Tariff Adjustment: Deciphering Why German Brands Bear the Brunt

![]() 02/07 2025

02/07 2025

![]() 687

687

Introduction

Mercedes-Benz and BMW are taking a significant hit.

"We have no choice but to pay the tax. We must comply." This sentiment, echoed by a Ford China official, resonates with joint venture brands and multinational companies that embarked on their China journey in 2025. Following the United States' tariff increase, China's retaliatory 10% tariff hike is an unavoidable reality.

Specifically, starting from February 10, 2025, China will impose additional tariffs on select imports from the United States, including a 10% tariff on crude oil, agricultural machinery, high-displacement vehicles, and pickup trucks.

This scenario resembles two beehives at war. Imagine bees freely flying between two gardens; now, the barriers between them are rising, making it increasingly difficult for them to gather honey. If tensions escalate, both sides risk losing out.

Moreover, when discussing high-displacement vehicles related to the automotive industry, it's akin to "when the city gate catches fire, the fish in the moat suffer."

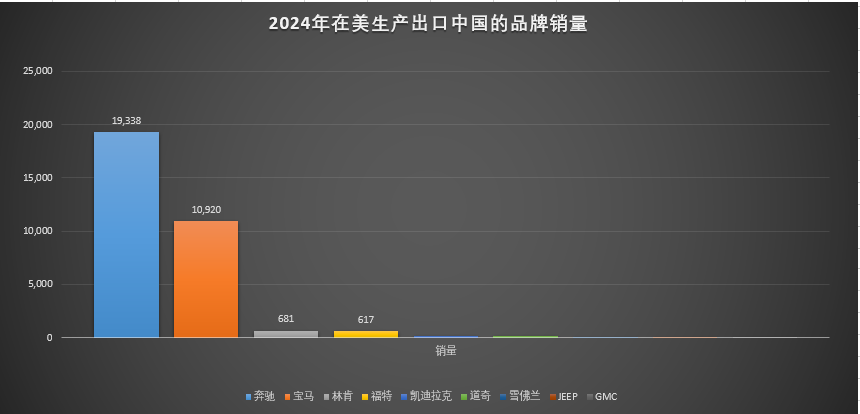

According to relevant statistics and calculations based on 2024 sales data of imported American car models, a total of 32,000 vehicles are affected. Among them, 1,862 are American brands, accounting for 5.8%. In contrast, 19,000 Mercedes-Benz vehicles and 11,000 BMW vehicles from Germany total 30,000 vehicles, accounting for 94.2%. Clearly, German brands are bearing the brunt.

Calculating the Additional Tax Burden

This time, American brands constitute a small proportion, with vehicles sold directly by automakers in China. The Lincoln Navigator, with 681 units sold last year, stands out with its relatively high sales volume. GM sells the Durango, Tahoe, Yukon through new import channels, alongside the JEEP Wrangler.

As mentioned earlier, "when the city gate catches fire, the fish in the moat suffer." This time, German brands are the hardest hit. Mercedes-Benz GLE and GLS series products manufactured in the United States and exported to China are affected, though some GLE and GLS models with displacements below 2.5L are spared.

BMW Group produces and exports the following models from its Spartanburg plant in the United States to China: X6, X7, X5M, X6M, XM, X4, and the all-new BMW X3 M50 (G45), all falling under the additional 10% tariff category. Consequently, sales prices are expected to rise.

However, according to the announcement, vehicles that complete customs clearance before February 10, 2025, will be subject to the original tariff rate. This implies that BMW's American-made models already at dealerships or having completed customs clearance at the port will remain unaffected. It's truly a "tightrope walk with heavy stakes."

So, how much will prices increase due to these additional tariffs?

Among American full-size SUVs, the Navigator and Tahoe are well-known to domestic users. The Navigator currently comes with a 3.5T engine across all trims, while the Tahoe is equipped with a 2.7T engine. Both models meet the "taxable" displacement standard.

The entry-level Navigator is priced at over 1 million yuan. Adding a 10% tariff, let's calculate the price increase.

Taking the Lincoln Navigator with a declared value of 1.008 million yuan as an example, the previous tariff rate was 15%. Based on a value of 1 million yuan, the tariff amounted to 1.5 million yuan. If imported after February 10 with an additional 10% tariff, the tariff will rise to 2.5 million yuan, an overall increase of 1 million yuan in tariffs. The total tax and fee will increase by approximately 1.6 million yuan.

In addition to tariffs, there are also a 25% consumption tax, a 13% value-added tax, and a 10% vehicle purchase tax.

After calculations, the total tax and fee before and after the retaliatory tariff are 0.8866 million yuan and 1.0501 million yuan, respectively. This translates to a price increase of 1.635 million yuan post-tariff hike, equivalent to adding the price of a decent mid-range car.

For the Mercedes-Benz G-Class, assuming a declared value of 500,000 yuan for a US-made Mercedes-Benz GLE with a 3.0-liter displacement, the overall tax and fee will increase by 75,000 yuan after February 10. Scaled up to 20,000 units, that amounts to at least 1.5 billion yuan. The impact is substantial.

A Mere Gesture

From a broader perspective, as a retaliatory strategy, China's 10% tariff on American crude oil, agricultural machinery, high-displacement vehicles, and pickup trucks, alongside a 15% tariff on American coal and natural gas, seems like a mere gesture.

In other words, China's response to Trump's previous 10% tariff increase was not significant. Years of confrontation with the United States have proven that China has numerous ways to mitigate the impact of tariffs. For instance, China simultaneously announced export controls on rare earths such as tungsten, tellurium, bismuth, molybdenum, and indium as part of its "anti-extortion" measures, a crucial strategy for the United States.

Moreover, this strategy of "tit for tat" indicates that China is unperturbed by public threats from the United States. And there is nothing more terrifying for the United States than indifference. However, businesses on both sides face a tough road. Can we still conduct business properly?

Regarding the tariff increase, a Ford official stated, "Both sides have announced tariff increases, right? For us, we must accept it. Of course, we still hope for a better trading environment. For multinational companies, there is significant business here (in China)."

As the mainstays of imported cars, Mercedes-Benz and BMW's reactions have become the barometer of this event. However, we have yet to receive a response from BMW after inquiring. Relevant analysts believe that "sales may be affected in the short term, but this (import) business cannot be halted, right? Which multinational company dares to say they won't pay this tax?"

Interestingly, just a few days ago on the 27th, BMW and Tesla filed complaints with the European Court of Justice, opposing tariffs on imported Chinese electric vehicles. Olof Schill, a spokesperson for the European Commission, stated the same day that the EU has taken note of these cases and will defend itself in court. This "challenge" has even been interpreted by the outside world as BMW's "pledge of allegiance."

In fact, in an era of mutual dependence, any single tariff strategy is a double-edged sword with significant backlash effects. Hence, many insightful individuals advocate for its cautious use.

For instance, on February 6, Ford Motor CEO Jim Farley said in a conference call with analysts that although Ford can withstand the short-term impact of President Trump's proposed tariffs (lasting a few weeks), if they persist, they will have a devastating impact on Ford.

Another point to consider is the impact on Chinese car models exported to the United States. However, a Ford China official said, "We haven't seen any official impact on exports yet. I'm still awaiting confirmation from my colleagues (in the United States). Some sources indicate no impact, while others suggest it might be affected. I'm unsure at this point."