Porsche Faces Tough Times: Layoffs and Market Challenges

![]() 01/03 2025

01/03 2025

![]() 564

564

"The chilling wind from China has already hit us hard," said a Porsche executive.

Text | Huashang Taolue Liang Liang

On December 17, the hashtag #PorscheChinaLayoffs surged to the top of trending topics, sparking heated discussions.

Multiple media outlets have reported that Porsche China is planning layoffs that could affect up to 30% of its workforce. Although the company immediately issued a statement denying the rumors, it is no secret that Porsche's sales and profits in China have plummeted.

[Loss of Spotlight]

"In the past two years, the Cayenne and Macan were hot sellers, and we often ran out of display cars," recalled Mr. Li, a sales manager at a Porsche 4S store in Beijing. Now, however, he is worried about unsold inventory:

"It's been two months, and this Panamera has only been viewed three times."

Mr. Li's troubles reflect the broader cooling of the Porsche China market.

It is reported that Porsche's largest 4S store in Beijing, which once sold nearly 100 new cars in a single month during its peak, has now seen sales halve.

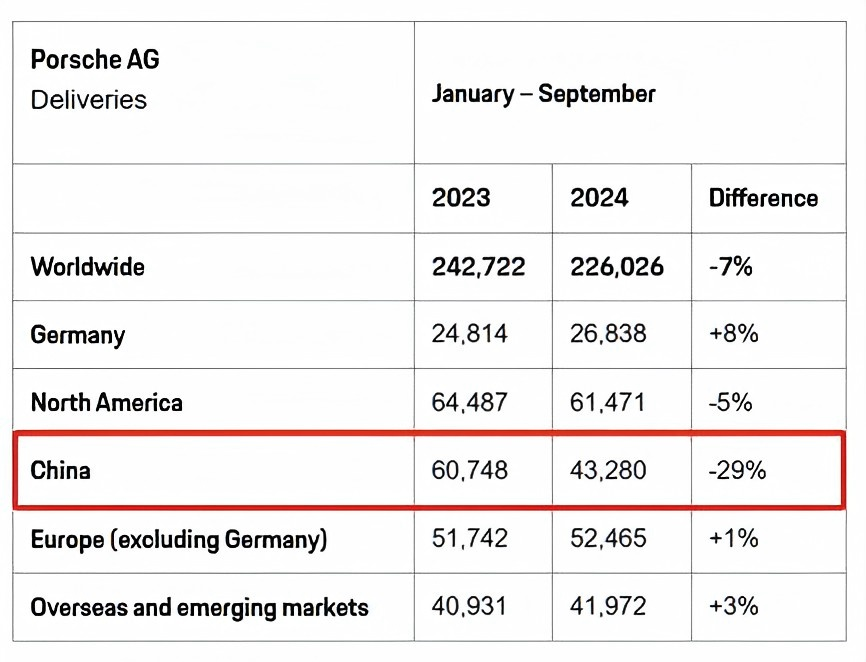

Data shows that in the first three quarters of 2024, Porsche's global sales declined by 7%, with 226,000 vehicles delivered. The biggest decline came from the Chinese market, where Porsche delivered a total of 43,300 vehicles, a steep drop of 29% compared to the 61,000 vehicles delivered in the same period last year. Some netizens even joked that Xiaomi, often dubbed as a 'knockoff Porsche,' has surpassed the real Porsche.

Behind the plunging sales, Porsche's sales system is also under strain.

In May this year, Porsche China faced a collective 'rebellion' from its dealers. According to insiders, the issue stemmed from Porsche China's pressure on dealers to meet sales targets by overstocking inventory, but dealers who were selling cars at a loss were unwilling to bear the huge financial pressure.

One dealer revealed that car sales profits were becoming thinner, while operating costs remained high, resulting in monthly losses.

Some dealers stopped picking up new cars as a way to 'force a rebellion' on Porsche headquarters, demanding subsidies and the replacement of senior executives.

This turmoil eventually ended with a change in senior management.

In September this year, Alexander Pollich, who had previously served as the CEO of Porsche Canada and the UK, with rich experience in global market management and having worked in Porsche's strategic department, took over as President and CEO of Porsche China, attempting to turn the tide. However, within less than 100 days of taking office, Porsche was once again embroiled in a layoff controversy.

Although Porsche China officially denied the rumors of layoffs, it also emphasized that the company is optimizing and restructuring its internal organizational structure.

An insider revealed that layoffs had already begun in early December, with the dismissal of permanent employees nearing completion and the overall layoff rate approaching 30%.

In addition to layoffs, Porsche also plans to 'slim down' its dealer network. Over the past two years, Porsche had hoped to alleviate the pressure of declining sales by expanding its dealer network, increasing the number of dealers from 136 at the beginning of 2022 to over 150 today. After this strategy failed, Porsche began to change course. According to the latest plan, this number will be reduced to 100 by the end of 2026.

Porsche's 'survival amputation' is also a common dilemma faced by foreign luxury automakers in China.

Data released by the China Passenger Car Association shows that in the first three quarters of this year, super-luxury brands such as Maserati and Aston Martin sold only 4,762 vehicles in total, a sharp decline of 60% year-on-year, with most brands selling only in the double digits each month.

Even BBA, once admired by working people, could not hide its decline. Public data shows that in the first three quarters of this year, sales of BMW, Mercedes-Benz, and Audi in China declined by 13.1%, 10.2%, and 8.5% year-on-year, respectively.

[Hard to Get a Car]

"Back then, buying a Cayenne wasn't just about having money," recalled Mr. Wang from Hangzhou about his experience buying a Cayenne in 2015. He still feels emotional about it.

He remembers that when he and his wife went to the 4S store for a test drive, the salesperson was too busy to greet them and only said, "Buying a Porsche now means waiting at least a year to pick up the car. Paying extra for optional features can prioritize production."

"Hard to get a car" is also a profound memory for many Chinese car owners when it comes to Porsche.

In 2001, Porsche officially entered the Chinese market. At that time, the German brand, known for its sports cars, only offered two models: the 911 and the Boxster, priced at over one million yuan each, mainly targeting the top wealthy class.

For most people, a Porsche is not just a car but a symbol of status and wealth.

As Porsche's soul model, the 911 has become a totem in the hearts of sports car enthusiasts since its inception in 1964, with its classic frog-eye headlights and streamlined body. After entering China, the 911 quickly gained favor with the wealthy and car enthusiasts.

"People who drive 911s talk about taste and lifestyle," recalled Mr. Zhang, a Beijing resident who frequently participates in supercar club activities. "Every time the car convoy gathers, it's usually the 911 that takes center stage."

Due to high demand, the 911 has been sold at a premium for years. Even with a price tag of over two million yuan, car owners are willing to wait a year and a half just to experience the saying - only Porsche can beat Porsche.

The 911 brought Porsche fame in the Chinese market, while the arrival of the Cayenne solidified its footing in the market.

As Porsche's first SUV, the Cayenne was once considered a product that 'betrayed the spirit of sports cars.' However, with its powerful performance and luxurious comfort, it quickly gained popularity in the global market, especially in China.

Taking 2018 as an example, Porsche sold a total of 79,011 vehicles in China, of which 29,634 were Cayennes, accounting for 37% of total sales.

The popularity of the Cayenne not only saved Porsche from its operational difficulties due to sluggish sports car sales but also helped it discover the password to success in the Chinese market.

After tasting the sweetness of SUVs, Porsche launched an even smaller SUV, the Macan, in 2014. This car resembles the Cayenne in both appearance and interior but is more affordable, even being considered tailor-made for Chinese consumers.

Riding on the wave of China's pursuit of high-end products at that time, the Macan quickly gained popularity after entering the Chinese market. Priced starting at 578,000 yuan, with personalized options, the final transaction price easily exceeded 700,000 yuan, yet demand still outstripped supply.

The double popularity of the Cayenne and Macan propelled Porsche China's sales to soar.

In 2015, the Chinese market became Porsche's largest single market globally, with sales exceeding 50,000 vehicles for the first time, a position it has maintained for seven consecutive years.

In 2021, Porsche's global sales reached a record high of 300,000 vehicles, with nearly 100,000 contributed by the Chinese market.

In 2022, Porsche's sales miracle in the Chinese market began to waver.

That year, its sales in China declined by 2.5%, further expanding to 15% in 2023, and by the first three quarters of 2024, it had plummeted by 29%.

"Every decision is incredibly difficult to make," said Alexander Pollich, the 'firefighter' CEO, without hiding his anxiety. "Porsche has felt this chilling wind from China. It has already hit us hard."

[Winning Back China]

In the eyes of most people, there are two main reasons for Porsche's declining sales:

First, the surge of new energy and intelligent automobiles in China has weakened Porsche's technological advantages, luxury experience, and even brand value. While domestic cars 'pay homage' to Porsche, they also steal Porsche's market share with lower prices and higher configurations.

Second, economic expectations are not what they used to be, and even wealthy people are tightening their belts.

However, in the view of Alexander Pollich, the new head of Porsche China, the biggest reason for Porsche's decline is the overall economic environment.

After taking office, Alexander Pollich visited all Porsche dealerships in China, traveling to dozens of cities to quickly understand and integrate into the Chinese market. After this intensive field investigation, he firmly believes that there are still opportunities for Porsche in China.

His confidence stems from two aspects: first, in the Chinese high-end car market, European and American fuel vehicle manufacturers still account for about 60% of the market share; second, in the market above 600,000 yuan, European and American fuel vehicles are the absolute mainstream, with a new energy penetration rate of only about 10%, and Porsche's pure electric vehicle sales can rank in the top three.

In summary, Porsche does not consider domestic automakers in China as its competitors.

But Alexander Pollich is deeply aware of the wave of new energy and intelligence. "Currently, the penetration rate of the new energy market in China is quite high, posing significant impacts and challenges to both Porsche and other luxury brands," he said.

To this end, in addition to conducting an internal and external system reform to address the immediate needs, Alexander Pollich is also promoting a medium- to long-term business adjustment strategy called 'Winning Back China,' with intelligence and electrification as one of the core strategies.

Porsche expects to launch new models such as the Taycan, all-new electric Macan, as well as new 911 and 911 GT3 by the end of 2025, covering a variety of power options including internal combustion engines, plug-in hybrids, and pure electric vehicles, with improvements in intelligence.

To further promote electrification and intelligence, Porsche is also strengthening localized research and development and implementation.

Alexander Pollich said, "The board has given us significant empowerment, even giving us a green light to open a research and development center in China. Recently, a new technology department was also established, hoping to use local research and development to convey updated voices to Weissach. So such plans are now being rapidly implemented to meet consumer needs and their expectations for luxury."

It is reported that Li Nan, a former Mercedes-Benz executive, will take on the role of Vice President of Porsche China's Technology Department, reporting directly to Alexander Pollich.

Ferdinand Porsche, the founder of Porsche, once said:

"Independence is Porsche's attitude. It's not about making the cars others expect but making the cars we think are right. Porsche must remain small and independent; otherwise, it will only produce soulless cars lacking distinct characteristics."

While actively seeking change, Alexander Pollich is also adhering to Porsche's style by taking measures such as refusing price wars to uphold the core brand value.

In his view, Porsche's DNA lies in racing, sports cars, mechanical specifications, and the driving experience. If these elements are discarded in favor of only talking about digitization and technology, the brand will lose its unique characteristics.

However, against the backdrop of the rapid rise of domestic new energy vehicles, consumers' expectations of automotive value are also changing. Porsche's unique value is being diluted. Whether Porsche admits it or not, more and more luxury car users are abandoning so-called mechanical performance in favor of domestically produced high-end new energy vehicles with higher configurations, stronger intelligence, and more affordable prices.

Taking the AITO M9 as an example, this car has accumulated over 160,000 orders in just 10 months since its launch and has ranked first in sales of luxury models priced above 500,000 yuan for six consecutive months, with monthly sales surpassing those of the BMW X5, Audi Q6, and Mercedes-Benz EQE.

"What customers care about most now is whether the infotainment system is HarmonyOS and if it can park automatically. No one asks about engine parameters or displacement," lamented Ms. Zhao, a Beijing luxury car salesperson. "Some car owners even complain that Porsche seems unable to understand Chinese. The voice navigation cannot find the destination."

In 2025, domestic brands will witness a concentrated outbreak of new products and technologies, with a stronger push into the high-end market. For Porsche and other high-end luxury brands like BBA, restarting growth is still possible, but the glory days of dominating the market are likely gone forever.

[Reference Materials]

[1] "Porsche, Amputation for Survival? The Era of Easy Money for Foreign Luxury Cars is Over!" Securities Times

[2] "Porsche's Dilemma is Not the Same as BBA's" Automotive Industry Economics

[3] "Porsche Forced to Save Its Business in China" ECNS

[4] "Porsche China CEO Alexander Pollich: No 'Price for Volume' Strategy, Will Restart 'Aggressive Mode'" China Business Herald

——END——

Welcome to follow [Huashang Taolue] to recognize influential figures and read tales of strategy.

All rights reserved. Private reproduction is prohibited.

Some images are sourced from the internet.

If infringement is involved, please contact us for deletion.