300,000 Yuan! Huawei and GAC Group Unveil Their New Car, Aiming to Rival Tesla Model Y?

![]() 01/15 2025

01/15 2025

![]() 586

586

While most automakers are still strategizing for the year ahead, GAC Group has already sprung into action.

It's only halfway through January, and GAC Group has accomplished two significant milestones:

First, it provided financial assistance and took over after-sales services for Hefeng Auto, which was grappling with a debt ratio of 92.94%. Unlike Evergrande and Jiyue, Hefeng Auto's fate can be considered relatively satisfactory.

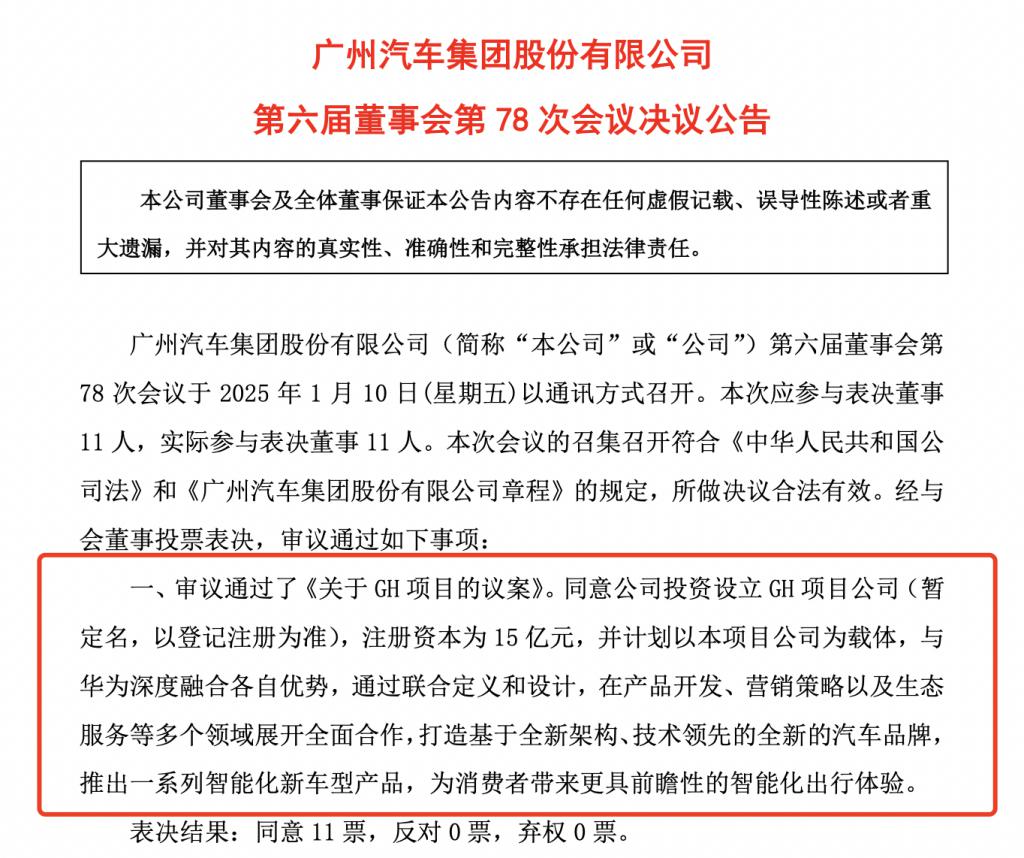

Second, GAC Group's collaboration with Huawei has reached a new stage, with the "Proposal on GH Project" officially receiving approval. The two entities will create a new automotive brand leveraging a novel architecture and cutting-edge technology.

Image source: GAC Group

According to Feng Xingya, General Manager of GAC Group, GAC and Huawei's Vehicle BU have commenced joint office work. The new brand will be positioned as a luxury intelligent new energy vehicle priced at 300,000 yuan.

GAC Group's 2024 annual performance forecast announcement revealed a net profit attributable to shareholders ranging from 800 million to 1.2 billion yuan, representing a year-on-year decrease of 72.91% to 81.94%. After excluding non-recurring gains and losses, the net profit is projected to incur a loss of 3.3 billion to 4.7 billion yuan.

Aion, the focal point of the group's transition to new energy, sold 374,884 vehicles throughout last year, a year-on-year decline of 21.90%. While Aion is gradually shedding the label of "ride-hailing vehicles," AOHPA, tasked with penetrating the high-end market, was relatively silent last year. Market discussions primarily revolved around negative topics such as Sima Nan's official experience with AOHPA's new car being criticized by netizens and Zhou Hongyi's hand being pinched during an AOHPA HT experience.

It's evident that GAC Group, which relies solely on Aion in the new energy realm, has not had a seamless transformation journey.

Screenshot: Zhou Hongyi's Livestream

With Hefeng Auto existing in name only, GAC Group may only have the path of collaboration with Huawei left if it aims to impact the high-end new energy market.

Intelligence is the Sole Pathway to the High End

GAC Group has long recognized the importance of penetrating the high-end market. Hence, in 2018, it jointly established Hefeng with NIO. The first model, HYCAN 007, directly targeted the 300,000 yuan pure electric SUV market, several years ahead of the launch of Tesla Model Y.

However, due to reasons like diluted equity and poor market sales, NIO chose to withdraw from Hefeng. Following the loss of its intelligence edge, Hefeng Auto's sales halved, and it could only survive on the "rebadged version of AION Y," Hefeng Z03.

Image source: Hefeng Auto official

Without creating a differentiated advantage, Hefeng will gradually retreat in the new energy market where the Matthew Effect is intensifying.

GAC Group and Huawei began collaborating as early as 2017, but the depth and scope of their cooperation became more apparent starting in 2024.

In April 2024, GAC Trumpchi announced the Trumpchi-Huawei Joint Innovation Plan; in September, the first cooperation result concept car between GAC Trumpchi and Huawei, 1Concept, was officially unveiled; in October 2024, GAC Trumpchi announced that it would launch three new flagship products that year and confirmed they would be equipped with the new-generation HarmonyOS cabin and Huawei's Kunlun Intelligent Driving ADS3.0.

More importantly, GAC Group signed a deepened cooperation agreement with Huawei in November last year. The cooperation mode between the two parties is the new HI PLUS mode. Products born under this new mode also share the same intelligence and marketing advantages as the "four realms" models.

Image source: Huawei Intelligent Automotive Solutions official website

Although models of the new brand cannot be sold in HarmonyOS Smart Auto direct stores, GAC Group, being a traditional large manufacturer, has no need to worry about the sales system. It is sufficient to leverage Huawei's intelligence and marketing advantages.

Faced with the increasingly competitive domestic new energy market, Diantong can clearly perceive that configuration levels among products of the same price range have already converged. Instead, the key to determining consumer purchases is the "soft demand" such as intelligent experience.

Huawei has been recognized by peers in the fields of intelligent driving and intelligent cabins. Even though the concept of "intelligent vehicle" has emerged in the automotive market, the connection between intelligent experience and intelligent cabins and driving is clearer, and consumer perception is direct enough.

For GAC Group, which urgently needs to explore the high-end new energy market, collaborating with Huawei is indeed a crucial step.

Two Speculations About the First Car of "Guanghua"

Currently, there is limited information about the first collaboration model between Huawei and GAC, a luxury intelligent new energy vehicle priced at 300,000 yuan, but Diantong has two speculations.

First, this car is more likely to be an SUV or sedan rather than an MPV.

The two MPVs, Trumpchi M6 and Trumpchi M8, are not unknown in the domestic market, but they primarily target the household MPV market below 300,000 yuan. Trumpchi E9, priced above 300,000 yuan, maintains a monthly sales volume of around 1,000 vehicles and is not very competitive compared to products of the same price range such as Lantu Dreamer, Tangshi D9 DM-i, Buick GL8 PHEV, and Xiaopeng X9.

After all, this is the first new energy vehicle jointly developed by the two parties. Diantong believes that GAC urgently needs to rely on this new car to make a splash in the high-end new energy market. The market demand for new energy SUVs and sedans priced at 300,000 yuan is much higher than that for new energy MPVs of the same price range.

Unless GAC Trumpchi launches a cluster of new cars, the first car is more likely to compete with a group of mid-to-high-end new energy sedans or SUVs for market share.

Image source: Diantong production

Second, Diantong believes that the first new car will simultaneously launch hybrid and pure electric powertrains rather than just one of the two.

Judging from the current market situation, the 300,000 to 400,000 yuan new energy market is dominated by pure electric products, such as Model 3, Model Y, Xiaomi SU7, and Zeekr 001, whose sales volumes are higher than other hybrid models.

In other words, the audience at this price range is more interested in mainstream pure electric products, which means that GAC will certainly not abandon the research and development of pure electric products.

Image source: Tesla official website

However, the market performance of multiple pure electric vehicles proves that having advantages in various aspects does not guarantee strong sales. Market sales data are largely influenced by the brand's reputation.

For the new brand resulting from the collaboration between GAC and Huawei, although it has the support of Huawei's influence, it is, after all, a brand new brand, and its market popularity is probably not as high as that of HarmonyOS Smart Auto.

Therefore, hybrids will be crucial for the sales volume of the first car. Coupled with the indispensability of pure electric powertrains, the new car will naturally be launched with dual powertrain options.

If the first product has excellent quality and can successfully leverage Huawei's influence to create momentum, the new car's monthly sales volume should be able to reach a level similar to that of the ZEEKR R7, which exceeded 15,000 units.

Huawei is Not a Lifesaver; One Must Be Strong Oneself

Last year, automotive brands such as Changan Group and Lantu had varying degrees of collaboration with Huawei. Judging from sales data, models such as the Deep Blue S07, Avitar 07, and the all-new Lantu Dreamer, which applied Huawei's corresponding technologies, did indeed experience relatively significant sales growth. The monthly sales volume of the all-new Lantu Dreamer even exceeded 10,000 units.

You might ask, does collaborating with Huawei give automakers the opportunity to sell well? From a product perspective, Diantong believes the answer is no.

Image source: Diantong production

Taking the all-new Lantu Dreamer, which was launched last year, as an example, only the top-of-the-line version is equipped with Huawei's Kunlun Intelligent Driving and HarmonyOS cabin. However, family users place great emphasis on handling, power, safety, and comfort, which are already maximized in other versions. Although the intelligent experience of the mid-to-low configurations is not as good as that of the top-of-the-line version, with the standard 8295 chip, the performance of the Lantu Xiaoyao cabin is completely on par with mainstream brand models, and the Lantu Kunpeng Intelligent Driving is also supported by 24 sensors and 26 intelligent driving assistance functions.

In other words, these cars can sell well because they have certain strengths in themselves, and collaborating with Huawei serves as an added bonus. The illusion that "collaborating with Huawei will create a hit product" is simply because these products have not been seen by more consumers.

Many counterexamples can also support this view. There are also many products on the market that have failed to improve despite applying Huawei's technology, such as the ARCFOX Alpha S HI version equipped with Huawei Intelligent Driving, the Refine RF8 equipped with the HarmonyOS cabin, and the Beijing Auto Magic Cube, among others.

One must be strong oneself. When one's own hard power is insufficient to convince consumers, no matter how famous the partner is, it won't make much of a difference.

Image source: GAC Trumpchi

Diantong observed that although GAC Group's journey towards the high end has not been smooth, judging from products such as AION UT and AION RT launched recently, the group does have a good grasp of the quality of household new energy vehicles and has accumulated considerable manufacturing experience in the MPV market. It should not be difficult to create a high-quality new energy vehicle.

However, with so many best-selling products priced at 300,000 yuan, how to make consumers have a deeper memory point may be the most important issue that the new brand needs to consider.

(Cover image source: Huawei Intelligent Automotive Solutions official website)

Source: Leitech