NIO Refutes Mass Layoff Rumors, Takes Multiple Actions, Market Value Plummets Over HK$300 Billion from Peak

![]() 02/21 2025

02/21 2025

![]() 459

459

Produced by Leida Finance, written by Peng Xue, edited by Shen Hai

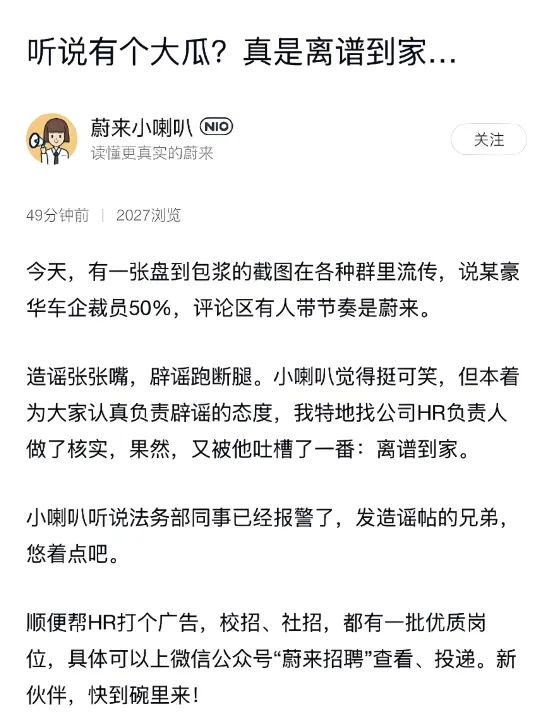

On February 20, in response to online rumors claiming that "a luxury automaker will lay off 50% of its staff," NIO issued a statement via its official account "NIO Little Horn," categorically denying the rumors as "ridiculous." NIO stated that after verification with the company's HR head, the rumor was proven false and emphasized that the legal department had reported it to the police.

This is not the first time NIO has been embroiled in rumors. In November 2024, online rumors circulated that "BYD would venture with NIO to acquire it." Both BYD and NIO promptly issued statements to refute these claims.

Currently, NIO's legal department plays a pivotal role in combating rumors, having repeatedly taken legal action against rumor mongers.

In the secondary market, NIO's share price has plummeted by over 80% from its peak, resulting in a market value erosion of over HK$300 billion. Consequently, the wealth of the company's founder, Li Bin, has also significantly dwindled.

NIO Denies Laying Off 50% of Staff, Legal Department Takes Robust Actions Against Rumors

On February 20, the "NIO Little Horn" on the NIO App announced that screenshots were circulating in various groups alleging that a luxury automaker had laid off 50% of its staff, with some commentators suggesting it was NIO.

"In the spirit of being responsible and serious about debunking rumors, I sought verification from the company's HR head, and sure enough, he complained again: it's ridiculous." NIO's legal department has reported the matter to the police.

This is not the first time NIO has been caught up in rumors.

By reviewing NIO's legal department's Weibo account, Leida Finance found that as early as May 10, 2023, NIO's legal department had posted about a series of organized and large-scale malicious attacks on NIO and its users in the form of articles, videos, and consistent negative comments from water armies. These actions aimed to disrupt NIO's normal operations and tarnish public perception of NIO and its users, causing serious misleading and substantial damage to the legitimate rights and interests of NIO and its users, suspected of violating relevant national laws and regulations.

In response, NIO has been safeguarding its rights and interests through litigation and other means. For instance, the online account "Car News" and its operator, Shanghai Yunti Information Technology Co., Ltd., deliberately published false statements by comparing prices of foreign models without batteries to prices of complete vehicles with batteries, misleading the public and maliciously hyping the situation by inciting national sentiment, slandering NIO, and praising one while criticizing the other. In response, NIO initiated litigation, demanding an apology and compensation of RMB 2 million. During the litigation process, "Car News" continued to maliciously publish videos that distorted facts and misled the public. In response, NIO obtained evidence and sent a lawyer's letter, demanding the deletion of the content and an apology.

NIO will continue to resolutely safeguard the legitimate rights and interests of NIO and its users through legal means and uphold the dignity of the law.

On July 22, 2023, NIO's legal department announced that it had received a public report stating that Xu XXX had registered accounts such as "Wei Wei Shelter" on multiple online platforms, cumulatively publishing tens of thousands of contents deliberately slandering, insulting, and defaming NIO, its users, and its products. After verifying the identity of the actual controller of the relevant online accounts and investigating and fixing relevant evidence of infringement, the company formally filed a lawsuit with the Shanghai court to hold Xu XXX accountable for the relevant legal responsibilities. Xu XXX subsequently signed an apology letter, admitting the illegal infringement and deregistering the relevant online accounts.

NIO's legal department expressed gratitude to the five individuals who provided relevant clues and evidence of infringement to NIO and will contact them to offer corresponding rewards.

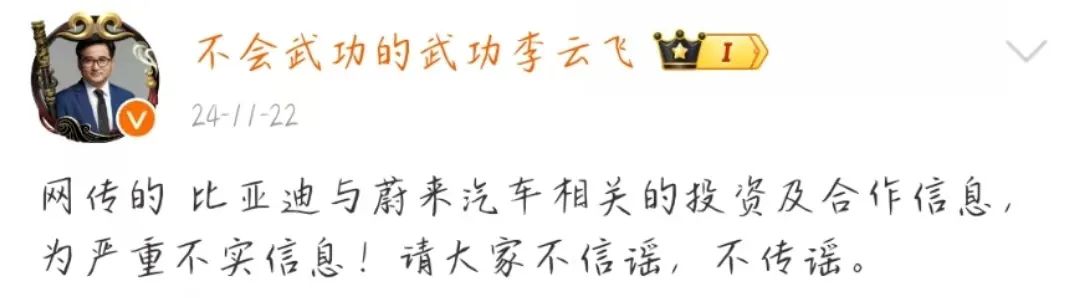

It is worth mentioning that in November 2024, online rumors circulated that "BYD would establish a joint venture with NIO to acquire it." Subsequently, both BYD and NIO's legal department issued statements to deny these rumors.

On November 22 last year, Li Yunfei, General Manager of BYD Group Brand and Public Relations Department, debunked the rumor on social media, stating, "The information circulating online about BYD's investment and cooperation with NIO is seriously untrue! Please don't believe or spread rumors."

On November 23, NIO's legal department posted that in response to rumors about NIO's capital-level cooperation with other enterprises, the company immediately reported it to the police and received acceptance.

On November 28 last year, NIO's legal department disclosed that the company received a notice on November 27 that, following in-depth investigations, local public security organs had quickly identified and controlled multiple suspects intentionally fabricating and spreading rumors related to NIO's capital market. Currently, the relevant personnel have been detained by the public security organs in accordance with the law.

Leida Finance noticed that since the beginning of the Year of the Snake, NIO's legal department has been quite active.

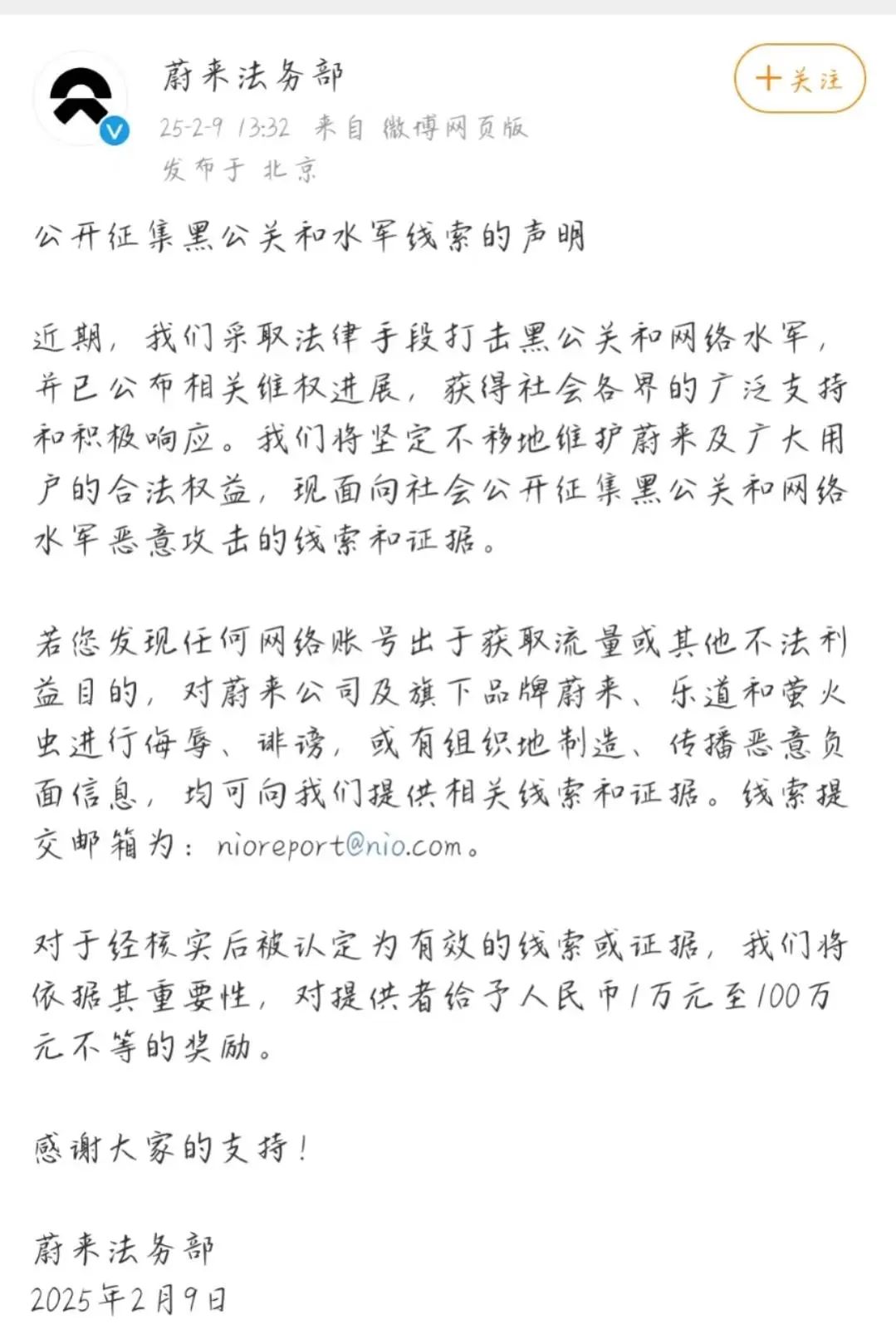

On February 9, NIO's legal department issued a statement stating that the company had recently taken legal action against black PR and online water armies, announcing relevant progress in safeguarding rights, receiving widespread support and positive responses from all sectors of society.

The company will unwaveringly safeguard the legitimate rights and interests of NIO and its users and is now openly soliciting clues and evidence of malicious attacks by black PR and online water armies from the public. For clues or evidence deemed valid after verification, providers will be rewarded with amounts ranging from RMB 10,000 to RMB 1 million, depending on their importance.

On February 17, NIO's legal department issued another statement stating that on the evening of February 16, it received a tip reporting that the online account "Yin Ge Popularizing New Energy" was spreading seriously false information about the Ledao brand. NIO stated that the legal department had fixed the evidence and filed a lawsuit with the court, retrieved the identity information of the suspected infringing online account, and reported it to the public security organs.

Founder Li Bin's Wealth Shrinks by RMB 37 Billion in Three Years

According to Tianyancha, NIO Holdings Limited, the company to which the Chinese brand NIO belongs, was established in 2017 and is a member of NIO China, located in Hefei, Anhui Province. It is primarily engaged in capital market services, with a registered capital of RMB 7.857 billion, exceeding 99% of its peers in Anhui Province, a paid-in capital of RMB 6.429 billion, and completed a strategic financing in 2024 with a transaction amount of RMB 3.3 billion.

Li Bin, the founder of NIO, was born on June 22, 1974, in Taihu, Anqing, Anhui Province. He holds a Bachelor's degree in Sociology from Peking University and minored in Law and Computer Science. He is the founder, chairman, and CEO of NIO.

The "2021 Hurun China Rich List" shows that Li Bin ranked 137th with an enterprise valuation of RMB 45 billion.

The "2024 Hurun China Rich List" reveals that Li Bin's fortune declined to RMB 8 billion, ranking 656th.

Based on this calculation, in three years, Li Bin's net worth has shrunk by RMB 37 billion, and his ranking has dropped by 519 positions.

Leida Finance observed that NIO reached its highest share price since its Hong Kong listing on June 27, 2022, at HK$199.2 (adjusted for previous rights issues), corresponding to a market value of approximately HK$417.9 billion. On February 20, NIO's closing price was HK$33.75 per share, with a total market value of HK$70.8 billion.

Based on this calculation, NIO's latest market value has eroded by HK$347.1 billion from its peak, and its share price has declined by over 83.06%.