What Are the Prospects for Technological Advancements in the Range-Extended Plug-In Hybrid Market by 2025?

![]() 02/06 2025

02/06 2025

![]() 675

675

In 2024, the battleground for plug-in hybrids and range extenders shifted to fuel efficiency in battery-depletion scenarios, while pure electric vehicles competed on range. However, these metrics are not the primary concern for consumers and car owners. Instead, they worry about being outpaced by more advanced chips and the rapid depreciation of their one-year-old cars due to new technologies. Fortunately, fuel-guzzling range extenders, jerky plug-in hybrids, and autonomous driving reliant on high-precision maps are unlikely to make a comeback this year.

Will the segmented end-to-end architecture disappear by 2025?

The buzzword in automotive technology in 2024 was undoubtedly "end-to-end," a concept that gained widespread acceptance and underwent rigorous testing, particularly with Huawei's ADS 2.0 and Li Auto's OTA 6.2. Prior to this, the market favored a modular approach, dividing perception, control, and decision-making into separate processes reliant on extensive code execution. This modular system was well-established but had limitations. Early autonomous driving systems primarily extended lane-keeping and adaptive cruise control with basic algorithms for optimizing perception data. Functions like navigating roundabouts, making U-turns, lane changes, overtaking, and toll gate passage, now considered standard, were advanced features in the first half of 2023 to 2024.

Due to the code logic, the transition between perception and control, as well as data transformation and transmission, was inefficient, leading to poor decision-making accuracy. This inefficiency was evident in hesitation in scenarios not covered by code, resulting in suboptimal navigation. Most crucially, these systems heavily relied on high-precision maps. To achieve human-like processing, enhancing data transmission efficiency was imperative. Thus, the concept of merging the separate modules of perception and control into a current end-to-end architecture emerged. The origins of the end-to-end concept trace back to Tesla's FSD and the transformer's self-attention mechanism, which expanded autonomous driving perception beyond mere video image conversion to include analysis and learning. The BEV (bird's-eye-view) perception concept further demonstrated the feasibility of future domestic L2+++ technology.

Examining current end-to-end architectures, including Huawei's GOD network, Li Auto's E2E+VLM, and various intelligent driving solution companies, reveals they are still within the realm of segmented end-to-end. Essentially, segmented end-to-end is a new term for modularization. However, the current integration of perception and control has led to an autonomous driving experience akin to L3. In China, the more mainstream autonomous driving solutions involve multi-sensor fusion with LiDAR and pure vision. Taking Huawei's ADS 3.2 as an example, after iteration, the independent BEV was incorporated into the GOD network, essentially a perception network unit with a learning and training mechanism. The GOD network concept includes the PDP network responsible for pre-decision planning. Thus, Huawei's GOD network logic represents a step towards a fully integrated end-to-end architecture. Following Li Auto's OTA 7.0 update at the end of last year, the integration of the VLM (visual language model) enabled the entire architecture to learn, infer, and autonomously provide multiple game theory solutions. The technology's iteration is clearly progressing towards the VLA (visual language action model). Simply put, after obtaining information through the perception architecture, it can directly make decisions. Classified by technology and effect, this represents the ultimate form of a one-model approach.

Regarding the pure vision solution, Tesla's CNN (convolutional neural network) broadly follows an architecture that integrates perception and pre-decision making, with the addition of the occupancy network. This divides the world environment into numerous cells and assigns coordinates based on obstacle shapes scanned by the camera. After learning and training, the system analyzes and predicts obstacle movement trajectories. Therefore, the underlying technical architecture of the vision solution is inseparable from cloud computing power. With the switch to Grok 3, the overall learning efficiency of FSD will double, explaining why it remains competitive without LiDAR and high-computing on-board chips.

Based on last year's technical advancements, the consensus among OEMs in autonomous driving technology this year is to utilize transformer+BEV, LiDAR, and other perception hardware to reduce costs and increase efficiency. The focus of the new round of technological competition lies in self-developed autonomous driving chip platforms. This shift is partly due to cost control but also presents challenges, as self-developed chips' hurdle is not just computational power but also photolithography machines and manufacturing processes. Moreover, it involves developing diverse cross-domain collaboration functions based on these chips. Moving forward, there will be an increasing number of integrated autonomous driving algorithm platforms, and 48V high-bandwidth wire control technology will also be a key area of competition this year. We will delve into these technical details later, but in summary, segmented end-to-end architectures will not disappear in 2025. Instead, they will evolve in a multimodal manner, leaving traditional modularization behind in 2024.

Fuel-consuming range extenders and jerky plug-in hybrids will be phased out this year

While the series-parallel plug-in hybrid architecture inherently includes range extension, isolating range extenders as a separate category yields different outcomes. In 2024, range extenders largely shed the label of technological backwardness. Their market acceptance stems from offering an electric vehicle-like experience with extended range compared to pure electric vehicles. However, the range extender itself poses problems. Roughly speaking, more than five range extenders were mass-produced in 2024, but only a couple truly addressed issues like vibration, knocking, and high fuel consumption.

We have previously analyzed the reasons behind high fuel consumption in range extenders. Early versions were modified internal combustion engines lacking direct drive conditions. Some solutions even involved removing a cylinder and expanding the speed range to achieve peak torque, resulting in poor NVH (noise, vibration, harshness), low durability, and low oil-to-electricity conversion efficiency. The issue lies in the cylinder block design. For efficient power generation with the motor, low torque can be disregarded. Therefore, the optimal range extender design is narrow and long, allowing the piston to work longer in the elongated combustion chamber through inertia. Whether naturally aspirated or turbocharged, this design better finds extreme throttle opening and closing conditions, aiming for a higher compression ratio. Reviewing range extender data, those with a lower bore-to-stroke ratio are generally associated with high fuel consumption and require high-octane gasoline.

High-octane gasoline means a higher octane rating, a solution for single ignition. However, technically, range extenders requiring high-octane gasoline cannot be considered advanced. After adopting a narrow and long cylinder block, it's necessary to optimize tumble flow for uniform compression ignition in the elongated combustion chamber. Some OEMs use a fishbelly shape to increase the combustible area, while others enhance high-energy ignition or focus on high-pressure nozzles that break down fuel particles. Thus, many solutions exist to eliminate the dependence on high-octane gasoline. Hence, the prediction for 2025 is that range extenders will not see significant technological advancements; any improvements will likely be detailed optimizations, such as more efficient electronic oil pumps and quieter silencing systems. In summary, fuel-guzzling range extenders reliant on 95-octane gasoline are outdated technologies this year.

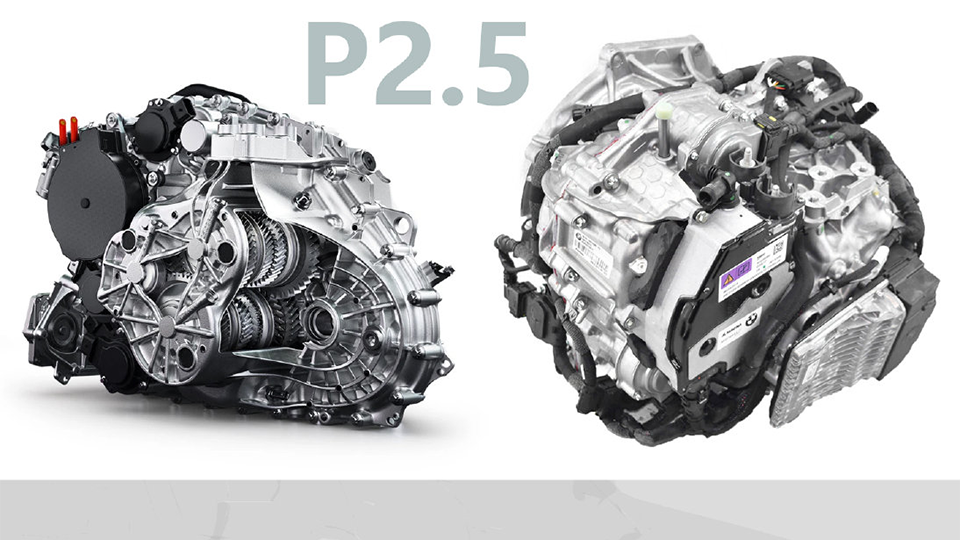

As for plug-in hybrids, the most criticized component is not the multi-gear DHT but the nearly obsolete P2.5 motor. Decoupling P1 or P2 was one of the most successful innovations in 2024, expanding electric drive scenarios, controlling fuel consumption, and enabling flexible integration into longitudinal off-road electric drive architectures. However, the P2.5, also integrated into the transmission, is limited by volume, resulting in restricted power output. Additionally, it must be paired with a dual-clutch transmission and placed on the even-numbered shaft end. While this optimizes power connection, it cannot resolve the inherent jerkiness during gear shifts. Economically, it is inferior to the P13 architecture, and in terms of torque amplification, it lags behind the traditional P2. Furthermore, its complex structure increases maintenance costs. With the growing trend of electric drive coverage, the P2.5 architecture will similarly become obsolete by 2025.