Xiaopeng takes the lead, Xiaomi faces Huawei, "First place" is not easy to sit

![]() 03/03 2025

03/03 2025

![]() 582

582

Life is unpredictable, and no one dares to stop and rest when it comes to selling cars.

As February comes to an end, a new round of competition has already begun. Even on weekends, sales posters for February from various companies are still released on the first day of March without any slackening.

Judging from the sales statistics, companies have mixed results, with only 9 brands exceeding 10,000 sales, indirectly proving that competition among new forces in 2025 has become even fiercer, and fewer and fewer will remain at the table.

Meanwhile, the ranking order on the sales chart is quietly changing. Someone moves forward, while someone falls behind. The only thing to do, besides striving to catch up, is to put some thought into the sales posters to regain a bit of self-esteem.

Being first is difficult

Being the top-selling new force brand has long been like sitting on the dragon throne; no one can stay there smoothly for long. Someone will always reach new heights.

In February, Xiaopeng once again secured the top spot. Xiaopeng Motors has been in the limelight in 2025. After successfully regaining the sales championship in January, it continued to hold this position firmly in February, and even more solidly. Among the new carmaking forces with data available, it is the only one with monthly sales exceeding 30,000 vehicles.

While 30,000 vehicles is not the first time Xiaopeng has broken through this threshold, it still demonstrates strength in leading the competition among peers. In February, which only had 28 days and was further affected by the Spring Festival holiday, Xiaopeng was able to maintain sales above 30,000 vehicles, which is indeed worth learning from its peers.

In terms of specific sales, Xiaopeng's main models are still the MONA M03 and P7+, indicating that the reforms implemented by Xiaopeng since the second half of last year have yielded significant results, successfully finding a breakthrough in pure electric vehicle sales.

Meanwhile, regarding the secret to its success, He Xiaopeng was quite generous in sharing it. Shortly after the Spring Festival holiday ended, an exclusive interview with He Xiaopeng exceeding 20,000 words caused a heated discussion. In the interview, He Xiaopeng talked in detail about firsthand information on Xiaopeng's reforms, including layoffs and procurement rectifications.

It is precisely because Xiaopeng conducted in-depth reforms from top to bottom that Xiaopeng Motors emerged from the ICU and quickly ran to the top position. Regarding the current situation, He Xiaopeng believes it is not stable. He mentioned that to be the first among new forces, weekly sales must exceed 15,000 vehicles, and Xiaopeng is still far from being absolutely at ease.

After stabilizing sales of new models, Xiaopeng Motors has finally begun to refresh existing models to further boost sales. On the last day of February, Xiaopeng launched a refreshed version of the G6, making significant adjustments to the current model. According to Xiaopeng's official introduction, more than 34% of the first-level assemblies have been renewed, with 81 updates.

Whether Xiaopeng can replicate the success of its new models with the refreshed models remains to be further verified by the market.

After Xiaopeng took the lead, Li Auto unfortunately slipped to second place. 2025 has been a bit unfavorable for Li Auto, with sales declining for two consecutive months. In February, Li Auto sold 26,263 vehicles, a month-on-month decrease of 12%.

The main reason is that Li Auto has not released a new model for more than half a year. Since the release of the L6 last year, Li Auto's product lineup has not been expanded. In an environment where competitors are constantly releasing new products, Li Auto's product competitiveness is bound to decline.

Of course, Li Auto has not been idle. It has been rapidly iterating in AI and intelligent driving. There have been continuous OTA upgrades on the in-vehicle system, especially in intelligent driving, where Li Auto has reached the first tier of the industry, capable of solving more complex scenarios.

Recently, Li Auto has released a new intelligent driving version, AD Max V13, which has been upgraded to a 10 million Clips model, claiming to reach the performance of a "human veteran driver" and achieve zero takeovers per hundred kilometers.

At the same time, Li Auto also has its own pace for new models. After nearly a year of silence, Li Auto's first pure electric SUV model was finally officially announced on February 25. The Li i8 debuted as a new series, with the i series representing intelligence and being an important achievement of Li Auto's transformation into an AI technology company since December last year.

Currently, on the one hand, Li Auto needs to rapidly iterate its existing products to regain lost market share; on the other hand, it needs the i8 to become a popular model that can turn the tide like the L6.

Following Xiaopeng and Li Auto is Leapmotor, which has fully exerted itself since 2024. It has steadily advanced from the second tier to the first tier, surpassing one competitor after another in its rapid pursuit.

In February, Leapmotor sold 25,287 vehicles. Although the month-on-month growth rate was low, the year-on-year increase was nearly 300%, making it worthy of being called the annual dark horse. Relying on its high cost-performance advantage, Leapmotor shone brightly in the 100,000-200,000 yuan price range. Moreover, judging from the sales changes over the past year, Leapmotor has been developing healthily and upward. As long as there are no major issues, Leapmotor's sales will remain stable.

Of course, Leapmotor's model lineup is still expanding. On March 10, the B10 model, which has been in the spotlight for nearly half a year, will be officially launched. It will be a model priced within 150,000 yuan equipped with lidar and supporting urban intelligent driving. Leapmotor once again demonstrates its precise product positioning. It can be said that it is difficult to find a brand more competitive than Leapmotor in the 100,000-200,000 yuan price range.

Polarization, Xiaomi faces Huawei

While Hongmeng Intelligent Driving continues to expand its circle of friends, sales have fluctuated significantly, dropping directly from 34,987 vehicles in January to 21,517 vehicles in February.

After the great success of the Wenjie M9, Hongmeng Intelligent Driving began to continuously pursue a high-end route, with models ranging from Xiangjie S9 to Zunjie S800, with continuously increasing positioning and prices, which led to an inevitable decline in sales. As vehicle prices increase, the market space is limited, which will inevitably compress sales.

Facing market challenges, the models under Hongmeng Intelligent Driving are constantly adjusting. Zhijie and Xiangjie have both begun to launch extended-range versions to expand the market. Meanwhile, in terms of intelligence, with Huawei's empowerment, Hongmeng Intelligent Driving has indeed widened the gap with other brands, achieving industry leadership in both intelligent cockpits and intelligent driving.

At the same time, Hongmeng Intelligent Driving also realizes that it needs mid-range models to support sales. The pre-sale of Wenjie M5 Ultra brings the latest intelligent driving software and hardware to the price range of just over 200,000 yuan, lowering the threshold for model experience and potentially becoming a new sales growth point in the future.

Unlike the high-end positioning of Hongmeng Intelligent Driving, Aion has been exploring the mid-to-low-end market. It has continuously explored products in the 150,000 yuan price range, maintaining stable sales. In February, it sold 20,863 vehicles, which can be considered a good result.

Unlike other new force brands, Aion, originating from GAC, has always competed with traditional automakers such as BYD and Geely. The release of Aion UT on February 28 further sinks the competitive market into A0-level new energy vehicles, with a starting price of 69,800 yuan, also coming on strong.

Aion UT is positioned to compete with the popular BYD Dolphin and Geely Xingyuan models. The Dolphin sold 360,000 vehicles in 2024, and Xingyuan surpassed 100,000 sales in just five months, making Aion see great opportunities in the A0-level market.

Whether Aion UT can become a new sales growth point for Aion depends on its performance after launch. Judging from last year, Aion's new models have brought significant sales growth after their launch.

As for Xiaomi's sales, they have always been a mystery. Xiaomi has always used vague sales data to announce monthly sales, which is the only exception in the entire industry, but no one has objected. Although the data is vague, the number of vehicles on the road is constantly increasing.

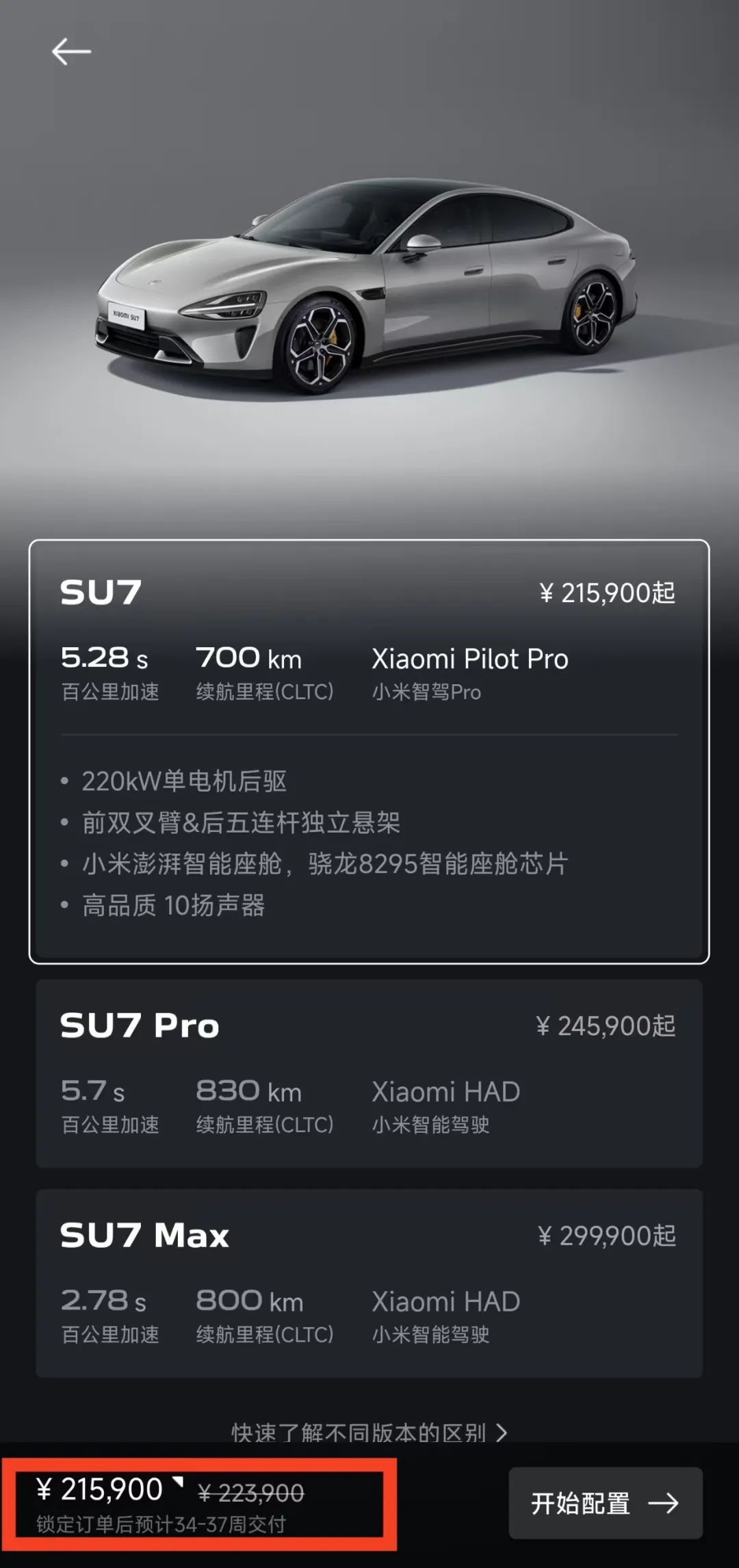

In February, Xiaomi once again summarized its sales data with "20,000+", marking the fifth month that Xiaomi's sales have exceeded 20,000 vehicles. Since its launch, Xiaomi has continuously climbed from the bottom of the new force sales rankings to where it is now. The most astonishing thing is that Xiaomi currently only has one model on sale, using one model to compete with the sales of its competitors' full range of models.

Most importantly, what has always constrained Xiaomi's sales is not orders but production capacity. Nearly a year after its launch, the delivery time for Xiaomi SU7 is still around 30 weeks, and weekly order lock-ins remain at a high point of over 10,000 vehicles.

With the launch of Xiaomi SU7 Ultra, Xiaomi's currently limited production capacity may be further compressed, as the SU7 Ultra has sold out its annual production capacity in just one day. Lei Jun can only find ways to expand production capacity; otherwise, when the YU7 is launched, factory owners may be Door-to-door asking for cars.

The remaining three brands, Deep Blue, Zeekr, and NIO, each have their own difficulties.

With its in-depth cooperation with Huawei, Deep Blue has fully integrated Qiankun Intelligent Driving, becoming a substitute for Hongmeng Intelligent Driving. However, in the price range below 200,000 yuan, it is still difficult for Deep Blue to pull away from its competitors. Currently, it can only be seen whether the new model S09 can become a new pioneer in boosting Deep Blue's sales.

As for Zeekr, the problem has always been the lack of staying power in new models. From the 001 to the 007 and then to the 7X, each new Zeekr model has become a hit, but after a few months of popularity, sales have seen a significant decline, making it difficult to maintain. Zeekr can only continue to rely on new models to drive sales growth.

Currently, Zeekr does not have a better strategy and can only continue to launch new models. The Zeekr 007GT unveiled in February is the next sales growth point for Zeekr, but the question is how long the Zeekr 007GT can drive sales growth for Zeekr.

NIO has replaced Xiaopeng as the most at-risk brand in 2025. With the sales boost from Ledao, NIO's sales in February were still only 13,192 vehicles. Although this is not bad compared to subsequent brands, compared with the same period, NIO has become the worst performer.

The launch of Ledao has not only failed to alleviate NIO's sales crisis but has also to some extent squeezed the sales of NIO's own brand. Li Bin himself is aware of the insufficient competitiveness of NIO's existing models, so he will launch refreshes and replacements for the entire lineup of models in the coming months.

On the surface, NIO has many cards to play, such as the ET9, a full lineup replacement, the Firefly, and new Ledao models. However, it is difficult to determine which one will be the trump card that can truly help NIO get out of its predicament.

In the past February, due to factors such as holidays, sales did not maintain the high point brought by December last year. However, many brands still maintained a growth trend, which can be considered a good start.

More importantly, the constant changes in rankings have also shown the market new vitality. No one can rest on their laurels; if they are not careful, they will be surpassed by latercomers. There is no absolute king, only continuously evolving strong players.

New force brands represent the front line of domestic new energy competition and influence the development of the entire new energy market to a certain extent. The fiercer the competition, the more vibrant the industry is.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for deletion.