Integration is not the end, Geely's new test has already begun

![]() 12/06 2024

12/06 2024

![]() 494

494

The "elephant" Geely Automobile has begun to "turn around".

Recently, news of Geely's sub-brand integration has been coming in one after another. From Geometry being merged into Yinhe, Radar Auto being incorporated into the Geely Group, to the merger of Zeekr and Lynk & Co, Geely has repeatedly demonstrated its determination and speed to accelerate integration.

All this stems from the "Taizhou Declaration" issued by Geely in September this year, a public declaration of Geely's "strategic focus and strategic integration." This "elephant" that once firmly implemented a multi-brand strategy has begun to turn around and "slim down."

Before the issuance of the "Taizhou Declaration," Geely's internal business integration had already quietly begun. Sources say that starting from the second quarter of this year, Geely began to make major adjustments to its R&D system, reset the CTO, integrate similar teams, and strengthen platform construction.

It can be said that integration is the strategic mainstay of Geely in 2024 and will affect Geely's development for a long time to come. The integration of any enterprise involves major adjustments to its organizational structure and personnel. Whether the integration of sub-brands can truly be achieved, and how to coordinate the relationships between the originally different structures and teams, these issues test Geely's integration capabilities.

Business Adjustment: Geely Moves Toward Large-Scale Integration

In fact, for a long time, the public's impression of Geely has been both familiar and vague. Everyone has heard of the name Geely, but it's hard to pin down an accurate corporate label for it; everyone knows that Geely has many brands, but it's difficult for outsiders to list them all, making it a challenging question.

Not only is there external confusion about Geely's brand recognition, but an insider from Zeekr also once said that even after working in the company for many years, it is difficult to sort out the equity relationships between the various brands.

The general consensus outside is that Geely is a very large and complex "automotive empire." Since the "Ningbo Declaration" in 2007, Geely has been adopting an expansion strategy, taking the philosophy of "the more children, the better the fight." Starting with the acquisition of Volvo, Geely has successively acquired Proton, Lotus, London Electric Vehicle Company, etc., from the outside, and internally incubated brands such as Lynk & Co, Zeekr, Yinhe, and more.

It has to be said that the strategy of separating brands has allowed Geely Automobile to benefit from the times. As history moves forward, Geely seems to believe that business integration is the way to go at this point. This conforms to the old saying: "After long union, comes division; after long division, comes union!"

After 17 years of separation, Geely has begun to move towards large-scale business integration.

Sources say that starting from the second quarter of this year, Geely's senior management began to frequently meet to discuss the integration of the R&D system, with participants including Geely's Central Research Institute and the intelligent driving, cockpit, electronic and electrical architecture, electric powertrain, vehicle platform, and backend procurement and supply chain teams behind each sub-brand.

If the integration of the R&D system is the prelude to Geely's large-scale integration, then the "Taizhou Declaration" publicly released by Geely in September is a glimpse of the full picture of the integration plan.

Geely Automobile's founder and Chairman of the Board, Li Shufu, clearly announced through the "Taizhou Declaration" that Geely has entered a new stage of strategic transformation, focusing on the future development of the automotive industry with five major initiatives: "strategic focus, strategic integration, strategic synergy, strategic stability, and strategic talent."

In October of this year, Geely officially merged the Geometry brand into the Yinhe brand. In the following two months, news of mergers and reorganizations among Geely's sub-brands poured in. First came the news that the electric pickup truck brand Radar Auto was incorporated into Geely, which was later confirmed by Radar-related personnel.

On November 14, Geely Holding announced the optimization of the equity structure of Zeekr and Lynk & Co, streamlining equity relationships, reducing related-party transactions, eliminating horizontal competition, and promoting deep integration and efficient fusion of internal resources. Zeekr will acquire a total of 50% equity in Lynk & Co by purchasing shares held by Geely Holding and Volvo, and an additional 1% through capital increases to Lynk & Co, involving more than 9.3 billion yuan.

In addition, there are rumors that LEVC EV380 will be incorporated into the Geely Automobile Group, while Volvo may withdraw its shareholding in Polestar, which may ultimately be absorbed into Zeekr.

Geely has entered a massive integration period.

Integration Builds Momentum, From "Fighting" to "Waging War"

According to incomplete statistics, since September, at least six sub-brands under Geely have undergone varying degrees of integration, with Geely repeatedly demonstrating its determination to accelerate integration.

The reason is that Geely may have seriously assessed the market situation, which has changed dramatically. In recent years, the global automobile production and sales scale has continued to grow, especially the rapid growth of China's new energy vehicle market. Amidst this huge market opportunity, in addition to the transformation and expansion of traditional automakers in the new energy field, many new auto brands have also emerged, making the automobile market become "crowded."

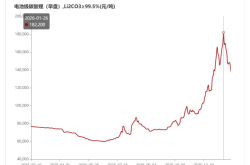

China's automobile market has become the most fiercely competitive market globally. To compete for a larger market share, since 2023, China's automobile market has witnessed round after round of price wars, with competition entering a white-hot stage. According to data from the China Passenger Car Association, from 2020 to 2023, the profit rate of China's automobile industry was 6.2%, 6.1%, 5.7%, and 5%, respectively, showing a downward trend.

At the same time, Geely Automobile's sales fell out of the top spot among Chinese independent brands. In 2022, Geely's annual sales volume was 430,000 units less than that of BYD, losing the top spot in sales volume among Chinese independent brands, which may be a major pain point prompting Geely to make adjustments.

Under such circumstances, Geely's market environment has rendered the strategy of "the more children, the better the fight" ineffective. Facing the new situation of market competition, it is necessary to cultivate stronger killer apps to cope with rapid market changes.

Therefore, it has become increasingly urgent to reduce costs and enhance overall competitiveness. However, under years of multi-branding strategies, Geely's sub-brands often experience issues such as overlapping positioning, market competition, and horizontal competition. This problem becomes more apparent as market competition intensifies.

For example, the recently announced merger of Lynk & Co and Zeekr is a very typical case.

In October 2016, Lynk & Co was established, shouldering the important task of premiumizing Geely Automobile, initially focusing on fuel vehicles. With the explosion of the new energy vehicle market, Lynk & Co realized that it could not only focus on fuel vehicles and soon established an electric vehicle business group, launching the Lynk & Co ZERO CONCEPT concept car in 2021.

However, this model was ultimately released under the name Zeekr 001, and Zeekr was also announced, positioning itself as a mid-to-high-end new energy vehicle brand.

This poses a problem: Lynk & Co and Zeekr, which share the same roots, are both targeted at the mid-to-high-end market and young consumers. The only difference is that Lynk & Co focuses on fuel and extended-range vehicles, while Zeekr focuses on pure electric vehicles.

With the intensification of competition in the new energy vehicle sector, such finely segmented brands have competitive shortcomings and are bound to miss out on many users. As a result, Lynk & Co launched a pure electric sedan, and Zeekr also spread news of starting to lay out extended-range vehicles.

The two brands have thus become more convergent, with their positioning becoming more blurred. More importantly, the market has not bought into this, as Lynk & Co's first pure electric sedan, the Z10, is very similar to the Zeekr X model, using the same Geely Hao Han architecture without many new highlights, resulting in unsatisfactory sales of the Z10.

In addition to horizontal competition caused by overlapping positioning, under the multi-brand separation strategy, many of Geely's sub-brands have not developed smoothly.

According to data released by the China Passenger Car Association, sales of multiple models under Geometry have long hovered in the three-digit range in 2024. In October, Geometry's sales market share was only 6%, ranking 82nd among independent brands. Among them, as Geometry's main model, sales of the Geometry A were 1,100 units in October this year, a decrease of 55.39% from the previous month, a direct halving.

In the pickup truck market, which has a scale of around 500,000 units, the electric pickup truck brand Radar Auto sells only around 5,000 units annually. In the domestic MPV market, LEVC EV380, the first electric MPV launched by Wing Zhen Automobile in June, has sold only around 1,000 units so far, with a low profile in the MPV market.

These sub-brands with little presence also need to enhance their potential through integration and maintain resource sharing within the company, such as technology and channels, to reduce cost inputs. After integration, perhaps a different situation will emerge.

Integration is not the end, Geely's new test has begun

Starting in 2024, Geely Automobile's performance has shown a clear upward trend.

The third-quarter financial report shows that Geely Automobile achieved revenue of 60.378 billion yuan in the third quarter, a record high and a year-on-year increase of 20.5%; shareholders' profit attributable to the company was 2.455 billion yuan in the third quarter, a year-on-year increase of 92%. From January to September, Geely Automobile achieved revenue of 167.684 billion yuan, a year-on-year increase of 36%; shareholders' profit attributable to the company reached 13.053 billion yuan, a year-on-year increase of 358%.

In terms of sales, Geely Automobile sold 534,000 vehicles in the third quarter of 2024, a record high and a year-on-year increase of 18.7%; total sales from January to September reached 1.49 million units, a year-on-year increase of 32.1%, completing 74.5% of the annual sales target of 2 million units.

From the perspective of Geely's senior management, integration can bring many benefits and continue the positive trend in performance. Firstly, it can eliminate horizontal competition and market competition among sub-brands; secondly, brand positioning complements each other, helping to enhance the product mix; thirdly, it achieves the unification of the product architecture and complements R&D capabilities; fourthly, the sales network is complementary, expanding user coverage; fifthly, it generates economies of scale, thereby promoting cost reduction and efficiency enhancement.

However, from another perspective, the integrated Geely also faces new challenges.

From the corporate level, integration is not simply 1+1, but involves a comprehensive integration of internal employees, sales channels, supply chain systems, and other dimensions.

Geely's multiple brands have long operated "independently," with separate R&D, sales, and channel teams. Now, with the advancement of integration, the functions of these teams inevitably overlap and intersect. In this situation, how to balance the interests of various teams, how to improve work efficiency, enhance organizational flexibility, optimize internal resource integration, and improve the management system, have become key issues that Geely urgently needs to address.

It cannot be denied that the integration of any enterprise is accompanied by major adjustments to its organizational structure and personnel. Whether the deep integration of sub-brands can truly be achieved and the relationships between the originally independent structures and teams can be coordinated is undoubtedly a test of Geely's integration capabilities.

More troubling is that large-scale organizational and personnel adjustments may cause some turbulence within Geely. Employees may worry about the uncertainty of their career development, and team collaboration may experience temporary chaos due to widespread anxiety. These internal emotional fluctuations are not only related to the smooth progress of integration work but will also directly affect Geely's performance in market competition and its future development potential.

The above content is a must-answer question for Geely's large-scale integration. Only by answering it well can Geely take the next step. Additionally, integration is not the end but a new beginning. Geely must carefully address these new challenges.

However, China Merchants Securities also pointed out that Li Shufu's recent substantial increase in shareholdings by approximately HK$300 million demonstrates the management's confidence in medium- and long-term development and undervalued share prices. This share increase is similar to the previous one before the product explosion from 2016 to 2018, which was a resonance of the maturity of the automobile manufacturing system and the start of the SUV cycle. This round follows the successful exploration of the electrification transformation path after two or three years and is a prelude to the second take-off.

Perhaps both Geely and Li Shufu are well-prepared for the development after integration.

Conclusion

Nowadays, the domestic automobile market is filled with highly skilled players and fierce competition. Geely faces unprecedented challenges. How to successfully break through is undoubtedly one of the key paths, with business focus being undoubtedly crucial. By integrating brands to focus on the core automotive business, Geely can concentrate resources to achieve breakthroughs in product development, technological innovation, market expansion, and other key areas.

The future is full of uncertainties, with a rapidly changing market environment, ever-evolving technological iterations, and constantly evolving consumer demands. Whether Geely can effectively cope with competitive pressures from all sides, achieve leapfrog development, and even regain the top spot in independent brand sales through its integration and focus strategy still needs time to test.