Revolutionizing the Automotive Industry: Changan and Dongfeng Aim for a Trillion-Yuan Auto Empire?

![]() 02/10 2025

02/10 2025

![]() 566

566

In recent years, China's automotive industry has undergone profound transformations, driven by waves of intelligent electrification, intensified international competition, and policy shifts. Each restructuring and collaboration among automakers has sent ripples through the market.

As the SASAC's "Three-Year Action Plan for the Restructuring of Central Enterprises" delves deeper, recent developments in the automotive sector have sparked heated discussions. The gears of fate for two automotive giants, Changan and Dongfeng, are now in motion. Could this mark the most groundbreaking strategic cooperation in China's automotive history?

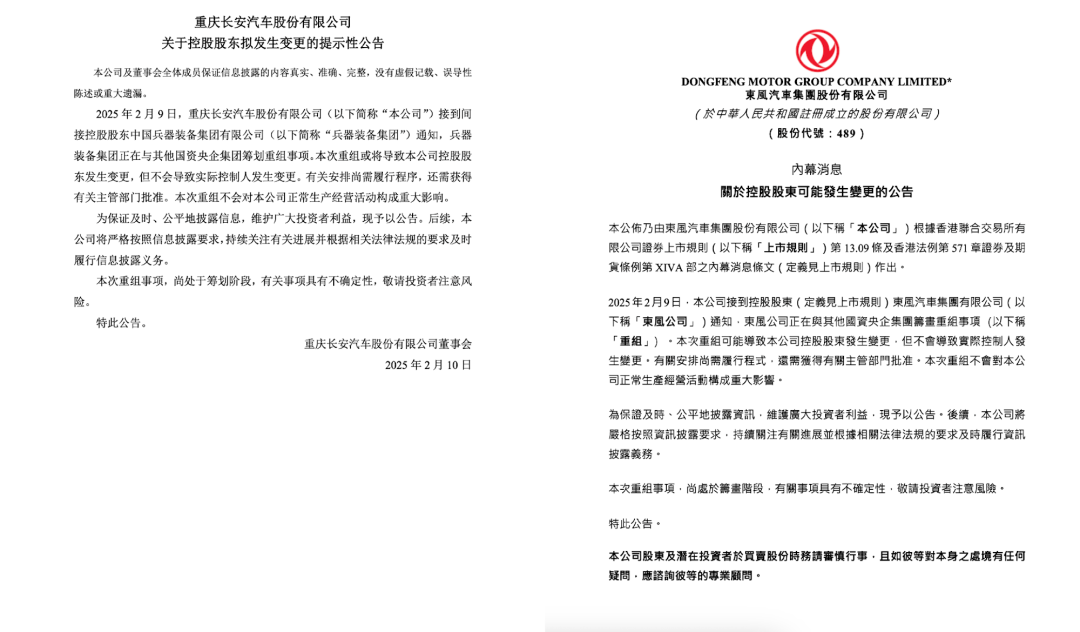

On February 9th, Changan Automobile Co., Ltd. and Dongfeng Motor Corporation Limited issued announcements stating that their indirect controlling shareholders, China South Industries Group Corporation and Dongfeng Motor Corporation, are "planning restructuring matters with other state-owned asset central enterprise groups." This could lead to changes in controlling shareholders and herald a new era for China's automotive industry.

Although FAW Group is not directly involved this time, it ignites speculation. Will "The Second Automobile Works of China" rise again?

The restructuring of central enterprises has accelerated, particularly in manufacturing, where policies encourage resource integration to enhance competitiveness. Examples include the merger of CRRC, the restructuring of CSSC and CSIC, and the consolidation of China Electronics Technology Group Corporation and China Hualu Group Corporation, reflecting a national push for optimization and integration.

China's automotive industry faces significant changes and challenges. The rise of new energy vehicles (NEVs) and the decline of traditional fuel vehicles necessitate central automotive enterprises to bolster their core competitiveness through integration and restructuring, aiding China's transition from a large automotive country to a powerful one.

SASAC Director Zhang Yuzhuo stated that the NEV businesses of FAW Group, Dongfeng Group, and Changan Automobile would be assessed separately. Meanwhile, SASAC Deputy Director Gou Ping encouraged central enterprises to undertake high-quality investments, mergers, acquisitions, and specialized integrations to expedite their grasp of core industrial resources and technologies.

The restructuring of central automotive enterprises is no longer an option but a necessity. China's quest to become a global top-10 auto group is within reach.

Changan Automobile Group leads among automotive central enterprises, showcasing strength in independent brands and the NEV field. In 2024, Changan sold 2.683 million vehicles, a 5.1% year-on-year increase, setting a seven-year high. Independent brand sales reached 2.226 million, accounting for over 80%, with NEV sales at 734,000, a 52.8% year-on-year increase, and overseas sales at 536,000, a 49.6% year-on-year increase, surpassing industry averages.

Changan has made strides in the NEV field, forging close ties with Huawei and Contemporary Amperex Technology Co. Limited in intelligence. Brands like Deep Blue, AVATR, and Changan Qiyuan have performed impressively, with rapid overseas expansion, particularly in Southeast Asia and South America.

Conversely, Dongfeng Motor Corporation Limited's 2024 sales performance was less impressive, with annual sales of 1.895 million vehicles, a 9.2% year-on-year decrease. Joint ventures Dongfeng Honda and Dongfeng Nissan face development challenges, with declining sales. While Dongfeng Fengshen and Voyah achieved good results, with year-on-year increases of 82.4% and 59.3% respectively, they still struggle to support Dongfeng's overall development in sales scale, brand influence, and product competitiveness.

During their development, Changan and Dongfeng have amassed rich technological, market, and brand resources. Changan excels in NEVs and intelligence, with its "Shangri-La Plan" and "Beidou Tianshu Plan" supporting transformation and upgrading. Dongfeng boasts unique expertise in automotive equipment, auto parts, commercial vehicles, and international layouts.

We speculate that their combined annual sales exceeding 5 million vehicles could propel them into the top ten global auto groups, fostering high-quality development in China's automotive industry and enhancing Chinese brands' international influence. Their 12 national-level intelligent manufacturing bases can optimize capacity utilization through flexible production line modifications, significantly reducing manufacturing costs per vehicle. The Wuhan-Chongqing dual headquarters model could form a "Yangtze River Economic Belt Automotive Industry Corridor," and this trillion-yuan empire puzzle game undoubtedly ignites imagination.

However, historical experience cautions that central enterprise mergers are not without challenges. Both parties must navigate management structure adjustments, brand positioning, and cultural integration. Issues like personnel turbulence, supply chain disruptions, and capital market skepticism cannot be overlooked.

Changan and Dongfeng may not merge directly but may progress through industrial alliances, capital-level cooperation, or strategic synergies, such as equity cooperation in specific business segments, joint ventures, or establishing a holding auto group while maintaining existing structures.

Amid the automotive industry's century-long transformation, the potential "century-long marriage" between Changan and Dongfeng is not merely a numbers game. When market laws align with national strategies, we anticipate not only the emergence of a trillion-yuan auto empire but also a crucial leap for China to become a powerful automotive nation.

The future is here, and the automotive industry's "national fleet" is finally taking shape!