Evaporation of $266 Billion! Tesla's Sales Stagnate, Marking First Decline in 15 Years

![]() 01/06 2025

01/06 2025

![]() 424

424

As the old year yielded to the new, Tesla awoke to a harsh reality. In just five trading days, its stock price plummeted by nearly 20%, resulting in a market value erosion of approximately $266 billion.

This steep decline stems primarily from growing market concerns over Tesla's sluggish sales and intensifying competition. Tesla has now reached a pivotal moment, witnessing its first sales decline in 15 years amidst waning vehicle demand.

1. $266 Billion Evaporated in Five Days!

On the first trading day of 2025, Tesla faced a chilly reception from the capital markets.

By the close of trading on January 2, Tesla shares were priced at $379.28 each, marking a significant 6.08% drop and setting a new closing low since December 6 of the previous year.

Overnight, Tesla's market value shrank by $78.8 billion (approximately RMB 575.2 billion), equivalent to the loss of one Ferrari or three Great Wall Motors.

Consequently, Musk's personal wealth dwindled by $13.8 billion overnight (approximately RMB 100.7 billion), reducing his net worth to $407.4 billion. Nonetheless, he retains his status as the world's richest person.

In fact, Tesla's stock price had been on a downward trajectory for several consecutive trading days as 2024 transitioned into 2025.

On December 24, 2024, Tesla's stock price surged by 7.36% to $462.28 but subsequently embarked on a continuous decline.

Over the following five trading days, Tesla's stock price continued to fall, ultimately reaching a new low of $379.28 on January 2, 2025.

A simple calculation reveals that Tesla's stock price declined by approximately 18% over these five trading days, with its market value eroding by a total of $266.4 billion, equivalent to nearly RMB 2 trillion.

2. Tesla's First Decline in 15 Years

The direct catalyst for Tesla's plunging stock price and evaporating market value lies in its lackluster sales figures.

According to recently released data from Tesla, the company delivered 495,600 vehicles in the fourth quarter of last year, marking a year-on-year increase of 2.3%. While this represents a record high, it fell short of Wall Street's expectations of 498,000 vehicles.

Some analysts have attributed Tesla's fourth-quarter delivery increase last year not to the strength of its models but rather to price reductions and other incentives.

When viewed from a broader perspective, it becomes evident that Tesla has encountered a significant setback.

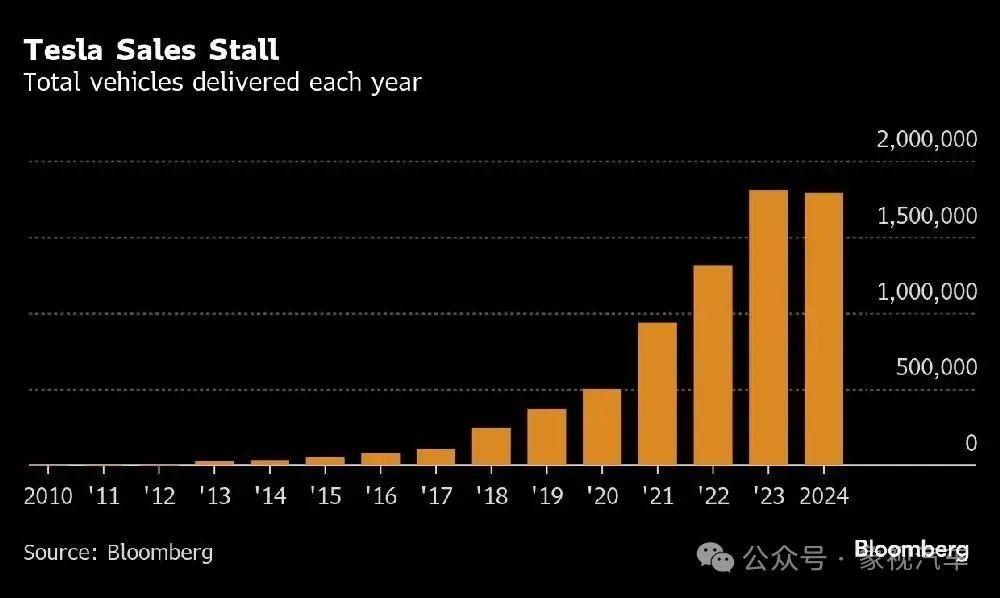

For the entire year of 2024, Tesla delivered a cumulative total of 1.7892 million vehicles, falling short of the 1.8 million vehicles generally expected by Wall Street analysts.

Compared to 2023, when Tesla delivered 1.8086 million vehicles, deliveries in 2024 declined by 1.07% year-on-year.

According to Bloomberg's analysis, after 14 consecutive years of year-on-year growth since 2010, Tesla has finally paused its performance growth, experiencing a rare year-on-year decline.

Although it is only a slight decline, it signals a concerning trend, indicating that Tesla's products are becoming less attractive in the market, and sales are beginning to wane.

3. Pushed into a Corner by BYD?

Founded in 2003, Tesla launched the Roadster in 2008, heralding the beginning of mass-produced electric vehicles globally.

In 2010, Tesla introduced the Model S, truly entering mass production with annual sales reaching five figures and steadily climbing. In 2017, Tesla introduced the Model 3, entering the mainstream price range and witnessing a surge in global sales.

As Tesla's global flagships, the Model 3 and Model Y have enjoyed immense success, consistently ranking as best-sellers in multiple global markets, driving up Tesla's sales.

However, the sales decline in 2024 signifies that Tesla has reached a critical juncture.

In Europe, traditional automotive giants like Volkswagen and BMW are accelerating their pursuit, posing a significant threat to Tesla. In the first 11 months of last year, Tesla's sales in Europe fell by 13.7% year-on-year to 282,700 vehicles.

In the U.S. domestic market, with General Motors and Ford keeping a close eye on the competition, Tesla's sales have also taken a hit, totaling only 364,700 vehicles in the first three quarters of last year, a year-on-year decrease of 26.77%.

In the Chinese market, Tesla faces fierce competition from numerous Chinese new energy vehicle companies such as BYD, Huawei, Li Auto, NIO, XPeng, Xiaomi, and others, pushing Tesla into a tight spot. Consequently, Tesla has resorted to initiating a price war to boost sales volume.

Global competition is intensifying, with new energy vehicle brands becoming increasingly competitive. Models like the Model 3 and Model Y are aging, while the new product Cybertruck has performed averagely. The inexpensive models Model 2 and Model Q have yet to be launched...

For these reasons, Tesla's global sales last year not only failed to increase but also declined.

Various signs indicate that Tesla's industry-leading advantages in technology, products, and branding are gradually being eroded by emerging companies. For instance, BYD sold an astonishing 4.27 million vehicles last year, two to three times that of Tesla.

Tesla's pivotal moment marks the formidable force of the times reshaping the global automotive industry.