Three Paths for Foreign Auto Companies | CIIE, The Way Out

![]() 11/08 2024

11/08 2024

![]() 652

652

Introduction

Introduction

How can the 'entrance' of the CIIE become the 'exit' for a way out? Foreign auto companies urgently need to seize this opportunity.

As dawn illuminated the signboard of the 7th China International Import Expo (CIIE), the city, though close to the Start of Winter solar term, exuded a warm and moist ambiance.

'After intense internal competition, foreign and joint venture auto companies are struggling, and the CIIE is predominantly attended by foreign businesses. Will automobiles still be the highlight?' a curious friend asked Mr. He while visiting the exhibition.

'Some see a decline in standards, others see reduced investment, and still others notice that auto companies are shifting their exhibition focus from futuristic showcases to promoting car sales,' Mr. He paused, 'but the transition from exhibit to commodity is a victory in itself. This year, we can also see that the integration of Chinese and foreign industries is still deepening.'

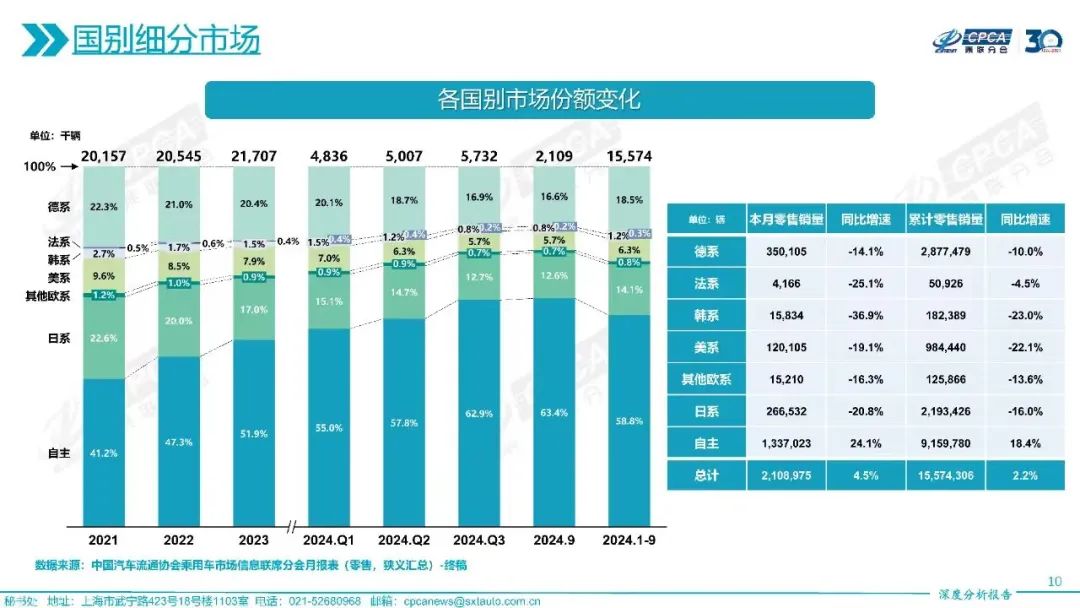

In the first three quarters of 2024, domestic passenger vehicle (excluding imports) retail sales increased by 2.2% year-on-year to 15.574 million units, with local brands achieving a growth rate of 18.4% and a market share of 58.8% at 9.16 million units.

'Joint venture brands were suddenly silenced,' remarked a friend who had worked in the communication department of a foreign auto company with deep emotion. 'They suddenly realized that no matter how hard they tried, they couldn't break out of the dilemma, leaving them feeling powerless.'

However, the automotive industry is intertwined, and the 'opposition and unity' between China and foreign countries are always two sides of the same coin.

'Thinking doesn't have to be binary, and the market doesn't have to be a zero-sum game.' Auto brands, whether Chinese or foreign, gasoline or electric, are all integral parts of the Chinese automotive industry once they enter the domestic market.

'Carefully observe, the CIIE presents at least three paths for foreign auto brands. Therefore, for foreign auto companies, the 'entrance' of the CIIE is indeed the 'exit' to a way out.'

Mr. He pointed diagonally ahead, with the cuffs of his gray trench coat reflecting the theme board of this year's CIIE, 'New Era, Shared Future' displayed prominently against a fiery red background.

'Sell what you're good at'

Under the pressure of intense internal competition within the industry, everything is inevitably viewed through a darker lens.

Moreover, the CIIE indeed faces objective factors such as 'budget controls by participating countries' and 'declining novelty.'

Walking through Hall 2.1 for automobiles, occasional criticisms such as 'nothing to see here' and 'it's Step back ' (regressed) could be heard, much like major auto shows before 2019, where dismissive evaluations seemed to have become politically correct and fashionable.

'In the past, auto companies' participation in the CIIE was positioned to showcase cutting-edge technologies or concepts,' began a more cynical friend, criticizing the 'vulgarization' and 'utilitarianism' of auto companies at the CIIE. 'Now, so many booths only have cars and no technology. Besides being imported cars, what's the difference from an auto show?'

'If the audience sees a good car and the auto company showcases what they're good at, they can give it a passing grade.' More voices were relatively moderate. 'Look, didn't Toyota, Nissan, and Volkswagen still bring plenty of technology displays?'

'What you're good at is actually the first way out. Showing it isn't just about 'having no technology to show, so only cars can be displayed' or merely thinking about promoting sales.' Mr. He added an explanation before his friend could question him, 'The transition from exhibits at previous CIIEs to commodities at this CIIE is already a symbolic gesture, indicating that technology and products are accepted by the market.'

In Hall 2.1, led by Mercedes-Benz and BMW, 'pure car booths' were set up. If you delve into the lineup, as Mr. He said, it's not about weakness or utilitarianism.

BMW still values the display of cutting-edge technologies and concepts. If you only saw performance cars like the new BMW M5 in Hall 2.1, you missed out on the entire exhibition. In the 'Innovation Incubation Zone' of the North Hall, BMW Group's Asia Pacific Technology Center set up a booth showcasing innovative technologies such as artificial intelligence and large language models from 10 startups from Germany, the United States, South Korea, and other countries.

Although Mercedes-Benz's display lineup consisted of only 10 models, it had a different connotation than before – the slogan shifted to 'No matter petrol or electric, it's all Mercedes,' positioning itself as 'luxury mobility.' The off-road icon, the Mercedes-Benz G-Class, showcased not only its core 'off-road trio' but also its electrified powertrain and digital off-road technology. Combined with top models like the Mercedes-Maybach EQS SUV and Mercedes-AMG C 63 S E PERFORMANCE F1, 'Mercedes is striving to excel in electrification and intelligence,' the intention is self-evident.

The concept of 'transforming exhibits into commodities' was first mentioned by Steve Hill, Senior Vice President of General Motors and President of General Motors China. At this year's CIIE, the booth for General Motors' high-end import business, Cadillac, saw little change in its lineup, but the status of the Chevrolet Tahoe SUV transitioned from a mere exhibit to a salable commodity, marking progress, and more products like the GMC Yukon will soon enter China.

'Embedding concepts and technologies into market-oriented models is progress in itself and a response to previous CIIEs,' Mr. He's perspective was always surprising yet undeniable. 'What better philosophy or forward-looking prediction is there than selling what you're good at?'

He used Ford as an example. After experiencing fluctuations in Chang'an Ford's business, Ford made significant adjustments to its strategy in China, eliminating all small cars, including the once globally best-selling Focus. Only medium and large cars that Ford excels at, such as the Edge and Explorer, were retained. As a result, although Ford couldn't expand its scale, it maintained its profit per vehicle, and its dealer profitability ratio was outstanding.

'Contraction doesn't necessarily mean defeat; it's also a form of self-preservation under pressure,' Mr. He said with a twist. 'Audiences are always picky. In the past, when there were more technology displays than actual cars, they said it was too abstract. Now, with more actual cars than technology concepts, they complain it's not flashy enough.'

Precisely because 'technology shows' cannot completely replace 'car displays,' even Hyundai Motor, which has always used the CIIE as a showcase for cutting-edge concepts, divided its booth in half, with the HTWO hydrogen energy industry on the left and high-performance cars like the Elantra N and IONIQ 5 N on the right.

'Perhaps the biggest shortcoming for auto companies isn't silencing critics but whether Cadillac and imported Hyundais can introduce their advantageous models faster. After all, the window for large gasoline vehicles is limited, and competitors like Wenjie and Lixiang are aggressively attacking,' he said, raising concerns and worries after defending auto companies.

Leveraging Chinese Technology

Since over a year ago, when Volkswagen negotiated technological cooperation with XPeng and SAIC, and Stellantis invested in using the Zero Run platform, Chinese automotive technology has been reverse-exported to foreign auto companies, sparking a new wave.

If we trace back further, foreign auto companies establishing R&D centers and design teams in China and then globalizing some of their achievements was an earlier example of 'China nurturing the world.'

As the Chinese automotive industry 'changed lanes to overtake,' the advantages of the electrification and intelligent industrial chain quickly became the new pillars that smart foreign auto companies intended to leverage. The display lineup at this year's CIIE further signifies that the path of 'leveraging Chinese technology' inherently possesses an escalation and iteration mechanism.

'I knew about the collaboration between Toyota and Pony.ai years ago. What's there to see now?' A friend, like an electronic toll collection (ETC) system, argued with Mr. He.

'What vehicle is the L4 system being tested on this time in collaboration with Pony.ai?' Mr. He countered.

'The Bozhi 4X.' The ETC replied somewhat puzzled.

'What was the predecessor of the Bozhi 4X?'

'The bZ4X, which suffered a bit of a setback.'

'On the marketing front, if L4 can be implemented, how will consumers view the intelligence of Bozhi and bZ in the future? Isn't it an elevation of image?' Seeing the ETC silent, Mr. He pressed on, 'On the technical dimension, based on the latest mass-produced vehicle, introducing a thousand Robotaxis that have already accumulated 40 million kilometers of driving, with an additional 10 million kilometers annually, isn't this better for the learning and accumulation of intelligent vehicles compared to using specially made test vehicles?'

We suddenly realized.

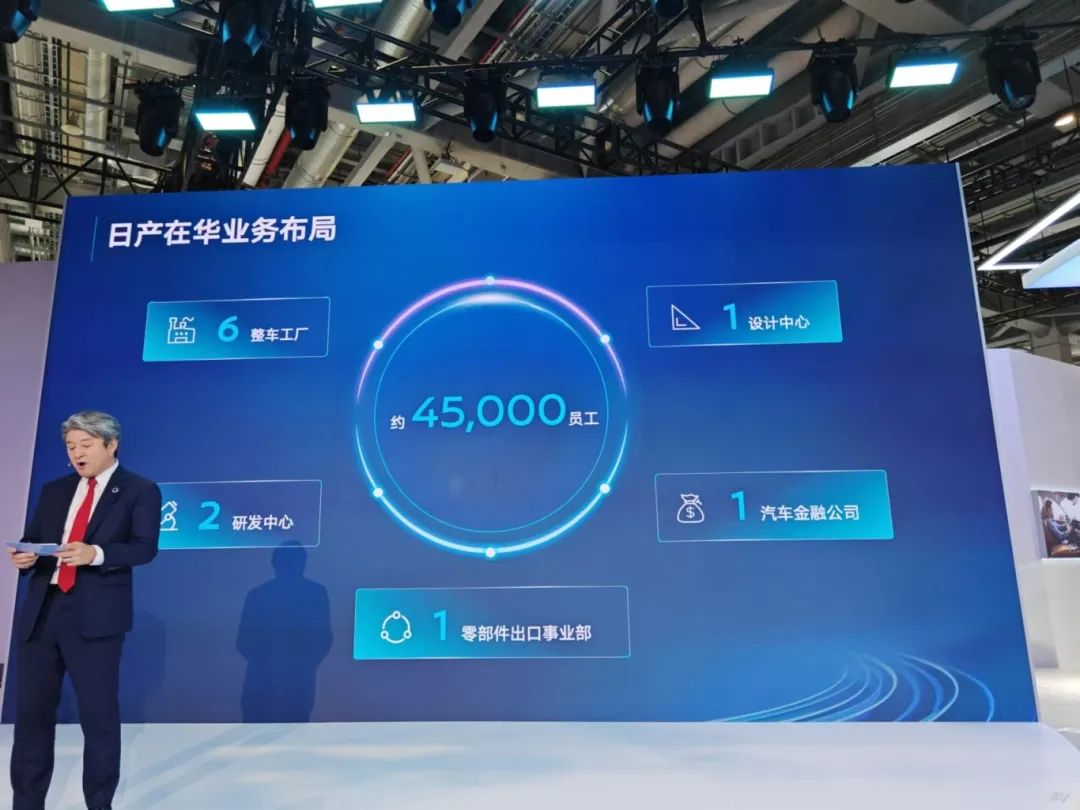

'Nissan's approach to leveraging Chinese technology is also worth delving into.'

Initially, we thought the collaboration between Nissan and WeRide was just an old story of 'procuring supplier technology and integrating it into vehicles.' However, after an in-depth conversation with staff, we learned that the e23 mobility service they cooperated on in Suzhou's Xiangcheng District has iterated from the Leaf to the Ariya in just two years for carrier vehicles. In the future, Nissan hopes that its technological collaboration with WeRide can nurture its passenger vehicle business and even expand globally.

Admittedly, WeRide currently dominates the intelligent driving technology of e23, but Nissan needs to integrate the system into the entire vehicle, develop its own intelligent cabin technology, and rationally apply the accumulated data to better provide mobility services for users.

After establishing NMS Nissan Mobility Services Co., Ltd., Nissan independently developed an intelligent route planning system integrating vehicles, roads, and clouds. 'Who says automakers can't master core technologies on their own?'

Deep cooperation, joint ventures, and integration with Chinese technology providers are the surest ways for foreign auto companies to quickly acquire cutting-edge technology. Volkswagen and Horizon Robotics are rapidly progressing. According to Horizon Robotics' prospectus and related information channels, its top five customers in 2023 were Lixiang ONE, FuRuiTaiKe, SAIC, and Inovance Technology, while in the first half of 2024, they became Corezone, NavInfo, Lixiang ONE, FuRuiTaiKe, and BYD.

The rising star, Corezone, is a joint venture between Volkswagen's software business CARIAD and Horizon Robotics. Its English name, CARIZON, is a fusion of their names, with Volkswagen and Horizon Robotics holding a 60:40 share ratio. Since 2023, Horizon Robotics has licensed algorithms and software related to advanced driver assistance and autonomous driving solutions to Corezone – simply put, supplying intelligent driving systems for Volkswagen vehicles.

Therefore, at the CIIE, Volkswagen's booth reserved a corner for CARIAD, with the slogan 'Developed in China, Innovated for China.'

Taking the Chinese Supply Chain Abroad

While many disagree with Milton Friedman's 'laissez-faire capitalism,' his assertion is worth contemplating: 'The greatest danger to consumers is monopoly – whether private or state-owned. The most effective protection for them is domestic free competition and global free trade.'

Our country, against the backdrop of a partial global trend towards de-globalization, remains committed to promoting a dual-circulation economy and emphasizes exports. The automotive industry plays a pioneering role in going global.

For China to rise, its manufacturing sector must thrive; for China to achieve global influence, its manufacturing sector must reach global markets; for China's manufacturing sector to reach global markets, it must be led by the automotive industry, the crown jewel of manufacturing; and for China's automotive industry to reach global markets, it must intensify its efforts to go abroad.

"A high wall built on a weak foundation will inevitably crumble," the prosperity of the entire automobile industry is inseparable from the support of auto parts. Apart from exporting complete vehicles, exporting auto parts and supply chains is a more challenging task with far-reaching implications. While sailing overseas alongside local brands is a natural first response, overseas automakers are now also helping Chinese auto supply chains open the door to globalization.

Local battery manufacturers such as CATL and BYD are accompanying foreign brands like Tesla in expanding into other markets. Momenta, as a leading intelligent driving supplier, will also contribute to the global segment of foreign automakers. This year's CIIE even featured automotive brands that proudly waved the banner of "Helping Chinese Suppliers Export".

Isao Sekiguchi, Global Vice President of Nissan Motor Co., Ltd. and General Manager of Dongfeng Nissan, told the media that the establishment of the Nissan (China) Parts Export Division aims to strengthen relations with China's supply chain. The number of cooperative suppliers has increased from 50 at the inception of Dongfeng Nissan to 540 today, helping Chinese suppliers achieve exports. Against the backdrop of industrial transformation, exported products have also evolved from basic components to high-tech components related to electrification, such as batteries and battery management systems.

As the Chinese automotive industry achieves a "lane change and overtaking" through electrification and intelligence, we must not forget the fragility of profitability.

As everyone knows, capital is a crucial element in the electrification and intelligence of automobiles.

BYD's leading electric drive technology and Huawei's intelligent technology are closely related to their massive investments over the years. Volkswagen alone is investing over 50 billion euros in its MEB electric platform. Toyota plans to invest $35 billion to promote electrification, with Lexus gradually achieving full electrification. NIO, a leading new energy vehicle maker, once asserted that 20 billion yuan is the threshold for manufacturing vehicles (smart electric vehicles).

It is no wonder that Volkswagen and Ford have allied, and General Motors and Honda have teamed up. Both electrification and intelligence are money-burning pits, and it is better to work together than to go it alone. This is because new energy vehicles have not yet reached the ownership level of fuel vehicles, so the costs cannot be fully amortized.

Foreign automakers participating in amortizing the astronomical costs of electrification and intelligence and pushing the relevant industrial chain overseas is the correct way for the rise of the Chinese automotive industry.

"Win-win has never been just an empty phrase," Mr. He always says meaningfully. "The CIIE is not just a grand spectacle; those who understand can always see the truth, while those who don't only remember conspiracy theories and heretical doctrines."