Price Wars: Why the Recurrence?

![]() 02/06 2025

02/06 2025

![]() 592

592

Starting the Year of the Snake with Zero Frames

Author | Wang Lei

Editor | Qin Zhangyong

The automotive industry's battles are becoming increasingly unoriginal.

On the first day of work in 2025, the flames of war in the automotive sector reignited, and as expected, it was another price war.

Offers included lower fixed-price transactions, 0% down payments or 0% interest financing, and subsidies for vehicle replacements worth billions of yuan.

Employing these repetitive tactics, automakers continuously devise new strategies to entice consumers to open their wallets.

Many had previously vocally opposed internal competition, but when push came to shove, they couldn't resist.

The bad news is that due to the price war, little profit remained in the automotive industry last year. Yet, they persist in focusing on price adjustments. It seems they won't be satisfied until several automakers or brands are eliminated in 2025.

01 The Battle of Interest-Free and 0% Down Payment

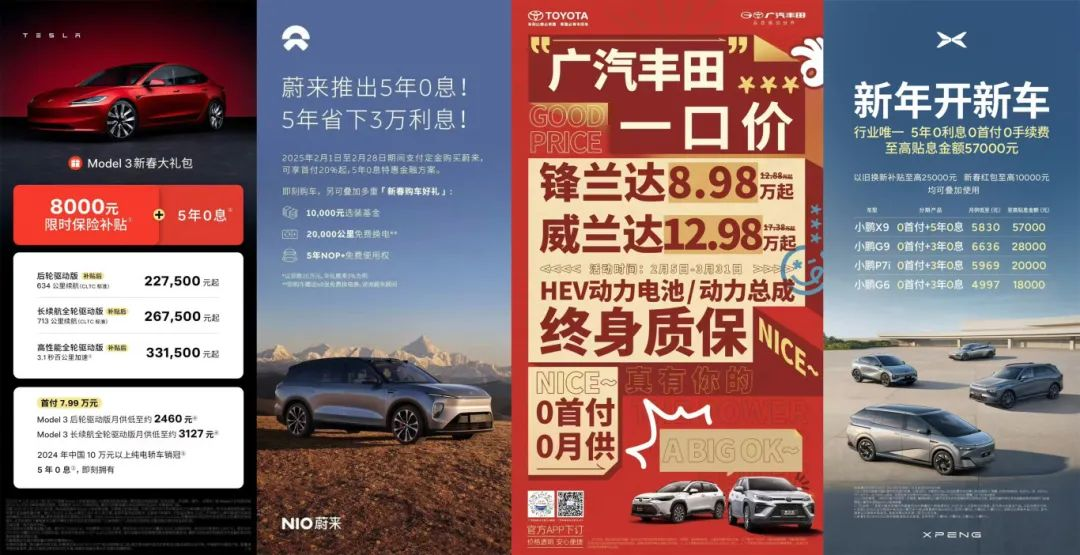

Since 2023, it seems to have become a tradition for price wars to erupt at the beginning of the year. Following the new year, with Tesla and XPeng successively introducing "interest-free promotion" policies, the price war for the Year of the Snake officially commenced.

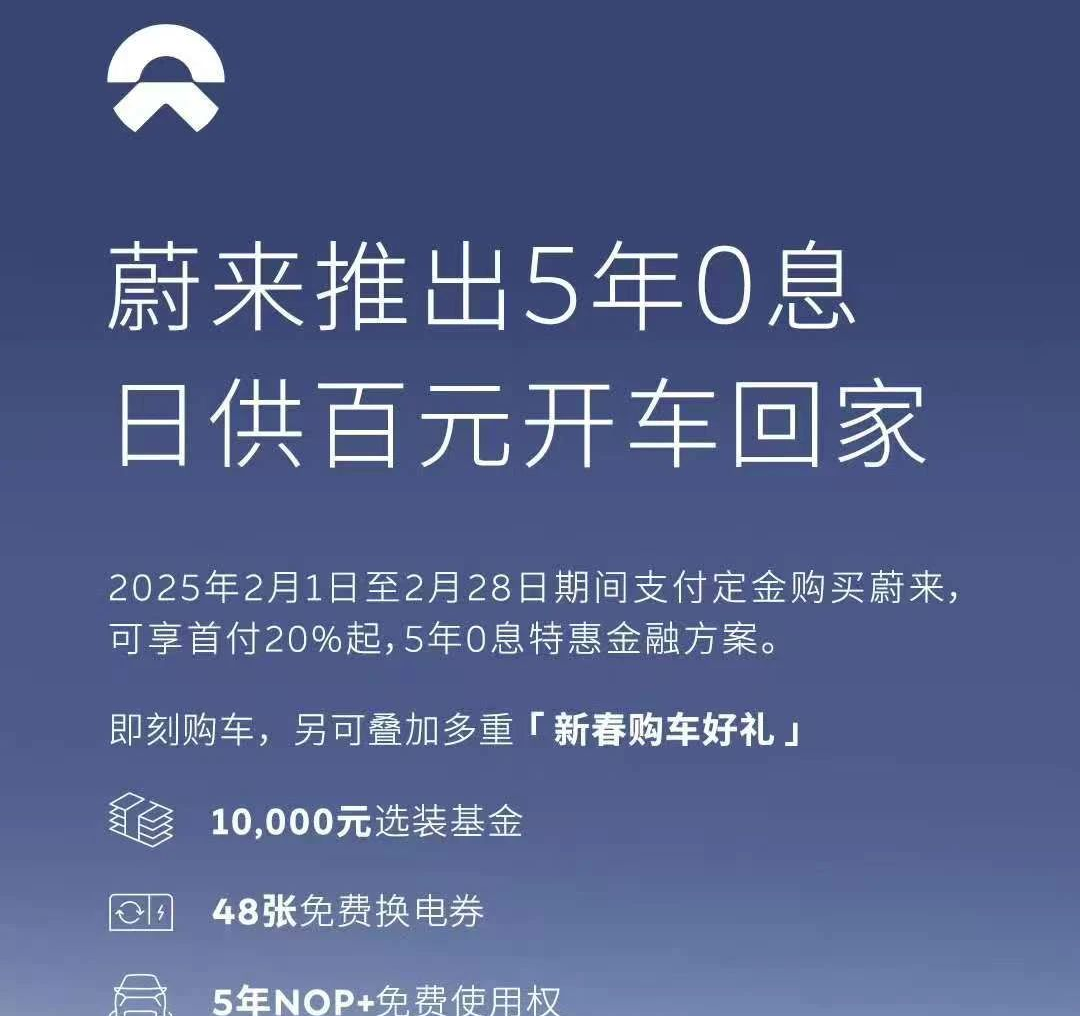

In fact, NIO should have fired the first shot of the new year. Even before the new year, on February 1st, the fourth day of the Lunar New Year, when everyone was still releasing their January sales results, NIO announced its preferential policies.

From February 1st to February 28th, users who pay a deposit to purchase relevant NIO models can enjoy a 5-year interest-free financial plan with a 20% down payment and no handling fees. Additionally, they receive a 4,800 yuan battery swap voucher, a 10,000 yuan renovation fund, and a NOP+ 5-year usage right, among other benefits.

Compared to NIO's previous car purchase incentives, the new benefits are clearly more generous.

Simultaneously, Leapmotor also updated its car purchase incentives. In addition to enjoying a national subsidy of 20,000 yuan for trade-ins, it also offers cash discounts ranging from 5,000 yuan to 15,000 yuan and various benefits. Compared to NIO's "explosive" benefits, Leapmotor's policy is basically the same as last month's.

On the first day back to work after the holiday, Tesla, XPeng, and other automakers joined the fray one after another, with tactics and strategies similar to NIO, targeting the interest-free space for loan car purchases.

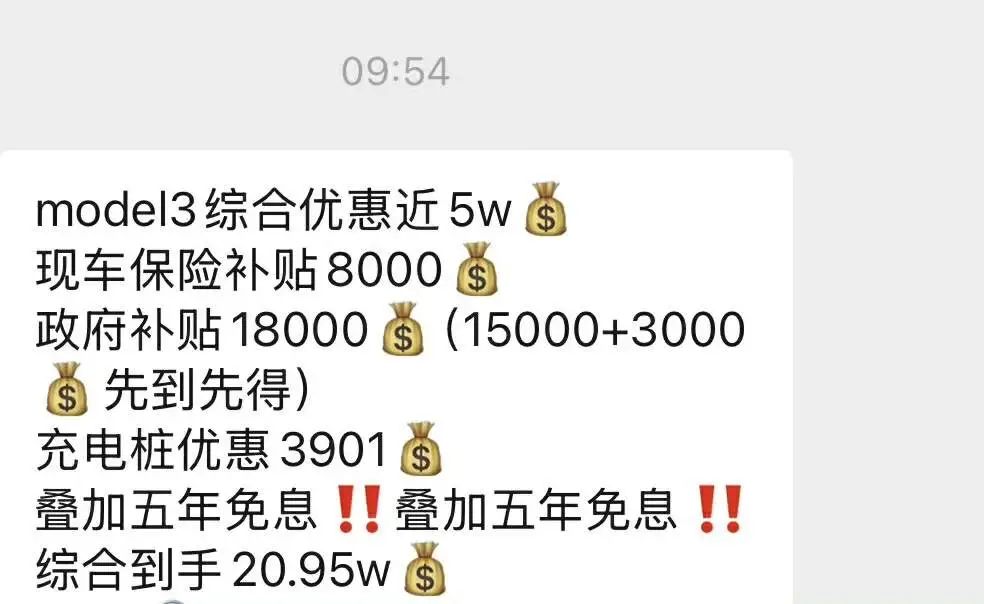

At 8 am that day, Tesla launched the largest ever discount package for the Model 3 – a limited-time insurance subsidy of 8,000 yuan + a 5-year interest-free policy + exclusive charging benefits.

Notably, this campaign not only supports the 5-year interest-free policy for both rear-wheel drive and all-wheel drive versions but also applies the insurance subsidy to all models, including the Model 3 Performance version, for the first time. Moreover, this is the first time that both insurance subsidies and a 5-year interest-free policy have appeared simultaneously.

After combining the subsidy policies, the price of the Tesla Model 3 rear-wheel drive version came to 209,500 yuan, which is the lowest price since the refreshed Model 3 was launched. Coupled with the 5-year interest-free policy, consumers can save even more, with a combined discount of nearly 50,000 yuan.

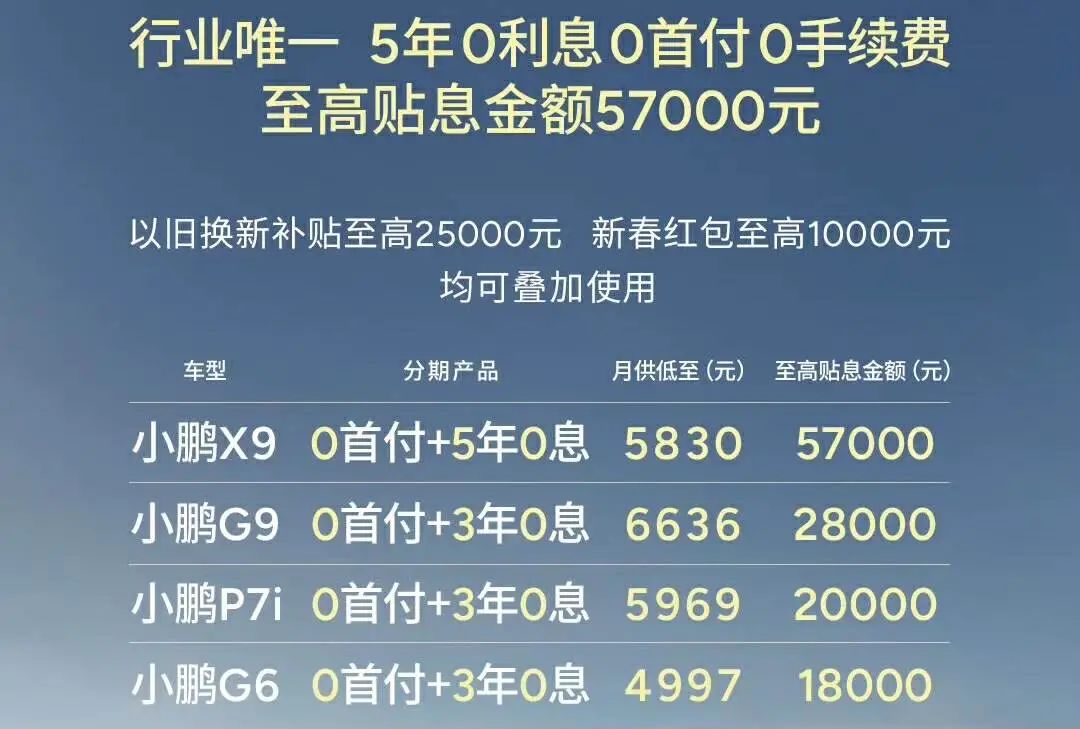

XPeng Automobile was also unwilling to be outdone, unveiling a major promotion of "5 years, 0% interest, 0% down payment," covering models such as the XPeng X9, XPeng G9, XPeng P7i, and XPeng G6.

This policy is valid from now until February 28th. Among them, the XPeng X9 has become the first model in the industry to offer a 0% down payment + 5-year interest-free policy, with a maximum subsidy amount of up to 57,000 yuan. Additionally, the G9, P7i, and G6 models receive subsidies of 28,000 yuan, 20,000 yuan, and 18,000 yuan, respectively.

Although XPeng's best-selling models, the MONA M03 and P7+, are not included in the "5-year, 0% down payment, 0% interest" promotion, they still offer limited-time benefits such as 888 kWh power cards, configuration upgrades/mall points, etc., to continue stimulating order growth.

IM Motors followed suit, announcing that the starting price of the IM L6 has been reduced to 189,900 yuan, a decrease of about 30,000 yuan from the starting price of 219,900 yuan when it was launched in May 2024.

Joint venture manufacturers are also not to be outdone. GAC Toyota announced a "fixed price" policy, valid from now until March 31st. The "fixed prices" for the Fenglanda and Wildlander are 89,800 yuan and 129,800 yuan, respectively, with a maximum direct reduction of 44,000 yuan. It also stated that purchases made during the limited period can enjoy policies such as "0% down payment, 0% interest" and "lifetime warranty for three core components."

Judging from the above promotional methods, although they are all price wars, it is not difficult to find subtle changes in tactics – automakers are beginning to shift their focus from "direct price cuts" to more sophisticated financial incentives.

In fact, starting in the second half of 2024, the price war gradually shifted from simple price competition to deeper value competition, such as using financial tools and long-term benefits to attract target users.

By binding users to financial plans for 5-7 years, the profit margins for subsequent charging, maintenance, and OTA upgrades are locked in advance. Automakers pass on the cost of interest subsidies to financial companies and use accounts receivable to obtain immediate cash flow, which is more sustainable than clearing inventory through price reductions.

When interest-free loans become a mainstream strategy, it also amounts to thousands or even tens of thousands of yuan in savings for consumers when all factors are considered. More importantly, this discount is not directly reflected in the price but hidden through loans, services, etc. This not only avoids making existing users feel cheated but also ensures new users receive substantial benefits.

The core logic behind this is that under the intensifying pace of price competition, automakers can no longer sustain simply giving away profits.

02 Unstoppable Firepower

Cui Dongshu, secretary-general of the Automobile Market Research Sub-division of the China Automobile Dealers Association, once predicted that in 2025, price wars among domestic automakers would continue and be exceptionally fierce.

Judging from past trends, low prices have always been the primary driver of sales growth.

Although this approach can stimulate sales, in the long run, a price war is undoubtedly detrimental to both sides, with automakers attracting a large number of buyers but also eroding profit margins and brand value.

Many industry leaders have also issued warnings. Yu Chengdong has clearly stated that relying on price wars to sustain a company's survival is not feasible. Although price wars can attract consumers in the short term, in the long run, this competitive approach cannot support the sustainable development of a company.

Wei Jianjun, chairman of Great Wall Motors, also said directly in a livestream, "The aftermath of the price war will last six to seven years, and its destructive power is devastating."

Li Shufu, chairman of Geely Automobile, also stated that endless internal competition and fierce price wars could ultimately lead to cutting corners, reducing product quality, and even triggering the emergence of fake and inferior products.

Moreover, more and more signs and data indicate that the nearly three-year price war has not been as beautiful as expected.

According to statistics from the Passenger Car Association, 227 models had price reductions throughout 2024, with new energy vehicles experiencing the most significant price reductions, averaging 18,000 yuan, or a reduction of 9.2%. Conventional fuel vehicles had price reductions of 13,000 yuan, or a reduction of 6.8%. The average price reduction for new vehicles in the overall passenger car market was 16,000 yuan, representing a reduction of 8.3%.

Price reductions mean profit concessions by OEMs, which is also reflected in the abysmal profit margins of the entire automotive industry.

According to data from the China Association of Automobile Manufacturers, in 2023, the average profit margin of the entire automotive industry was 6.5%, down 0.8 percentage points from 2022. By October 2024, this figure had further declined to 4.5%, with profit margins in October and December even falling to a historical low of 4.1%.

National statistics show that in 2024, the automotive industry generated revenue of 10,647 billion yuan, an increase of 4% year-on-year; costs amounted to 9,330.1 billion yuan, an increase of 5%; and profits totaled 462.3 billion yuan, a decrease of 8% year-on-year. The profit margin of the automotive industry was 4.3%, which is still relatively low compared to the average profit margin of 6% for downstream industrial enterprises.

The pressure of the price war is not only borne by automakers; suppliers throughout the industrial chain are also struggling to escape the vortex of low prices. In November, news spread that BYD required suppliers to reduce prices by 10%. Similarly, SAIC Maxus also made a similar request.

Compared to automakers, automotive component manufacturers have long been in a weak position in the industrial chain, making it difficult for them to withstand the pressure of price reductions passed on by automakers. This demand for price reductions puts suppliers under tremendous pressure to survive and may even lead to instability in the supply chain.

The price war has also put small and medium-sized automakers on the brink of elimination. After many automakers have resorted to price wars as their trump card, many new forces have been unable to survive 2024 due to their insufficient self-sustaining capabilities and inability to sell cars even with discounts.

New forces such as HiPhi, Hopon, Nezha, and Jiyue all came to a halt in 2024. With the intensification of the price war, many new automakers are still facing tight capital chains.

There has long been a consensus in the industry that price wars will not last, but the reality is that once the fighting starts, it will not easily end. At this point, it's not about who has more ammunition, but who has more endurance.

The whistle for a new round of knockout competitions has sounded again.