BYD Reigns Supreme, Tesla Falters: Will 2025 Usher in More Turmoil?

![]() 01/03 2025

01/03 2025

![]() 515

515

"The competition among automakers is intensifying daily."

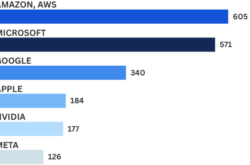

Source: US Stock Research Society

On January 1, the 2024 report on the battle for dominance in the new energy vehicle (NEV) industry was freshly released!

There's no surprise about the sales champion in the domestic passenger vehicle market; it's still BYD, with annual sales exceeding 4 million vehicles. Additionally, many new entrants have set new historical highs, with Li Auto leading the pack with 500,000 deliveries. The competition among automakers is intensifying daily.

BYD firmly holds the top spot

Li Auto leads the new entrants

Specifically, data shows that BYD sold 509,400 vehicles in December. Throughout the year, BYD's cumulative passenger vehicle sales reached 4.25 million. Looking ahead to 2025, BYD not only plans to launch numerous new products but will also actively expand its overseas markets. Driven by both new products and overseas markets, BYD's prospects for 2025 are highly anticipated.

Li Auto tops the list of new entrants, delivering 58,513 new vehicles in December, a year-on-year increase of 16.2%. As of the end of 2024, Li Auto delivered a total of 500,508 new vehicles throughout the year, with a cumulative historical delivery volume exceeding 1.13 million.

Moreover, the number of Li Auto's retail centers, after-sales service centers, and supercharging stations nationwide continues to grow, providing more convenient services for users.

As a dark horse in the 2024 NEV market, Xiaomi Motors set a new delivery record in December, exceeding 25,000 units. Since its launch, Xiaomi Motors has delivered a cumulative total of over 135,000 new vehicles throughout the year, surpassing the 100,000-unit target set at the beginning of the year. In 2025, Xiaomi Motors will challenge the annual delivery target of 300,000 vehicles, and its second model, Xiaomi YU7, is also attracting significant market attention.

XPeng Motors has set a new monthly delivery record for four consecutive months, delivering a total of 36,695 new vehicles in December, a year-on-year increase of 82% and a month-on-month increase of 19%. Among them, the delivery volumes of XPeng MONA M03 and P7+ both exceeded 10,000 units. In the fourth quarter of 2024, XPeng Motors set a new record for quarterly deliveries.

NIO also set a new monthly delivery record, delivering 31,100 vehicles in December, a year-on-year increase of 72.9%. Throughout the year, NIO delivered a total of 222,000 vehicles, a year-on-year increase of 38.7%. Additionally, at NIO Day 2024, NIO's smart electric executive flagship ET9 was officially launched and is expected to start deliveries in March 2025.

ZEEKR delivered a record-high of 27,190 new vehicles in December, a year-on-year increase of 102%. Throughout the year, ZEEKR delivered a cumulative total of 222,123 new vehicles, a year-on-year increase of 87%. Simultaneously, ZEEKR announced its plan to challenge the delivery target of 320,000 vehicles in 2025.

Leapro Motor also achieved impressive results in December, delivering 42,517 new vehicles, marking the second consecutive month of delivering over 40,000 units. Throughout the year, Leapro Motor delivered nearly 300,000 new vehicles, exceeding its annual sales target. Looking ahead to 2025, Leapro Motor aims to hit the new target of 500,000 vehicles.

GAC AION achieved sales of 46,851 vehicles in December, with year-on-year and month-on-month growth. Among them, sales of the AION RT continued to grow, with over 16,000 vehicles sold in its first month. Throughout the year, GAC AION sold over 400,000 vehicles. Next, GAC AION will launch another popular new model, the AION UT.

Thalys achieved sales of 37,319 vehicles in December. Throughout the year, Thalys sold a cumulative total of 426,885 NEVs, a year-on-year increase of 182.84%.

Deep Blue Motors sold over 30,000 vehicles for two consecutive months in December, reaching 36,577 units. Throughout the year, Deep Blue Motors sold a cumulative total of 243,894 vehicles. Since its inception, Deep Blue Motors has delivered over 400,000 vehicles.

As a regular guest in the 10,000-unit club, the ARCFOX brand sold 12,032 vehicles in December. Throughout the year, ARCFOX sold a cumulative total of 81,017 vehicles, a year-on-year increase of 169.91%.

On the eve of the delivery report release,

Is Tesla in turmoil again?

Tesla, often seen as the benchmark for new entrants to surpass, is expected to release its fourth-quarter and full-year delivery and production report on January 2. The market generally predicts that Tesla's fourth-quarter delivery data will set a new record, surpassing the 484,507 vehicles delivered in the same period last year.

According to analyst predictions, Tesla is expected to deliver approximately 506,763 vehicles in the fourth quarter, with 476,398 deliveries of Model 3 and Model Y and a total of 30,365 deliveries of other models.

Tesla's robust delivery channel benefits from improved demand in major markets, particularly the Chinese market. Additionally, Tesla has introduced various incentives in the US and international markets, such as zero-interest financing policies, to attract more consumers to purchase the new Model 3 and Model Y.

However, to achieve a total annual delivery volume of over 1.8 million vehicles, Tesla needs to deliver at least approximately 515,000 vehicles in the fourth quarter. However, based on the market's expected delivery volume of 506,763, Tesla's global vehicle deliveries in 2024 will be slightly lower than the 1,808,581 vehicles delivered in 2023, meaning Tesla's annual "slight growth" forecast in its latest earnings report may fall short.

Nonetheless, analysts remain confident in Tesla's delivery growth in 2025 and predict that the electric vehicle giant will deliver over 2 million vehicles this year. Tesla typically does not provide specific delivery guidance for the following year in its fourth-quarter delivery report, but the earnings call later in January may reveal some relevant information.

As of Tuesday's close, Tesla's share price fell by 3.25%, but it has cumulatively increased by over 62% throughout 2024. Analysts believe that although deliveries may be slightly lower than the previous year, this report may not significantly impact Tesla's share price.

UBS predicts in a report that Tesla will deliver approximately 510,000 vehicles in the fourth quarter, a year-on-year increase of 5% and a month-on-month increase of 10%. UBS analysts point out that as the narrative around AI-driven stocks gradually gains momentum, delivery results have less of an impact on Tesla's share price than in the past.

Additionally, Tesla's energy storage business has attracted significant attention. UBS expects energy storage deployments to reach 9.1 GWh this quarter, a month-on-month increase of 32%. However, UBS also warns that due to the instability of energy storage deployments, predictions may not be entirely accurate.

After the delivery report is released, the focus will shift to Tesla's earnings call at the end of January. UBS emphasizes that investors may pay more attention to Musk's comments, especially regarding 2025 guidance and AI development.

By 2025, Tesla plans to increase sales by 20% to 30%, reaching 2.2 to 2.4 million vehicles, a forecast that exceeds the 1.9 million and 2 million vehicles predicted by UBS and the market consensus. New models (such as the anticipated low-cost model and the new Model Y expected to be launched early this year) may drive growth in Tesla's sales.

UBS also notes that market trends vary by region: the Chinese market is growing steadily due to promotional activities, the European market is weak due to slowing exports, and shipments in the US market remain stable.

Barclays analysts predict that Tesla will deliver 515,000 vehicles in the fourth quarter, driving year-on-year growth in annual deliveries.

However, Barclays also points out that while this milestone is noteworthy, Tesla's delivery figures have little impact on the overall optimistic outlook for its share price. Instead, market excitement about autonomous vehicles, AI, and post-election optimism are the primary drivers of Tesla's share price surge.

2025

Will the biggest obstacle emerge for NEVs?

2025 is predicted to be a challenging year for the electric vehicle industry, and investors in the automotive industry, including Tesla, need to be prepared. It is predicted that the Trump administration may cancel the tax credit of up to $7,500 per electric vehicle, which will undoubtedly increase the purchase cost of electric vehicles and significantly suppress consumer demand.

Taking the German market as an example, data clearly demonstrates this trend. As of November, sales of pure electric vehicles in Germany decreased by approximately 26% year-on-year to 347,048 units, while overall vehicle sales remained almost unchanged from the previous year. The share of pure electric vehicles in new vehicle sales also declined from 18% in 2023 to 13% in 2024.

The main driver of this change is price increases, particularly the reduction in purchase subsidies. The German government previously provided subsidies of up to $5,000 for vehicle purchases, but after the subsidy reduction, electric vehicle prices increased by 12%, leading to a significant decline in demand.

If this model is applied to the US market, electric vehicle sales may face a similar downward trend. Currently, the average price of electric vehicles in the US (excluding subsidies) is $55,000, while the average price of electric vehicles eligible for subsidies is $47,500.

If tax credits are lost, the price of a $47,500 electric vehicle will soar to $55,000, an increase of up to 16%. In 2024, sales of pure electric vehicles in the US are expected to be approximately 1.3 million, with a year-on-year increase of 5% to 10%. However, if tax credits are canceled, sales in 2025 may plummet to approximately 1 million vehicles.

Facing this challenge, Tesla plans to launch a new low-cost model to mitigate the impact. This new model is expected to be launched in the first half of 2025 with a starting price of approximately $30,000. Looking back, Tesla's Model Y sold approximately 65,000 units in its first year, and this new model is expected to attract more consumers in 2025, potentially selling over 100,000 units.

If this plan is successfully implemented, electric vehicle sales in the US market may stabilize around 1.1 million units, with Tesla's sales remaining stable or even showing a slight increase of 0% to 5%. Meanwhile, Tesla will also seek support from overseas markets. Wall Street predicts that Tesla's global deliveries will reach approximately 2.1 million in 2025, a year-on-year increase of approximately 17%.

Other automakers are also actively responding to this challenge. For example, Toyota announced a price of $37,000 for the 2025 BZ4X, a decrease of $6,000 or 14% compared to the 2024 model. Although price reductions can help offset the impact of canceled tax credits, they will also put pressure on profit margins.

Despite the uncertainties ahead, Tesla investors do not seem overly concerned. Since the trading day after the election (December 30), Tesla's share price has increased by 61%.

Investors generally believe that the close relationship between Trump and Tesla CEO Elon Musk will bring many benefits to the company, including promoting the implementation of federal autonomous vehicle regulations and clearing the way for Tesla's planned autonomous taxi service to be launched by the end of 2025.