A Pivotal Milestone for the Battery Swapping Industry

![]() 02/24 2025

02/24 2025

![]() 452

452

Volkswagen has already embraced battery swapping, but where do other joint venture brands stand?

Body

Joint venture brands that have lagged behind in smart electric strategies are now beginning to pay close attention to cutting-edge electric products, such as battery swapping.

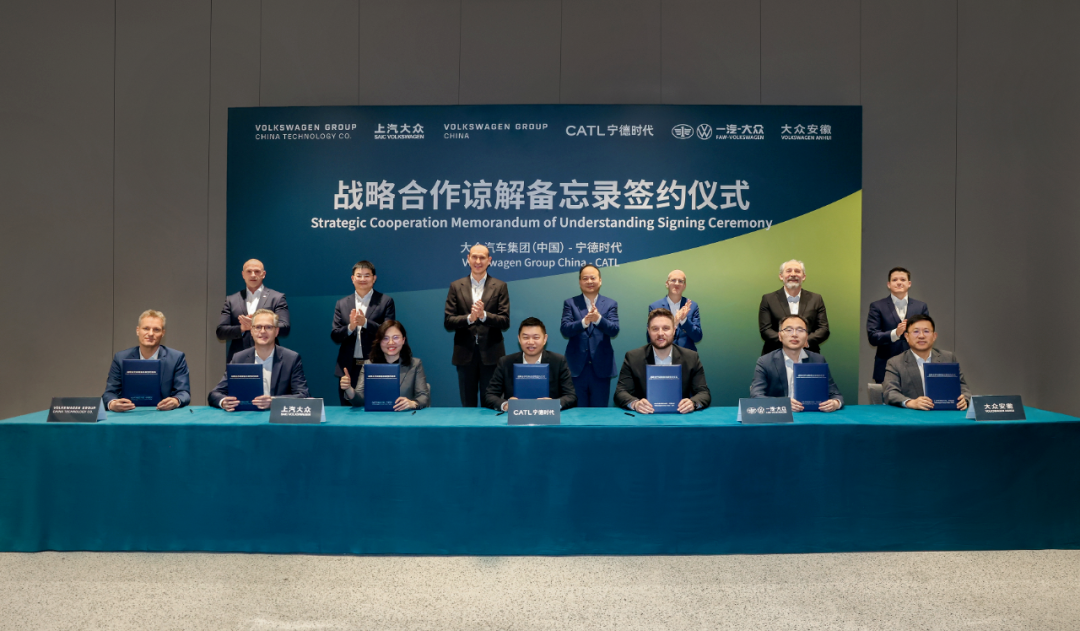

On February 21, CATL announced that it had recently signed a strategic cooperation memorandum with Volkswagen Group China. Officials hailed this signing as a significant milestone.

The memorandum further outlines that both parties will delve into areas like battery recycling, battery swapping, V2G technology, carbon emission reduction, and transparency in raw material supply, leveraging power batteries as a foundation.

Indeed, battery swapping has emerged as an integral part of this collaboration.

Photos from the signing ceremony reveal that, in addition to Volkswagen Group China and CATL, three OEMs were also present: SAIC Volkswagen, FAW-Volkswagen, and Volkswagen (Anhui).

It's plausible that these three automakers may introduce CATL battery-swapping models in the future.

In the context of the battery swapping industry, Volkswagen's entry into CATL's battery swapping alliance represents a pivotal event. It marks the first mainstream joint venture brand to venture into this industry.

Why is Volkswagen delving into battery swapping?

According to official statements, this cooperation aims to help Volkswagen Group China capitalize on market opportunities, provide Chinese consumers with high-quality and safe new energy vehicles, and accelerate the transition to electrification.

Compared to their past success, joint venture brands now find themselves in a challenging position. Last year, with the exception of FAW Toyota, which recorded a slight increase, sales of all other mainstream joint venture brands declined, with SAIC-GM experiencing a drop of over 50%.

Transitioning to new energy is no longer optional for joint venture brands. However, each joint venture automaker has its unique approach to this transition.

Considering Volkswagen's cooperation with CATL, battery swapping will be a crucial component of Volkswagen's new energy transition, acting as an "accelerator" in this shift.

Alternatively, for mainstream joint venture brands like Volkswagen, embracing battery swapping could be a means of achieving "lane-changing overtaking."

Technically, due to battery degradation, the useful life of a battery is shorter than that of the entire vehicle. Scrapping the entire vehicle is not only a significant waste for users but also for society.

At the CATL Chocolate Battery Swapping Ecosystem Conference held on December 18, 2022, CATL Chairman and CEO Zeng Yuqun posed "four questions": Does every battery only serve one vehicle? Is increasing battery capacity the only way to address range anxiety? Should users bear the cost of battery degradation? Can continuous advancements in battery technology and cost reductions ensure that every consumer benefits at all times?

Moreover, from a penetration rate perspective, as new energy adoption increases, the contradiction between grid capacity, charging pile density, and user charging experience is bound to intensify. Battery swapping stations can also function as small energy storage stations, aiding in grid peak shaving.

These factors explain why battery swapping has garnered increasing attention from officials and industry insiders in recent years.

"Based on market demand, we predict that by 2030, battery swapping, home charging, and public charging piles will share the market equally," said Zeng Yuqun, expressing confidence in the future of the battery swapping market.

Volkswagen has already embraced battery swapping; how far are other joint venture brands from following suit?