultra-luxury cars enjoyed a long period of "good days" in the Chinese market. In 2021, sales of million-yuan luxury cars in the domestic market peaked, accounting for about 1.38% of the market.

In 2022, the overall market share of ultra-luxury cars began to decline to 1.16%. However, some luxury car brands still achieved good sales that year, with Ferrari, Lamborghini, and Bentley recording sales growth rates in China of 73%, 9%, and -9% respectively. Ferrari also added 1,552 new Chinese owners that year.

However, starting from 2023, ultra-luxury cars have reached a turning point, with their market share shrinking to 1.08%. Sales of Ferrari, Lamborghini, and Bentley in China have all declined to varying degrees, by 4%, 17%, and 18% respectively.

Amidst declining sales, "ultra-luxury cars" have also had to actively participate in price wars. Recently, the collective "rebellion" of Porsche China dealers hit the trending topics, revealing dealers' dissatisfaction with inventory pressure and increasing discounts, which have even reached the point of selling cars at a loss.

In the past six months, promotional messages such as "Buy a Taycan, Get a Xiaomi SU7 Free," "Bentley Flying Spur Discounted by 700,000 yuan," and "Maserati as Low as 500,000 yuan" have emerged in clusters. In addition, BBA could not sit idly by, with price reductions of over 100,000 yuan for many models.

However, ultra-luxury cars that have proactively lowered their prices have instead made car owners feel "betrayed." Even worse, BMW's "flip-flopping" on price reductions, increases, and reductions this year has eroded consumers' perception and trust in luxury car brands.

It can only be said that, under the continuous "price war" in the domestic new energy vehicle circle, consumers have almost become "desensitized" to price reductions. Coupled with erratic pricing strategies, consumers are more inclined to wait and see rather than rush to buy luxury cars.

2. New force automakers fill in the gaps

In addition to strategic issues, the reason why ultra-luxury cars are "hard to sell" is also due to the macroeconomy entering a "tightening era," making high-end consumption more cautious among the general public.

However, it is worth noting that the core consumer group for ultra-luxury cars is ultra-high-net-worth individuals. The impact of the economic environment is unlikely to prevent them from affording a new car. Therefore, the "loss of steam" in ultra-luxury car sales is more due to their market share being eroded by other brands.

According to a survey by the automotive self-media "Jia Shi Pai," before the explosion of the new energy vehicle market in 2020, sales of imported cars and joint venture/wholly-owned brands in the domestic market had been steadily increasing. However, starting from 2020, their market share began to decline, especially in the field of imported cars dominated by ultra-luxury cars, whose market share fell by over 50% compared to its peak.

Based on the actions of domestic new energy automakers in recent years, it is self-evident who has taken over the market share of ultra-luxury cars.

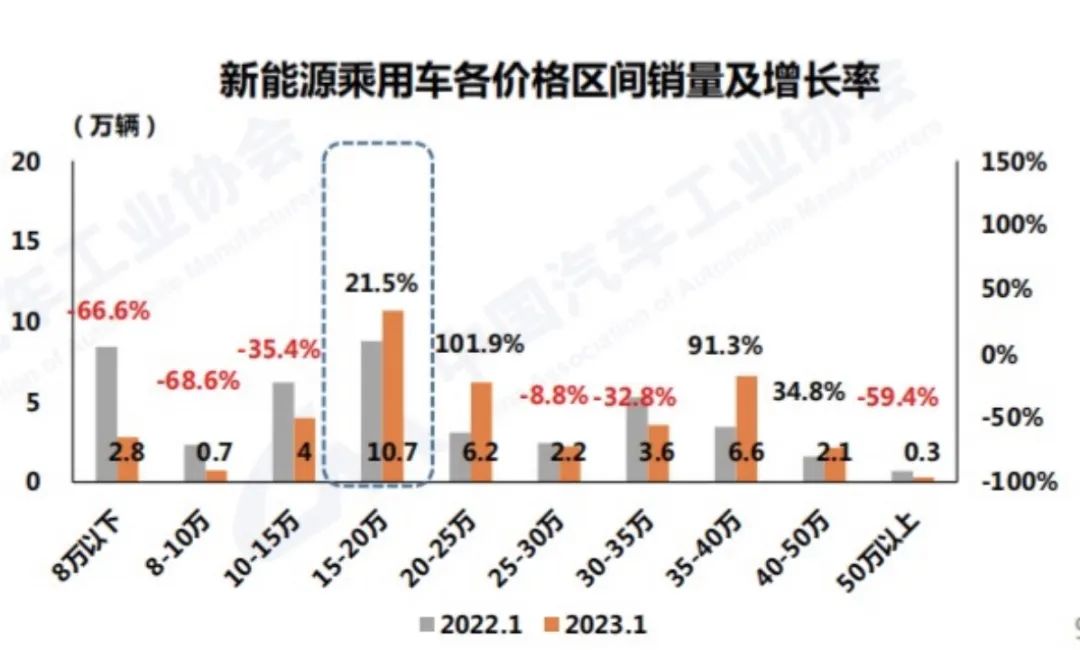

Starting from 2021, sales of new forces such as Li Auto, AITO, NIO, and others have begun to grow rapidly, with their main sales prices hovering around 300,000 yuan. According to statistics from the China Association of Automobile Manufacturers, sales of models priced between 350,000 and 400,000 yuan saw the largest increase last year, with a year-on-year growth rate exceeding 100%.

Among them, the high-end flagship SUV AITO M9, released last year, has a main sales price of around 500,000 yuan. In the nine months since its launch, cumulative bookings have exceeded 150,000 vehicles.

After the release of the AITO M9, the phrase "If you don't work hard, you can only drive BBA" became an online meme. Compared to the successive price reductions of BBA, the trend of domestic new energy vehicles collectively aiming high has become increasingly apparent.

For example, BYD launched the 660,000-yuan Denza D9 and the over-million-yuan BYD Look up U8; Great Wall Motors' Tank 700 and Geely's Zeekr 001FR are priced above 700,000 yuan; and NIO's ET9 is priced at 800,000 yuan.

Zhou Hongyi, a well-known figure in the automotive industry, believes that domestic new energy vehicles will redefine luxury cars. The rise of new energy vehicles has led to a new automotive trend, guiding consumers to gradually transition from brand orientation to value orientation. It also provides consumers with more choices, including fuel vehicles/electric vehicles, intelligent driving, smart cabins, and more personalized in-car configurations.

However, although domestic automakers frequently aim high, market performance is not always as optimistic as expected. Taking BYD Look up U8 as an example, its sales have declined from 1,652 vehicles in January to 294 vehicles in September this year.

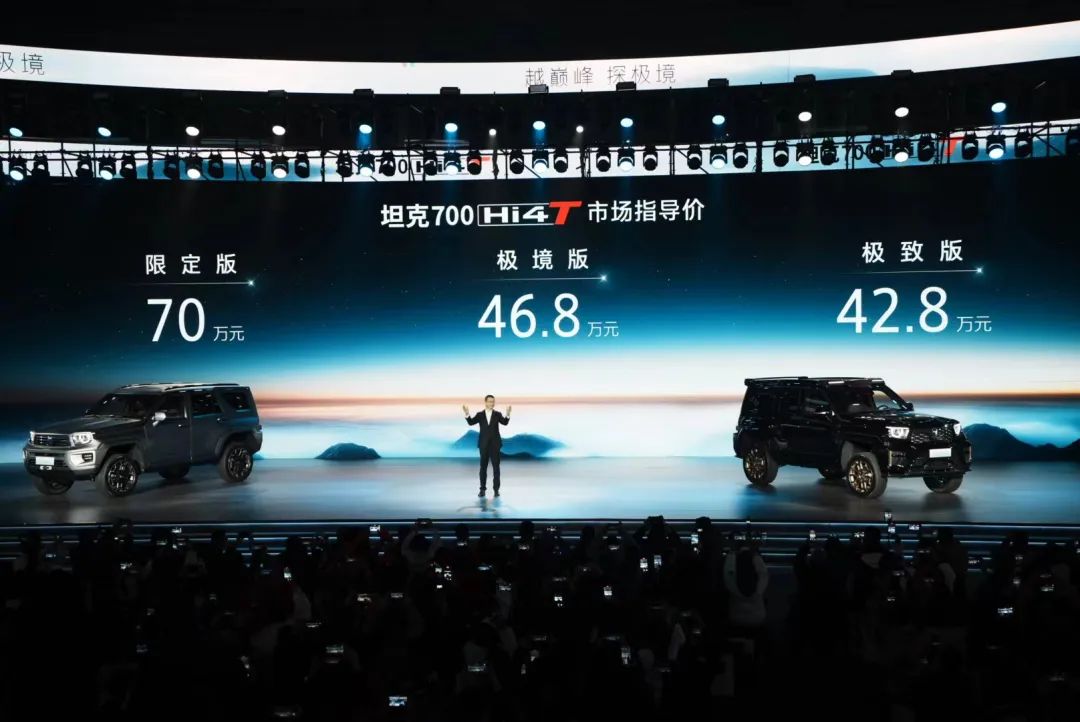

Since its launch in February this year, sales of the Great Wall Motors Tank 700 have also declined from 2,235 vehicles in March to 1,196 vehicles in September. Although the initial version was priced at 700,000 yuan, subsequent versions have been reduced to a price range of just over 400,000 yuan.

The core reason why domestic high-end new energy vehicles are "not popular" lies in brand momentum. Generally, brand development is easier from top to bottom than from bottom to top. It is unrealistic to expect to change consumers' perception of a brand through a single product.

In addition, most traditional luxury car products have been verified by the global market. In contrast, although domestic high-end new energy vehicles are worthy of their million-yuan price tags in terms of technology and configuration, they may not fully meet user needs in terms of usage experience. For example, functions such as in-situ turning and emergency floating water of BYD Look up U8 are considered too impractical by many consumers.

This means that for domestic high-end new energy vehicles to successfully "aim high," they must not only be willing to invest and use high-quality materials but also importantly, refine the details. These "invisible product strengths" are the core competitiveness of high-end luxury products.

3. The "long-termism" of domestic automakers

Although overseas ultra-luxury car brands have collectively encountered setbacks in the Chinese market in recent years, it is more accurate to say that they are temporarily dormant rather than defeated. Once the "lion awakens," they will remain formidable competitors.

Recently, Audi announced that its new A5L model will be equipped with Huawei's intelligent driving system, officially joining Huawei's intelligent driving "circle of friends." It is worth mentioning that Audi is taking an unconventional path by equipping its first fuel vehicle, rather than an electric vehicle, with Huawei's intelligent driving technology.

Mercedes-Benz also recently released a video showcasing the world's first demonstration of its "L2++" level mapless intelligent driving system. Earlier, there were media reports that Mercedes-Benz would adopt an advanced intelligent driving solution provided by Momenta, which will be applied to its all-new pure electric CLA.

It can be seen that in the new energy era of the automotive industry, overseas luxury car brands have started slowly and face greater difficulties in transformation, giving domestic new energy automakers an opportunity to "overtake on the bend."

However, some luxury car brands have begun to step down from their "thrones" and even show courage by breaking the mold to readjust the underlying logic of their products and seek new transformation paths.

Admittedly, China's new energy vehicle industry demonstrates strong competitiveness and development potential, whether in terms of the completeness of the industrial chain, the speed of technological progress, or the improvement of intelligence levels.

However, it cannot be ignored that the long-accumulated brand heritage of overseas luxury car brands is still their "trump card." Therefore, in this competition in the high-end automotive market, what the domestic automotive industry needs to consider is not just how to create a Chinese version of "Ferrari, Maserati" but to explore more cooperation in production, manufacturing, intelligent driving technology, and other aspects. By enhancing product capabilities in a subtle manner, they can step onto the global stage.

To establish a brand as a global consensus, automakers must not only "look up" but also "get down to work." After all, short-term sales do not represent everything. For China's automotive industry to win in the second half of the new energy vehicle race, more accumulation is needed.