December Battery Swapping Passenger Car Sales: A Historic Milestone

![]() 01/26 2025

01/26 2025

![]() 541

541

Each December marks the pinnacle of new energy vehicle sales for the year, and the battery swapping passenger car market mirrors this trend. Insurance data reveals that December witnessed a record-breaking sales figure of 41,815 units for battery swapping passenger cars, surging by a robust 52% compared to November.

Among various brands, NIO, BAIC, Geely, FAW, and SAIC all recorded varying levels of growth in December, with Dongfeng being the sole exception, experiencing a slight decline.

Focusing on individual brands, NIO maintained its stellar performance in December with total sales exceeding 32,609 units, a 53% increase from the previous month. Notably, the Ledao L60 stood out with sales surpassing 10,000 units in December, marking a historic milestone as the first battery swapping vehicle to achieve this feat. Additionally, since NIO Day, four units of the NIO ET9 have been delivered.

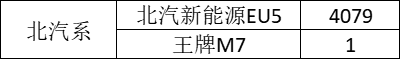

BAIC followed closely with sales of the BAIC BJEV EU5 reaching 4,079 units in December, more than doubling from the previous month. The EU5's quality was further highlighted in the Q4 complaint-sales ranking of popular new energy vehicles by Chezhizhi.com, where it ranked second only to the Xiaomi SU7.

Geely held onto third place with sales of 2,815 units in December, a 44% increase from the previous month. In December, Geely introduced a new model, the Ruilan 8, a renamed version of the Fengye 80v L, positioned as a seven-seater battery swapping MPV. With the addition of the Ruilan 8, Geely now boasts six battery swapping models, second only to NIO's nine models.

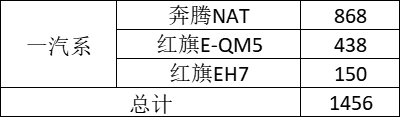

FAW sold 1,456 units in December, with minimal month-on-month variation. Recently, CATL and FAW Hongqi jointly announced the opening of Hong Kong's first Chocolate Swap Station, deploying the Hongqi E-QM5 electric taxi version. Both parties aim to establish a new energy travel network that encompasses Hong Kong and extends to ASEAN.

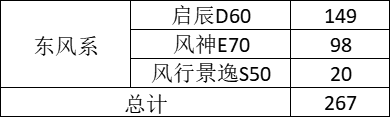

SAIC's market performance in December was slightly stronger than Dongfeng, with the former selling 578 units and the latter selling 267 units. This disparity is primarily attributed to the near-doubling of Feifan brand sales in December. However, it remains unclear whether this surge is due to a December-specific factor or improved operational efficiency following the abandonment of its solo flight strategy.