Revenue surpasses Tesla, is BYD's debt risk misunderstood?

![]() 11/14 2024

11/14 2024

![]() 546

546

"Debt ratio does not equal high risk. Judging a company's risk solely based on the asset-liability ratio has significant limitations."

@TechNewSense Original

BYD's quarterly revenue surpasses Tesla for the first time, but is labeled "high risk" due to its debt ratio?

Recently, BYD's third-quarter report revealed that its revenue reached approximately 201.125 billion yuan, an increase of 24.04% year-on-year, surpassing Tesla for the first time. Furthermore, BYD's gross margin rebounded quarter-on-quarter in the third quarter.

However, there is a notable gap between BYD and Tesla in terms of net profit and market value, two key indicators. BYD's net profit attributable to shareholders in the third quarter was 11.607 billion yuan, while Tesla's net profit for the same period was $2.167 billion (approximately 15.4 billion yuan). On the first trading day after BYD released its third-quarter financial report, its market value was less than one-sixth of Tesla's.

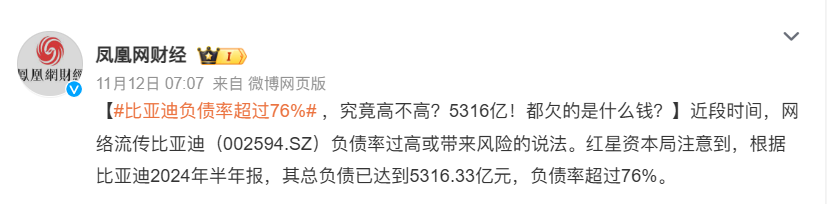

Perhaps due to the gradual emergence of operational difficulties faced by some new energy vehicle (NEV) companies, BYD's debt ratio has also become a focus of public attention. According to BYD's third-quarter financial report, the asset-liability ratio of this leading NEV company reached 77.47%. As a result, many people began to worry whether BYD was facing the risk of excessive debt burden, and some even compared BYD to Evergrande.

01

Don't Just Look at the Debt Ratio

In fact, the debt ratio does not equal high risk. Judging a company's risk solely based on the asset-liability ratio, a single indicator, obviously has significant limitations.

A secondary market investor told "Technode App" that the asset-liability ratio is a reverse indicator for evaluating a company's debt repayment ability. However, from an investor's perspective, a company's high debt ratio is not necessarily related to its quality.

Currently, the NEV industry is undergoing unprecedented rapid development. It is a technology-intensive and capital-intensive industry that is highly dependent on capital investment. Companies need to invest huge amounts of funds in R&D innovation, capacity expansion, market expansion, and other aspects.

Looking at global automakers, most have relatively high asset-liability ratios.

Among foreign automakers, Ford's asset-liability ratio reached 84% in the first half of this year, General Motors' was 75%, and Volkswagen's and Toyota's were 70% and 61%, respectively. Among domestic automakers, Thalys' asset-liability ratio was 89.02%, BAIC BluePark's was 85.02%, and JAC Motors' was 69.61% in the first half of this year. It is worth mentioning that Leap Motor, known as a dark horse, had an asset-liability ratio exceeding 100% in both 2019 and 2020.

Looking at the world's most prominent high-end manufacturing companies, Apple's asset-liability ratio is 84%, Airbus's is 85%, and Dell's and Boeing's are even higher, at 103% and 117%, respectively. Overall, BYD's asset-liability ratio remains at a reasonable level within the industry.

Compared to the "hollow" number of the asset-liability ratio, the debt structure can better reflect a company's actual debt situation. Among a company's total liabilities, some are operating liabilities, which are unpaid amounts in the daily operation process and are interest-free, while others are debts raised from the capital market, which are interest-bearing and create pressure.

In 2023, BYD's borrowings from financial institutions amounted to only 30.3 billion yuan, accounting for only 5% of its total liabilities, with interest-free liabilities accounting for over 90% of the total. By the first half of 2024, BYD's interest-bearing liabilities were only 21.4 billion yuan, accounting for 4% of its total liabilities. Not only is this proportion low, but it also shows a gradual downward trend.

Compared with its peers, in the first half of 2024, Geely Holding's interest-bearing liabilities were 86 billion yuan, accounting for 19% of its total liabilities, while Great Wall Motor's were 17.7 billion yuan, accounting for 14% of its total liabilities. BYD's figures are already at a low level within the industry.

02

No Worries About Debt Repayment Ability

It is worth noting that BYD's financial expenses in 2023 were -1.5 billion yuan. A significant portion of these financial expenses consists of net interest expenses, which represent the difference between interest expenses incurred from interest-bearing liabilities and interest income generated from monetary cash. A negative financial expense indicates that there is no pressure to repay interest and that there is even interest income.

Whether interest-bearing or interest-free, it is still necessary to assess BYD's debt repayment ability. In the first half of this year, BYD borrowed 21.353 billion yuan from financial institutions, while its consolidated cash and cash equivalents balance for the same period was 54.227 billion yuan, which is more than sufficient to repay the principal of its interest-bearing liabilities.

According to the 2023 financial report, BYD's cash inflows from operations amounted to 610 billion yuan. Over 430 billion yuan was used for interest-free liabilities such as payments to suppliers and employee salaries, leaving a net operating cash flow of 170 billion yuan, which eliminates any concerns about repayment.

BYD's sound financial condition enables it to minimize the settlement cycle with suppliers. According to the 2023 annual report, BYD's payment terms with suppliers are 128 days. However, according to Wind data, the average payment terms for suppliers of 32 listed automakers in 2023 were 189 days.

Globally, Toyota was the top debtor in 2023 with liabilities of $217 billion, based on its enormous business scale with annual sales exceeding 10 million vehicles. In contrast, BYD's ability to incur liabilities of 500 billion yuan demonstrates its outstanding operational strength.

As BYD's performance continues to climb and its global layout accelerates, a high debt ratio is inevitable. In terms of the gross margin of the automotive business, which measures a company's main business profitability, BYD's stands at 25.6%. Maintaining a high gross margin showcases BYD's stronger anti-risk capability compared to other automakers.

Moreover, most of BYD's debts are naturally incurred along with business growth rather than accumulated through high-risk external financing. If BYD, which is in a transitional phase, slows down its innovation pace due to concerns about debt issues, it would be putting the cart before the horse.