Volkswagen Emerges from Strike Turmoil, Unleashes 'Three Arrows' for Breakthrough

![]() 01/06 2025

01/06 2025

![]() 546

546

Lead

Volkswagen, once mired in strike turmoil, has finally reached a compromise with the union. The major threat facing the Volkswagen Group has been averted. While CEO Oliver Blume's path forward is not without obstacles, he now has ample room to reform Volkswagen and usher in a fresh start.

Produced by | Heyan Yueche Studio

Written by | Zhang Dachuan

Edited by | He Zi

Full text: 1782 words

Reading time: 3 minutes

The strike turmoil plaguing Volkswagen will temporarily come to an end. Recently, media disclosed that Volkswagen AG has reached an agreement with Germany's IG Metall union.

According to relevant information, by 2030, Volkswagen will lay off more than 35,000 employees globally, saving up to 1.5 billion euros in labor costs annually. Additionally, about 4,000 managers at the Volkswagen Group will face salary reductions. If Volkswagen's financial situation improves by 2030, further salary reductions will not be necessary. The previous plan to close German factories has been withdrawn.

△ Volkswagen and the union have reached an agreement, with the union agreeing to layoffs and executive pay cuts in exchange for Volkswagen withdrawing its plant closure plan.

Volkswagen Prepares for the Future

According to Volkswagen's third-quarter financial report, the company's revenue for the quarter was 78.48 billion euros, a year-on-year decline of 0.5%. While Volkswagen's overall revenue remained stable, its operating profit was only 2.86 billion euros, a significant year-on-year decrease of 41.7%, with the operating profit margin falling to 3.6%, the lowest level in four years. Volkswagen's layoffs and executive pay cuts are more preventive measures.

Examining Volkswagen's global market, taking the data for the first nine months of 2024 as an example, sales in Europe declined by 1%, while sales in North and South America increased by 7% and 15%, respectively, performing respectably. However, in the Chinese market, Volkswagen faced considerable challenges, with market sales declining by 10%. Especially, the domestic price war has compelled every global automaker to respond, including Tesla, which has also reduced prices consecutively in China in 2024. Solving the problem in the Chinese market has become a headache for every automaker CEO. Especially for Volkswagen, the Chinese market once occupied a very important position in its global layout, providing significant sales and profits for the group. In the short term, not only multinational automakers like Volkswagen and Toyota but also domestic rising stars like BYD and Geely are in the center of the price war vortex. In other words, the only way to sell well is to reduce prices. In this context, Oliver Blume sought an agreement with the union to streamline the group and ease financial constraints, essentially saving momentum for future development.

△ Led by BYD, independent brands have launched round after round of price wars in the domestic market.

Can Volkswagen Achieve a Turnaround?

To achieve a turnaround, Volkswagen has several strategies in place:

1. Continuous High R&D Investment

In terms of R&D investment alone, Volkswagen's overall R&D investment in 2023 reached $23.6 billion, twice that of Toyota and far ahead of Tesla and BYD, whose R&D budgets were only $4 billion and $5.6 billion, respectively. With the guarantee of high R&D investment and external support, Volkswagen has a good chance to catch up in product capabilities. Next, while maintaining high investment, Volkswagen needs to optimize its R&D investment and focus on improving the efficiency of R&D fund use.

2. Adjustment of Intelligent Connectivity R&D Strategy

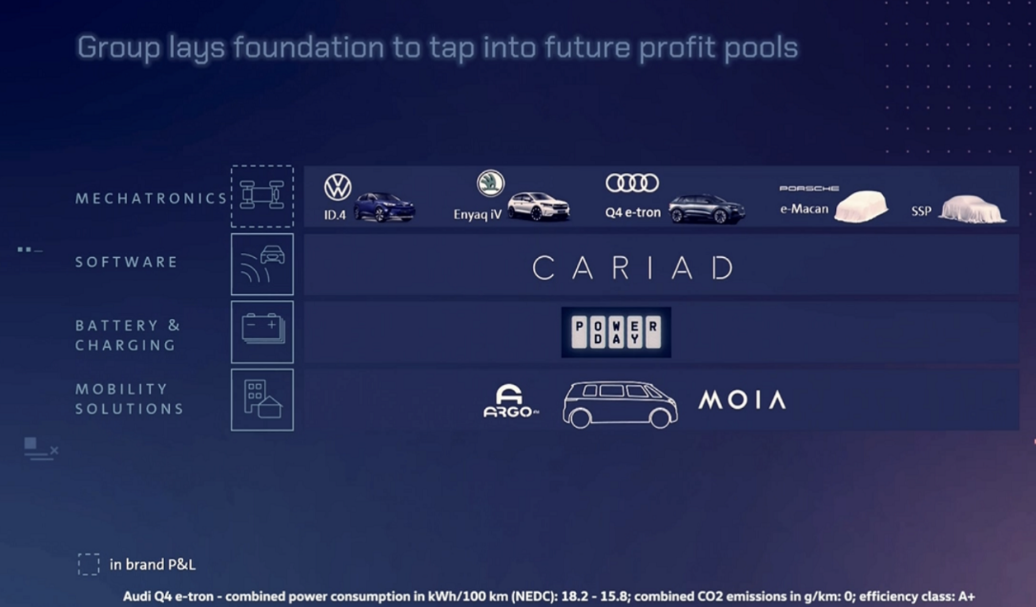

In terms of intelligence, Volkswagen has taken a detour. Oliver Blume's predecessor, Herbert Diess, had been insisting on emulating Tesla by establishing the group's software company CARIAD and adopting a full-stack in-house development strategy to promote the comprehensive intelligence of all brands under the Volkswagen Group. Since its inception, CARIAD has not only suffered severe losses but also experienced delivery delays that have severely impacted the delivery of multiple Volkswagen brand models.

△ Volkswagen's collaborations with XPeng and Rivian signify the company's shift away from a full-stack in-house development strategy.

After Oliver Blume took office, Volkswagen has transitioned from full-stack in-house development to comprehensive integration. On the one hand, it has invested in XPeng and Rivian, two emerging automakers in the Chinese and American markets, to compensate for its shortcomings in intelligent connectivity. On the other hand, it has not abandoned CARIAD, which it nurtured, by acquiring small companies and finding suppliers to complement CARIAD's deficiencies. With Volkswagen's existing scale and volume, the company is fully capable of ensuring that both in-house development and technology introduction can progress in parallel.

△ As Volkswagen's "own son," CARIAD still has great potential for the future.

3. The Leadership of the Volkswagen Group

If there is another reason why we are optimistic about Volkswagen's turnaround, it must be Oliver Blume, the current CEO of the Volkswagen Group. He studied for his Ph.D. under Wan Gang, an advocate for the transformation of China's automotive industry towards new energy vehicles, at Tongji University in Shanghai. Compared to the leaders of other multinational automakers, Oliver Blume understands China better and is more aware of the impact Chinese automakers will have. Even if he cannot keep up with the latest developments in the domestic automotive industry in real-time, his fellow students and teachers at Tongji University should keep him informed about the latest developments in domestic new energy and intelligent connectivity, enabling him to make more objective judgments about Volkswagen's future development direction.

△ Oliver Blume is one of the CEOs of multinational automakers who understands the Chinese market best.

Commentary

Many European automakers, including Volkswagen, are currently struggling. However, for these multinational automaker giants, they possess the resilience to navigate through cycles. Even if they experience a temporary downturn or if a generation of models lacks competitiveness, they still have the potential and confidence to catch up and surpass others in the future. Volkswagen's R&D expenses in 2023 amounted to $23.6 billion. As long as it can be prudent and calculated in the future, combined with Volkswagen's accumulation of many core technologies in the past, the company still has a good chance to excel in the new track of intelligent electric vehicles. However, in the coming years, Volkswagen must be prepared for tough times. It remains to be seen whether Oliver Blume can find a sustainable path for the Volkswagen Group amid the onslaught of Chinese competitors, including BYD, and the powerful German unions.

(This article is originally created by Heyan Yueche and cannot be reproduced without authorization)