Will Oil Vehicles Outshine New Energy Vehicles in 2025 Joint Ventures?

![]() 02/05 2025

02/05 2025

![]() 615

615

In 2025, are there still joint venture vehicles worth buying? Put another way, what advantages will joint venture vehicles offer this year? Historically, Japanese cars' low fuel consumption has been outpaced by domestic single-gear plug-in hybrids. German cars' suspension tuning and handling can no longer claim supremacy compared to domestic active chassis technology supported by algorithms. American cars' large-displacement off-road vehicles face competition from decoupled electric four-wheel drive and even range extension with four motors. In summary, many of the partial advantages once boasted by joint venture vehicles have now been replaced or surpassed by domestic technology. Hence, by this year, joint venture vehicles will focus on power, intelligent driving, and intelligent cabins. So, what new cars will joint venture brands introduce next? Will any new technologies land?

Heavyweight oil vehicles are solely from BBA, while Volkswagen's new plug-in hybrids will arrive next year.

As of this year's Spring Festival, at least 10 joint venture automakers have released new plans. First, let's discuss German cars. SAIC Volkswagen and FAW-Volkswagen will primarily rely on oil vehicles in 2025, with over 16 new models from the two joint venture factories. Among them, oil vehicles include the new Tharu L, new Sagitar L, Lamando L, Lavida, T-Roc, and Teramont PRO, which will be replaced. The new Talagon will also feature the fifth-generation EA888 engine. Summarizing the upgrade ideas of new oil vehicles, we can discern four main points. Firstly, there is a redesign of the shape, with traditional oil vehicle characteristics significantly weakened, such as the adoption of more through-type concepts and abandoning large-mouth grilles.

Secondly, the size is further extended. In addition to the 60mm increase in the wheelbase of the Tharu L, the Lamando L, Sagitar L, and Polo PLUS will all emphasize cabin space. Thirdly, there is an increase in intelligent configuration, such as stacking up to three front-row in-vehicle screens. Among them, the Tharu L uses the 8155 chip, introduces the iFLYTEK voice solution, and also features the DJI intelligent driving system, adding a set of pilot functions that can autonomously change lanes and overtake on highways. Fourthly, there is an upgrade to the power system. In addition to maintaining the existing 1.5T Evo2 (EA211) engine, the fifth-generation EA888 2.0T will also be available, but currently, there are no plans for sedans.

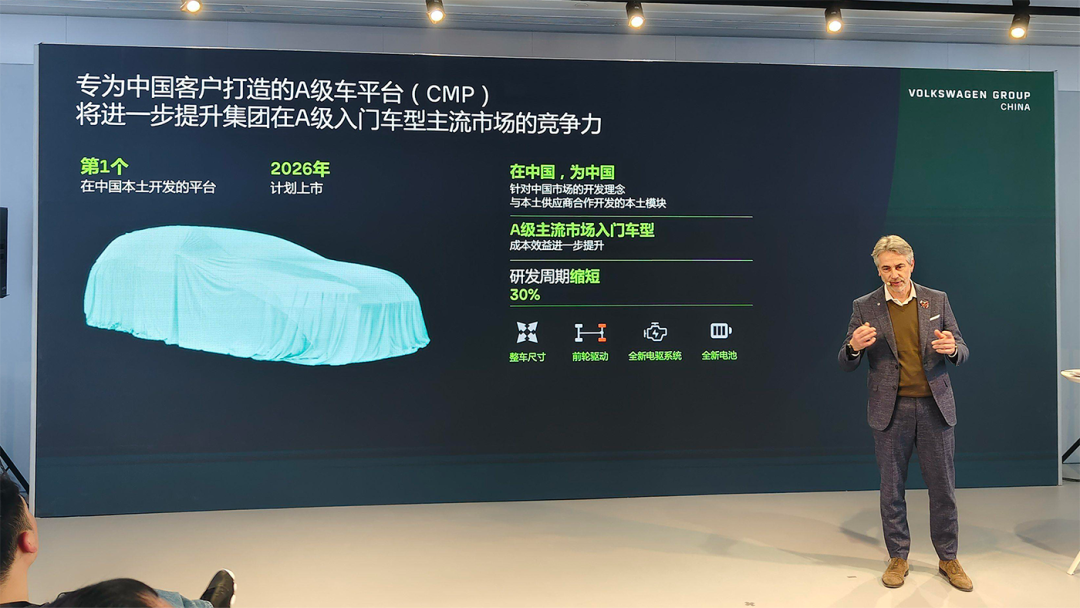

So, after this major round of upgrades, is Volkswagen's oil vehicle competitiveness strong enough? From a technical standpoint, there are no substantial changes to the engines and transmissions of the main sales models, and the chassis still comes from the long-used MQB evo platform. While there are tuning and optimizations, they may not be groundbreaking. In summary, Volkswagen in 2025 will still implement new technologies in plug-in hybrids, pure electrics, and range extension, focusing on the A-class pure electric platform CMP priced at 140,000-180,000 yuan, the pure electric B-class SUV based on the Xpeng G9, as well as plug-in hybrid sedans combined with SAIC DMH and the CEA electrical and electronic architecture. These new technologies will not be densely launched until 2026 at the earliest. Therefore, for Volkswagen this year, plug-in hybrids will still be modified from the MQB evo. Although the official mentioned that the pure electric range under new technologies will increase to 100km, based on the existing DQ400e dual-clutch transmission, the P2 motor architecture means that shift smoothness remains a question mark.

German joint venture luxury brands, BMW, Mercedes-Benz, and Audi, have all focused on the new 2.0T engine this year. After the replacement of the domestic BMW X3, in addition to the extended wheelbase to match the standard wheelbase of the X5, the power parameters of the entire system have increased. The maximum power of the 25Li has risen to 140kW, and the 30i to 190kW. The core components of the B48B20W have been significantly upgraded. For example, although the Miller cycle is still used, the intake valve opening time is shortened. Besides the high-pressure injection system, a small portion of fuel can also be injected into the combustion chamber through the low-pressure system. At the same time, the performance of the turbocharging system and intercooler has also been improved. These technical improvements allow the engine to inhale more air faster, with high torque at low speeds and start-up performance comparable to that of a 48V mild hybrid. Turning to intelligent technology, the mass-produced Head-Up Display will be first configured on BMW's new-generation models. In the future, the iX3 will also use cylindrical batteries, potentially increasing endurance and charging efficiency by 20%. Additionally, the 5 Series will also utilize V2X technology, supporting functions such as lane changes with eye signals, essentially enabling highway piloting.

The domestic Audi A4L has been replaced by the A5L, but the fifth-generation EA888 is the main attraction. It features 500Bar high-pressure direct injection, a VTG variable geometry turbocharger, a deeper Miller cycle with more extreme valve closing timing, and a series of friction-reducing technologies used since the fourth generation. The good news is that after improving thermal efficiency, it's not just a boost in book parameters. The new engine finally no longer burns oil. Keywords like higher thermal efficiency and the Miller cycle suggest that this new engine is also paving the way for the next-generation plug-in hybrid technology. As for Mercedes-Benz, the CLA will offer pure electric, 2.0T, and 1.5T plug-in hybrid options. The engine developed in collaboration with Geely and HORSE is also noteworthy for cylinder block casting, deep friction reduction, and thermal efficiency. However, even more noteworthy than the new engine is Mercedes-Benz's self-developed L2+ highway NOA in China. The intelligent driving technology primarily promoted by new energy vehicles will also appear in Mercedes-Benz's oil vehicles in the future.

Will Japanese cars pushing affordable intelligent driving have a chance to catch up with domestic cars?

Japanese cars, previously active in the hybrid market, will basically make no moves on plug-in hybrids and oil-electric hybrids this year. Except for Honda introducing new Accord, new Civic, and new CR-V models, they are hardly preparing to promote the landing of engine-related technologies. The focus is on the Ye S7 and Ye P7 within the W pure electric architecture. Unsurprisingly, Toyota's sixth-generation RAV4 will likely be delayed this year. The notable cars to watch will be the bZ3C, Box Zhi 3X, and Box Zhi 7 in the new energy sector. Besides the three-electric technology, what's expected is actually the price of the new cars, Momenta intelligent driving, and Huawei intelligent cabin.

Judging from the new year plans of the entire joint venture brand, they can be roughly divided into two directions: one is the landing of new technologies represented by BBA, and the other is the landing of intelligence typified by Japanese cars. However, whether it's Dongfeng Nissan N7, Honda's Ye brand in China, or Toyota's bZ3C, Box Zhi 3X, and Box Zhi 7 in China, they have clearly partnered with Huawei and Momenta and are preparing to make a comeback through intelligence this year. But the question arises: with the decreasing price of domestic vehicles equipped with intelligent driving technology and the price reduction of high-level intelligent driving option packages, will this strategy work for Japanese cars?

Let's first summarize from the timeline. At the end of 2023, Li Auto launched a large model. In January 2024, Geely introduced the Xingrui AI large model. During the same period, BYD released its intelligent vehicle strategy. In April, NIO NOP+ was introduced. In May, XPeng launched end-to-end technology, and Volkswagen equipped its vehicles with the DJI intelligent driving system. In October, HarmonyOS Intelligent Driving basically completed the popularization of the basic and advanced versions of the Qiankun intelligent driving function. However, FAW Toyota, GAC Toyota, Dongfeng Honda, and GAC Honda have scheduled the landing of large models until the end of 2024. Without a first-mover advantage and before being verified by the market, using it on new cars may not attract the market due to specific functions and effects, but rather due to the overall vehicle price.

It is certain that in 2025, Deep Blue Automobile will come standard with Huawei's L2.5 intelligent driving system across its entire lineup, priced at the 200,000 yuan level. Going up another 50,000 yuan, there is even the Zhijie R7, which comes standard with air springs and a CDC fully-loaded Tuling chassis. BYD's end-to-end plan also aims to lower the threshold for intelligent driving to the 150,000 yuan level. Of course, in the 150,000 yuan price market, there is already the Aion RT equipped with a lidar, offering urban NOA and highway NOA at 150,000 yuan. Similar effects are also available on the XPeng MONA M03 (2024 MAX version). GAC Toyota Box Zhi 3X is also preparing to pull the price down to 150,000 yuan, but it is not yet certain whether it will be standard across the entire lineup. Therefore, from a price perspective, if Japanese cars want to catch up with domestic cars through intelligent cabins or intelligent driving this year, the first consideration should be how to set a reasonable SKU.