Will New Force Automakers Lag Behind in Core Technology by 2025?

![]() 02/05 2025

02/05 2025

![]() 677

677

In 2025, the divergence in consumption patterns between early adopters and rational consumers is anticipated to reach its zenith.

This trend is evident throughout the year, as people eagerly await the new plans of major automakers for 2025. They ponder over the types of new cars that will be introduced, how much cheaper they might be compared to current models, and the specifications of their sofas, TVs, fridges, and intelligent driving systems. Similar to how they evaluate mobile phones, consumers are making informed decisions about their next automotive purchases.

However, there is a clear stratification among automakers, leading to significant gaps and differences among consumer groups. For instance, many people steadfastly avoid Japanese cars, while others never consider domestic brands. Many prefer new force automakers over traditional ones.

Despite Li Bin's assertion that "We've been making cars for 10 years, so we shouldn't be called new force anymore," from a sociological perspective, consumer groups still draw a distinct line between new force automakers and traditional ones.

For some time now, new force automakers have enjoyed rapid sales growth and now dominate many segment rankings. This has led to the perception that leading new force automakers are innovating rapidly, while traditional automakers are sluggish. However, 2025 might be the year this view is reversed.

Among the new force automakers, only Xiaomi and Huawei appear to be the most competitive?

Analyzing the 2025 new car plans of several leading new force automakers reveals stratification in the application of new technologies.

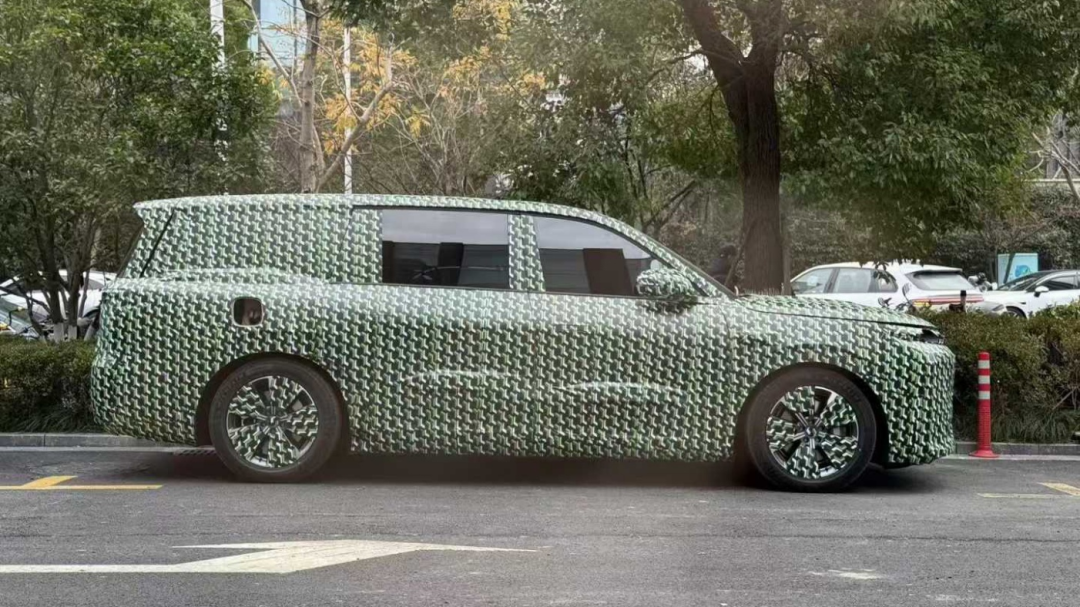

In 2025, NIO will first upgrade its flagship model, the NIO ET9, and is expected to launch the second model of NT3.0, the all-new NIO ES7. Meanwhile, models that currently account for the majority of sales in the NT2.0 line-up will gradually be upgraded to NT2.5, akin to a mid-cycle facelift. Ledao will introduce two new models: a large 5-seat SUV and a 6-7 seat family SUV. Additionally, its third brand, Firefly, will debut.

There are two core technological changes. Firstly, the gradual adoption of the 900V architecture, which further reduces power consumption and speeds up charging. For example, under the testing standards of the Ministry of Industry and Information Technology, the Ledo L60 boasts a power consumption of 12.1kWh per 100 kilometers, slightly outperforming the benchmark Model Y in the same class.

The other core change is the World Model NWM, which represents a significant upgrade in end-to-end and large models. However, Li Bin is not aggressive in pursuing L3 intelligent driving, so its capabilities will remain within the industry's first tier. Nevertheless, like many car owners, don't expect to be able to lie down and let the car drive itself.

XPeng will launch four models in 2025: the XPeng G7, which has just been declared by the Ministry of Industry and Information Technology; the heavily revised XPeng G6, a direct replacement for the older XPeng P7; and the first extended-range vehicle, likely to be the XPeng G9. What technologies will these new models feature? The technological logic is straightforward. It's foreseeable that there won't be any groundbreaking new technologies. Instead, the focus will be on stacking configurations to lower prices, similar to NIO's approach, while leveraging their strength in AI intelligence. As a result, the level of core hardware is relatively average. For instance, the M03 even equips a trailer suspension for a car priced over 100,000 yuan, and XPeng's extended-range system uses Dongan's mid-to-low-end products.

The same is largely true for Lixiang. The focus for the year will be on the pure electric i-series. The existing extended-range L-series models are likely to receive a facelift featuring the NVIDIA Thor chip. The brand's technological focus is AI, as evidenced by Li Xiang's recent return. On the surface, it's about L3 and L4 intelligent driving, but at its core, it's about automotive robots. However, it's still premature to discuss these advancements. More attention should be paid to the mysterious pure electric i-series, which currently only reveals 800V and a new BMS. Given Li Xiang's style, this is clearly not all, and there are hidden aces up his sleeve.

Leap Motor will introduce new sedans, full-size SUVs, large MPVs, and the already announced Leap Motor B10. Leap Motor's sales have surged significantly. Its approach is similar to BYD's due to its extensive vertical integration capabilities for self-research and production, making its vehicles highly competitive in terms of price in segment markets. However, its current strategy isn't to disrupt the market with a specific groundbreaking technology.

AITO is another player to watch, with its AITO 06 potentially becoming a price killer. With Chang'an's technological research and development backing and Huawei's full empowerment, it boasts a strong internal combustion engine technological capability, which is rare among new force automakers. Therefore, as long as pricing, production capacity, and promotion are well-executed, sales will follow.

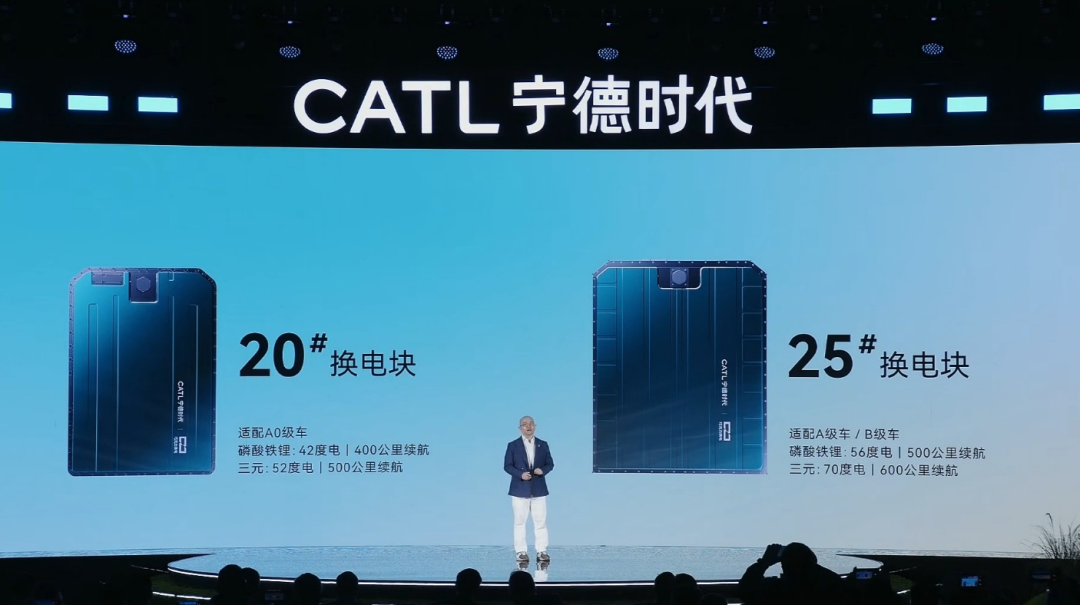

So, the performance of several leading new force automakers is roughly as described. How significantly the range will increase in 2025 depends largely on the new products released by CATL. In terms of performance, automakers have more control over software algorithms and management capabilities. Motors, on the other hand, rely heavily on players like Huichuan, LEC, and the rising BYD Fudi.

The conclusion is relatively clear: Overall, except for Xiaomi and Huawei Hongmeng Zhihang, the hard power of other automakers needs further observation.

Are traditional automakers overtaking new force automakers in many technologies?

When driving in formation on the highway and aiming to maintain the integrity of the convoy, the following vehicle needs to be faster than the leading one. The current market competition is analogous. Reviewing the new technologies announced for 2025, many automakers that have completed their transformation are showing clear trends of catching up and overtaking.

For instance, in the realm of power batteries, the terms 4C, 5C, and semi-solid have been popular in recent years. Since they are already well-known, they represent mass-produced products that are competitive but not the most advanced.

What will emerge in 2025? The answer is 6C batteries.

By parameters alone, today's 5C batteries will quickly become outdated.

In September 2024, SAIC-GM announced new equipment in collaboration with CATL. The technical specifications for charging include a 200-kilometer range increase with just 5 minutes of charging, which will be used in the newly upgraded Ultium quasi-900V high-voltage battery architecture. While these data might not seem particularly impressive as it uses lithium iron phosphate instead of ternary lithium, it's still a significant advancement.

In January 2025, Svolt Energy released its 6C battery technology, boasting a key technical indicator of a 6C charging rate and a charging time of 8.5 minutes from 10% to 80%.

The most aggressive player is Chery. In October 2024, Chery announced its new Kunpeng battery product at a conference, supporting 6C charging with the fastest charging time of 5 minutes adding 400 kilometers of range.

The new 5C batteries in 2024 generally refer to charging from 0 to 100% in 12 minutes. However, on actual vehicles, these speeds will be slower. For instance, the first 5C battery-equipped Ideal MEGA has charging parameters of completing 10%-80% charging in 12 minutes. In other words, due to internal competition among several traditional major manufacturers, we are on the brink of entering the true 5C era in 2025. If Chery's 5-minute charging for 400 kilometers can be widely applied, the significance of solid-state batteries will diminish.

This is because, according to related products that have been launched, the semi-solid battery charging rate on the IM L6 is only 3C, with 12 minutes of charging adding about 400 kilometers of range.

Therefore, from a battery perspective, it's questionable whether new force automakers can maintain their early lead from previous years. Back then, to secure increased supply from CATL, He Xiaopeng was rumored to have flown to Fujian for negotiations, subsequently switching battery-related strategies. The focus is now on obtaining quality products rather than new ones, as new products are prone to issues. However, batteries are not much of an issue for AITO, as it is a joint venture with CATL.

Motors are another key area. Entering 2024, dominated by new energy, the acceleration of cars is no longer as valued as it was for fuel vehicles. Among new cars priced over 250,000 yuan, whenever the vehicle's definition and sports are somewhat related, impressive acceleration figures are expected. For instance, the 299,000-yuan ZEEKR 001 can achieve a 0-100km/h acceleration time of 3.3 seconds, while the 298,000-yuan NIO ET5 can do it in 4 seconds.

However, in early January, with the announcement of the BYD Han L, the motor battle for new energy vehicles in 2025 will also intensify. Despite its huge sales and unbeatable cost-effectiveness, BYD's industry and user praise for its motors is not proportionally leading. After all, there was a significant difference in previous motor powers. The rated power, which is most frequently used in daily life, is around 70kW, which can only maintain a peak power of around 240kW for a short time. However, in promotions, the data of 240kW appears very frequently. Now, with the emergence of the Han L, the peak power of the rear motor of the four-wheel drive version is 580kW and the rated power is 300kW, making it a product with top parameters in the industry.

The currently known situation is that BYD may have overcome the problem of permanent magnet motors being prone to demagnetization at high speeds/temperatures and is expected to use ultra-fine particle manufacturing technology. As long as energy consumption control, battery management strategies, and manufacturing costs can be optimized, this will be the strongest known product in the industry. At the same time, in addition to BYD, more traditional automakers are conducting research and development in this area. For example, Mercedes-Benz's classic YASA motor on the track, and after Lotus broke through motor technology, Geely can also benefit widely.

In terms of the industry, there are not many competitors that can challenge these advancements, such as Xiaomi's V8S self-developed motor and Porsche's 500kW motor. As for Huawei, although it does not directly participate in car manufacturing, it has top-tier partners like Chery and Changan. The best extended-range system in the industry is currently equipped in its AITO and AITO Avita models. Additionally, the price of the Respect S800, which will be officially announced in 2025, may also set a new benchmark for extended-range capabilities.

This aligns with what we mentioned earlier: from a traditional technology perspective, apart from Xiaomi and Huawei, there are not many other significant players.

Final Thoughts

The new market landscape reveals that after several years of early adoption by new force automakers, traditional technology is not only catching up but also surpassing. Furthermore, this shift likely means that the previous advantages