2024 New Energy Vehicle Investment and Financing Report: Capital Inflow Exceeds 100 Billion Yuan - Unveiling the Fundraising Champion

![]() 01/22 2025

01/22 2025

![]() 493

493

Preface

Firestone's depiction of the new energy vehicle industry chain highlights its expansive scope, encompassing manufacturing, components, and services. Based on this comprehensive view, Firestone conducted an in-depth statistical analysis of the industry's investment and financing landscape in 2024.

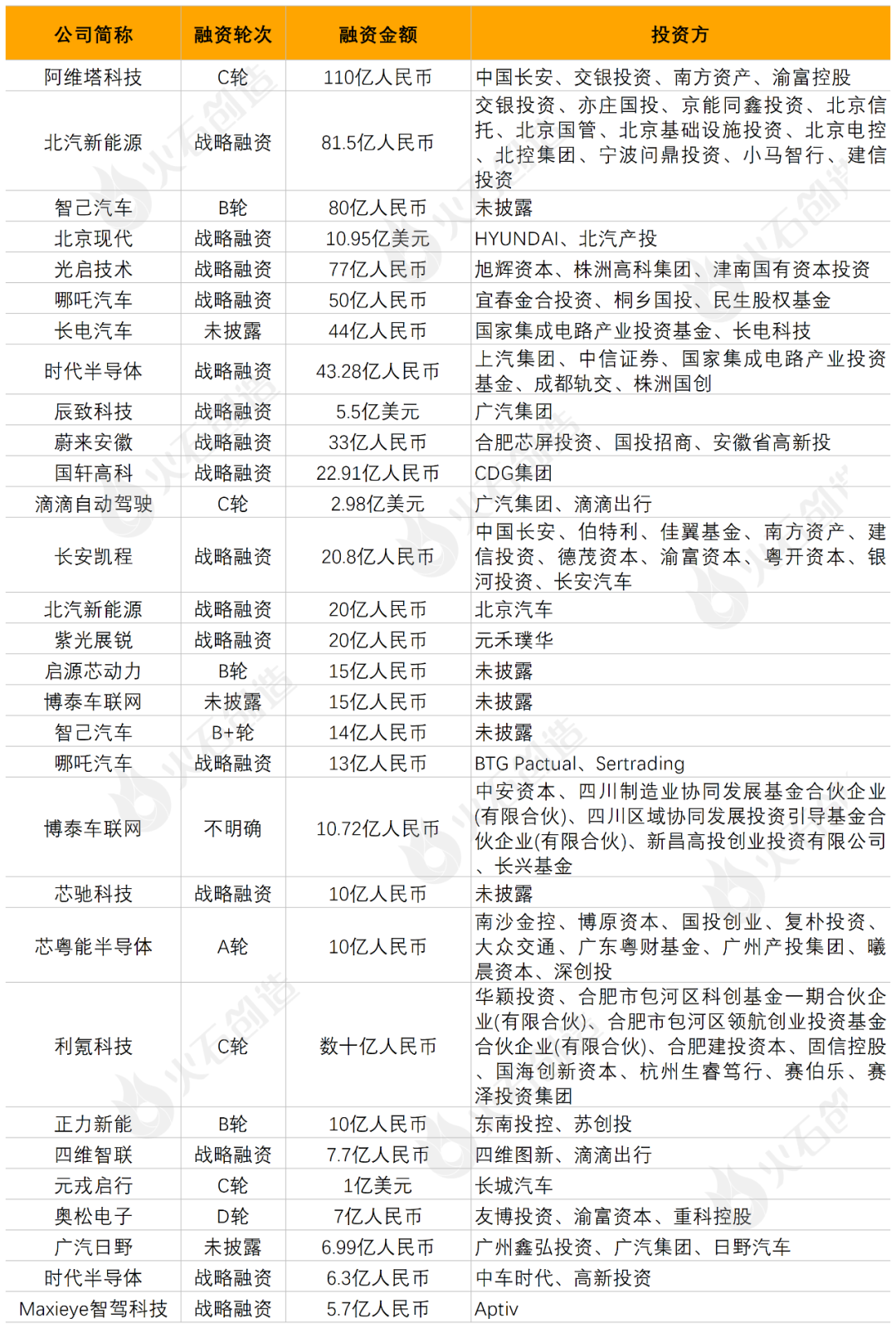

Top 30 Financing Events in the New Energy Vehicle Industry in 2024

Source: Firestone Industrial Data Center

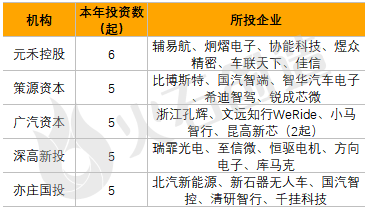

Annual Active Investment Institutions

Source: Firestone Industrial Data Center

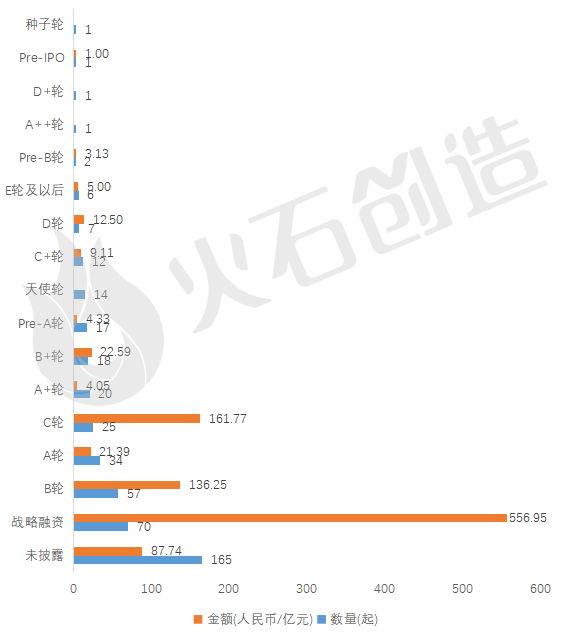

[Financing Overview] In 2024, the national new energy vehicle sector witnessed 451 investment and financing events (excluding proposed acquisitions, acquisitions, private placements, and listings), with a cumulative amount surpassing 102.581 billion yuan (excluding undisclosed amounts).

[Distribution of Financing Rounds] Strategic financing dominated this year's financing landscape, accounting for 70 projects. By amount, strategic financing led with 55.695 billion yuan, representing 54.29% of the total. Series C financing followed closely with 16.177 billion yuan, accounting for 15.77%.

Chart: Number and Amount of Financing Rounds

Source: Firestone Industrial Data Center

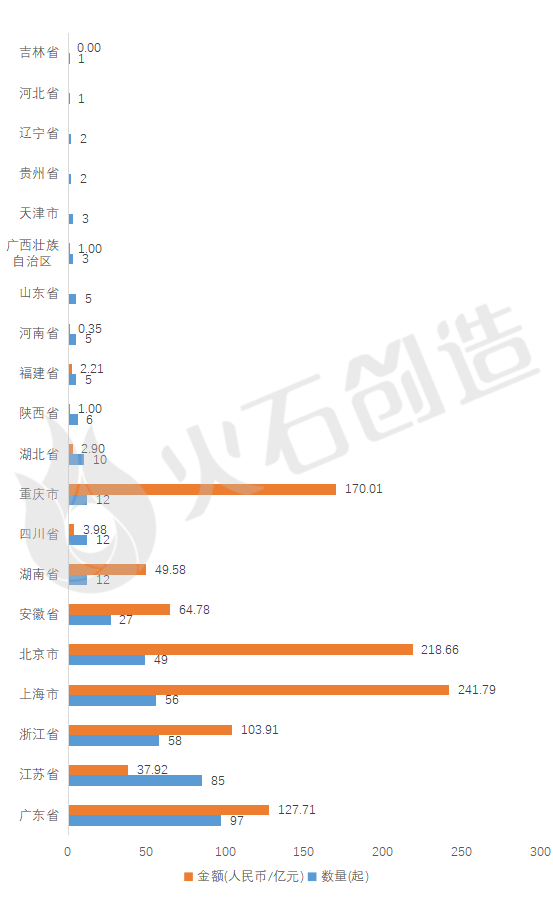

[Geographical Distribution of Financing] Guangdong Province (97 cases) and Jiangsu Province (85 cases) led in the number of financing events. In terms of funding, Shanghai topped the list with 24.179 billion yuan (23.57% of the total), followed by Beijing with 21.866 billion yuan (21.32% of the total).

Chart: Number and Amount of Financing in Various Regions

Source: Firestone Industrial Data Center

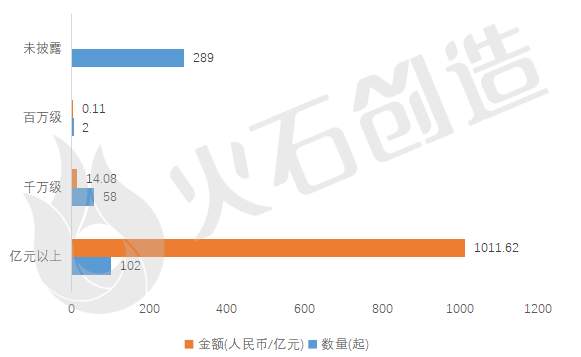

[Distribution of Financing Amounts] A total of 451 projects received investments amounting to over 102.581 billion yuan. Notably, 102 cases secured over 100 million yuan each, totaling 101.162 billion yuan, or 98.62% of the overall financing.

Chart: Distribution of Financing Amounts

Source: Firestone Industrial Data Center

Most Notable Financing Projects

1. AITO: Completed Series C Financing Exceeding 11 Billion Yuan

AITO announced the successful completion of Series C financing, raising over 11 billion yuan. This round was jointly funded by Changan Automobile, Chongqing Yufu Funds, Southern Asset Funds, SDIC Funds, BOCOM Investment, and other strategic and market investors. AITO is now preparing for its IPO, aiming for a 2026 listing.

Founded in 2018, AITO integrates the strengths of Changan Automobile, Huawei, and CATL in vehicle R&D, smart vehicle solutions, and smart energy ecosystems. They have jointly developed the CHN platform, characterized by "new architecture, strong computing, and high-voltage charging." AITO's business spans the entire industry chain, including intelligent connected and new energy vehicle technology R&D, component production, and operation services. (View relevant enterprise information on Industrial Data Pass)

2. BAIC BJEV: Completed Strategic Financing of 8.15 Billion Yuan

BAIC BJEV Technology Co., Ltd. (stock code: 600733) announced that its subsidiary Beijing Electric Vehicle Co., Ltd. has secured 8.15 billion yuan through the introduction of 11 strategic investors, including Beijing State-owned Capital Operation and Management Co., Ltd., Beijing Infrastructure Investment Co., Ltd., and others.

BAIC BJEV is China's pioneering independently operated new energy vehicle enterprise, holding production qualifications and pioneering mixed-ownership and employee shareholding reforms. As a high-tech company under Beijing Automotive Group Co., Ltd., it offers integrated solutions for green and smart travel. Relying on core technologies in batteries, electric motors, electric control systems, intelligent connectivity, and automated driving, BAIC BJEV aims to provide users with an ultimate electric, intelligent, and personalized driving experience. (View relevant enterprise information on Industrial Data Pass)

3. IM Motors: Completed Series B Financing Exceeding 8 Billion Yuan

IM Motors announced the completion of Series B equity financing, raising over 8 billion yuan. The funds will support the development of new-generation intelligent vehicle models, R&D in high-level intelligent driving and future cabin technologies, market expansion, and overseas market entry. The financing was led by BOC Asset Management, with participation from ABC Investment, Lingang Group, and follow-on investments from CATL, Momenta, and Qingdao Energy. SAIC Motor, ICBC Investment, and BOCOM Investment also increased their investments.

Founded in 2020 in Shanghai's Zhangjiang area, IM Motors is a new energy vehicle brand jointly invested by SAIC Motor, Alibaba, and the Pudong New Area, focusing on the R&D and manufacturing of high-end intelligent electric vehicles. (View relevant enterprise information on Industrial Data Pass)

4. Beijing Hyundai: Received a Capital Injection of 1.095 Billion Dollars

Beijing Automotive announced that its subsidiary, Beijing Automotive Investment Co., Ltd., has agreed with Hyundai Motor Company to jointly inject 1.095 billion dollars into Beijing Hyundai, with each party contributing 548 million dollars based on their current shareholding ratio. Post-injection, Beijing Hyundai's registered capital will increase to 4.074 billion dollars, maintaining a 50-50 shareholding structure.

Established in 2002 with a registered capital of 1,219,068,000 US dollars and a 50-50 shareholding structure, Beijing Hyundai is a 30-year joint venture between Beijing Automotive Investment Co., Ltd. and Hyundai Motor Company. With over 15,000 employees and cumulative sales exceeding 5 million vehicles, Beijing Hyundai was China's first Sino-foreign joint venture in the automotive sector post-WTO accession, recognized as a leading project for revitalizing Beijing's modern manufacturing industry. (View relevant enterprise information on Industrial Data Pass)

5. Kuang-Chi Technologies: Completed Strategic Financing of 7.7 Billion Yuan

Kuang-Chi Technologies announced the introduction of three strategic investors—Zhuzhou Metamaterials, Jinnan State Investment, and Gongqingcheng Kunzhi Metamaterials—through equity transfer agreements. A total of 323,188,182 unrestricted tradable shares were transferred, representing 15.00% of the company's total share capital, for a total consideration of 7.7 billion yuan.

Founded in 2001, Kuang-Chi Technologies (002625.SZ) is a high-tech enterprise specializing in the R&D, production, and sales of cutting-edge equipment products utilizing new-generation metamaterials. With international technological leadership in metamaterials, Kuang-Chi is the world's only company to apply metamaterial technology on a large scale in this field. (View relevant enterprise information on Industrial Data Pass)