New Energy Vehicles Mature, 2025 Set to Be a Pivotal Year

![]() 01/09 2025

01/09 2025

![]() 496

496

This article is relatively long and will take about 10 minutes to read. Bookmark it for later.

2024 was a transformative year for the domestic automobile market, marked by fierce internal competition and unprecedented price wars. The year kicked off with HiPhi's exit and culminated in JYEV's sudden collapse, suggesting that the battle has only just begun.

01 Annual Summary of the New Energy Vehicle Market in 2024

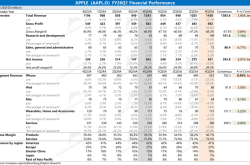

The price war in the domestic automobile market intensified in 2024, with price reductions reaching a three-year high. According to Cui Dongshu, Secretary-General of the China Passenger Car Association, 227 models saw price cuts from January to December 2024, surpassing 148 in 2023 and 95 in 2022.

Domestic retail sales of new energy vehicles are estimated to reach 11 million in 2024, up 42.2% year-on-year, with a penetration rate exceeding 50% for six consecutive months. The top 50 passenger car models in China are expected to account for about 42% of total sales, with new energy vehicles accounting for 54% of these top 50 sales and fuel vehicles accounting for 46%. While both categories occupy 25 seats, new energy vehicles surpassed fuel vehicles in total terminal sales for the first time.

Monthly sales of the 50th-ranked Deep Blue SL03 reached 4,500 units, a critical threshold for new energy vehicles to survive in the market. Models failing to meet this threshold face a higher risk of elimination. Monthly sales of 5,000 units are no longer a safe benchmark, especially for brands with multiple models selling only 10,000 to 20,000 units.

Deep Blue SL03

Despite a decline in sales for over half of fuel vehicle models, the top 50 fuel vehicles still achieved total terminal sales of 7.22 million, down only 1.5% year-on-year, indicating resilience due to new models compensating for losses. Models like Jietu Traveler, Arrizo 8, Xingyue L, Tiggo 8, Tanyue, Mercedes-Benz GLC, and Hongqi H5 saw terminal sales grow over 30% year-on-year. Notably, Jietu Traveler, launched in September 2023, witnessed a more than three-fold increase in terminal sales.

Overcapacity remains an issue for both fuel and new energy vehicles.

According to Gaishi Auto, China's passenger vehicle capacity utilization rate fell from 61.8% in 2017 to 47.5% in 2023. After intense market clearance in 2024, domestic brands' capacity utilization rate rose from 56.4% to 60.4%, but when including joint ventures, mainstream automakers' rate declined from 58.4% to 55.6%, according to Founder Securities. To maintain operating rates, automakers often traded volume for price. By year-end, the average price of B-segment sedans fell to 160,000 yuan, and C-segment SUVs to 300,000 yuan.

The automobile industry is characterized by economies of scale, long cycles, and heavy investment. Without scale, profits dwindle, and losses multiply. SGMW's net profit fell from 2.56 billion yuan in the first half of 2015 to 100 million yuan in the same period this year. Over a decade, SAIC Volkswagen's net profit dropped from 15.03 billion yuan to 860 million yuan, and Changan Ford's from 8.8 billion yuan to 1.82 billion yuan. SGMW, with sharp sales declines this year, incurred losses.

Previously, some OEMs boasted large scale, global layout, and strong cash flow, claiming they could withstand many battles in the new energy market. However, in 2024, leading domestic automakers called for fewer price wars and reduced losses. This sentiment is widespread in the automotive industry. Even Huawei's Yu Chengdong, previously high-profile, emphasized that Huawei's BU for vehicles must be profitable, as annual investments of hundreds of billions of yuan are unsustainable. Living within means and cost-cutting can reduce losses but competitiveness stems from high investments in capital and technology, and accurate market positioning. This is the true focus now, not ranking disputes.

02 New Energy Vehicles Secure a Stronghold in the Luxury Market

After over a decade of growth, BBA's annual sales declined for the first time this year, not due to external factors but because domestic brands have firmly established themselves in the luxury market. In the first 11 months, including imported vehicles, Mercedes-Benz, BMW, and Audi sold 637,000, 618,000, and 597,000 units in China, respectively, down 9%, 15%, and 4% year-on-year.

Their market share shifted to domestic luxury brands like Li Auto and AITO. AITO M9 received 200,000 orders in its first year and topped the sales chart for SUVs priced above 500,000 yuan for eight consecutive months, previously held by BMW X5. In November, AITO M9 sold 16,000 units, nearly twice that of BMW X5.

A question arises: why aren't domestic brands selling well above 500,000 yuan? The main reasons are product definition and premium pricing power. New energy vehicles' core lies in electrics and intelligent driving. While there's a theoretical gap in electrics, it's narrowing due to price wars. Top intelligent driving players like Tesla, Huawei, XPeng, and Momenta lack strong brand premiums, often offering "lifetime intelligent driving" and "limited-time discounts."

China has affluent groups, but impressing them isn't easy. According to the "China Population Census Yearbook-2020," among 457.9 million households, 41.67% own cars. Among these, 0.88% own cars priced between 500,000 and 1 million yuan, and 0.27% own luxury cars above 1 million yuan. This translates to about 5.2558 million households owning luxury cars above 500,000 yuan. Even if each household owns one such car, ownership is at least 5.5 million. Current ownership is around 9.6 million, indicating most luxury car owners have multiple models above 500,000 yuan.

AITO M9's success lies in product definition. While technical capabilities are strong, they aren't the core decision factor. It's a combination of "exploiting the new energy market gap + focusing on semi-customized products for high-net-worth users + fully leveraging existing technologies," coupled with effective marketing.

To improve further, electric luxury brands must deliver exponential performance and experience enhancements, like comfort for Mercedes-Benz, handling for BMW, and technology for Audi. To succeed in this niche, they must find distinct labels and unique entry points. Currently, neither pure electric nor hybrid products above 500,000 yuan have been highly successful.

Excluding the super-luxury market above 500,000 yuan, the average passenger vehicle price has risen continuously, from 153,000 yuan in 2020 to 179,000 yuan in 2024. In terms of structure, the sales share of models above 200,000 yuan increased from 14.2% in 2017 to 32.3% from January to August 2024, and models above 300,000 yuan from 5.7% in 2017 to 14.7% in the same period. The rising share of mid-to-high-end models indicates a clear trend of consumption upgrading.

03 Middle-aged People Become the Mainstay in the New Energy Market

Previously, automakers preferred targeting the young market due to their fondness for trendy products, quick decision-making, and large rigid demand groups. Since 2018, as the post-90s generation, with a declining population, became the main buyer group, compact car market share fell rapidly from nearly 60% to 47.54% in 2023. Many automakers primarily producing compact cars saw significant sales declines.

From 2018 to 2023, with the post-90s youth population declining and accelerating entry into the used car market, China's youth auto market sharply deteriorated, with terminal sales falling below 8 million units and market share dropping to 36.55%. During this period, many joint venture automakers focusing on youth families and compact products with lagging local R&D were forced out of business. From 2024 to 2030, Yi Auto Research Institute predicts China's youth auto market will continue to shrink significantly, with market share potentially falling to 25%, losing its dominant position.

In recent years, BYD, an emerging star, has precisely captured the middle-aged user group. From 2020 to 2023, as China's auto market aged, BYD attracted a large number of working-class middle-aged men and women with its energy-efficient entry-level products like Qin PLUS, Song PLUS, Song Pro, and commuting-oriented small electric vehicles like Yuan PLUS, Dolphin, and Seagull.

In the second half of 2024, BYD aggressively pushed forward the "Old Boy Strategy," rapidly launching energy-efficient large vehicles like Tang L, Tang MAX, Hiace 08, Tengshi N9, and FANGCHENGBAO 8, as well as high-end electric vehicles like Tengshi Z9 GT, aiming to capture more high-quality middle-aged men and women.

The automotive industry has long cycles, traditionally spanning four to five years but now compressed to one or two. However, core component updates still take about three to four years. Market sales competition is largely determined in the early stages of product definition and layout. Turning the tide through pure marketing strategies in later stages is minimal. Thus, frequent live broadcasts and increased presence by automaker leaders have little impact on sales.

Transitioning from targeting youth to middle-aged groups is challenging, requiring a revamped chain and realigned writing team. Finding unsatisfied stock space in someone else's comfort zone is even more difficult.

However, not all automakers must rush into the middle-aged family market. The elderly market is growing rapidly. China's elderly auto market has gained momentum. In 2014, terminal sales were only 550,000 units, approaching 1 million in 2017, and accelerating in recent years, exceeding 1.5 million in 2022 and 2 million in 2023, reaching 2.27 million. From 2024 to 2030, with the accelerated entry of the post-60s generation, a large retiring population, it's predicted that the elderly auto market will continue to flourish, with market share potentially exceeding 20%, becoming a new blue ocean market in China. In ten years, as the post-80s generation, with a higher car ownership rate, also begins to retire, China's elderly auto market will accelerate its growth and may become the new main market.

In 2025, Intelligent Driving and Batteries Alone Cannot Guarantee Success

01 Intelligent Driving: Far from the Final Chapter

By the end of 2024, most mainstream automakers achieved nationwide driving without (high-precision) maps. Top players are shifting from rule-based algorithm frameworks to neural network model-dominated architectures, known as "end-to-end technology." Why the switch?

The reason is simple: "Rule-based code is becoming unmanageable, and even when writing new code, the old code may crash." This is how a Tech Lead from a top intelligent driving solution provider responded.

2024 marked the dawn of end-to-end technology in the automotive sector. Most mainstream automakers had just mastered the art of navigating nationwide without maps and were transitioning to neural network-centric architectures, heralding the end-to-end era. The allure of this technology was irresistible, as large models liberated engineers from the Sisyphean task of optimizing countless scenarios, offering robust generalization capabilities. The industry's focus shifted from talent acquisition and extravagant salaries to model design, tool chain development, and rigorous testing and verification. Notably, the metric for advancement shifted from team size (Huawei's BU for vehicles, for instance, boasts nearly 5,000 developers) to cloud computing power by the second half of 2024.

XPeng pioneered the implementation of a "one-stage end-to-end" large model in domestic vehicles, revolutionizing the sector by eliminating the need for maps. Through extensive real-vehicle testing across 2,595 cities and a cumulative mileage of 7.56 million kilometers, XPeng ensured the reliability and safety of its intelligent driving system, making nationwide driving a breeze.

The underlying message is clear: substantial cash reserves and sales volume are prerequisites; otherwise, engaging in the intelligent driving race could lead to relentless and unsustainable losses.

From a computational and data perspective, Tesla leads the pack, followed closely by Li Auto and Huawei. Due to geopolitical constraints, traditional automakers face challenges in procuring large volumes of chips overseas. A more feasible approach is partnering with entities like Huawei, SenseTime, and Horizon Robotics, which possess chip reserves and manufacturing capabilities. Consequently, SAIC, which previously shunned Huawei's "soul," has now embarked on frequent collaborations with the tech giant.

In 2024, the estimated installed base of city NOA for brands like NIO, Huawei, and Li Auto is projected to be between 1.5 to 2 million units. Huawei anticipates that within the next five years, the adoption of high-end intelligent driving will reach 20 million units. The question lingers: is high-end intelligent driving a necessity? BYD, the frontrunner in new energy vehicle sales, has provided its answer: comprehensive implementation, even in models priced above 100,000 yuan. Any company claiming that intelligent driving is too expensive or unnecessary would be exposing its shortcomings and selling points.

Entering the large model era, a foundational model becomes essential. The more vehicles sold, the more corner cases collected, leading to faster improvement efficiency and fostering a data-driven positive cycle. This explains BYD's eagerness to popularize high-end intelligent driving by 2025.

Huawei and Li Auto have publicly stated their intentions to launch L3 pilot demos in 2025, but the number of competitors is bound to exceed two. NIO has announced L3 readiness on the ET9, and XPeng is highly likely to join the fray. As milestones for mid-level, high-level, and L3 intelligent driving are comprehensively refreshed, the competition for top-tier positions in intelligent driving will intensify. In the realm of intelligent driving, there are only two paths: high investment or even higher investment. Until the final outcome is achieved, long-term expenditure and losses are inevitable.

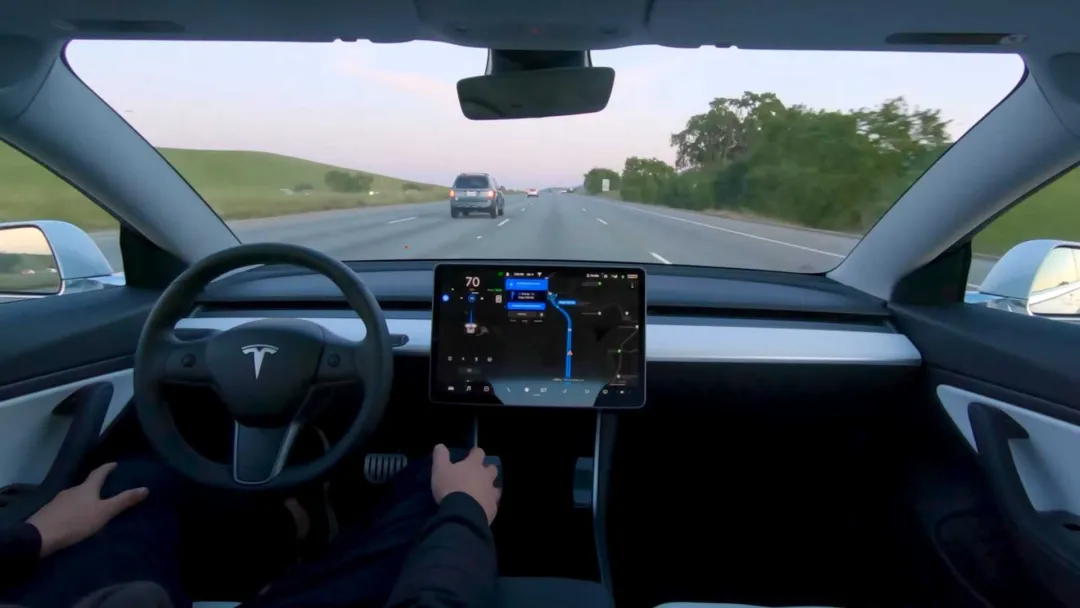

02 Tesla Accelerates Intelligent Driving, While Li Auto Faces the "Pure Electric" Battlefield

Tesla and Li Auto exemplify two notable cases of new energy vehicle companies: strong sales coupled with significant future challenges.

Despite substantial growth in the Chinese market, Tesla failed to reverse its first-ever decline in global deliveries in 2024, reflecting a complex market landscape and fierce competition. During this period, Tesla produced 459,445 vehicles, a decrease of about 7% year-on-year. Total deliveries for 2024 amounted to 1.79 million, down 1.1% from the previous year and below analysts' expectations of 1.806 million.

According to Reuters, the Trump administration is considering ending the $7,500 tax credit for consumer electric vehicle purchases. This move could exacerbate the slowdown in the US electric vehicle transition and further impact Tesla's sales in its largest market.

On December 5, 2024, foreign media reported that some testers received the updated version of Tesla FSD V13.2, featuring numerous significant enhancements over V12. Tesla developers revealed that if one could analyze its structure, this version leverages engineering iteration technology derived from its rocket engines. Regarding this potent FSD update, Musk tweeted that FSD V13's capabilities are 5-10 times that of its predecessor.

Tesla garnered widespread attention with an initiative launched in North America: a 30-day free trial of FSD (Fully Self-Driving, human-supervised version). This plan allows select users to experience advanced driving technology free of charge until February 22, 2025.

However, Tesla's current Autopilot and FSD technologies haven't fully achieved true autonomous driving capabilities. They are also under scrutiny due to lawsuits, investigations by the US National Highway Traffic Safety Administration, and criminal investigations by the Department of Justice. The transition from R&D to commercialization of autonomous driving technology often requires a prolonged period. Currently, large-scale commercial application is still several years away, meaning Tesla will struggle to achieve rapid sales and profit growth through its autonomous driving business in the short term.

To meet Musk's target of a 20% to 30% sales increase by 2025, Tesla will rely more on its promised cheaper vehicle versions and the subsequent market performance of the Cybertruck.

Now, let's turn to Li Auto, currently the top-selling new force brand.

According to Li Auto's product roadmap, by 2025, the company will offer a lineup comprising 5 extended-range models, 1 super flagship (MEGA), and 5 pure electric models. The Li One M8 is expected to be one of the 5 pure electric models, likely serving as Li Auto's first pure electric SUV, positioned as a six-seat mid-to-large SUV.

Rendered image of the M8 circulating online

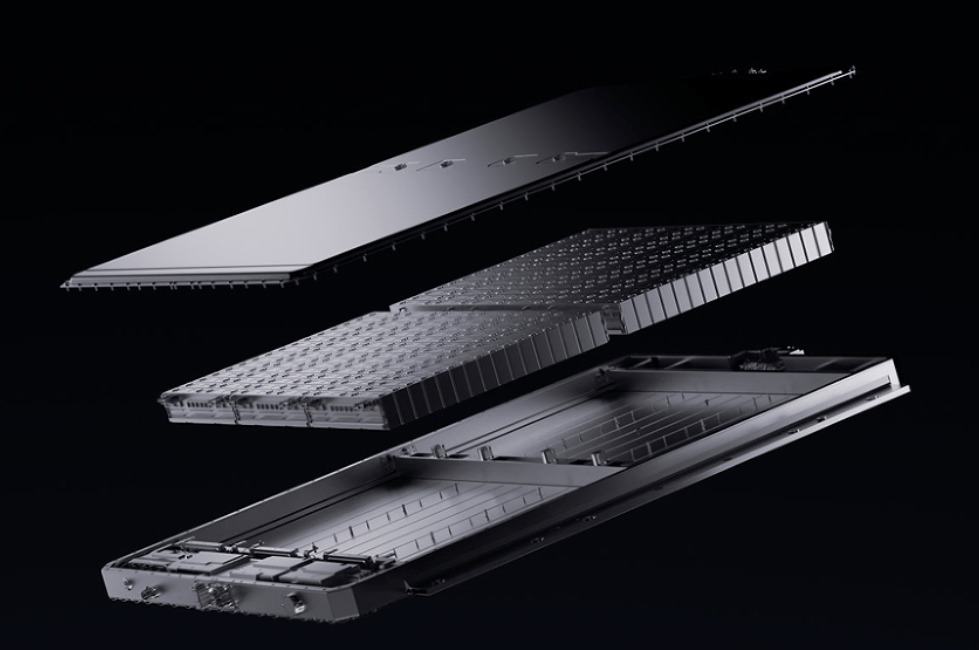

Li Xiang revealed that Li Auto aims to release a new pure electric SUV model in the first half of 2025 to cater to more family users. Regarding this upcoming model, Li Xiang emphasized the need to address two issues: product design and the provision of over 2,000 supercharging stations by the time of delivery.

Li Auto has already encountered setbacks with its MEGA model in the pure electric segment, and there is no established blueprint for creating a successful luxury pure electric vehicle. Will 2,000 supercharging stations alleviate pure electric anxiety? NIO, with over a thousand battery swap stations, doubts this. Battery swapping and charging are integral parts of after-sales service that users naturally expect rather than premium features. The current biggest issue with pure electric vehicles is the battery, with winter attenuation remaining a problem. Fast charging stations offer a decent experience but aren't convenient enough. Achieving high range necessitates heavier batteries, which also incur higher costs.

So, is solid-state battery the optimal solution? Currently, it doesn't appear so. There's still a long way to go before solid-state batteries gain widespread consumer acceptance from vehicle integration. Based on various predictions, domestic power battery shipments will exceed 2TWh by 2030, but shipments of solid-state batteries (including semi-solid and fully solid) across various fields are expected to be 65GWh. Consequently, the penetration rate of solid-state batteries in the power sector in 2030 will be less than 3% at its peak.

Qin Lihong, co-founder and president of NIO, once revealed that the production cost of NIO's 150kWh semi-solid-state battery pack is almost equivalent to the price of an entire NIO ET5 (priced at 298,000-356,000 yuan). BYD executive Lian Yubo also believes that semi-solid-state batteries will gradually replace fully liquid electrolyte batteries, but their high cost will be a significant obstacle to market acceptance.

Relevant calculations indicate that the cost of semi-solid-state batteries, considering a yield rate of 90%, is 0.87 yuan/Wh. This cost lacks a competitive advantage compared to the mainstream LFP/ternary battery system (0.4 yuan/Wh) level. Moreover, it's understood that among current semi-solid-state battery products, those with less electrolyte addition and higher performance struggle to achieve a 90% yield rate on the production line. Benchmarking the current cost level of liquid lithium batteries (0.4 yuan/Wh), according to industry predictions, semi-solid-state batteries are expected to be realized around 2035, with true fully solid-state batteries even further off.

Written at the end

A brand that continually emphasizes avoiding internal competition without taking substantial action will inevitably be overtaken by its successors. From an industry perspective, once market penetration exceeds around 50%, the difficulty of further growth increases exponentially. Thus, traditional fuel vehicles will still maintain a certain market share and relevance for some time.

However, surviving in a shrinking market is incredibly challenging, as evidenced by the "price-halving" experienced by BBA brands. Consequently, mainstream brands will continue to consolidate, cut money-losing departments, and adopt the strategy of "buying is better than making." New entrants will also face a new arduous start. Relatively low cash reserves and high debt ratios imply that high-risk investments in the future will be difficult, making it challenging to stay at the forefront of the times.

The countdown for the new energy market has only just begun.

References:

Passenger car price reductions hit a three-year high Source: Jiemian News

The Chinese market fails to reverse Tesla's decline Source: Growth croissance

Intensifying internal competition and cost reduction measures Source: Myautotime

The year of intelligent driving's "martial arts competition" Source: Qichezhixin

China's top 50 best-selling cars in 2024 Source: DiYi DianDongQiCheWang

"De-youthification" is the key for Geely to compete against BYD Source: Yiche Research Institute