Exclusive Spy Shots of Tesla Model Q! Starting Price May Hover Around 160,000 Yuan – Will It Be Tesla's New Sales Catalyst?

![]() 02/18 2025

02/18 2025

![]() 632

632

As the year 2025 dawned, Changan and BYD swiftly engaged in the "intelligent driving equity" battle, catching many off guard. The landscape of intelligent driving has swiftly shifted from the secluded realm of technological breakthroughs to rapid-scale popularization.

Tesla, a seasoned player in the field of intelligent driving, has finally responded to this new wave of competition. According to blogger Joe Tegtmeyer, an aerial video of Tesla's Texas Gigafactory captured a camouflaged test vehicle, suspected to be Tesla's most affordable model yet, the Model Q (code-named Project Redwood). This marks the first public exposure of spy shots of the Model Q.

Source: @Joe Tegtmeyer

Based on the exposed images, the Model Q, with its sleek body lines, gives the impression of a "miniature Model Y" to electric vehicle enthusiasts.

Rumors suggest that Tesla Model Q could hit the market as early as the first quarter of this year. As Tesla's most budget-friendly offering, will it remain competitive in the domestic market, propelling Tesla's sales to new heights?

Is a domestically produced Model Q with a starting price of 160,000 yuan on the horizon?

In 2024, Tesla delivered 1.7892 million vehicles globally, with Model 3 and Model Y accounting for 95.24% of total sales. Despite their enduring popularity, it's worth noting that Tesla's deliveries last year fell by approximately 20,000 units compared to 2023's 1.808 million, marking the first year-on-year decline in annual deliveries since 2015.

Ultimately, this decline can be attributed to the fiercely competitive domestic pure electric vehicle market.

While Tesla Model Y maintains a strong market position, Model 3's reign as the best-selling pure electric sedan has been usurped by Xiaomi SU7. To counteract this sales decline, Tesla is poised to accelerate the launch of its entry-level SUV, the Model Q.

At an investor conference hosted by Tesla's head of investor relations, Travis Axelrod, the company revealed that the subsidized price of Model Q will be below $30,000 (approximately RMB 217,800), with a starting price potentially around $25,000 (approximately RMB 181,500).

Previously, analysts from independent investment bank Evercore disclosed that the compact SUV, Model Q, will be equipped with two different capacities of lithium iron phosphate batteries – 52kWh or 75kWh – and offer two drive forms: single-motor and dual-motor. The vehicle's pure electric range is estimated at approximately 402km.

Source: Tesla Motors Official Website

Currently, the test conditions for this range are unclear, but to be competitive in the domestic market, a pure electric range exceeding 500km is generally required. However, interested consumers need not worry; considering domestic pure electric SUVs equipped with battery packs around 52kWh, the CLTC pure electric range of the domestic version of Model Q should exceed 500km.

Analysts previously predicted that to reduce material costs to $20,000, the new vehicle would not include a glass panoramic roof. However, the exposed images indicate otherwise, as the glass panoramic roof is still present.

Source: @Joe Tegtmeyer

Furthermore, Tesla's domestically produced models already boast the lowest prices globally. The starting price of the domestically produced Model 3 is roughly RMB 23,000 cheaper than that in the U.S. market. Given this, the starting price of the domestically produced Model Q is likely to fall within the range of RMB 160,000 to 170,000.

While this lower price range may facilitate Tesla Model Q's conquest of overseas markets like Europe and North America, it may not prove as effective in the Chinese market. Competitors such as Zeekr X, the second-generation AION V, and Volkswagen ID.4 will pose stiff competition. Moreover, at similar prices, domestic consumers have numerous attractive options, including the Lynk & Co 08 EM-P and BYD Song PLUS EV.

The competitive environment in the domestic auto market is notably tougher than in overseas markets. For Model Q to replicate Model Y's domestic success, it must overcome at least two challenges.

Model Q offers a great price, but its product might fall short.

For this entry-level SUV, Musk's strategy is to reduce costs to lower the product price. However, it's essential to note that domestic products at the same price point, like the Lynk & Co 08 EM-P and the Deep Blue S07, offer superior material configurations compared to the higher-tiered Model Y.

To cut design costs, Model Q's configuration is likely to mirror that of Model Y. It's easy to predict that Model Q's configuration level will struggle to compete with mainstream domestic new energy SUVs.

You might ask, if Model Y's configuration is also inferior to other competitors, why is Model Y popular while Model Q might not be?

The crux of this issue lies in the fact that the purchasing needs of customers for 250,000-yuan pure electric SUVs differ significantly from those for 150,000-yuan SUVs.

Judging by domestic market sales rankings, popular 150,000-yuan new energy SUVs are characterized by high configuration and low refueling costs, exemplified by the BYD Song PLUS DM-i, Leadway L60, and Deep Blue S07. These customers are more inclined to get a better driving experience at a lower price, whereas the 250,000-yuan audience is often more willing to pay for brand influence.

Moreover, Tesla's specialty, Full Self-Driving (FSD) technology, may not come standard on all models.

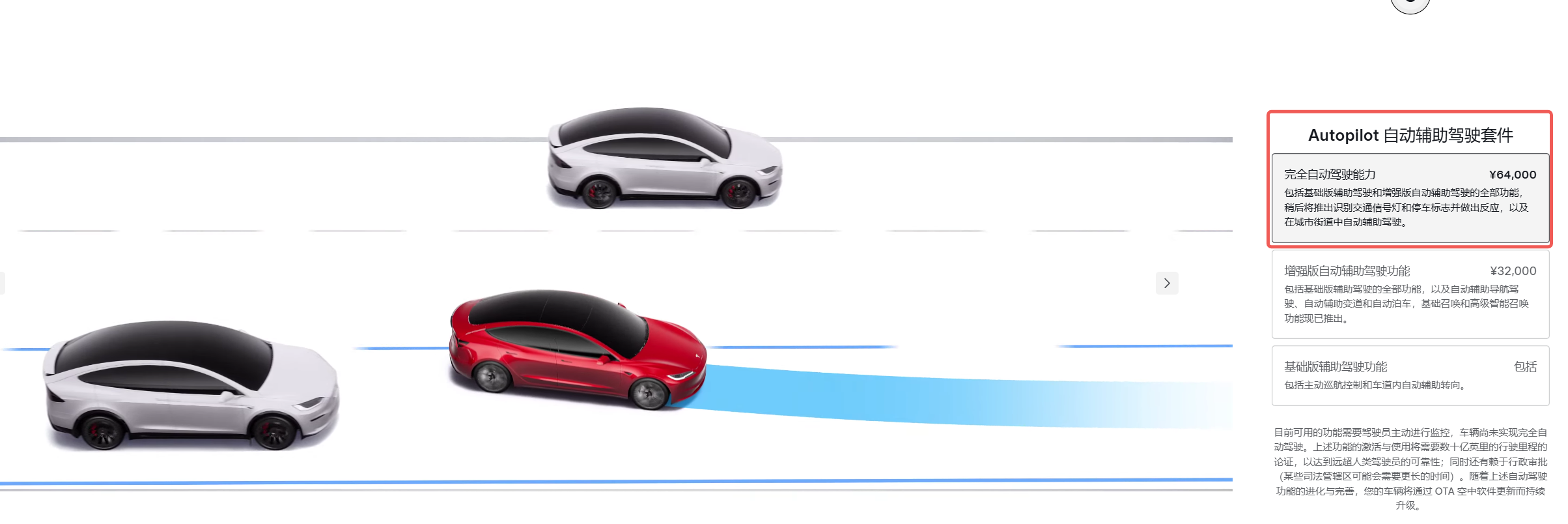

According to Evercore analysts, including FSD increases the vehicle's overall cost by at least $2,000. Based on the Model Y intelligent driving version, users need to pay an additional RMB 64,000 to experience FSD in Model Y, and even the Enhanced Autopilot feature requires an extra RMB 32,000.

Screenshot: Tesla Motors Official Website

If Model Q continues to use the same assistance system as Model Y, the price paid by consumers may exceed RMB 200,000. Even to lower the purchase threshold, the entry-level Model Y might not offer FSD as an option.

Since last year, automakers like Xpeng, GAC Aion, GAC Toyota, Changan, and BYD have tried to bring the purchase threshold for high-level intelligent driving down to the 150,000 yuan mark or even lower. From a "intelligence to price ratio" perspective, consumers might as well opt for competitors equipped with high-level intelligent driving or bite the bullet and choose the larger Model Y.

In other words, Model Q's primary competitiveness lies solely in brand recognition.

Will Tesla rely on Model Q to bolster its performance?

Musk's approach to autonomous driving is far more aggressive than his stance on automobile products themselves.

At the "WE, ROBOT" conference held in October last year, Musk unveiled the fully autonomous Tesla Cybercab and Tesla Robovan. On January 30th of this year, during the 2024 financial report conference call, Musk announced that Tesla will launch a fully autonomous driving version in June and aims to introduce it to the North American market by 2027.

Regarding the automobile products, the hardware update speed of Tesla models is undoubtedly one of the slowest in the industry. Model 3 and Model Y have not undergone significant iterative upgrades since their inception, with enhancements primarily focusing on software aspects like the infotainment system and intelligent driving system.

Source: Tesla Motors Official Website

Technologically, Tesla's intelligent driving capabilities are considered top-tier in the industry. However, FSD has yet to be approved for the domestic market, and there are no signs of Musk's fully autonomous driving and Robotaxi business model being implemented.

The latest intelligent driving technology has not been substantially applied, coupled with the technological advancements of other domestic brands. As a result, Model 3 and Model Y find it challenging to continue leveraging their brand recognition advantage, evidenced by Tesla's sales decline in 2024.

Therefore, the more affordable Model Q will become Tesla's sales driver this year.

In 2023, 36Kr revealed that Tesla was planning an annual production capacity of up to 4 million vehicles for Model Q, with the North American Gigafactory accounting for 2 million, and Berlin and Shanghai each contributing 1 million in capacity.

Although time has passed, and the accuracy of this information may have diminished, we can still glean insights from Tesla's sales target: the company announced that its sales target for this year is to increase by 20% to 30%, implying sales this year will be 360,000 to 540,000 units higher than last year. This should be Tesla's official sales expectation for Model Q.

At this juncture, domestic new and old brands are accelerating their transformation, with new energy players like BYD, Xpeng, and Wenjie continuing to push boundaries. Facing an increasingly competitive new energy market, Tesla previously relied on price reductions to attract users. However, for Model Q, which might not boast as robust a configuration or hard power, the competitive pressure in the domestic market could surpass expectations.

(Cover image source: @Joe Tegtmeyer)

Source: LeTech