Lexus Officially Announces Localization in China: Can Shanghai Foster Another 'Tesla'?

![]() 02/06 2025

02/06 2025

![]() 503

503

Introduction

Landing in Shanghai marks a pivotal battle to reverse the tide and the final leap during the crucial transformation window.

After more than a decade of intermittent discussions in the industry, the localization of Lexus was finally made official on the first working day following the 2025 Chinese New Year, bringing this matter to a conclusive chapter.

Toyota China announced on February 5 that Toyota and Shanghai have reached a strategic cooperation agreement for green and low-carbon development, planning to establish a research and development (R&D)/production company for Lexus pure electric vehicles and batteries in Jinshan District, Shanghai. The first pure electric vehicle model is anticipated to commence production as early as 2027.

Its significance and attention are self-evident.

Sixty years after entering the Chinese market, Toyota has finally pressed the decision button regarding the critical transformation, becoming the second foreign auto company to establish a wholly-owned factory in Shanghai after Tesla, and also setting a precedent for Japanese automakers to build their first wholly-owned factory in China.

Toyota's aspirations for the localization of Lexus extend far beyond mere car manufacturing. It is reported that the cooperation will extend from Shanghai to the Yangtze River Delta region and beyond, encompassing advanced technology applications in logistics networks, cooperation with upstream and downstream enterprises in the industrial chain, hydrogen energy, autonomous driving, battery recycling and reuse, and more, jointly creating a model project in China and globally.

Finalizing the localization of Lexus is a rational choice for Toyota to maximize its interests from a pragmatic perspective and is the general trend for Lexus to overcome its passive situation.

For a long time, Lexus has effortlessly profited in the Chinese market and long enjoyed the benefit of price hikes. In this era of fierce competition and the growing presence of Chinese luxury car brands, Lexus has also transitioned from its former "high-profile" stance to a "strongly pragmatic" one. Landing in Shanghai is a crucial battle to turn the tide and the final leap during the transformation window.

Thirty-six years after its inception, Lexus has chosen to restart from China. Meanwhile, Akio Toyoda, who succeeded his father Shoichiro Toyoda, is more convinced than ever that only by establishing roots in China can Lexus secure its future amidst the global trend towards electrification and intelligence.

Long-awaited, landing in Jinshan

It has been over a year since the industry reported that Toyota was in talks with the Shanghai government about the possibility of establishing a wholly-owned subsidiary. Over the past year, despite gradual revelations by Chinese and Japanese media, Toyota China has remained tight-lipped, consistent with the steady and low-key style of Toyota and Lexus. They plan meticulously and act decisively, and almost all major plans are cautiously announced officially, with a commitment to follow through.

Now, this significant event, which has frequently appeared in the news, been hotly debated by the industry for over a decade, and agitated the nerves of several generations of automakers, has finally been confirmed by Toyota officials. Before delving into its internal logic and rationale, let's first outline the core information regarding the localization of Lexus:

First, the operating mode.

This is a 100% wholly-owned project by Toyota, avoiding the bottlenecks of joint ventures and eliminating the need to balance the interests of FAW Toyota and GAC Toyota. The entire project essentially mirrors Tesla's Chinese model, including support from the Shanghai local government in terms of policies, land, and manpower, with the new factory's production targets focusing on pure electric vehicle models.

Second, project expectations.

Following Toyota China's official announcement, Japanese media such as Yomiuri Shimbun further revealed more details. The annual production target of the new factory is approximately 100,000 vehicles, and the initial overall operation plan will create about 1,000 new jobs. Yoshihiro Miyazaki, vice president of Toyota, stated that the local Chinese team will handle all processes from design, research and development to manufacturing.

Third, factory site selection.

"Why Jinshan?" After the news was confirmed, the choice of Jinshan District, Shanghai, as the site for the local production base became a mystery to many readers.

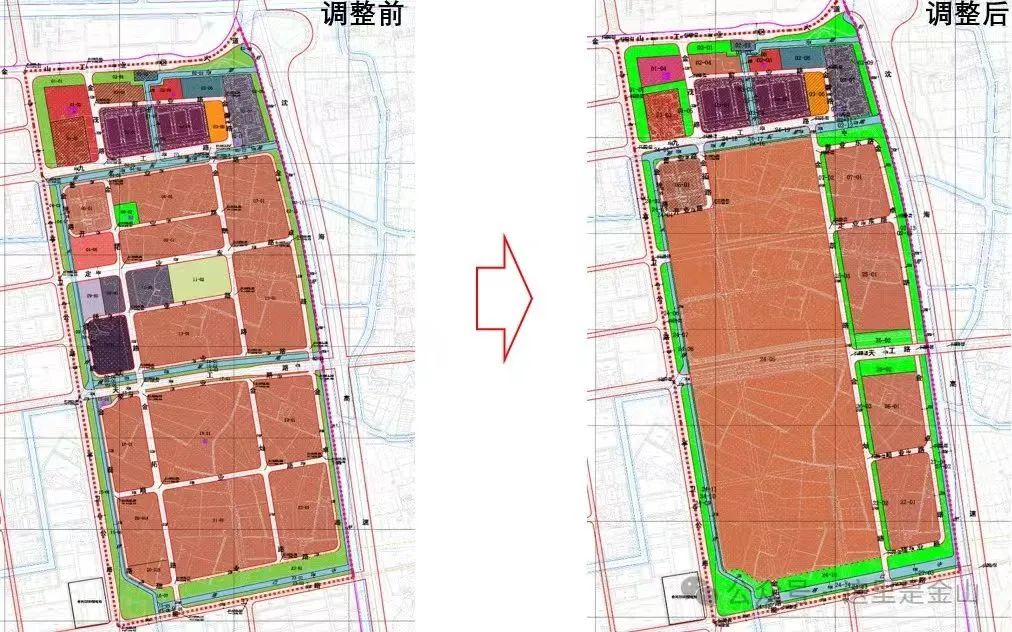

In November last year, the Jinshan District Government website announced a document adjusting the planning of a land unit in Jinshan Industrial Zone due to the intention to introduce new energy vehicle and cutting-edge battery industry projects. Specifically, multiple small plots were merged into one large plot, classified as Class II industrial land with a total area of about 113 hectares.

In terms of area, this reserved land is significantly larger than Tesla's Lingang Phase I with 86 hectares. Industry insiders have speculated that this is probably the upcoming Lexus China factory. This information has also been confirmed by multiple insiders to AutoCommune, indicating that the Jinshan District Government has provided sufficient land security for Toyota's factory construction in advance.

Of course, Toyota also has its own considerations.

Unlike Tesla's Lingang factory, Toyota offers a broader industrial perspective for the localization of Lexus. Geographically, the project's influence is intended to extend from Shanghai to the Yangtze River Delta region and beyond, highly consistent with what Japanese media have always emphasized as "radiating the entire Asia through China's industrial chain"; in terms of the industrial chain, it encompasses logistics networks, hydrogen energy, autonomous driving, battery recycling and reuse, and other upstream and downstream areas, offering immense imagination space from manufacturing to commercial returns.

Let's take hydrogen energy as an example.

Jinshan District is a key base for hydrogen source supply and new material industries in Shanghai, particularly industrial by-product hydrogen. Relying on the industrial advantages of Shanghai Petrochemical and Shanghai Chemical Industry Park, the region has been committed to building a hydrogen energy industry chain cluster. This coincides with Toyota's focus on the hydrogen energy field, and related advantages can be efficiently integrated with new energy vehicles.

Localization is not a panacea

In the past, there was little progress in the localization of Lexus, with relevant project leaders either being vague or outright denying it, or using "brand/annual sales of a single model not reaching the localization threshold" as an excuse. Ultimately, the balancing of interests is incredibly realistic.

The first consideration is the north-south joint venture.

Toyota has two passenger vehicle joint venture partners in China, namely FAW Toyota and GAC Toyota. The most challenging issue for Lexus to produce in China is balancing the relationship between FAW Group and GAC Group.

The second consideration is profit.

During the golden decade of fuel vehicles, luxury car brands have made substantial profits in the Chinese market, and Lexus is no exception. Since Lexus "makes money effortlessly," basically all profits are Toyota's own as an imported brand. Once localized, the profits earned by Lexus in the Chinese market are likely to become a "cash printing machine" for joint venture partners.

The third consideration is the market.

A few years ago, many multinational brands chose to localize in China, primarily motivated by seizing market opportunities and reducing costs. However, for Lexus, which has already reaped the benefits of the fuel vehicle era, there was no urgency to rush into the Chinese market. Moreover, producing in Japan facilitates transportation to China, and the cost level is also compressible.

The fourth consideration is Japan itself.

As mentioned earlier, Toyota's factories in Japan have sufficient capacity to support production. Once a new factory is established in China, it means that some capacity in Japan will be transferred to China. Additionally, newly produced vehicles localized in China can also extend to other countries and regions in Asia, which is detrimental to capacity utilization and employment in Japan.

Considering the market, profits, and relationship with partners, it is not difficult to understand why Toyota is advancing the localization process of Lexus at this juncture. However, the current situation differs from the past. With transformation and breakthrough now the top priority, the numerous considerations of the past decade are not as critical as "survival".

In 2023, Lexus sold a total of 181,400 vehicles in China, marking a year-on-year increase of 3%. Although growth persists, the growth rate has slowed compared to previous years.

In 2024, Lexus sold only 181,900 vehicles in China, with a slight year-on-year increase of 0.3%, but far below previous peak values. In fact, the sales volume of 227,000 vehicles in 2021 was Lexus's most dazzling performance, followed by a continuous decline. The title of sales champion among imported car brands in the Chinese market, which it had long defended, was also ceded to competitors.

Against this backdrop, Lexus is certainly anxious.

Akio Toyoda first revealed in 2021 that Lexus would achieve 100% coverage of pure electric sales in Europe, North America, and China by 2035. This also implies that in the next decade or so, Lexus will take the lead in transforming into a pure electric brand within Toyota, becoming a "pioneer representative" of Toyota's electrification transformation.

However, the reality is that Lexus's "pioneer spirit" is only evident within Toyota. When the brand "wrestles" with other luxury brands or China's high-end new carmaking forces, its fuel vehicle models lack competitiveness, and its electrification layout is relatively slow.

Moreover, intelligence has become the forefront. China has emerged as the optimal location for foreign brands to establish localized industrial chains and implement business models. Mass-verified technology, process technology, product technology, a plethora of excellent engineers, and abundant resources have nearly become a unique business model globally.

This is also the underlying logic behind Toyota's decision to integrate the new generation supply chain of Lexus into China and establish a wholly-owned manufacturing facility in Shanghai.

However, the issues currently faced by Lexus include, first, the collective decline of second-tier luxury brands, squeezed by price reductions of first-tier luxury brands; second, the intensifying price war, with Lexus's brand premium not as high as before; and third, the continuous stream of high-quality products from Chinese brands, with rapid iteration speeds, such as Huawei, NIO, XPeng, and Li Auto.

Solving any of these issues is not a one-time solution through localization.

The Tesla model is not a panacea.